Lipid Nanoparticles Market Research, 2033

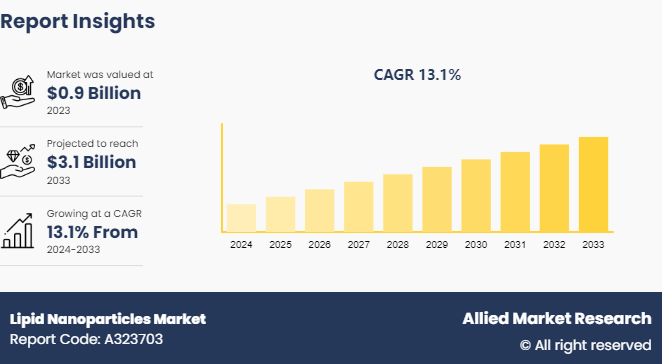

The global lipid nanoparticles market size was valued at $0.9 billion in 2023, and is projected to reach $3.1 billion by 2033, growing at a CAGR of 13.1% from 2024 to 2033. Increasing prevalence of chronic diseases, such as cancer and cardiovascular disorders, ongoing research and development and expansion of the biopharmaceutical sector are major driving factors for the market growth.

Market Introduction and Definition

Lipid nanoparticles (LNPs) are nanoscale particles ranging from 10 to 1000 nanometers in diameter, primarily composed of lipids. They are designed to encapsulate therapeutic agents such as drugs, vaccines, and genetic materials, protecting them from degradation and enhancing their delivery and efficacy. LNPs can mimic the structure of biological membranes, making them biocompatible and capable of efficiently interacting with and penetrating cells. Their lipid composition typically includes phospholipids, cholesterol, and other lipid molecules that aid in stabilizing the nanoparticle structure and controlling the release of the encapsulated cargo. LNPs have gained significant attention in medical and pharmaceutical research, particularly for their role in mRNA vaccine delivery and targeted drug delivery systems.

Key Takeaways

The lipid nanoparticles market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major lipid nanoparticles industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The major factors driving the lipid nanoparticles market growth include rising prevalence of chronic diseases, such as cancer, diabetes, cardiovascular diseases, and neurological disorders, and rise in demand for advanced drug delivery systems. These conditions often require long-term treatment with drugs that have severe side effects when administered through traditional methods. LNPs offer a promising alternative by enabling targeted and sustained delivery of therapeutic agents, thereby reducing systemic side effects and improving patient compliance. In oncology, for example, LNPs can be used to deliver chemotherapeutic agents directly to tumor cells, minimizing damage to healthy tissues.

In addition, ongoing advancements in nanotechnology and biotechnology led to the development of more sophisticated and efficient LNP formulations thereby driving the growth during the lipid nanoparticles market forecast. These advancements enable better control over particle size, surface characteristics, and drug release profiles, making LNPs a versatile platform for a wide range of therapeutic applications. Moreover, the increasing demand for personalized medicine is propelling the market, as LNPs can be tailored to deliver specific drugs to targeted cells or tissues based on individual patient profiles.

However, the high cost associated with the production and development of LNP-based formulations, as the manufacturing process involves sophisticated technology and stringent quality control measures to ensure the stability and efficacy of the nanoparticles, leads to elevated production costs which may limit the market growth. Conversely, advances in nanotechnology facilitated the development of lipid nanoparticles with enhanced stability, targeted delivery, and controlled release properties. This opened new avenues for drug delivery, allowing for more effective and efficient therapeutic interventions. Furthermore, innovations in lipid chemistry led to the creation of novel lipid formulations that can encapsulate a wide range of therapeutic agents which provide lipid nanoparticles market opportunity.

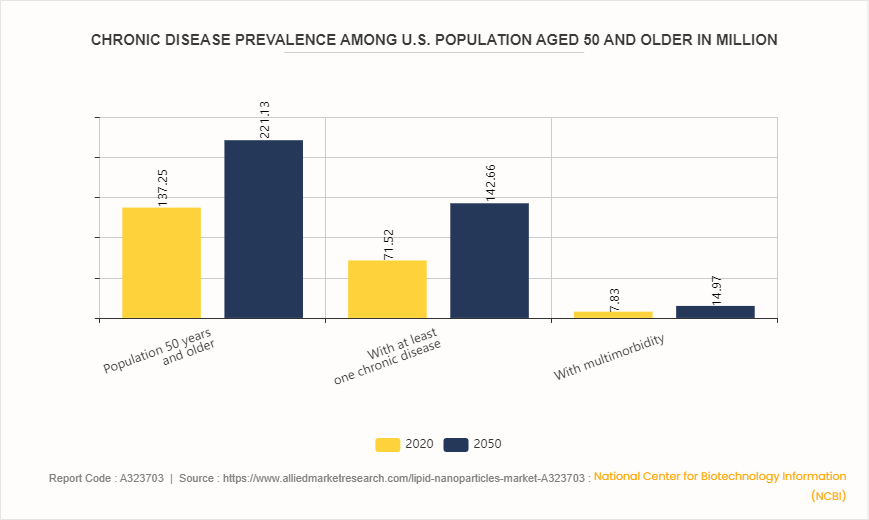

Chronic Disease Prevalence Among U.S. Population Aged 50 and Older

According to projections from the National Center for Biotechnology Information (NCBI) , the U.S. population aged 50 and older is expected to grow significantly from 137.25 million in 2020 to 221.13 million by 2050. Concurrently, the prevalence of chronic diseases within this age group is anticipated to nearly double, with those having at least one chronic condition increasing from 71.522 million to 142.66 million. Moreover, the number of individuals experiencing multimorbidity is projected to rise from 7.83 million to 14.96 million. This surge in chronic disease prevalence underscores the critical need for advanced therapeutic strategies, such as lipid nanoparticles, which offer targeted drug delivery and improved treatment efficacy. The lipid nanoparticle market is poised to expand in response to this growing demand, driven by the necessity to manage complex health conditions more effectively among an aging population.

Market Segmentation

The lipid nanoparticles market analysis is segmented into type, application, end user, and region. On the basis of type, the market is categorized into solid lipid nanoparticles, nanostructured lipid carriers, and others. On the basis of application, the market is bifurcated into therapeutics and research. As per end user, the market is classified into pharmaceutical & biotechnology companies, academic & research institutes, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the lipid nanoparticles market share due to its strong pharmaceutical industry, advanced healthcare infrastructure, and significant investment in biotechnology research. The presence of key players and early adoption of novel drug delivery systems, especially for mRNA vaccines, further bolsters the market in this region. In the Asia-Pacific region, countries such as China, Japan, and India are experiencing rapid growth in the lipid nanoparticles market. This growth is driven by increasing investments in healthcare infrastructure, rising awareness of advanced drug delivery systems, and the expansion of pharmaceutical manufacturing capabilities.

According to a report of The National Nanotechnology Initiative (NNI) Supplement to the President's 2023 Budget, highlighted substantial investments by various agencies, including the Department of Health and Human Services (HHS) and the Biomedical Advanced Research and Development Authority (BARDA) , to support the validation and commercialization of lipid nanoparticle mRNA delivery technology.

Industry Trends

The Food Drug & Administration (FDA) held a symposium in October 2022 to discuss the recently finalized guidance on drug products containing nanomaterials and how it can be implemented in regulatory filings.

In 2022, the Australian government announced a $3 million grant through the Cooperative Research Centres Projects Grants scheme to BioCina, a biopharmaceutical contract development and manufacturing organization (CDMO) based in Adelaide, South Australia. BioCina’s partners in the project are the University of Adelaide and Cytiva. Researchers at the university will address the design and manufacture of lipid nanoparticles.

Competitive Landscape

The major players operating in the lipid nanoparticles market include ABP Biosciences, LLC., Merck KGaA, Cytiva, CD Bioparticles, CordenPharma, Precigenome LLC., Beam Therapeutics, Acuitas Therapeutics, GENEVANT SCIENCES CORPORATION, and Helix Biotech, Inc. Other players in lipid nanoparticles market includes Arbutus Biopharma, Croda International Plc, and so on.

Recent Key Strategies and Developments in Lipid Nanoparticles Industry

In February 2024, CordenPharma International announced the launch of new Lipid NanoParticle (LNP) Starter Kits for effective mRNA formulation in the development of mRNA-based therapeutics such as mRNA vaccines or gene therapies. The starter kits provide researchers and developers with the essential components needed to create and optimize their own LNPs for mRNA delivery.

In July 2023, Cytiva, a global life sciences leader launched the NanoAssemblr commercial formulation system, purpose-built for clinical and commercial manufacturing of lipid nanoparticle medicines.

In August 2022, Merck and Orna Therapeutics, a biotechnology company pioneering a new investigational class of engineered circular RNA therapies announced a collaboration agreement to discover, develop, and commercialize multiple programs, including vaccines and therapeutics in the areas of infectious disease and oncology.

In January 2022, Pfizer Inc. and Acuitas Therapeutics, a company focused on developing lipid nanoparticle (LNP) delivery systems to enable messenger RNA (mRNA) -based therapeutics announced that they had entered into a Development and Option agreement under which Pfizer will have the option to license, on a non-exclusive basis, Acuitas’ LNP technology for up to 10 targets for vaccine or therapeutic development.

Key Sources Referred

National Center for Biotechnology and Information (NCBI)

Centers for Medicare & Medicaid Services (CMS)

National Health Service (NHS)

Australian Government Department of Health and Aged Care

Government of Canada's Health and Wellness

Ministry of Health and Family Welfare (MoHFW)

National Health Mission (NHM)

Centers for Disease Control and Prevention (CDC)

Food and Drug Administration (FDA)

National Institutes of Health (NIH)

World Health Organization (WHO)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, lipid nanoparticles market trends, estimations, and dynamics of the market analysis from 2023 to 2035 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the lipid nanoparticles market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global lipid nanoparticles market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global lipid nanoparticles market size, key players, market segments, application areas, and market growth strategies.

Lipid Nanoparticles Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.1 Billion |

| Growth Rate | CAGR of 13.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 220 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Precigenome LLC., Merck KGaA, Helix Biotech, Inc., ABP Biosciences, LLC., Acuitas Therapeutics., CordenPharma, Genevant Sciences Corporation, CD Bioparticles, Cytiva, Beam Therapeutics |

The total market value of lipid nanoparticles market is $0.9 billion in 2023.

The market value of lipid nanoparticles market in 2033 is $3.1 billion.

The forecast period for lipid nanoparticles market is 2024 to 2033.

The base year is 2023 in lipid nanoparticles market.

Lipid Nanoparticles are tiny, spherical vesicles made from lipids (fats) that are used as drug delivery systems. They can encapsulate active pharmaceutical ingredients (APIs), such as mRNA, proteins, or small molecules, protecting them from degradation and ensuring efficient delivery to target cells.

The growth of the market is driven by the increasing demand for novel drug delivery systems, advancements in nanotechnology, the rise in mRNA-based vaccines and the growing application of LNPs in cancer therapy, gene therapy, and other chronic diseases.

Loading Table Of Content...