Liqueurs Market Research 2031

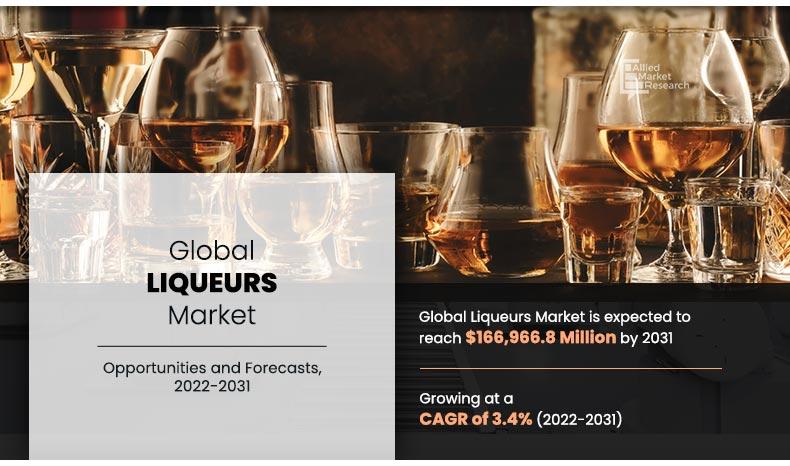

The global liqueurs market was valued at $118,040.5 million in 2021, and is projected to reach $166,966.8 million by 2031, registering a CAGR of 3.4% from 2022 to 2031.

Liqueurs are alcoholic beverages made by combination of distilled spirits with flavoring ingredients such as fruits, herbs, spices, nuts, or cream. These beverages have a lower alcohol content than spirits, ranging from 15% to 30% ABV, and are sweetened to enhance taste. Liqueurs are used in cocktails, consumed neat, or served as dessert beverages. Popular varieties include coffee, herbal, fruit, and cream-based liqueurs. Their versatility in mixology and growing demand for premium flavors contribute to their widespread global consumption.

Market Dynamics

The increase in demand for flavored and exotic liqueurs has driven global liqueurs market growth as consumers explore unique taste profiles beyond traditional offerings. Expanding preferences for fruit-infused, botanical, and spice-based flavors have led manufacturers to introduce a wider range of innovative products. Demand for tropical, floral, and dessert-inspired liqueurs has increased, influenced by evolving consumer palates and a growing inclination toward mixology. Premiumization trends have further contributed to this shift, with consumers seeking high-quality, artisanal options that offer distinctive flavors and ingredients. The expansion of flavored liqueurs in cocktails and culinary applications has also boosted global liqueurs market share, strengthening the use of liqueurs in both home and professional settings.

The global cocktail culture has strengthened the demand for flavored and exotic liqueurs, particularly in the on-trade sector, where mixologists continuously experiment with new blends. Social media and digital platforms have further boosted consumer awareness, encouraging experimentation with unique liqueur-based beverages. The younger demographic, in particular, has shown increased interest in novel flavors, contributing to sustained market expansion. In addition, seasonal and limited-edition offerings have gained popularity, as they have driven brand engagement and repeat purchases, further strengthening the role of flavored and exotic liqueurs in shaping global liqueurs market size.

However, stringent government regulations and high taxation on alcohol create significant challenges during global market analysis by increasing costs for manufacturers and consumers. Many countries impose heavy excise duties, import tariffs, and value-added taxes on alcoholic beverages, which has made liqueurs more expensive and less accessible. In markets such as India and Australia, high excise duties significantly impact pricing, as it reduces affordability and limits consumer demand. Strict advertising restrictions in regions such as the European Union and the U.S. further challenge brand visibility and marketing efforts, making it difficult for manufacturers to promote new product launches effectively. In addition, complex licensing requirements and distribution regulations in various countries create barriers for new entrants, restricting global industry expansion.

Tightened regulatory policies, including alcohol sale restrictions and consumption limits, further restrain global liqueurs market size. Countries such as Norway and Sweden enforce state-controlled alcohol sales through monopoly retailers, reducing availability and limiting consumer choice. In the Middle East, stringent regulations, including bans on alcohol sales in certain regions, significantly hinder market potential. Rising health concerns have also led to increased warning labels and packaging restrictions, as seen in Thailand and South Korea, where government policies mandate prominent health warnings. These regulatory challenges collectively slow down overall market demand for global liqueurs, affecting growth prospects for industry players.

Furthermore, innovation in low-ABV and non-alcoholic liqueur alternatives is driving global liqueurs market opportunities as consumers seek healthier and mindful drinking options. Rising demand for reduced-alcohol beverages has led manufacturers to develop products that cater to evolving preferences without compromising taste. Many brands are introducing botanically infused, low-ABV liqueurs that provide a sophisticated drinking experience while aligning with wellness-conscious trends. The expansion of non-alcoholic alternatives has gained traction in markets such as Europe and North America, where consumers are increasingly opting for alcohol-free spirits and cocktails. This shift is shaping global market trends, encouraging product diversification and innovation to capture a broader consumer base.

The growth of ready-to-drink (RTD) liqueur-based beverages is further strengthening global liqueurs market, driven by convenience and changing consumption patterns. RTD cocktails featuring liqueurs are gaining popularity in both on-trade and off-trade channels, offering pre-mixed options that cater to busy lifestyles and social occasions. Premiumization within the RTD segment has also contributed to the expansion of high-quality, craft-inspired liqueur-based beverages. Brands are utilizing this trend by launching limited-edition and seasonal flavors to attract new consumers. Moreover, the increasing availability of RTD liqueur options in retail stores and online platforms is expected to contribute to sustained market growth, enhancing accessibility and consumer engagement.

Segment Overview

The liqueurs industry has been segmented on the basis of type, packaging, distribution channel, and region. Based on type, the market is divided into neutrals/bitters, creams, fruit flavored, and others. On the basis of packaging, the liqueurs market is divided into glass, PET bottle, metal can, and others. Based on distribution channel, the market is divided into convenience stores, on premises, retailers, and supermarkets. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Type

Neutrals/Bitters segment dominates the global market and is expected to retain its dominance throughout the forecast period.

By Type

Based on type, the market is categorized into neutrals/bitters, creams, fruit flavored, and others. Neutrals/bitters segment constitute a major market share; however, the creams segment is projected to experience growth at the highest CAGR during the liqueurs market forecast period. Neutral liqueurs, such as coffee, cream, and herbal varieties, serve as essential components in classic and contemporary cocktails, making them highly popular across both on-trade and off-trade channels. Bitters, known for their aromatic and digestive properties, have gained significant traction in premium cocktail culture. Expanding consumer interest in complex and refined flavor profiles has driven demand for bitters, particularly in regions where craft cocktails and mixology are growing. Brands continue to introduce innovative bitter liqueurs infused with botanicals, spices, and citrus elements, appealing to both casual consumers and professional bartenders. The presence of well-established bitter liqueur brands and their association with traditional and modern mixology further contribute to market expansion. Increasing availability through retail and e-commerce platforms has also supported higher consumption levels globally.

By Packaging

Metal Can segment is expected to grow at a highest CAGR of 7.6% during the forecast period.

By Packaging

Based on packaging, the glass segment leads in terms of liqueurs market share and is expected to continue to grow with robust CAGR during the forecast period. Glass packaging is widely preferred by high-end and artisanal brands due to its ability to preserve the original taste and aroma of liqueurs. The non-reactive nature of glass packaging ensures product integrity, making it a reliable option for premium offerings. Growth in consumer preference for sustainable packaging has further driven demand for this segment, as glass is 100% recyclable and aligns with environmental concerns. Moreover, the rising trend of gifting alcoholic beverages has also contributed to its dominance, with brands investing in decorative and customized glass bottles to attract buyers. The association of glass packaging with luxury and authenticity continues to influence purchasing decisions, reinforcing its strong market position in the global liqueurs industry.

By Distribution Channel

On Premises segment is expected to grow at a highest CAGR of 5.0% during the forecast period.

By Distribution Channel

On the basis of distribution channel, the liqueurs market is categorized into convenience stores, on premises, retailers, and supermarkets. The retailers segment held the major share in the market and is projected to remain dominant during the forecast period. Liqueur retailers, including specialty liquor stores and dedicated alcohol outlets, offer a diverse range of products, catering to consumer preferences for premium, craft, and imported liqueurs. These retailers provide expert recommendations and exclusive collections, which attract both casual buyers and enthusiasts. Strong supplier relationships and established distribution networks ensure consistent availability of products. Growth in demand for high-end and limited-edition liqueurs has further driven sales in this segment. The integration of online sales by liqueur retailers has expanded consumer reach, enhancing convenience and accessibility.

By Region

Asia-Pacific dominates the market and is expected to grow with a CAGR of 4.6% during the forecast period

By Region

Region-wise, Asia-Pacific dominates the liqueurs market and is expected to grow with a CAGR of 4.6% during the forecast period. Rising disposable incomes, expanding urban populations, and increasing preference for premium and imported liqueurs are key growth drivers. Countries such as China, Japan, and India have witnessed growing demand for flavored and craft liqueurs, supported by evolving consumer preferences and the influence of cocktail culture. Established brands such as Suntory, Jinro, and Kweichow Moutai have strengthened their market presence by offering region-specific flavors and expanding distribution networks. International brands such as Baileys and Cointreau continue to gain traction through premium retail channels and on-premises sales. Furthermore, increasing investments in marketing and product innovation, along with government efforts to regulate and streamline alcohol distribution, are expected to support sustained market expansion in Asia-Pacific.

Competitive Analysis

Major companies have adopted agreement, product launch, expansion, and merger strategies to sustain the intense market competition. Key players profiled in the liqueurs market report include Bacardi Limited, Beam Suntory Inc., Brown-Forman Corporation, Diageo Plc, Davide Campari-Milano S.p.A., Girolamo Luxardo S.p.A, Lucas Bols B.V., Mast-Jägermeister SE, Pernod Ricard SA, and Remy Cointreau.

Other market players (not profiled in report) in the value chain include De Kuyper Royal Distillers, E. & J. Gallo Winery, Peel Liqueur, Sazerac Company, Stock Spirits Group, The Drambuie Liqueur, Terra Ltd., and CL World Brands Limited.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the liqueurs market analysis from 2021 to 2031 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and market opportunities.

Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier–buyer network.

In-depth analysis of the liqueurs market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market industry.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global liqueurs market trends, key players, market segments, application areas, and market growth strategies.

Liqueurs Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Packaging |

|

| By Distribution Channel |

|

| By Region |

|

Analyst Review

Increase in inclination of people toward alcoholic beverages has changed the market dynamics. Liqueurs that have a thick and sleek consistency were referred to as crèmes, oils, or analgesics. The market environment in alcohol industry is presently leaning toward consolidation and aggressive marketing.

A proliferation in the mergers and acquisitions (M&A) is the most visible indication of the consolidation in the alcohol industry. The present form of each of the major global brewers is substantially affected by M&A. Globalization drives the mergers and acquisitions of the world’s leading producers, as they have increasingly focused their efforts on selling their products to fast-growing developing countries. Collaborations and acquisitions are the key strategies followed by market players to sustain the intense competition in the industry, as in-house capacity building is believed to be difficult for novice players in the market.

The Asia-Pacific liqueurs market presents promising opportunities, owing to surge in growth of the beverage industry. This is due to the augmentation in disposable income demographic, coupled with aggressive promotion efforts by established players to exploit new markets. This is primarily owing to the reason that a large portion of the demographic in these countries is expected to reach the legal drinking age and thus, maintain the industry growth. In addition, rise in young working population and growth in disposable income has stimulated the market growth.

The global liqueurs market was valued at $118,040.5 million in 2021, and is projected to reach $166,966.8 million by 2031

The global Liqueurs market is projected to grow at a compound annual growth rate of 3.4% from 2022 to 2031

Major companies have adopted agreement, product launch, expansion, and merger strategies to sustain the intense market competition. Key players profiled in the liqueurs market report include Bacardi Limited, Beam Suntory Inc., Brown-Forman Corporation, Diageo Plc, Davide Campari-Milano S.p.A., Girolamo Luxardo S.p.A, Lucas Bols B.V., Mast-Jägermeister SE, Pernod Ricard SA, and Remy Cointreau.

Region-wise, Asia-Pacific dominates the liqueurs market

The increase in demand for flavored and exotic liqueurs

Loading Table Of Content...