Liquid Detergent Market Research, 2033

The global liquid detergent market size was valued at $33.1 billion in 2023, and is projected to reach $58.7 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033. Liquid detergent is a liquid cleaning chemical intended for use on laundry, dishes, and other surfaces. It usually contains surfactants, which lower the surface tension of water for removing dirt and grime, as well as enzymes, perfumes, colorants, and other functional chemicals designed for specialized cleaning activities.

Liquid detergents are easy to measure and disperse fast in water, thus customer desire for convenient and effective cleaning solutions is growing. The surge in urbanization and dual-income homes has also increased demand for convenient cleaning solutions that save energy and time. Furthermore, the transition to eco-friendly and biodegradable formulas is gaining traction, owing to consumers' increased environmental concern. Packaging innovations, such as refillable bottles and concentrated formulae, are driving liquid detergent market growth.

Key Takeaways

The liquid detergent market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the liquid detergent market forecast period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major liquid detergent industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

??????Key market dynamics

The growing knowledge and awareness of hygiene and cleanliness, particularly in the aftermath of the COVID-19 pandemic, has increased the market demand for efficient sanitation solutions. This transition has resulted in an increased demand for liquid detergents, that are believed to be more effective and user-friendly than their powder equivalents. Furthermore, urbanization and rising disposable incomes, especially in emerging nations, are driving the industry's growth. As more people relocate to cities and family budgets improve, there is an increasing need to spend on high-quality and easy cleaning goods.

The biggest barrier impeding expansion, however, is the harmful effects of liquid detergents. Despite efforts to promote more environmentally friendly products, many liquid detergents continue to include chemicals that damage aquatic life while contributing to water pollution. Furthermore, the plastic packaging commonly utilized for liquid detergents raises serious environmental issues, contributing to the worldwide plastic waste crisis. Another constraint is the expensive nature of raw chemicals used to manufacture liquid detergents, such as surfactants, enzymes, and perfumes.

The increasing liquid detergent market demand from customers for products that are sustainable and environmentally friendly creates an opportunity for growth. As people become more aware of environmental concerns, there is a significant market for liquid detergents made with biodegradable chemicals, minimum packaging, and environmentally friendly manufacturing procedures. This trend towards green products has the potential to foster innovation while also appealing to environmentally sensitive customers. Furthermore, the expanding trend of product diversity provides an opportunity for producers to create specialized liquid detergents for specific applications, such as hypoallergenic formulae, detergents for delicate textiles, or solutions developed for high-efficiency washers. The emergence of e-commerce also presents a big growth opportunity, as it allows businesses to reach a larger audience with reduced overhead expenses while simultaneously providing customers with the ease of shopping online.

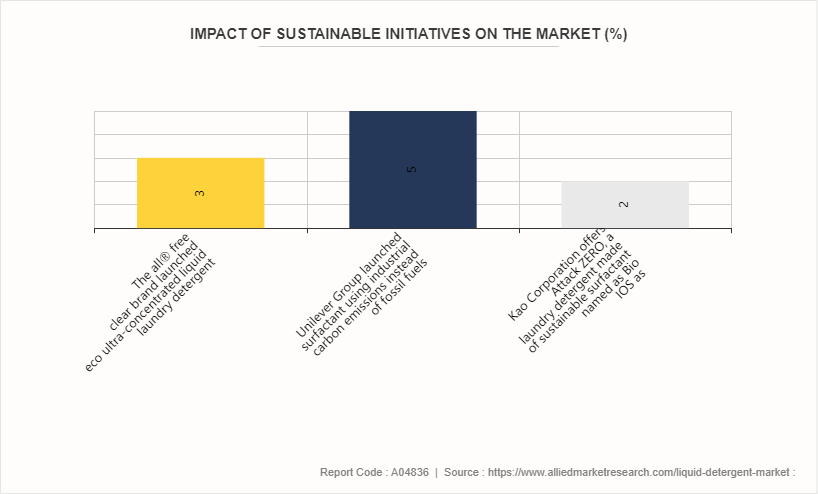

Sustainability Initiatives in Global Liquid Detergent Market

The all free clear brand is expanding its portfolio of sustainability-driven innovations. The new all free clear eco ultra-concentrated liquid laundry detergent contains a USDA-certified biobased solution and comes in a 100% recyclable plastic bottle. This comprehensive, ecologically responsible product launched worldwide in March 2022.

In April 2021, Unilever collaborated?with India Glycols and LanzaTech to generate a surfactant using industrial carbon emissions instead of fossil fuels. The surfactant is utilized to create laundry soap. For the first time, the three businesses are collaborating, leveraging biotechnologies and a freshly designed supply chain to make a groundbreaking change in manufacturing.

In early 2019, Kao Corporation?released Attack ZERO, a liquid laundry detergent in Japan. It is Kao's first product to have Bio IOS. Bio IOS is a new and sustainable surfactant?made using the leftover material from extracting edible palm oil from the fruit of the oil palm.?

Market Segmentation

The liquid detergent industry is segmented into nature, product type, distribution channel, end user, and region. On the basis of nature, the market is divided into organic liquid detergents and conventional liquid detergents. On the basis of application, the market is divided into laundry and dishwashing. By distribution channel, the market is divided into online sales channels, supermarket & hypermarkets, departmental & convenience stores, and independent grocery stores. Depending on the end user, the market is divided into residential and commercial. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In North America, the U.S.?leads the industry with a high penetration rate because of an established infrastructure and a significant demand for ease and efficiency in-home activities. The U.S. market has a high demand for luxury and environmentally friendly goods, reflecting the country's rising environmental concern.

According to liquid detergent market statistics, consumers in Europe, particularly in Germany and the UK, place a premium on sustainability and high-quality goods. The European market also demonstrates a preference for condensed solutions that decrease packaging waste.

The sector is quickly developing throughout Asia-Pacific, notably in China and India, owing to increased urbanization, rising disposable incomes, and changing lifestyles. For instance, India's liquid detergent business is expanding rapidly as more customers prefer liquid forms over traditional bars and powders due to their ease and efficacy. Similarly, China's market benefits from its vast population and increasing middle class, who are?more ready to spend on better-quality cleaning products.

Latin America has a mixed outlook; nations such as Brazil and Argentina are seeing sluggish growth as a result of economic instability and shifting consumer tastes. However, as economies stabilize and the urban middle class grows, there is a progressive trend towards liquid detergents.

The market in the Middle East and Africa is still expanding, with South Africa displaying remarkable growth because of its higher economic development than other African nations. The UAE and Saudi Arabia are additionally experiencing a higher need for liquid detergents, driven by rising living standards and an increasing expatriate community looking for familiar brands and goods.

Industry Trends:

In May 2022, Breeze, a Unilever PLC trademark, released a new product named 'Breeze Detergent.' The new product has a diluted recipe and is available?in a 500 ml bottle that can be poured into 2.5 liters of water, allowing users to wash more than 60 times.

In May 2022, Procter & Gamble (P&G) extended its liquid detergent division by establishing a production facility in Hyderabad, India. The corporation invested USD 2.51 billion.

According to the Bureau of Labor Statistics, in the United States, the average annual expenditure on soaps and detergents in 2022 accounted for USD 85.37, which increased from USD 80.49 per consumer unit in 2021.

According to the Russian Federal State Statistics Service, Russia's detergent output has continuously increased year after year. The quantity of detergent manufacturing peaked in 2021, with 2, 139 thousand metric tonnes of detergents produced.

Competitive Landscape

The major players operating to gain liquid detergent market share include Procter & Gamble, Church & Dwight, Henkel Company KGaA, Unilever Plc, S. C. Johnson & Son, Inc Amway Corporation, Reckitt Benckiser Group plc, Colgate-Palmolive, The Clorox Company, and Godrej Consumer Products, Kao Corporation, and Johnson & Son, Inc.

Other players in liquid detergent market includes Lion Corporation, Wipro Consumer Care and Lighting, Seventh Generation Inc., Guangzhou Blue Moon Industrial Co., Ltd., Method Products, PBC, and others.

Recent Key Strategies and Developments

In June 2021, Tide, a Procter & Gamble company, invented the laundry detergent for space usage. The business secured a Space Act arrangement with NASA to investigate possibilities of cleaning products for astronauts.

In October 2022, MyKirei by KAO brand launched a new Easy-Spray Laundry Detergent for cleaning garments and household linens. This innovative product provides a small, refillable solution to heavy, space-consuming bottles, hence boosting the company's revenue.

In May 2022, Proctor & Gamble (P&G) established its first liquid detergent production facility in India on the outskirts of Hyderabad, investing $26.83 million.

Key Sources Referred

American Cleaning Institute (ACI)

European Detergents Association (AISE)

Soap and Detergent Association (SDA)

International Association for Soaps, Detergents, and Maintenance Products (A.I.S.E.)

Consumer Specialty Products Association (CSPA)

Soap and Detergent Association of Canada (SDAC)

China Cleaning Industry Association (CCIA)

Indian Home & Personal Care Industry Association (IHPCIA)

Japan Soap and Detergent Association (JSDA)

Australian Cleaning and Hygiene Suppliers Association (ACHSA)

Brazilian Association of the Soap, Detergent, and Synthetic Detergent Industry (ABIPLA)

South African Cleaning and Hygiene Suppliers Association (SACHA)

National Association of Chemical Distributors (NACD)

International Association of Environmental Analytical Chemistry (IAEAC)

Global Soap & Detergent Association (GSDA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the liquid detergent market analysis from 2024 to 2033 to identify the prevailing liquid detergent market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the liquid detergent market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global liquid detergent market trends, key players, market segments, application areas, and market growth strategies.

Liquid Detergent Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 58.7 Billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 230 |

| By Nature |

|

| By Application |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Johnson & Son, Inc., Godrej Consumer Products, Procter & Gamble, SC Johnson & Son, Inc., Unilever Plc, Colgate-Palmolive, Henkel Company KGaA, Kao Corporation, Amway Corporation, Reckitt Benckiser Group plc, The Clorox Company, S. C. Johnson & Son, Inc, Church & Dwight |

Analyst Review

Liquid detergents are complex mixture of surfactants used for effective cleaning action on dirt and grease. These detergents aid in washing process by reducing the surface tension of water. They are used for washing laundry and dishes. Huge untapped potential in emerging economies particularly in India, China, and Brazil for liquid detergent is expected to boost the growth of the global liquid detergent market. The market is in growth stage in developing regions, and is poised to gain significant momentum in the forthcoming years, owing to the fact that efficacy in promotional and advertising is expected to fuel the penetration of liquid detergents.

Moreover, Asia-Pacific and LAMEA are projected to register a significant growth as compared to the saturated markets of Europe and North America, due to rapid urbanization, increase in penetration of technology even in small cities, growth in disposable income, and improvement in standard of living.

In line with increase in health-conscious consumers, a paradigm shift from conventional liquid detergent to organic liquid detergent have been witnessed in the recent years. As a result, prominent manufacturers have ventured into organic segment to capture lucrative opportunities in the segment.

The global liquid detergent market was valued at $33.1 billion in 2023, and is projected to reach $58.7 Billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

The liquid detergent market registered a CAGR of 5.9% from 2024 to 2033

The forecast period in the liquid detergent market report is from 2024 to 2033.

The top companies that hold the market share in the liquid detergent market include Procter & Gamble, Church & Dwight, Henkel Company KGaA, Unilever Plc, and others.

The liquid detergent market report has 4 segments. The segments are nature, application end user, and distribution channel

Loading Table Of Content...