Lithium Carbonate Market Research, 2033

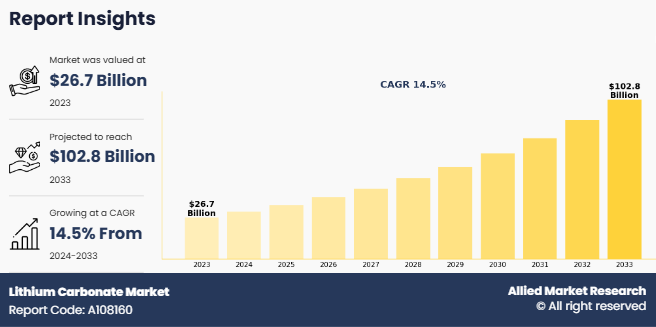

The global lithium carbonate market was valued at $26.7 billion in 2023, and is projected to reach $102.8 billion by 2033, growing at a CAGR of 14.5% from 2024 to 2033.

Introduction

Lithium carbonate (Li2CO3) is a chemical compound composed of lithium, carbon, and oxygen. As a white, odorless, crystalline powder, it has garnered significant attention in various industries due to its unique properties. It is primarily produced through the extraction of lithium from natural minerals such as spodumene, or through the processing of lithium-rich brine sources. Lithium carbonate has an array of applications, especially in energy storage, pharmaceuticals, and ceramics. This versatile compound is central to several emerging technologies and industrial processes.

The most prominent and growing application of lithium carbonate is in the production of lithium-ion batteries. These batteries are essential for powering everything from mobile phones and laptops to electric vehicles (EVs) and grid storage solutions. Lithium-ion batteries rely on lithium carbonate as a key precursor material for the production of cathodes, particularly lithium cobalt oxide (LiCoOâ‚‚) and lithium iron phosphate (LiFePOâ‚„). As the demand for electric vehicles increases, so does the need for lithium carbonate, making it a critical component in the energy storage and renewable energy sectors.

Lithium carbonate is used in the synthesis of lithium compounds, including lithium hydroxide, which is essential for producing high-performance battery cells. The growing trend of electrification in transportation, as well as the widespread adoption of renewable energy sources such as solar and wind, further amplifies the demand for lithium carbonate. Lithium carbonate has been used in medicine for decades, particularly in the treatment of psychiatric disorders. One of its most important applications is in the management of bipolar disorder. Lithium salts, including lithium carbonate, act as mood stabilizers and are commonly prescribed to help prevent the extreme mood swings associated with this condition. Lithium carbonate works by influencing neurotransmitter signaling and modulating the activity of the central nervous system.

Key Takeaways

- The lithium carbonate market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global nano fertilizers markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the lithium carbonate market are Ganfeng Lithium Group Co., Ltd, Albemarle Corporation, SQM S.A., Tianqi Lithium, LevertonHELM Limited, Camber Pharmaceuticals, Inc, Central Drug House, Vishnupriya Chemicals Pvt. Ltd, PACIFIC ORGANICS PVT. LTD, and Merck KGaA. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

Growth in renewable energy storage is expected to drive the growth of the market. The rising demand for energy storage in renewable energy systems is driving the need for lithium carbonate, a key raw material in lithium-ion battery production. As renewable energy adoption grows, lithium-ion batteries play a crucial role in stabilizing and storing power, thus increasing the demand for lithium carbonate extraction and processing. Large-scale energy storage integration into grid networks further accelerates this trend, supporting reliable renewable energy supply. The global push for carbon reduction and technological advancements reinforce this demand. Notable projects include South Africa’s Oya Hybrid Power Station (operational in December 2024), combining 155 MW solar, 86 MW wind, and 92 MW/242 MWh battery storage, and Australia’s Snowy 2.0 (February 2025), a 2.2 GW pumped-hydro project providing 350,000 MWh storage to stabilize the national grid and meet peak demand.

However, lack of recycling infrastructure is expected to hinder the growth of the lithium carbonate market. The lack of recycling infrastructure for lithium-ion batteries poses a significant challenge to the long-term sustainability of the lithium carbonate supply chain. As demand for lithium-ion batteries continues to rise—driven by electric vehicles (EVs), renewable energy storage, and consumer electronics—the industry faces increasing pressure to establish efficient and scalable recycling solutions. However, current lithium-ion battery recycling infrastructure remains underdeveloped, creating both environmental and supply chain risks. The complexity of lithium-ion battery recycling further exacerbates the problem, as lithium-ion batteries contain a variety of materials, including lithium carbonate, cobalt, nickel, manganese, and graphite, all of which are difficult to extract and separate. Current recycling methods, such as pyrometallurgical and hydrometallurgical processes, can be energy-intensive, costly, and inefficient, often recovering only a fraction of the lithium content.

Segments Overview

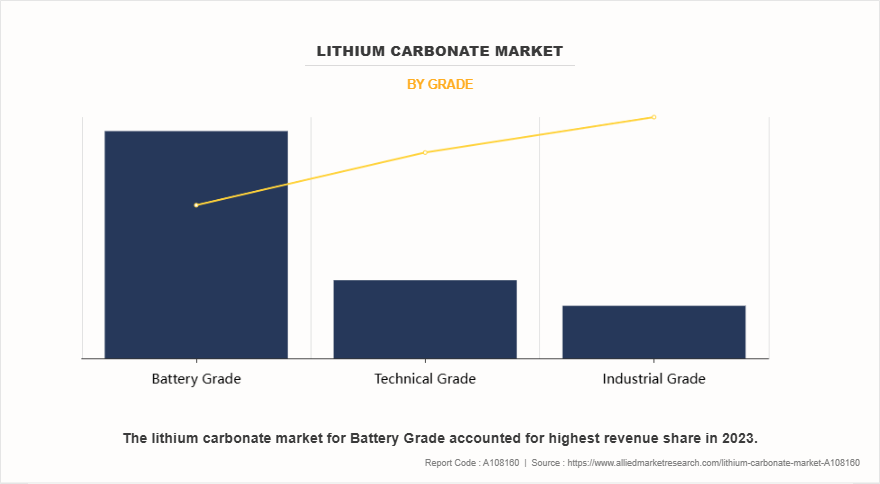

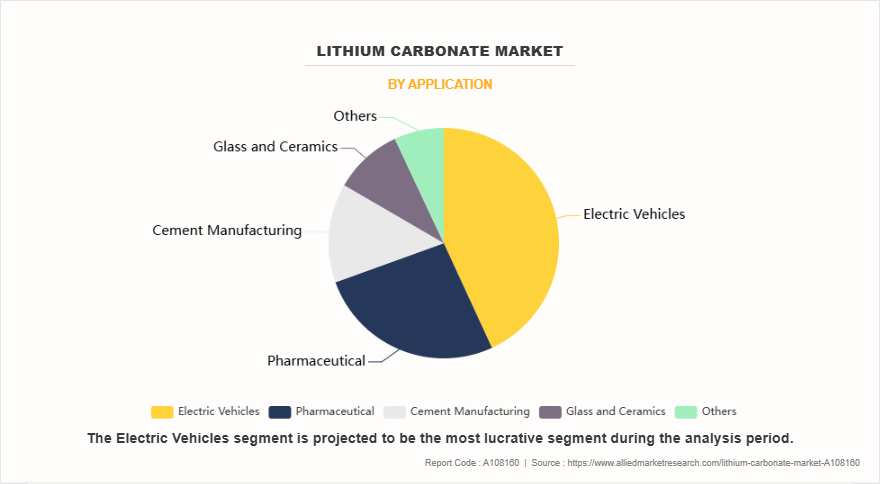

The lithium carbonate market is segmented into grade, application, and region. On the basis of grade, the market is divided into Battery Grade, Technical Grade, and Industrial Grade. On the basis of application, the lithium carbonate market is categorized into electric vehicles, pharmaceutical, cement manufacturing, glass & ceramics, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of grade, the battery grade segment dominated the market in 2023. The demand for battery-grade lithium carbonate has surged in recent years, driven by the global push for sustainable energy and the electrification of transportation. It plays a critical role in enhancing battery efficiency, energy density, and charge-discharge cycles, making it a preferred choice for EV manufacturers and grid-scale energy storage projects. Moreover, ongoing advancements in battery technology, including solid-state batteries and next-generation cathode materials, continue to drive the evolution of lithium carbonate processing and refinement to meet the industry's stringent quality standards.

On the basis of application, the electric vehicles segment dominated the market in 2023. Lithium carbonate is a critical raw material in the production of lithium-ion batteries, which power electric vehicles (EVs). As a key lithium compound, it serves as the primary source of lithium for cathode materials in battery chemistries such as lithium iron phosphate (LFP) and lithium nickel manganese cobalt oxide (NMC). These batteries offer high energy density, extended cycle life, and efficient power delivery, making them well-suited for electric vehicle applications. The demand for lithium carbonate has surged in recent years, driven by the global transition toward sustainable transportation and the push for reduced carbon emissions.

By region, Asia-Pacific dominated the lithium carbonate market in 2023 . Lithium carbonate is a critical raw material in the Asia-Pacific region, driven primarily by its role in lithium-ion battery production for electric vehicles (EVs), consumer electronics, and energy storage systems. China, the dominant player in the global lithium market, leads in both lithium carbonate consumption and refining capacity. The country has aggressively expanded its battery manufacturing sector, driven by government incentives for EV adoption and grid-scale energy storage. As a result, Chinese lithium carbonate demand has surged, with significant investments in domestic and international lithium mining projects to secure a stable supply chain.

Competitive Analysis

The major prominent players operating in the lithium carbonate market include Ganfeng Lithium Group Co., Ltd, Albemarle Corporation, SQM S.A., Tianqi Lithium, LevertonHELM Limited, Camber Pharmaceuticals, Inc, Central Drug House, Vishnupriya Chemicals Pvt. Ltd, PACIFIC ORGANICS PVT. LTD, and Merck KGaA.

In December 2024, Ascend Elements, a Massachusetts-based battery recycling company, announced plans to commence lithium carbonate production from recycled lithium-ion batteries at its Covington facility in 2025. The facility aims to produce up to 3,000 metric tons annually, marking the first commercial-scale recycled lithium carbonate production in the U.S.

In September 2024, Redwood Materials, founded by former Tesla executive JB Straubel, secured a $2 billion loan from the U.S. Department of Energy's Advanced Technology Vehicles Manufacturing Loan Program in February 2023. The funds are intended to support the establishment of a domestic supply base for electric vehicle batteries, reducing reliance on imports.

Lithium Carbonate Industry News:

- In October 2024, Rio Tinto agreed to acquire Arcadium Lithium (formerly Allkem and Livent) for $6.7 billion, aiming to enhance its position in the lithium market. This move underscores Rio Tinto's commitment to expanding its lithium production capabilities.

- In October 2024, General Motors invested $625 million in Lithium Americas Corp. to develop the Thacker Pass lithium mine in Nevada. This strategic move aims to bolster GM's domestic supply chain for electric vehicle batteries.

- In February 2025, Volkswagen Group and Contemporary Amperex Technology Co. Limited (CATL) announced a collaboration to develop new lithium batteries in China. This partnership aims to enhance product development for electrified vehicles and includes initiatives in battery recycling and vehicle-to-grid technology.

- In February 2025, Japan's Idemitsu Kosan announced plans to build a lithium sulphide plant at its Chiba refinery to support the development of all-solid-state batteries, crucial for the future of electric vehicles. This initiative aligns with Toyota Motor's plans to launch EVs with advanced solid-state batteries by 2027-2028.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lithium carbonate market analysis from 2023 to 2033 to identify the prevailing lithium carbonate market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lithium carbonate market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lithium carbonate market trends, key players, market segments, application areas, and market growth strategies.

Lithium Carbonate Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 102.8 billion |

| Growth Rate | CAGR of 14.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 334 |

| By Grade |

|

| By Application |

|

| By Region |

|

| Key Market Players | Central Drug House, Merck KGaA, Tianqi Lithium Corporation, SQM S.A., Vishnupriya Chemicals Pvt. Ltd., Albemarle Corporation, LevertonHELM Limited, PACIFIC ORGANICS PVT. LTD., Camber Pharmaceuticals, Inc., Ganfeng Lithium Group Co., Ltd |

Analyst Review

According to the opinions of various CXOs of leading companies, increase in grid-scale energy storage is expected to drive the growth of market. The growing need for reliable and efficient grid-scale energy storage systems is playing a pivotal role in driving the demand for lithium carbonate. Lithium-ion batteries, particularly those that rely on lithium carbonate in their manufacturing process, have emerged as a leading technology for large-scale energy storage applications. These batteries offer several advantages that make them ideal for grid stabilization. They have a high energy density, meaning they can store a large amount of electricity in a relatively small space. Additionally, lithium-ion batteries are known for their fast charging and discharging capabilities, making them particularly effective in managing sudden fluctuations in grid demand. In October 2024, the U.S. substantially increased its utility-scale battery capacity, adding over 20 gigawatts (GW) in the past four years, with 5 GW added in the first seven months of 2024 alone. This expansion is expected to double to 40 GW by 2025, enhancing grid stability and supporting renewable energy integration.

However, price fluctuations of lithium carbonate are expected to hamper the growth of market in future. The market for lithium carbonate is highly volatile, with prices experiencing significant fluctuations due to supply-demand imbalances. As one of the key raw materials for lithium-ion batteries, lithium carbonate is in high demand, driven by the rapid expansion of the electric vehicle (EV) industry, grid-scale energy storage systems, and consumer electronics. However, the global lithium supply chain is complex, and factors such as geopolitical events, production bottlenecks, regulatory changes, and technological advancements contribute to unpredictable price swings. According to the Fusion Media Limited, in November 2022, lithium carbonate prices reached an all-time high, exceeding $80,000 per ton. This surge was driven by robust demand from the electric vehicle (EV) sector and constrained supply chains. Bernstein forecasts that spot lithium carbonate prices could average $12,000 per ton in 2025, with a significant increase to $20,000 per ton in 2026 and $25,000 per ton in 2027. These projections are more optimistic than the current market consensus. All these factors are expected to hamper the growth of the market.

The global lithium carbonate market was valued at $26.7 billion in 2023, and is projected to reach $102.8 billion by 2033, growing at a CAGR of 14.5% from 2024 to 2033.

The major prominent players operating in the lithium carbonate market include Ganfeng Lithium Group Co., Ltd, Albemarle Corporation, SQM S.A., Tianqi Lithium, LevertonHELM Limited, Camber Pharmaceuticals, Inc, Central Drug House, Vishnupriya Chemicals Pvt. Ltd, PACIFIC ORGANICS PVT. LTD, and Merck KGaA.

Asia-Pacific is the largest regional market for lithium carbonate.

Electric Vehicles is the leading application of lithium carbonate market.

Advancements in lithium extraction technologies are the upcoming trends of lithium carbonate market.

Loading Table Of Content...

Loading Research Methodology...