Lithium Chloride Market Research, 2031

The global lithium chloride market size was valued at $1.7 billion in 2021, and is projected to reach $3.2 billion by 2031, growing at a CAGR of 6.8% from 2022 to 2031.

Lithium chloride is primarily used in the electrolysis of lithium metal. It is also used as an aluminium brazing flux in vehicle components and as a desiccant to dry air streams. It is also utilized in various electronics industry, manufacturing of lithium ion batteries and manufacturing of pharmaceutical drugs such as antimanic agents.

The increasing use of lithium chloride across the electronics industry in smartphones, tablets, smart watch, camera, pacemakers due to its ability to store up to 150 watt-hours of electricity into 1 kilogram of battery is expected to serve as a crucial growth factor for the lithium chloride market. Also, rise in adoption of lithium chloride in the pharmaceutical industry to treat mood disorders such as (mania frenzied, abnormally excited mood) in people with bipolar disorder (manic-depressive disorder, a disease that causes episodes of depression, episodes of mania, and other abnormal moods). However, the health hazards associated with lithium is anticipated to hamper the growth of the lithium chloride market. On the contrary, increased popularity of electric vehicle in lithium chloride industry is expected to generate lucrative opportunities for the global lithium chloride market.

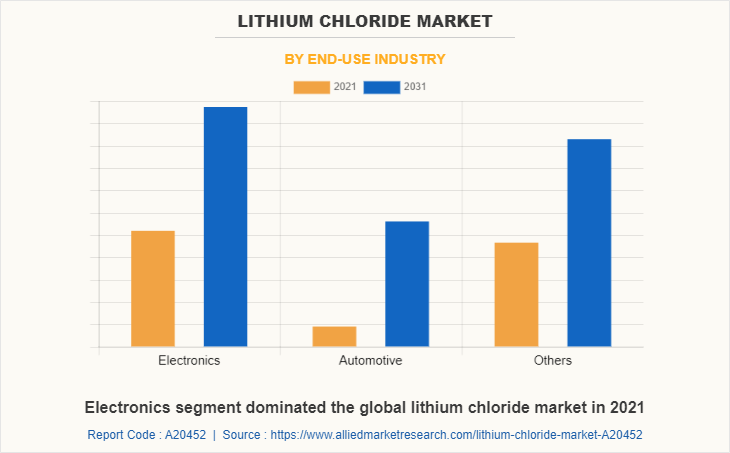

The global lithium chloride market is segmented into type, application, end-use industry and region. On the basis of type, the market is categorized into lithium chloride hydrate, lithium chloride anhydrous and others. On the basis of application, the market is categorized into batteries, air treatment and others. On the basis of end-use industry, the market is categorized into electronics, automotive, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. The llithium chloride market share is analyzed across all significant regions and countries.

The major players operating in the global lithium chloride market Alfa Aesar, American elements, Albemarle Corporation, FMC Corporation, Glentham Life Sciences, Harshil Industries, Honeywell International Inc., Levertonhelm Ltd, Nippon Chemical Industries, Suzhou Huizhi Lithium Energy Material Co. Ltd, Sichuuan Brivo Lithium Materials Co. Ltd, Tokyo Chemicals, SQM S.A, Loba Chemie, and Mody Pharma.

Asia-Pacific is projected to register a robust growth during the forecast period. This is attributed to the fact that lithium chloride is used as a brazing flux for aluminum in automobile parts. Lithium chloride in Asia-Pacific is used in battery applications of automobiles, truck, bus, train, or other transportation vehicles. Lithium-ion (Li-ion) batteries are the key component of most of the automotive vehicles in the region.

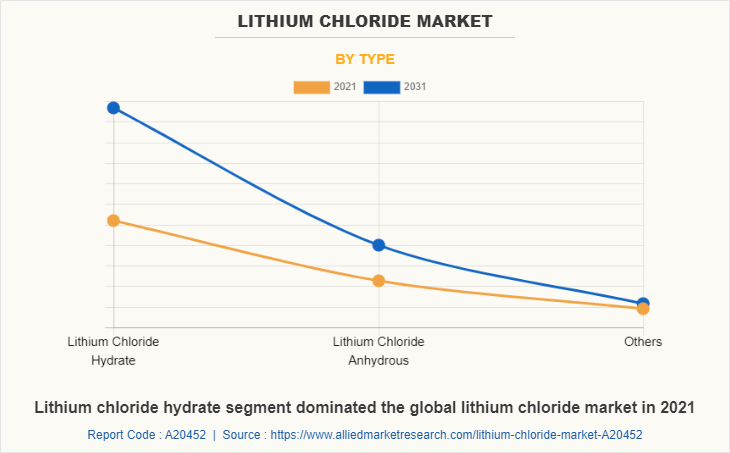

Lithium chloride hydrate segment dominated the global lithium chloride market in terms of revenue, in 2021. Lithium chloride hydrate is 99.99% trace metals basis. Lithium chloride hydrate materials can be decomposed by electrolysis to chlorine gas and the metal. They are formed through various chlorination processes whereby at least one chlorine anion is covalently bonded to the relevant metal. It is widely used in automobile parts. Such demand for lithium chloride hydrate in automobile applications is expected to boost the lithium chloride market growth throughout the forecast period.

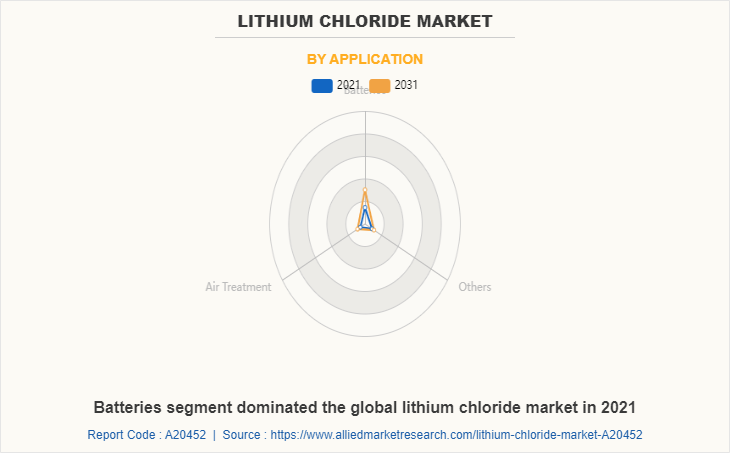

Batteries segment dominated the global lithium chloride market in 2021. Lithium chloride is used in rechargeable batteries for cell phones, laptop computers, digital cameras, and electric vehicles. Lithium is also used in non-rechargeable batteries used in devices such as cardiac pacemakers, toys, and clocks. The global production capacity of lithium chloride batteries is thus expected to expand dramatically, rising from almost 300 gigaton-hours in 2018 to more than two terawatt-hours in 2028. Thus, increasing demand of lithium ion batteries is expected to boost the lithium chloride market in forecast period.

Electronics segment dominated the global lithium chloride market in 2021. Lithium chloride is used in electronic devices such as smartphones, tablets, and laptop computers for communication. Lithium-based batteries are widely used in portable devices due to their high efficiency, high energy and power density, and low self-discharge rate. These factors are expected to drive the segment growth during the forecast period.

COVID-19 Analysis:

The COVID-19 pandemic had moderate effects on the lithium chloride market. Lithium chloride has been reported as a potential antiviral drug for certain viruses. It can efficiently impair the replication of a variety of viruses, including infectious bronchitis coronavirus (IBV) and transmissible gastroenteritis coronavirus (TGEV). During the COVID-19 pandemic, most people are isolated and in order to reduce depression and mania, the drug demand for lithium chloride has increased. Further, the growth of pharmaceutical industry during the pandemic is likely to propel the lithium chloride market growth. The pharmaceutical export market turnover was $24.4 billion in 2020-21, witnessing an 18.1 percent growth. India’s domestic pharmaceutical market is estimated at $41 billion in 2021 and likely to grow to $65 billion by 2024 and further expected to reach $130 billion by 2030.

Furthermore, the COVID-19 epidemic has naturally increased the long-standing trend toward manufacturing automation. Motion sensors, contactless sensors and contactless elevators are highly marketed in pandemic for keeping house safe and secure. The size of the global industrial automation market reached about $175 billion in 2020. The market is expected to grow at a compound annual growth rate (CAGR) of around significant percent until 2025. In 2025, the size of the global industrial automation market should reach roughly $265 billion. Furthermore, increased sales of automations, items worldwide have created demand for lithium chloride market during the pandemic.

Therefore, the above mentioned factors are predicted to surge the demand for lithium chloride globally during the COVID-19 pandemic.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lithium chloride market analysis and lithium chloride market forecast from 2021 to 2031 to identify the prevailing lithium chloride market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lithium chloride market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lithium chloride market trends, key players, market segments, application areas, and market growth strategies.

Lithium Chloride Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | GLENTHAM LIFE SCIENCES, Sichuuan Brivo Lithium Materials Co. Ltd, Suzhou Huizhi Lithium Energy Material Co. Ltd, TOKYO CHEMICALS, Alfa Aesar, Honeywell International Inc., Nippon Chemical Industries Co. Ltd, FMC Corporation, HARSHIL INDUSTRIES, MODY CHEMI PHARMA LTD, Albemarle Corporation, SQM S.A, LEVERTON HELM LTD, AMERICAN ELEMENTS, LOBA CHEMIE |

Analyst Review

According to the perspective of the CXOs of leading companies, the lithium chloride market is anticipated to witness growth in the near future due to its extensive use in applications such as batteries, air treatment, and other industries.

Lithium chloride has been used in batteries, RNA precipitation, organic synthesis, supplements and other power sector equipment. It is a vital part of power industry. It assists steam-generating boilers in maintaining specific temperatures. Consequently, the increasing demand from medical, electronics, and automotive industries is projected to surge the demand for lithium chloride during the forecast period. Further, the Asia-Pacific region is projected to register a robust growth during the forecast period.

The lithium chloride market was valued at $1,7 billion in 2021, and is projected to reach $3.2 billion by 2031, growing at a CAGR of 6.8% from 2022 to 2031.

The increasing use of lithium chloride across the electronics industry in smartphones, tablets, smart watch, camera, pacemakers due to its ability to store up to 150 watt-hours of electricity into 1 kilogram of battery is expected to serve as a crucial growth factor for the lithium chloride market. Also, there is rise in adoption of lithium chloride in the pharmaceutical industry to treat mood disorders such as (mania frenzied, abnormally excited mood) in people with bipolar disorder (manic-depressive disorder, a disease that causes episodes of depression, episodes of mania, and other abnormal moods).

Batteries are the leading applications of Lithium Chloride Market

The major players operating in the global lithium chloride market Alfa Aesar, American elements, Albemarle Corporation, FMC Corporation, Glentham Life Sciences, Harshil Industries, Honeywell International Inc., Levertonhelm Ltd, Nippon Chemical Industries, Suzhou Huizhi Lithium Energy Material Co. Ltd, Sichuuan Brivo Lithium Materials Co. Ltd, Tokyo Chemicals, SQM S.A, Loba Chemie, and Mody Pharma.

Asia-Pacific is projected to register a robust growth during the forecast period.

On the basis of type, the lithium chloride hydrate segment dominated the global lithium chloride market in terms of revenue, in 2021.

On the basis of end-use industry, the electronics segment dominated the global lithium chloride market in 2021.

Loading Table Of Content...