Lithium Foil Market Research, 2031

The global lithium foil market size was valued at $7.1 billion in 2021 and is projected to reach $40.9 billion by 2031, growing at a CAGR of 19.2% from 2022 to 2031.

Lithium foil is straight and bright, free of oil spots and other foreign matter, has no visible oxides and nitrides, no holes, wrinkles, creases, and other defects, and slight processing stripes and roll marks are allowed. Lithium foil is widely used in high-energy lithium primary and secondary battery anode materials and is also one of the core materials of lithium-ion solid-state batteries and semi-solid batteries. Lithium foil-based batteries are small in size, large in capacity, and have no memory effect.

Lithium is a soft, silver metal, and is the lightest of all the metals on the earth. Lithium is kept under oil to check corrosion as the metal reacts gradually in water and in the air where it ultimately forms a black coating of oxide. Lithium finds application as an alloying agent with aluminum and magnesium. Lithium is used in the manufacturing of batteries.

The growth of the market is directly proportional to the growth of the electric and electronics industry. Trends in electric vehicles have an impact on lithium foil producers. Factors, such as the growing demand for lithium foil in the automotive, electronics & electric, and medical implants are expected to drive the lithium foil market growth. In addition, an increase in the consumer base for electric and electronics products in the Asia-Pacific region will boost the demand for lithium foil, thus in turn it will drive the market growth during the forecast period.

The internet of things (IoT) is a technology where a system of interrelated computing devices, mechanical and digital machines, objects, animals, and people are provided with unique identifiers (UIDs) and are able to produce, process, and transfer data over a network without requiring human-to-human or human-to-computer interaction. A lot of progress has been made on batteries as well as in other energy storage devices such as micro-fuel cells, micro-heat engines, and capacitors. However, of them, all batteries, and in particular lithium batteries are the dominant source of power in the IoT industry due to their miniaturization, high capacity, good temperature sensitivity, and less weight. Lithium foil is used in lithium-ion batteries as it offers the highest energy density in the rechargeable battery and makes charging a lithium-ion battery easier, faster, and long-lasting. These properties of lithium foil are expected to increase its demand in electrical and electronics industries over the forecast period.

Additionally, a soft, stretchable and mechanically deformable lithium battery has been developed, these lithium batteries are used in the development of wearable devices. Lithium batteries exhibit high capacity and free-form characteristics that are ideal for mechanical deformation. As a result of the increasing demand for high-performance wearable devices like smart bands, implantable electronic devices like soft wearable devices, and pacemakers for use in the realistic metaverse, the development of soft and stretchable batteries, like the human skin and organs, has been gaining a lot of interest. Thus, the increased demand for lithium batteries in smart wearables will drive the market growth for lithium foil during the forecast period.

Lithium foil is the primary source for Li-Ion battery packs as it is more stable and safer in charging and discharging energy compared to other minerals. Lithium foil-based batteries offer high performance and it also provides an ideal renewable energy solution for many different applications. Lithium batteries are used in powering almost all the electronic gadgets around us, from our earbuds to laptops and mobile phones. Their usage is not limited to consumer electronics alone and these batteries are popular in the electric vehicle industry as well. Since these are considered to be the most suitable energy storage devices for powering electric vehicles, the demand for lithium-ion batteries has been increasing tremendously in the last few years.

The lithium-ion battery is gaining major acceptance in the industry due to falling battery prices and new markets emerging such as electric vehicles and energy storage systems (ESS). Indeed, there has been a great focus to strengthen the global market with updated and innovative technology solutions to make EVs a resilient industry. Furthermore, the growth of the Lithium-ion battery manufacturing industry comes as no surprise since there are numerous advantages to using lithium batteries. From its wide range of applicability in devices such as smartphones, electronic vehicles laptops, and many other uses and a benefit, this industry is booming at an exponential rate. The energy density of lithium-ion batteries is extremely high, making this one of its primary attractions. Devices like our mobile phones need to operate for longer periods of time while not on charge. This consumes a considerable amount of power and thus a battery made from lithium-ion would provide a much higher density of power. Thus, in turn, market growth for lithium foil will boost over the forecast period.

However, the presence of alternatives such as aluminum foil and copper foil may hamper the growth of the global lithium foil industry during the forecast period. The high cost of solid-state lithium foil is attributed to both materials processing costs and low throughput manufacturing. Lithium prices have been widely discussed in the auto industry, and beyond, due to the cost of metal necessary to make those batteries have been skyrocketing which can hamper the lithium foil market growth over the forecast period.

The demand for lithium foil will expand due to the increasing acceptance of electrical vehicles and lithium batteries over the forecast period. Lithium foil offers many benefits when used in batteries such as they are very good for electricity storage, being light in weight and it makes soft batteries. Do these benefits of lithium-based batteries, lithium-ion batteries get used in electric vehicles that they are a safer option compared to their different alternatives. This is due to battery manufacturers forever ensuring that customers remain protected in the unlikely event of a system failure. Automakers, for instance, install charging protections in electric cars to protect the batteries from repetitive rapid charging sessions in a short amount of time.

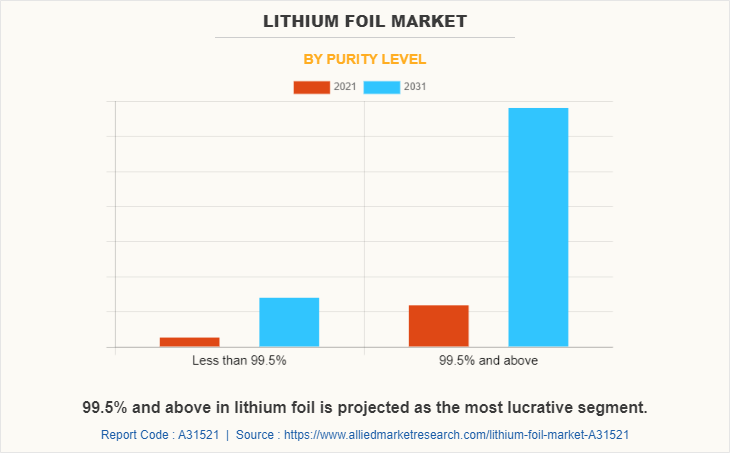

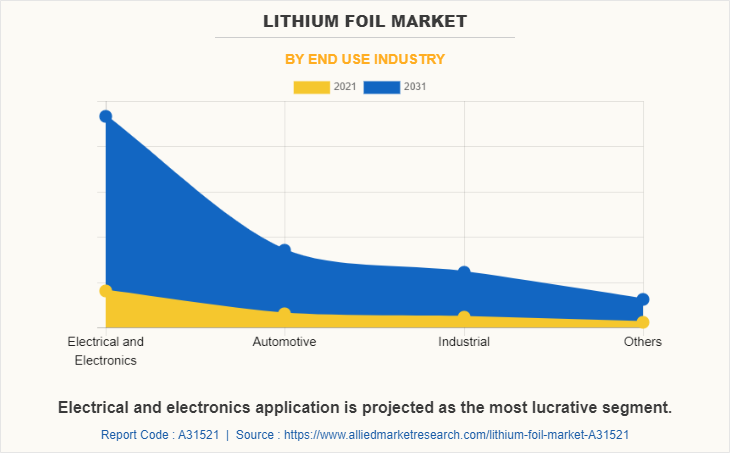

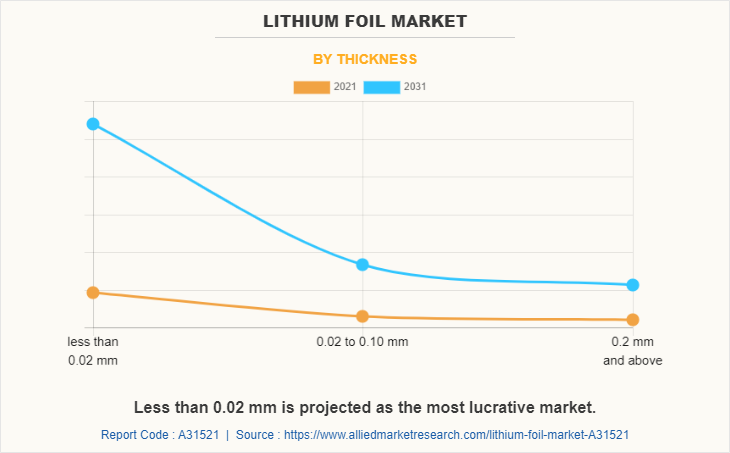

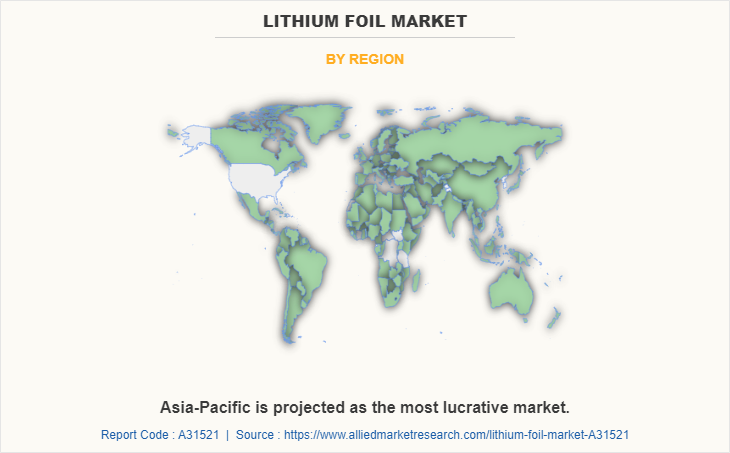

The lithium foil market is segmented on the basis of purity level, thickness, end-use industry, and region. On the basis of purity level, the market is classified into less than 99.5% and 99.5% and above. On the basis of thickness, the market is classified into less than 0.02 mm, 0.02 to 0.10 mm, and 0.2 mm and above. On the basis of the end-use industry, the market is classified into Electrical & Electronics, Automotive, Industrial, and Others.

The global Lithium foil market analysis covers in-depth information about the major industry participants. The key players operating and profiled in the report include American Elements, Albemarle Corporation, BASF SE, China Energy Lithium Co., Ltd., Ganfeng Lithium Co., Ltd., Nanoshel LLC, Merck KGaA, The Honjo Chemical Corporation, Thermo Fisher Scientific, and UACJ Foil Corporation.

On the basis of purity level, the 99.5% and above segment accounted for 82.8% lithium foil market share in 2021 and is expected to maintain its dominance during the forecast period. This is owing to the high demand for pure lithium foil in electronics and electric products.

On the basis of the end-use industry, the electrical and electronics segment dominated the global lithium foil market in terms of revenue, in 2021. This is owing to an increase in the growth of the consumer base in the electronics and energy sectors.

On the basis of thickness, the less than 0.02 mm segment dominated the global lithium foil market in terms of revenue, in 2021, and is expected to maintain its dominance during the forecast period. This is owing to the high demand for 0.02 mm lithium foil in the automotive and electronics sector.

On the basis of region, the Asia-Pacific segment accounted for 40.2% revenue market share of the global lithium foil market in 2021 and is expected to maintain its dominance during the forecast period. This is owing to the increased growth of lithium’s deployment in electric vehicles.

IMPACT OF COVID-19 ON THE LITHIUM FOIL MARKET

The outbreak of the COVID-19 pandemic has had an adverse impact on the global economy as governments globally were forced to implement lockdowns to prevent the spread of the virus. As a result, the operations of lithium foil were hampered. The onset of COVID-19 began in China and quickly spread to South Korea. Together, they produce the majority of the lithium-ion (Li-ion) batteries used in the world. Three-quarters of the global battery manufacturing capacity is located in China, which dominates the battery supply chain. This development caused a number of interruptions in the Li-ion battery supply chain, which also impacted the stationary energy storage and electric vehicle markets across the globe and impacted the lithium foil market growth.

From the beginning of 2021, the supply chain of raw materials required for manufacturing batteries improved as well as electrical & electronics industry started their operation normally which increased the demand for lithium foil rapidly. Moreover, an increase in the implementation of lithium foils in batteries used in numerous end-use products such as electric vehicles, smart wearables, IoT devices, RFID tags, and others is predicted to stimulate the growth of the lithium foil industry during the forecast period.

KEY BENEFITS FOR STAKEHOLDERS

- The report provides an in-depth analysis of the global lithium foil market trends along with the current and future market forecast.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analyses during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the lithium foil industry for strategy building.

- A comprehensive global lithium foil market analysis covers factors that drive and restrain the market growth.

- The qualitative data in this report aims at market dynamics, trends, and developments.

Lithium Foil Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 40.9 billion |

| Growth Rate | CAGR of 19.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 248 |

| By Purity level |

|

| By End Use Industry |

|

| By Thickness |

|

| By Region |

|

| Key Market Players | The Honjo Chemical Corporation, Nanoshel LLC, China Energy Lithium Co., Ltd, Ganfeng Lithium Co., Ltd, AMERICAN ELEMENTS, Thermo Fisher Scientific, Inc., Merck KGaA, BASF SE, Albemarle Corporation, UACJ Foil Corporation |

Analyst Review

According to the opinions of various CXOs of leading companies, the lithium foil market is driven by high demand for lithium foil for the manufacturing of batteries which are used in different end-use industries such as electrical & electronics, automotive, industrial, and others. In addition, an increase in the consumer base for electric and electronics products in the Asia-Pacific region is expected to boost the demand for lithium foil, thus in turn driving the market growth during the forecast period. On the other hand, high manufacturing and equipment cost of lithium foil is projected to hinder market growth during the forecast period.

The global lithium foil market was valued at $7.1 billion in 2021 and is projected to reach $40.9 billion by 2031, registering a CAGR of 19.2% from 2022 to 2031.

The global lithium foil market is segmented on the basis of purity level, thickness, end-use industry, and region.

High demand for lithium foil in the electric and electronics industry and high demand for lithium foil in the production of electric vehicles. These are the key factors driving the global lithium foil market

The leading players in the market are American Elements, Albemarle Corporation, BASF SE, China Energy Lithium Co., Ltd., Ganfeng Lithium Co., Ltd., Nanoshel LLC, Merck KGaA, The Honjo Chemical Corporation, Thermo Fisher Scientific, and UACJ Foil Corporation.

Ever since the pandemic, industries across the sectors, such as electrical businesses, have experienced supply chain disruptions and significant delays in new installations in their offices as well as commercial applications. These steps hamper industries and pose challenges to their growth potential.

Loading Table Of Content...