Lithium-ion Battery Market Research, 2032

The global lithium-ion battery market size was valued at $46.2 billion in 2022, and lithium-ion battery industry is projected to reach $189.4 billion by 2032, growing at a CAGR of 15.2% from 2023 to 2032.

The lithium-ion battery market growth is driven by the increase in demand for electric vehicles (EVs), consumer electronics, and renewable energy storage systems. Government initiatives toward carbon neutrality and the rise in adoption of EVs significantly boost market growth. In addition, the surge in need for longer battery life and faster charging in devices such as smartphones and laptops further propel demand for lithium-ion batteries. Surge in renewable energy usage, particularly solar and wind power, necessitates efficient storage solutions.

Introduction

A lithium-ion battery is a rechargeable power storage system that makes use of lithium ions shifting between the positive and negative electrodes to store and release electrical energy. It is a type of rechargeable battery that has received considerable use in various applications, which include electric vehicles, portable electronics, and renewable energy systems.

Report Key Highlighters:

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence, and key strategic developments by prominent manufacturers.

- The lithium-ion battery market is fragmented in nature among prominent companies such as BYD Co., Ltd., A123 Systems, LLC, Hitachi, Ltd., CATL, LG Chem, Panasonic Corp., Saft, Samsung SDI Co., Ltd., Toshiba Corp., and GS Yuasa Corporation.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global lithium-ion battery market such as undergoing R&D activities, public policies, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 2,500 lithium-ion battery-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global lithium-ion battery market.

Market Dynamics

The increase in future applications of lithium-ion batteries in a variety of industries, consisting of electric vehicles, consumer electronics, and renewable energy storage, has paved the way for tremendous advancements in energy storage technology. The demand for environment-friendly and reliable energy sources has risen due to the rapid innovation and improvement of these sectors.

The automotive enterprise has witnessed a surge in the adoption of electric automobiles (EVs) driven by the aid of government initiatives to phase out fuel-based vehicles. The bold "zero carbon" targets set by governing bodies worldwide have similarly accelerated the demand for EVs, hence extend in the demand for lithium-ion batteries as a key component in electric-powered car strength systems. In addition, the tremendous use of consumer electronics in daily life has created a great need for high-performance rechargeable batteries. Lithium-ion batteries have found application in a wide variety of devices, which include smartphones, laptops, tablets, and wearable technology.

The continuous advancements in these digital devices, alongside growing customer expectations for longer battery life and faster charging, have similarly propelled the demand for lithium-ion batteries. Furthermore, the expansion of renewable electricity sources such as photo voltaic and wind power has necessitated efficient electricity storage solutions. Lithium-ion batteries play an indispensable function in storing electricity generated from these sources, enabling grid stability, and facilitating the integration of renewable power into existing electricity systems. The increase in emphasis on sustainability and the transition toward smooth electricity sources have created great opportunities for the lithium-ion battery market in the discipline of renewable energy storage.

However, the production of lithium-ion batteries is not an exceptional challenge. One of the key problems is the issue of the environmental impact associated with the extraction and disposal of lithium, as properly as the manufacturing method itself. Efforts are being made through manufacturers to advance extra sustainable and environmentally friendly battery manufacturing techniques to address these concerns.

Moreover, security issues related to lithium-ion batteries, such as the risk of thermal runaway and manageable fire hazards, require continuous lookup and improvement to improve battery layout and implement sturdy security mechanisms. The enterprise is centered on improving battery performance, extending cycle life, and increasing electricity density while ensuring security and reliability.

“The Future of Lithium-Ion Batteries: Powering the World with Sustainable Energy Storage”

Lithium-ion batteries are set to shape the future of power storage with their enduring advancements and attainable applications. Key traits in the area encompass expanded power density, quick charging capabilities, prolonged cycle life, and the emergence of solid-state batteries. These improvements are anticipated to pave the way for a greater sustainable and efficient strength landscape.

Manufacturers have made efforts to decorate power density in lithium-ion batteries and are centered on storing extra electricity in smaller and lighter packages. This advancement is predicted to enable longer-lasting units and make bigger the variety of electric vehicles, spurring their wider adoption. In addition, researchers work on lowering charging instances by exploring advanced battery chemistries and charging infrastructure improvements.

Battery durability is another place of focus, aiming to extend the quantity of charge-discharge cycles a battery is predicted to withstand. This is anticipated to minimize the want for prevalent replacements and contribute to a more sustainable battery lifecycle. Solid-state batteries, which use a stable electrolyte instead of a liquid one, offer extended safety, greater power density, and improved thermal stability. They signify a promising avenue for future strength storage technologies. Sustainability is a driving force behind future lithium-ion batteries. Manufacturers improve greener production processes, minimizing the environmental effect on battery manufacturing. In addition, developments in battery recycling applied sciences are expected to enable the restoration of precious materials and make a contribution to a circular economy. The future of lithium-ion batteries appears promising as they continue to evolve and electricity several industries. These developments are predicted to play a pivotal position in attaining a greener and greater sustainable future with the aid of decarbonizing transportation, supporting renewable energy integration, and driving the demand for portable electronics.

Segmentation Overview

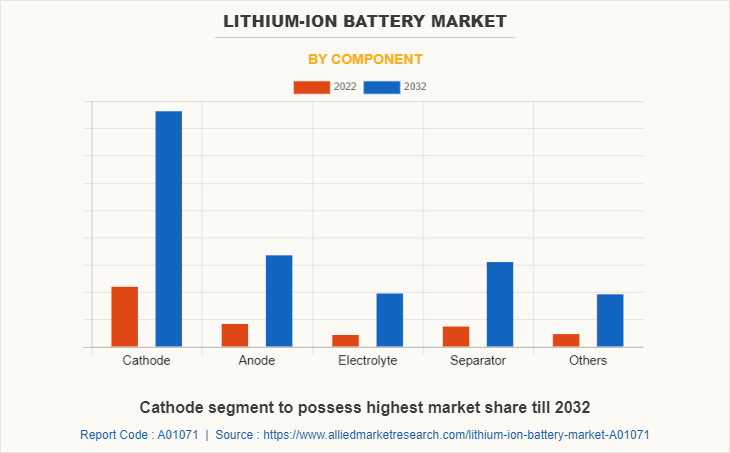

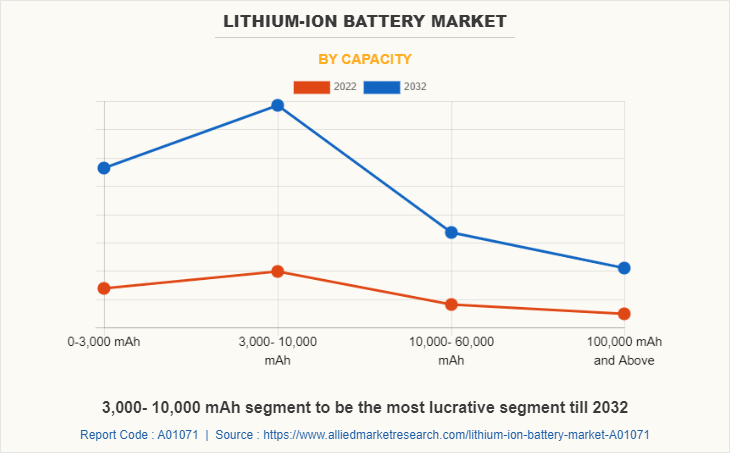

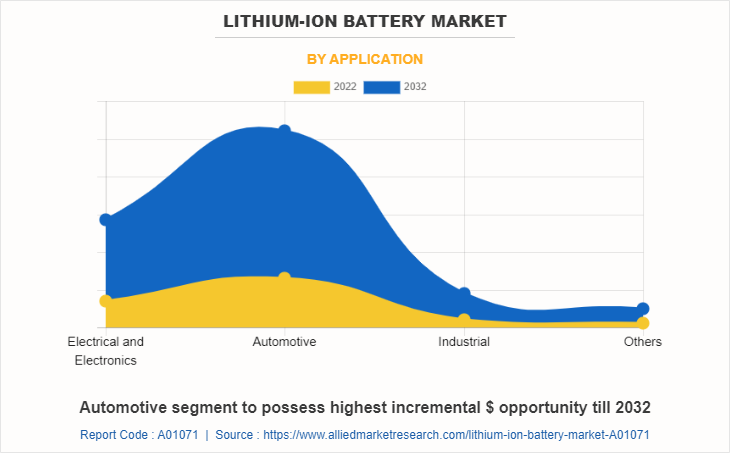

The lithium-ion battery market forecast is segmented on the basis of component, capacity, application, and region. On the basis of component, it is categorized into cathode, anode, electrolyte, separator, and others. On the basis of capacity, it is divided into 0-3,000 mAh, 3,000-10,000 mAh, 10,000-60,000 mAh, and 10,000 mAh and above. On the basis of application, it is classified into electrical & electronics, automotive, industrial, and others. On the basis of region, the lithium-ion battery market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Component

On the basis of component, the cathode segment emerged as the global leader by acquiring nearly half of the lithium-ion battery market share in 2022. The global shift toward electric mobility has been a significant driver for the cathode market. The demand for high-performance cathode materials with improved energy density and longer lifespans increases due to the increase in demand for EVs.

By Capacity

On the basis of capacity, the 3,000- 10,000 mAh segment emerged as the largest market share in 2022. The increase in demand for portable electronics, such as smartphones and wearables, creates an opportunity for compact and lightweight batteries. In addition, the growth in renewable energy sector seeks energy storage solutions, making these batteries suitable for storing and supplying clean energy.

By Application

On the basis of application, the automotive segment emerged as the largest market share in 2022. The increase in demand for electric vehicles, technological advancements, and the development of charging infrastructure drive the lithium-ion battery market in automotive applications. The demand for electric vehicles is driven by environmental concerns and government incentives boost the demand for the lithium-ion battery market growth.

By Region

On the basis of region, Asia-Pacific region is a key player in the global lithium-ion battery market, due to the rise in demand for electric vehicles (EVs) in countries such as China, Japan, and South Korea. The abovementioned countries have been actively promoting EV adoption to lower carbon emissions and dependence on fossil fuels for transportation and power generation.

Impact of Russia-Ukraine War on Global Lithium-Ion Battery Market

The Russia-Ukraine war has the potential to extensively impact the lithium-ion battery market. Ukraine plays a essential position in the world supply chain for crucial minerals and metals used in battery manufacturing, consisting of lithium, cobalt, and nickel. If the conflict disrupts mining operations or transportation routes in Ukraine or neighboring countries, it could lead to a shortage of these key raw materials, inflicting elevated expenditures and supply constraints for lithium-ion batteries. Moreover, the geopolitical uncertainty resulting from the conflict may also dampen investor self assurance and decision-making in the battery sector.

Impact of Global recession on Global Lithium-Ion Battery Market

A global recession in 2023 is expected to have tremendous implications for the lithium-ion battery market. During an financial downturn, there is generally a reduce in consumer spending, reduced commercial enterprise investments, and an ordinary slowdown in financial activity. These factors are expected to directly have an impact on the demand for lithium-ion batteries across a variety of sectors, which encompass military, defense, marine, and offshore applications.

The first major impact is a achievable slowdown in market growth. Reduced purchaser purchasing strength and decreased investments in new projects, which lead to the demand for lithium-ion batteries. The slower increase fee can have an effect on the universal market expansion, potentially leading to reduced income and revenue.

Furthermore, the delay or cancellation of projects that require lithium-ion batteries might also have a negative influence on the market. Economic uncertainty all through a recession regularly effects in corporations keeping back on investments and prioritizing cost-cutting measures. As a result, projects such as the electrification of protection vehicles or the integration of renewable energy in marine and offshore purposes may experience delays or face cancellation.

Competitive Landscape

The major companies profiled in this report include BYD Co., Ltd., A123 Systems, LLC, Hitachi, Ltd., CATL, LG Chem, Panasonic Corp., Saft, Samsung SDI Co., Ltd., Toshiba Corp., and GS Yuasa Corporation. The government all over the world has set sights on the development of renewable energy sources which require high energy density storage batteries, key manufacturers have innovated and expanded their production capacities in order to meet market demand across the globe due to rapid increase in demand for energy recent years. Additional growth strategies such as new product developments, acquisition, and business expansion strategies, are also adopted to attain key developments in the lithium-ion battery market trends.

Recent product launches in the automotive industry that has a positive impact on the demand for the lithium-ion battery market:

- Tesla Cybertruck (2023): Tesla's Cybertruck is equipped with advanced lithium-ion batteries, offering significant range and performance, driving higher demand for this technology in electric trucks.

- Lucid Air Sapphire (2023): The launch of the Lucid Air Sapphire, a luxury sedan featuring a high-capacity lithium-ion battery pack, enhances demand for high-performance batteries in the luxury EV segment.

- BMW i7 (2023): BMW's all-electric i7 luxury sedan leverages advanced lithium-ion battery technology for extended range and fast charging, boosting demand in the premium EV market.

- Hyundai Ioniq 7 (Expected 2024): Hyundai’s Ioniq 7 SUV, featuring an efficient lithium-ion battery system, is anticipated to drive battery demand with its combination of range and spacious design.

- Ford Explorer EV (Expected 2024): Ford's electric version of the Explorer SUV, offering powerful lithium-ion batteries, contributes to the increased demand for EV batteries, especially in the SUV market.

- These product launches reflect the industry's commitment to electrification, driving growth in the lithium-ion battery market as manufacturers push for higher performance, efficiency, and sustainability in EVs.

- In June 2021, Tesla unveiled the Model S Plaid, which points an advanced battery pack with elevated energy density and range. The Model S Plaid claims to have the longest range of any electric powered automobile on the market, with an estimated range of over 520 miles.

- Tesla continues to be a key player in the EV market, launching models such as the Model 3, Model Y, and the especially predicted Cybertruck. These motors matter on lithium-ion batteries for their power storage and have considerably contributed to the multiplied demand for such batteries.

- Ford delivered the Mustang Mach-E in late 2020, its first all-electric SUV. The Mach-E offers more than one battery options, consisting of a long-range battery pack that enables a vary of up to three hundred miles on a single charge.

- The Volkswagen ID.4, launched in 2020, is an all-electric compact SUV. It makes use of a lithium-ion battery pack to supply a vary of around 250 miles on a single charge, making it appropriate for daily commuting and city driving.

- In 2020, Chevrolet released an updated version of the Bolt EV, an lower priced all-electric compact car. The Bolt EV obtained a larger battery pack, increasing the range to about 259 miles, addressing one of the key considerations for attainable electric powered vehicle buyers.

- Lucid Motors introduced the Lucid Air luxury electric powered sedan in 2021. The Air boasts an awesome vary of up to 517 miles on a single charge, thanks to its superior lithium-ion battery technology and aerodynamic design.

- Other essential automakers such as Audi, Nissan, and BMW have additionally been launching electric auto models, such as the Audi e-tron, Nissan LEAF, and BMW i3, all of which make use of lithium-ion batteries.

- The upward thrust of electric powered vehicles has been notable, with manufacturers recognizing the potential for greener transportation in the business sector. Companies such as Tesla (Semi), Rivian (R1T), and Ford (F-150 Lightning) have brought electric powered truck models that count on lithium-ion batteries for electricity storage.

- Electric bikes and scooters have won popularity as environment friendly and eco-friendly transportation options. Companies such as Zero Motorcycles, Harley-Davidson (LiveWire), and Lime (electric scooter sharing) have brought electric two-wheelers that utilize lithium-ion batteries.

- Ride-hailing groups such as Uber and Lyft have been increasingly more adopting electric powered motors into their fleets, using the demand for lithium-ion batteries. In some cities, there are devoted electric vehicle ride-hailing services, such as Green Tomato Cars in the UK, which exclusively use EVs.

key historical trends in the lithium-ion battery industry:

- Cost Reduction: Over the past 30 years, the cost of lithium-ion batteries has dropped by approximately 97%, driven by technological advancements and economies of scale.

- Increased Energy Density: Energy density has increased fivefold over the last three decades, enabling more energy to be stored in the same space, improving performance in EVs and other applications.

- Rising Demand: Demand surged, especially in the automotive sector, with a 65% increase in automotive lithium-ion battery demand in 2022 compared to 2021.

- Material Demand and Supply: The rapid growth in battery demand has escalated the need for key materials like lithium, cobalt, and nickel, intensifying efforts to scale up mining and processing.

- Technological Innovations: Developments such as solid-state batteries are on the horizon, promising higher energy densities and quicker charging.

- Environmental and Recycling Efforts: Sustainability concerns have led to an increased focus on recycling and reducing the environmental impact of battery production.

These trends underline the lithium-ion battery industry's critical role in powering future technologies.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lithium-ion battery market analysis from 2022 to 2032 to identify the prevailing lithium-ion battery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lithium-ion battery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lithium-ion battery market trends, key players, market segments, application areas, and market growth strategies.

Lithium-ion Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 189.4 billion |

| Growth Rate | CAGR of 15.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 444 |

| By Component |

|

| By Capacity |

|

| By Application |

|

| By Region |

|

| Key Market Players | CATL, GS Yuasa International Ltd., BYD Co., Ltd., Hitachi, Ltd., SAMSUNG SDI CO., LTD., Saft Groupe S.A., Toshiba Corporation., Panasonic Corporation, A123 Systems LLC, LG Chem |

Analyst Review

According to CXOs perspective, lithium-ion batteries are expected to experience significant growth in demand due to the increase in awareness among individuals and businesses regarding the advantages of energy storage and the efficient use of lithium-ion technology. Lithium-ion batteries are increasingly preferred over other battery technologies due to their high energy density, longer lifespan, and faster charging capabilities.

The CXOs further added that the lithium-ion battery market is poised for rapid expansion during the forecast period, driven by the growth in need for reliable energy storage solutions and the implementation of renewable energy systems. Governments around the world promote the transition to clean energy and support the deployment of energy storage technologies through various incentives and regulations. This has led to an upsurge in demand for lithium-ion batteries in residential, commercial, and utility-scale applications.

In Asia-Pacific, the lithium-ion battery market presents lucrative opportunities for key manufacturers due to the increase in investment in renewable energy projects and the expansion of electric vehicle infrastructure in this region. Countries such as China, Japan, and South Korea are leading in the adoption of electric vehicles and renewable energy sources, thereby driving the demand for lithium-ion batteries.

The escalating demand for energy storage solutions in both the consumer and industrial sectors, especially during peak usage periods, serves as a significant driver for the global lithium-ion battery market. Major market players are actively responding to this demand through investment in research and development to improve battery performance, enhance safety features, and reduce costs. Moreover, the increase in demand for electric vehicles is expected to further boost the demand for lithium-ion batteries in the automotive sector.

However, despite the positive outlook, there are challenges that need to be addressed for the widespread adoption of lithium-ion batteries. The high initial cost of these batteries remains a significant barrier, particularly for large-scale applications. In addition, concerns regarding the environmental impact of lithium-ion battery production and disposal need to be carefully managed to ensure sustainable growth in the market.

Growth in demand for electric vehicles (EVs) and consumer electronics proliferation are the key factors boosting the Lithium-ion battery market growth.

Increase in energy storage installations is the Main Driver of Lithium-ion battery Market.

BYD Co., Ltd., A123 Systems, LLC, Hitachi, Ltd., CATL, LG Chem, Panasonic Corp., Saft, Samsung SDI Co., Ltd., Toshiba Corp., and GS Yuasa Corporation

Automotive application is projected to increase the demand for Lithium-ion battery Market

The lithium-ion battery market is segmented on the basis of component, capacity, application, and region. On the basis of component, it is categorized into cathode, anode, electrolyte, separator, and others. On the basis of capacity, it is divided into 0-3,000 mAh, 3,000-10,000 mAh, 10,000-60,000 mAh, and 10,000 mAh and above. On the basis of application, it is classified into electrical & electronics, automotive, industrial, and others. On the basis of region, the lithium-ion battery market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The market value of Lithium-ion battery in 2032 is expected to be $189.4 billion

Loading Table Of Content...

Loading Research Methodology...