Lithium Mining Equipment Market Research, 2032

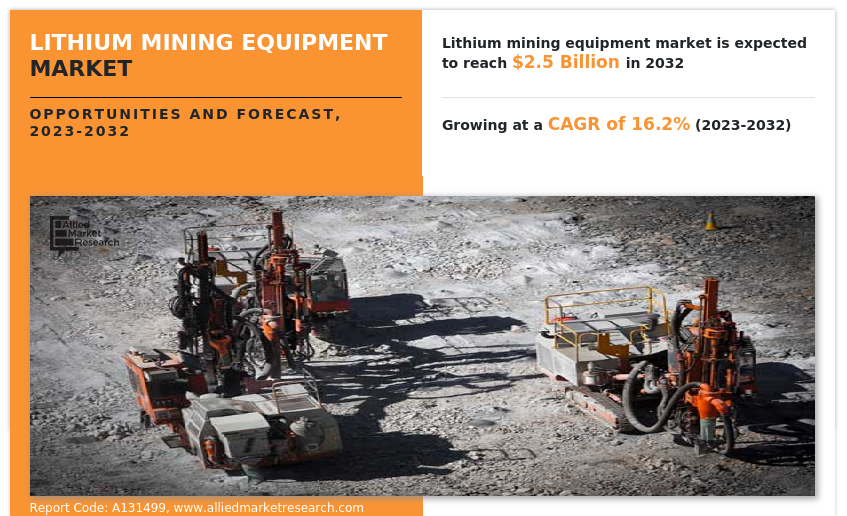

The Global Lithium Mining Equipment Market size was valued at $371.6 million in 2020, and is projected to reach $2.5 billion by 2032, growing at a CAGR of 16.2% from 2023 to 2032.

Lithium mining equipment encompasses a range of machinery and tools designed for the extraction, processing, and refinement of lithium-bearing materials from geological sources such as brines and hard rock deposits. It includes equipment like drills, crushers, pumps, separators, and processing plants that facilitate the recovery of lithium compounds.

These specialized tools are essential for efficiently extracting lithium, a critical component in lithium-ion batteries, which power electric vehicles, energy storage systems, and various electronics. The equipment's role is pivotal in meeting the growing demand for clean energy solutions and advancing sustainable technologies across industries.

Lithium Mining Equipment Market Market Dynamics

The industrial use of lithium is expanding in a number of industries, including batteries, electronics, aircraft, and ceramics, and demand for lithium across all sectors is rising. To extract and process minerals containing lithium, there is a growing demand, which necessitates the use of more sophisticated and efficient lithium mining equipment market. Additionally, in order to fulfill the rising industrial demand for lithium, mining operations may need to increase their production.

Larger production volumes can result in economies of scale, prompting mining corporations to invest in specialist equipment that can handle greater capacity, improve productivity, and lower operating costs. However, Australia is one of the world's top lithium producers, thus they continually modify the mining technique for lithium. For instance, in June 2022, the Australian Nuclear Science and Technology Organization (ANSTO) and Lithium Australia Limited (LIT) developed an innovative technique to extract additional lithium from lithium mining waste. Lithium has a wide range of uses due to its versatility in the industry, and that primarily drives the growth of the lithium mining equipment market.

In addition, the low self-discharge rate of lithium-ion batteries (Li-ion) allows them to hold their charge for a long time when not in use. Their usability and dependability are improved by this feature, which enables them for used in applications with frequent intermittent or periodic usage. Further, Li-ion batteries have a high efficiency of charge-discharge, which enables them to provide usable power with the fewest losses possible from the energy they store. This effectiveness results in longer device runtimes, less energy used, and better overall performance. As Li-ion technology develops, it offers even more energy density, longer lifespans, and improved safety features, reinforcing its critical position in advancing contemporary electronics and renewable energy solutions.

For instance, in June 2023, in order to establish a factory in Gujarat, India for the production of lithium-ion cells, Tata Group would invest around $1.6 billion. The plant's starting output will be 20 GWh. Moreover, Li-ion batteries are made to accommodate fast charging, enabling the comparatively speedy recharge of electric vehicles. Lithium mining equipment market opportunity have emerged as essential in this landscape due to their multifaceted applications. Rapid charging infrastructure is essential for the broad adoption of electric vehicles since it minimizes charging downtime and increases the usability of electric vehicles. Further, in July 2023, Panasonic Holdings will invest $4 billion in Kansas to construct a second electric vehicle battery manufacturing facility in the U.S. This factory will produce high-capacity batteries for Tesla and other electric vehicle manufacturers.

Furthermore, in electric vehicles, lithium-ion batteries serve as the main form of energy storage. The cathodes of these batteries heavily rely on lithium. For instance, in May 2023, the major producer of different sorts of automobiles, Kia plans to invest around $1 billion to develop a new electric vehicle facility in Mexico. Additionally, manufacturers of electric vehicles continually strive to increase their vehicles' energy density and range. This involves employing more lithium-ion batteries in order to boost their capacity and expand the range of EVs on a single charge. Due to this tendency, there will be a greater requirement for mining equipment to extract and process the raw material, which is expected to boost the lithium mining equipment market growth.

The lithium mining equipment market is witnessing various obstructions in its regular operations due to COVID-19 pandemic and inflation. lockdowns and travel restrictions imposed to curb the spread of the virus led to supply chain disruptions. Manufacturers faced difficulties in sourcing raw materials, components, and parts needed for producing lithium mining equipment. Delays in shipments and logistical bottlenecks affected the timely delivery of equipment, contributing to project delays and reduced operational efficiency.

However, the COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war, and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for machineries and equipment. In addition to this, the cost of mining equipment has also increased substantially, and many countries; especially, the countries in Europe, Latin America, and developing economies in Asia-Pacific are experiencing severe negative impacts in industrial production, including the production of various machineries. However, India and China are performing relatively well. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. However, with the continued talks between different countries, a peace agreement between Ukraine and Russia can be devised.

Lithium Mining Equipment Market Segmental Overview

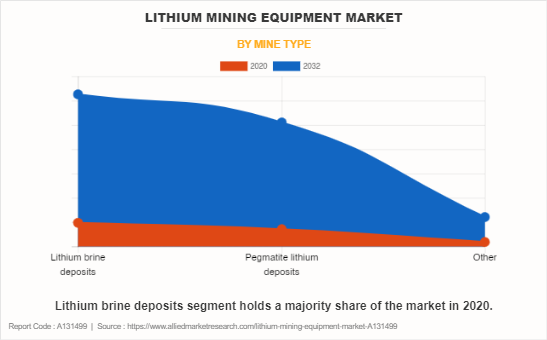

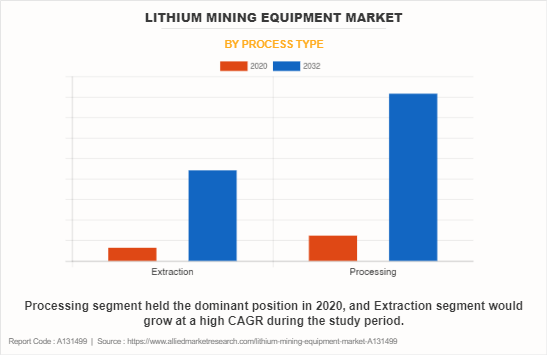

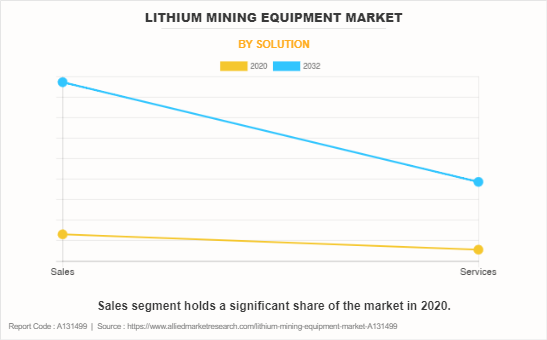

The Lithium Mining Equipment Market is segmented on the basis of mine type, process type, solutions, and region. By mine type, the lithium mining equipment market is bifurcated into lithium brine deposits, pegmatite lithium deposits, and others. Furthermore, the process type segment is further categorized into extraction and processing. Depending upon the solution, the market is categorized into sales and services. Region-wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Portugal, UK, and rest of Europe), Asia-Pacific (China, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By Mine Type:

The Lithium Mining Equipment Market is bifurcated into lithium brine deposits, pegmatite lithium deposits, and others. In 2020, the lithium brine segment dominated the lithium mining equipment market share, in terms of revenue. However, the pegmatite lithium deposits segment is expected to grow with a higher CAGR during the forecast period. Moreover, lithium extraction from brine sources often requires less energy compared to hard rock mining. Pegmatite lithium deposits offer advantages for sustainable lithium production. Brine deposits, while attractive due to lower operational costs and a smaller carbon footprint are influenced by weathering in sedimentary formations. This energy efficiency further contributes to the environmental benefits of lithium mining equipment market overview production. In contrast, pegmatites occur in igneous and metamorphic rocks that are less affected by weathering. This makes pegmatite lithium deposits more resistant to environmental factors, potentially resulting in a more stable production over time.

By Process Type:

The Lithium Mining Equipment Market is divided into extraction and processing. In 2020, processing dominated the lithium mining equipment market forecast, in terms of revenue, and extraction is expected to witness growth at a higher CAGR during the forecast period. Different types of lithium deposits require specific processing methods. This diversification leads to a broader range of equipment needs, creating opportunities for equipment manufacturers to specialize and cater to different processing requirements. Furthermore, modern extraction techniques can significantly improve the efficiency and speed of lithium recovery. Enhanced extraction processes allow for higher production rates, driving the demand for advanced and specialized mining equipment to meet increased output.

By Solution:

The Lithium Mining Equipment is divided between sales and services. The sales segment accounted for a higher market share in 2020, and the service segment is anticipated to register a higher growth rate throughout the forecast period. Moreover, consistent sales enable companies to invest in research and development, product improvement, and expansion of their product offerings. This contributes to the overall growth and sustainability of the lithium mining equipment industry. Furthermore, the service providers offer maintenance plans and repair services to ensure the longevity and reliability of mining equipment. Regular maintenance and timely repairs can prevent downtime, extend equipment life, and optimize operational efficiency.

By Region:

Asia-Pacific accounted for the highest market share in 2020 and LAMEA is expected to grow with a higher CAGR throughout the projected period. The LAMEA region is known to have significant lithium reserves, particularly in countries like Chile, Argentina, and Bolivia. These reserves could attract investment in lithium mining activities, which in turn would drive the demand for mining equipment.

Competition Analysis

Competitive analysis and profiles of the major players in the lithium mining equipment market are provided in the report. Major companies in the report include Aquatech International LLC, Caterpillar Inc., EDDY Pump Corporation, FEECO International, Inc., FLSmidth & Co. A/S, Koch Separation Solutions, NOV INC., Saltworks Technologies Inc., Samco Technologies, Inc., and Storage & Transfer Technologies (STT). For instance, in March 2023, Aquatech International LLC and Fluif Technology Solutions Inc. have formed a strategic partnership to provide cutting-edge separation, brine concentration, and water reuse solutions in important areas, such as lithium, essential minerals, and brine mining.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the lithium mining equipment market segments, current trends, estimations, and dynamics of the lithium mining equipment market analysis from 2020 to 2032 to identify the prevailing lithium mining equipment market opportunities.

- The lithium mining equipment market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lithium mining equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global lithium mining equipment market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the lithium mining equipment market players.

- The report includes the analysis of the regional as well as global lithium mining equipment market trends, key players, market segments, application areas, and market growth strategies.

Lithium mining equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.5 billion |

| Growth Rate | CAGR of 16.2% |

| Forecast period | 2020 - 2032 |

| Report Pages | 240 |

| By Mine type |

|

| By Process type |

|

| By Solution |

|

| By Region |

|

| Key Market Players | NOV INC., Aquatech International LLC, Koch Separation Solutions, Samco Technologies, Inc., FLSmidth & Co. A/S, FEECO International, Inc., Caterpillar Inc., Storage & Transfer Technologies (STT), EDDY Pump Corporation, Saltworks Technologies Inc. |

Analyst Review

Lithium mining equipment is utilized to extract lithium-rich materials from geological sources, such as brines or hard rock deposits, through processes such as drilling, blasting, and crushing. The widespread shift toward electric vehicles as a sustainable transportation solution is a major driver for the lithium mining equipment market. Lithium-ion batteries are essential for EVs, creating a robust demand for lithium extraction and processing equipment. However, the energy-intensive processes involved in lithium extraction and production contribute to carbon emissions, particularly if fossil fuels are used. As the global focus on carbon reduction intensifies, pressure to adopt cleaner extraction methods and reduce the carbon footprint of mining operations impact the market's growth.

Moreover, urbanization and infrastructure development are poised to drive the growth of the lithium mining equipment market due to increased demand for clean energy technologies. As cities expand, the need for sustainable transportation solutions, such as electric vehicles powered by lithium-ion batteries, escalates. In addition, urbanized areas require efficient energy storage systems for grid stability, utilizing lithium-ion technology. This surge in lithium demand fuels investments in mining operations, propelling the need for advanced equipment to extract and process lithium resources. Consequently, urbanization acts as a catalyst for the lithium mining equipment market's expansion, supporting the global transition toward greener and more resilient urban environments.

The Lithium Mining Equipment Market size was valued at $543.12 million in 2022.

Based on the mine type, the lithium brine deposits hold the maximum market share of the Lithium Mining Equipment Market in 2022.

The Lithium Mining Equipment Market is projected to reach $2,515.84 million by 2032.

The growth of the electronics industry and increasing industrial applications of lithium are the key trends in the Lithium Mining Equipment Market.

The product launches and partnerships are key growth strategies of the Lithium Mining Equipment Industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The High initial cost of mining equipment is the effecting factor for the Lithium Mining Equipment Market.

The latest version of the global Lithium Mining Equipment Market report can be obtained on demand from the website.

Loading Table Of Content...

Loading Research Methodology...