Lithium Titanate (LTO) Batteries Market Overview

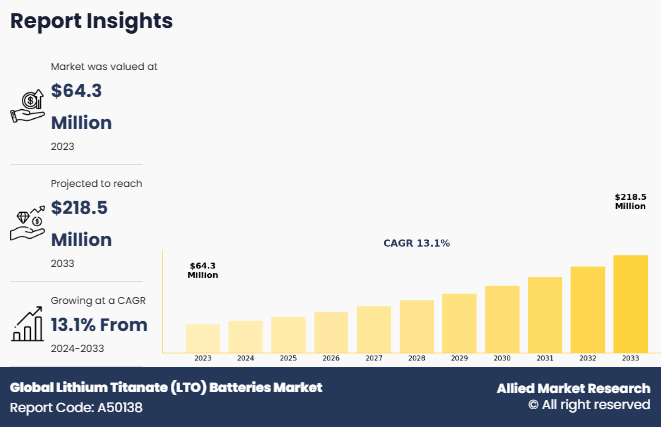

The lithium titanate (lto) batteries market was valued at USD 64.3 million in 2023, and is projected to reach USD 218.5 million by 2033, growing at a CAGR of 13.1% from 2024 to 2033. Rising adoption of electric vehicles (EVs) worldwide, supported by government policies to cut carbon emissions, is fueling demand for LTO batteries. Superior features such as fast charging, long cycle life, and enhanced safety make LTO batteries a preferred choice in EV applications.

Key Market Insights

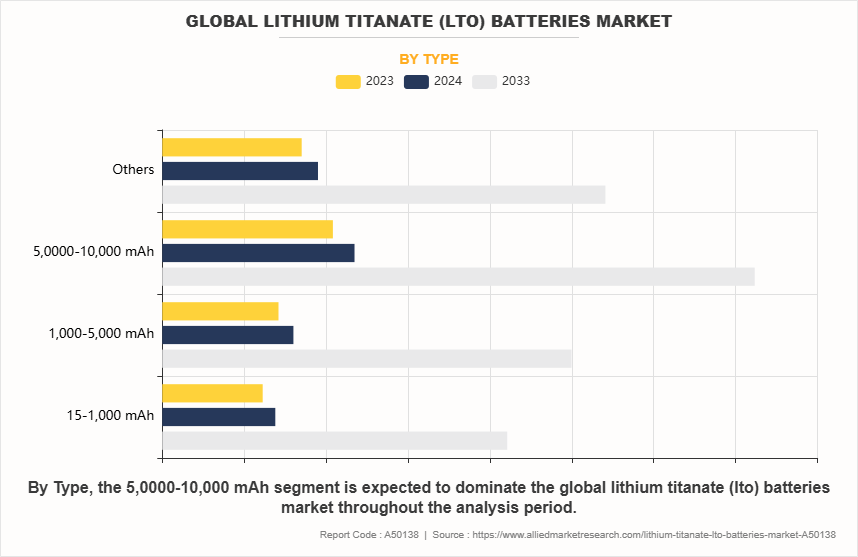

- 5,000–10,000 mAh batteries held the largest market share of $20.8 million in 2023 and are expected to dominate through the forecast period.

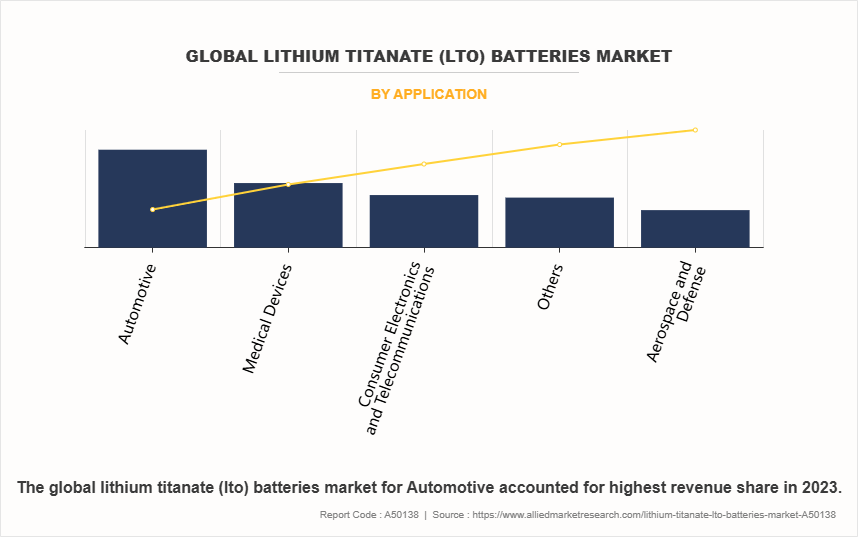

- The automotive sector led the market with 32.3% share in 2023, maintaining its dominance in the coming years.

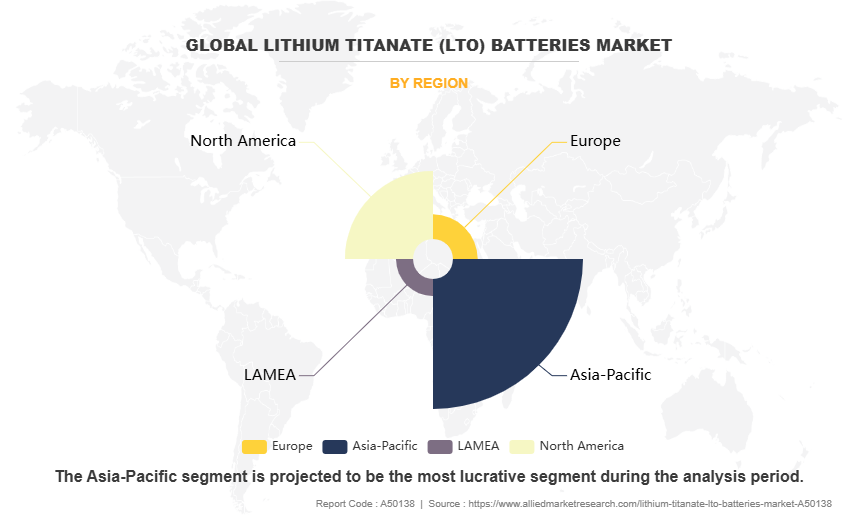

- North America is projected to record the highest CAGR of 13.3% during the forecast period.

Market Size & Forecast

- 2033 Projected Market Size: USD 218.5 million

- 2023 Market Size: USD 64.3 million

- Compound Annual Growth Rate (CAGR) (2024-2033): 13.1%

Report Key Highlighters

- The lithium titanate batteries market forecast provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The lithium titanate (LTO) batteries market is fragmented in nature among prominent companies such as Dongturbo Electric Company Ltd., BEIJING HJBP CO., LTD., Toshiba International Corporation, Microvast Holdings, Inc., NICHICON CORPORATION, Leclanché SA, ELB Energy Group, Targray, Altair Nanotechnologies Inc., Yinlong Energy International Pte Ltd.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in lithium titanate batteries industry such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,500 lithium titanate (LTO) batteries-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for lithium titanate (LTO) market.

Introduction

A lithium titanate (LTO) battery is a type of rechargeable lithium-ion battery that uses lithium titanate as the anode material instead of conventional graphite. This composition enhances safety, cycle life, and charging speed while reducing the risk of thermal runaway. LTO batteries have an extremely high cycle life, often exceeding 10,000 charge-discharge cycles, making them ideal for applications requiring long-term reliability, such as electric buses, grid storage, and industrial power backup. In addition, they can charge rapidly due to their high power density and perform well in extreme temperatures. However, their lower energy density as compared to traditional lithium-ion batteries makes them less suitable for consumer electronics and long-range electric vehicles.

Market Dynamics

The global lithium titanate batteries market size is experiencing significant growth, driven primarily by increase in adoption of electric vehicles (EVs). LTO batteries are favored in the EV industry due to their rapid charging capabilities, extended cycle life, and enhanced safety features, effectively addressing common consumer concerns such as range anxiety and charging time. This preference is particularly evident in regions such as China, which accounted for 41% of global EV sales in 2020, with 1.3 million EVs sold that year. Government initiatives globally are further propelling the lithium titanate (LTO) batteries market. For instance, the U.S. has committed over $3 billion to enhance domestic production of advanced batteries and materials for EVs across 14 states, aiming to reduce reliance on foreign battery supplies. Similarly, the European Union has allocated €210 billion under the REPowerEU plan to expand renewable energy capacities, indirectly boosting the demand for advanced battery technologies like LTO.

Technological advancements and strategic industry partnerships are also contributing to market expansion. Companies such as China's CATL, in collaboration with Stellantis, are investing $4.48 billion to build a lithium battery factory in Spain by 2025, reflecting a strategic move to meet Europe's growing demand for EVs and reduce dependency on external battery sources. These developments underscore a global trend towards sustainable energy solutions, positioning LTO batteries as a critical component in the transition to cleaner energy and transportation systems.

However, the lithium titanate (LTO) batteries market faces several significant restraints that hinder its growth and widespread adoption. One primary challenge is the lower energy density of LTO batteries as compared to traditional lithium-ion batteries, which limits their application in devices requiring compact, high-energy storage solutions, such as portable electronics and long-range electric vehicles. This inherent limitation restricts the market expansion; thus, hindering the market growth.

Another critical restraint is the dominance of China in the global battery supply chain. Chinese companies, supported by state policies, have established a strong hold over critical minerals essential for battery production, including lithium. This dominance poses economic risks for other countries, as reliance on Chinese battery components can lead to supply vulnerabilities. For instance, the U.S. Department of Homeland Security has expressed concerns about the economic risks associated with dependence on Chinese utility storage batteries, emphasizing the need for a secure domestic supply chain.

Furthermore, geopolitical tensions and trade policies contribute to market uncertainties. China's proposed export restrictions on technologies used in battery manufacturing and critical mineral processing is expected to hinder the international expansion plans of major battery producers and challenge Western companies relying on Chinese technology. Addressing these challenges requires strategic efforts to diversify supply chains, invest in alternative battery technologies, and establish domestic production facilities to reduce dependency on dominant players in the market.

On the contrary, government initiatives worldwide are playing a pivotal role in this expansion. In the U.S., the Department of Energy announced over $3 billion in grants to enhance domestic production of advanced batteries and materials for EVs across 14 states. This effort aims to reduce reliance on foreign battery supplies and bolster the U.S. battery manufacturing sector. Similarly, the UK's Export Finance department is set to provide financing to companies importing critical minerals essential for manufacturing, including lithium, to support industries such as defense, aerospace, and battery production.

Segments Overview

The lithium titanate batteries market is segmented on the basis of type, application, and region, By type, the market is studied into 15-1,000 mAh, 1,000-5,000 mAh, 5,000-10,000 mAh, and others. By appliction, the market is classified into aerospace and defense, medical devices, consumer electronics and telecommunications, automotive, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In 2023, the 5,000-10,000 mAh segment was the largest revenue generator, and is anticipated to grow at a CAGR of 13.3% during the forecast period. The demand for 5,000–10,000 mAh lithium titanate (LTO) batteries is rising due to their fast charging, long cycle life, and extreme temperature resistance, making them ideal for high-power applications. As electric mobility expands, ebikes, e-scooters, and small electric vehicles increasingly rely on LTO batteries to enable quick charging and extended durability, reducing downtime and enhancing fleet efficiency. Unlike traditional lithium-ion batteries, LTO cells support thousands of charge cycles without significant degradation, making them cost-effective for commercial and shared mobility solutions.

Another key driver is rise in need for reliable energy storage in renewable energy systems, industrial backup solutions, and military-grade applications. LTO batteries provide stable power for microgrids, solar energy storage, and portable industrial equipment, ensuring continuous operation even in extreme environments. In addition, their superior thermal stability reduces safety risks, making them ideal for aerospace, defense, and heavy-duty industrial tools that require high discharge rates and rapid energy replenishment.

By application, automotive accounted for the largest share, in terms of revenue in the lithium titanate (LTO) batteries market ans is anticipated to grow at a CAGR of 13.3% during the forecast period. The demand for lithium titanate (LTO) batteries in automotive applications is rising due to their ultra-fast charging, long cycle life, and exceptional safety features. As electric vehicle (EV) adoption grows, manufacturers seek batteries that reduce charging times and enhance durability. LTO batteries can recharge in minutes and endure over 20,000 charge cycles, making them ideal for public transport fleets, taxis, and delivery vehicles, where frequent recharging is necessary. In addition, their high thermal stability eliminates the risk of overheating or fire, addressing key safety concerns in electric mobility.

Another major factor driving the demand for lithium titanate (LTO) batteries in automotive sector is the expansion of commercial and heavy-duty electric vehicles, including buses, trucks, and construction machinery. These vehicles require high-performance, long-lasting energy storage solutions that can withstand harsh environments and extreme temperatures. As governments enforce stricter emission regulations and invest in EV infrastructure, LTO batteries are emerging as a preferred choice for next-generation automotive power systems.

The North America lithium titanate (LTO) batteries market size is projected to grow at the highest CAGR of 13.3% during the forecast period and accounted for 28.5% of globa lithium titanate batteries market share in 2023. The lithium titanate (LTO) batteries market in North America, particularly in the U.S., Canada, and Mexico, is expanding due to rise in adoption of electric vehicles (EVs), renewable energy storage, and industrial power backup solutions. The U.S. leads the region with strong investments in EV infrastructure and grid modernization, driven by government incentives and policies promoting sustainable energy. The Inflation Reduction Act (IRA) and Bipartisan Infrastructure Law are pushing for domestic battery production, benefiting LTO technology due to its fast charging and long lifespan. In addition, the demand for commercial EV fleets, including electric buses and trucks, is increasing, supporting the need for durable, high-performance batteries.

In Canada, the focus on renewable energy integration and smart grid development is creating opportunities for lithium titanate batteries market growth in solar and wind energy storage. The Canada government’s push toward clean energy solutions has led to increased adoption of battery storage systems for remote areas and off-grid applications. Furthermore, the country’s growing telecommunications sector is investing in backup power solutions to ensure network reliability, driving demand for LTO batteries in telecom infrastructure.

Mexico’s automotive and industrial sectors are also contributing to the growth of the LTO battery. As a major hub for automobile manufacturing, Mexico is witnessing a shift toward EV production and supply chain localization. Also, the country's industrial automation and smart city projects require efficient and safe energy storage, making LTO batteries a preferred choice. With increase in regional collaborations and investments in sustainable energy and transportation, the North America lithium titanate (LTO) batteries market is expected to grow significantly in the coming years.

Which are the Top Lithium Titanate (LTO) Batteries companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the lithium titanate (LTO) batteries industry.

- Dongturbo Electric Company Ltd.

- BEIJING HJBP CO., LTD.

- Toshiba International Corporation

- Microvast Holdings, Inc.

- NICHICON CORPORATION

- Leclanché SA

- ELB Energy Group

- Targray

- Altair Nanotechnologies Inc.

- Yinlong Energy International Pte Ltd

Key Benefits for Stakeholders

- This report provides a quantitative lithium titanate batteries market analysis of the market segments, current trends, estimations, and dynamics of the lithium titanate (lto) batteries market analysis from 2023 to 2033 to identify the prevailing lithium titanate (lto) batteries market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lithium titanate (lto) batteries market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as lithium titanate (lto) batteries market trends, key players, market segments, application areas, and market growth strategies.

Global Lithium Titanate (LTO) Batteries Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 218.5 million |

| Growth Rate | CAGR of 13.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 28 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Leclanché SA, Dongturbo Electric Company Ltd., Toshiba International Corporation, Altair Nanotechnologies Inc., NICHICON CORPORATION, Microvast Holdings, Inc., ELB Energy Group, BEIJING HJBP CO., LTD., Targray, Yinlong Energy International Pte Ltd |

Analyst Review

From a CXO perspective, the global lithium titanate (LTO) batteries market presents a strategic opportunity driven by increase in demand for high-performance energy storage solutions. LTO batteries' fast-charging capability, extended cycle life, and superior thermal stability make them highly attractive for electric buses, industrial energy storage, and military applications. With governments worldwide investing heavily in clean energy infrastructure, companies can capitalize on policies like the U.S. Inflation Reduction Act and China’s $400 billion renewable energy, which is expected to to drive the market for lithium titanate (LTO) batteries . However, challenges such as lower energy density and higher production costs necessitate innovation in material efficiency and manufacturing scalability.

For executives and investors, the focus should be on strategic partnerships and supply chain optimization to ensure raw material availability and cost-effectiveness. Collaborations with EV manufacturers and grid storage providers will drive demand, while investments in next-gen LTO chemistry could enhance energy density and competitiveness.

Growing demand for high-performance energy storage solutions, governments policies and investments in clean energy, expansion of electric vehicles, and technological advancements and cost optimization are the upcoming trends of the global lithium titanate (LTO) batteries market in the globe.

Automotive is the leading application of the global lithium titanate (LTO) batteries market.

Asia-Pacific is the largest regional market for the global lithium titanate (LTO) batteries market.

The global lithium titanate (LTO) batteries market was valued at $64.3 million in 2023 and is estimated to reach $218.5 million by 2033, exhibiting a CAGR of 13.1% from 2024 to 2033.

Dongturbo Electric Company Ltd., BEIJING HJBP CO., LTD., Toshiba International Corporation, Microvast Holdings, Inc., NICHICON CORPORATION, Leclanché SA, ELB Energy Group, Targray, Altair Nanotechnologies Inc., Yinlong Energy International Pte Ltd are the top companies to hold the market share in the global lithium titanate (LTO) batteries market.

Loading Table Of Content...

Loading Research Methodology...