Live Cell Imaging Market Research, 2032

The global live cell imaging market was valued at $2.3 billion in 2022, and is projected to reach $5.2 billion by 2032, growing at a CAGR of 8.2% from 2023 to 2032. The rise in incidences of cancer significantly contributes to the growth of the live cell imaging market owing to its critical role in cancer research, diagnosis, and treatment development. For instance, National Cancer Institute, Division of Cancer Control & Population Sciences (DCCPS), stated that, 623,405 people are living with metastatic breast, prostate, lung, colorectal cancer or metastatic melanoma in the U.S. Live cell imaging allows researchers to observe and analyze cellular behavior in real-time. This capability is crucial in understanding the complex mechanisms underlying cancer development, progression, and metastasis.

Furthermore, technological advancements serve as a significant driver, continually enhancing imaging modalities, microscopy techniques and software solutions. These innovations elevate the precision, resolution, and speed of live cell imaging, empowering researchers to explore cellular processes in real-time with exceptional detail. Live cell imaging plays a pivotal role in drug discovery, disease modeling, and understanding cellular responses to therapeutic interventions.

Key Takeaways

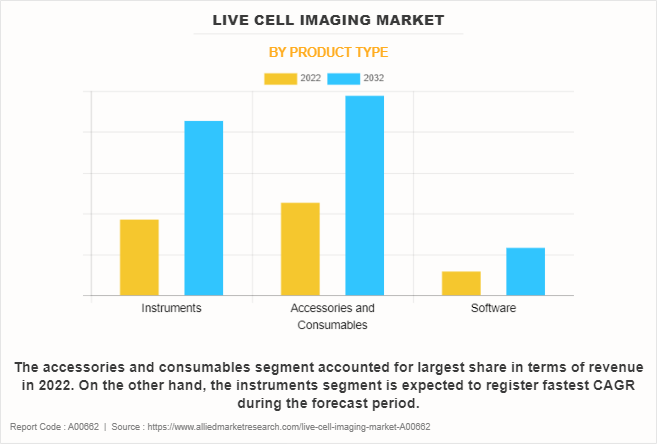

- On the basis of product type, the accessories & consumables segment dominated the market in terms of revenue in 2022. However, the instruments segment is anticipated to register the fastest CAGR during the forecast period.

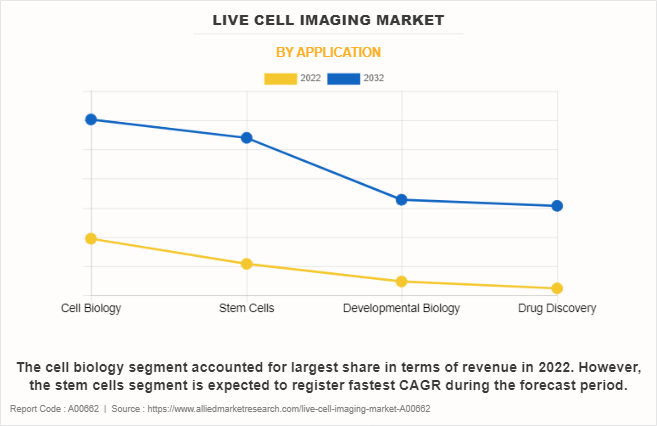

- On the basis of application, the cell biology segment accounted for the largest share in terms of revenue in 2022. On the other hand, stem cells segment is anticipated to register fastest CAGR during the forecast period.

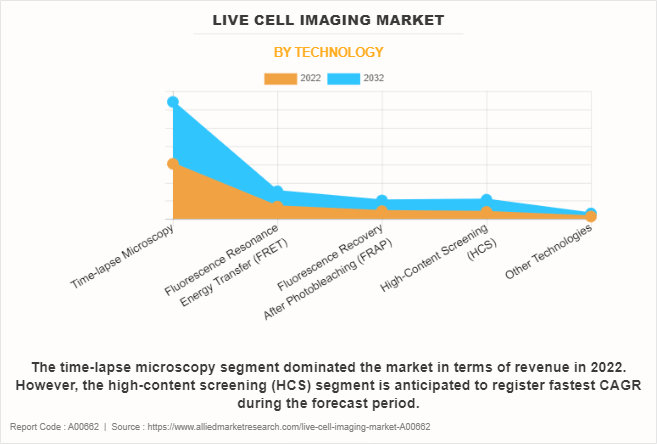

- On the basis of technology, the time-lapse microscopy segment dominated the market in terms of revenue in 2022. However, high-content screening (HCS) segment is anticipated to register fastest CAGR during the forecast period.

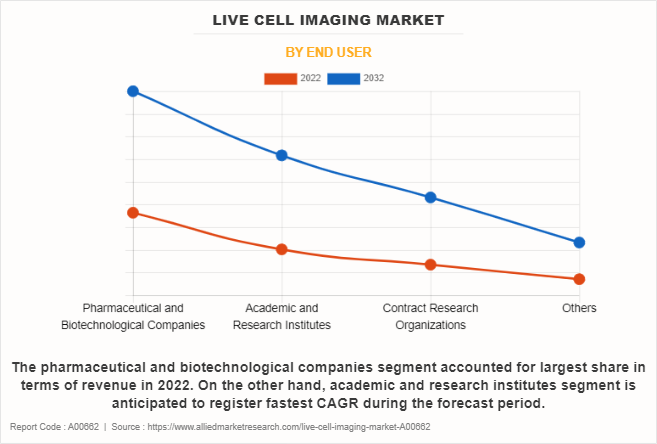

- On the basis of end user, the pharmaceutical & biotechnological companies segment dominated the market in terms of revenue in 2022. However, academic & research institutes segment is anticipated to register fastest CAGR during the forecast period.

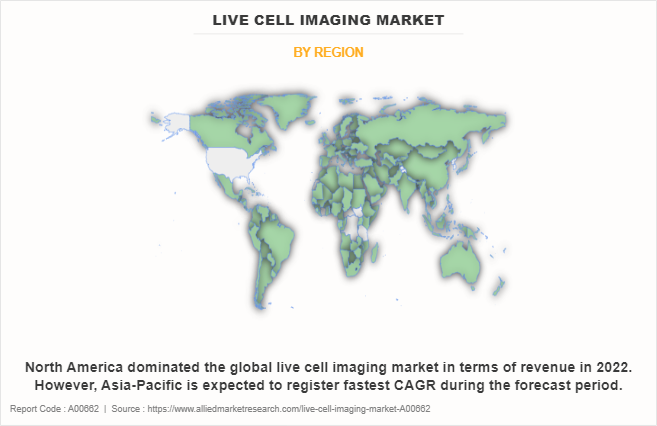

- On the basis of region, North America generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period.

Live cell imaging is an innovative technique that enables scientists to observe and analyze biological processes within living cells in real time. This powerful method involves using specialized microscopy tools and fluorescent labeling to capture dynamic cellular events as they occur. The technique provides valuable insights into various cellular activities such as cell division, protein trafficking, molecular interactions, and responses to stimuli, offering a deeper understanding of cellular behavior and function.

Market Dynamics

The major factors driving the growth of the live cell imaging industry include growth in demand for understanding cellular dynamics, role in cancer research, diagnosis, and treatment development. This technology enables real time observation of cellular behavior, crucial for understanding cancer mechanisms and tumor progression. Live cell imaging aids in drug discovery by evaluating treatment responses directly on live cancer cells, paving the way for targeted and more effective therapies. It facilitates personalized medicine by studying individual cell characteristics, guiding tailored treatment strategies. Moreover, its contributions to diagnostics aid in early detection and accurate diagnosis, while its role in monitoring treatment responses enhances patient care.

In addition, the increase in interdisciplinary collaboration between biologists, physicists, chemists, and engineers has spurred the refinement of imaging methods, leading to the creation of more sophisticated imaging platforms and analytical tools. This collaboration has been instrumental in driving the development of advanced imaging modalities such as super-resolution microscopy, multiphoton microscopy, and light-sheet microscopy, which offer enhanced spatial and temporal resolution, reduced phototoxicity, and deeper tissue penetration.

Furthermore, the growth in demand for understanding cellular dynamics in various research fields, including cell biology, developmental biology, neuroscience, and pharmacology, has fueled the widespread adoption of live cell imaging. Researchers seek to study complex biological mechanisms, disease progression, screen potential drugs, and monitor cellular responses to different stimuli or treatments, all of which necessitate the use of live cell imaging techniques.

Moreover, the accessibility of user-friendly imaging software for data acquisition, processing, and analysis has simplified the interpretation of complex imaging datasets, making live cell imaging more approachable for researchers with diverse backgrounds. The integration of automated imaging systems with advanced software algorithms has facilitated high-throughput imaging and quantitative analysis, enabling researchers to extract meaningful information from vast amounts of imaging data efficiently. In addition, the live cell imaging market growth has expanded significantly in emerging markets owing to the development of healthcare infrastructure and increased R&D activities. Rapid urbanization and economic growth in countries such as China and India have created substantial opportunities for live cell imaging manufacturers to cater to the needs of these growing markets.

Segmental Overview

The live cell imaging industry is segmented into product type, application, technology, end user and region. On the basis of product type, the market is segregated into instruments, accessories & consumables, and software. The instruments segment is further divided into microscopes, standalone systems, and cell analyzers. On the basis of application, the market is classified into cell biology, stem cells, developmental biology, and drug discovery. On the basis of technology, the market is segregated into time-lapse microscopy, fluorescence resonance energy transfer (FRET), fluorescence recovery after photobleaching (FRAP), high-content screening (HCS), and other technologies.

On the basis of end user, the market is divided into pharmaceutical & biotechnological companies, academic & research institutes, contract research organizations, and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (India, China, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Product Type

The accessories & consumables segment accounted for largest live cell imaging market share in terms of revenue in 2022, owing to heightened demand for fluorescent dyes, imaging reagents, and specialized cell culture media, alongside the wide array of available consumables. Furthermore, growth of the segment was fueled by progress in accessory technologies such as enhanced imaging chamber designs and superior-quality cell culture consumables, meeting the evolving demands of research and augmenting imaging capabilities.

On the other hand, the instruments segment is expected to register fastest CAGR during the forecast period. This surge is attributed to ongoing advancements in imaging technologies such as super-resolution microscopy and high-content screening systems, spurring the demand for innovative instruments offering superior resolution and enhanced functionality. Moreover, the expansion of research activities across various scientific disciplines necessitates more sophisticated and specialized imaging instruments to meet varied experimental requirements, thereby propelling growth of the segment.

By Application

The cell biology segment accounted for largest live cell Imaging market share in terms of revenue in 2022, owing to heightened emphasis on exploring fundamental cellular processes. In addition, the expanded applications of live cell imaging techniques in studying cell division, migration, and signaling events contributed significantly to the growth of this sector, further augmented by the widespread adoption of live cell imaging for analyzing dynamic cellular behaviors.

However, the stem cells segment is expected to register the fastest CAGR during the forecast period. This surge is fueled by the escalating focus on regenerative medicine, where live cell imaging plays an integral role in monitoring stem cell behavior, differentiation, and integration into tissues. In addition, increased interest in personalized therapies and the expansion of clinical applications demanding real-time monitoring of stem cell-based treatments has further propelled the segment growth. Furthermore, ongoing advancements in live cell imaging technologies have enabled precise observation and manipulation of stem cell behavior, thereby facilitating advancements in therapeutic development.

By Technology

The time-lapse microscopy segment accounted for largest live cell Imaging market size in 2022, primarily owing to its distinctive ability for continuous, real-time monitoring of cellular processes. Its widespread adoption across various research fields stems from its capability to capture dynamic changes over prolonged durations, playing a pivotal role in unraveling intricate details of cellular dynamics essential for both fundamental research and practical applications, such as drug development and studying disease progression.

However, the high-content screening (HCS) segment is expected to register the fastest CAGR during the forecast period. This is attributed to its capacity to concurrently analyze diverse cellular facets, meeting the escalating demand for comprehensive cellular analysis in both drug discovery and research endeavors. Furthermore, the increased incorporation of automated platforms amplifies the efficiency and scalability of HCS, thereby enhancing high-throughput screening capabilities and contributing significantly to growth of the segment.

By End User

The pharmaceutical & biotechnological companies segment accounted for largest live cell Imaging market size in 2022, owing to substantial investments in research, propelling the demand for innovative live cell imaging technologies. In addition, the escalating adoption of advanced imaging tools within these companies has augmented research capabilities, fostering innovation in cellular studies. Moreover, live cell imaging plays a crucial role in drug development for these entities, enabling real-time assessment of efficacy and toxicity of drug candidates, thereby accelerating the drug discovery process.

However, the academic & research institutes segment is anticipated to register fastest CAGR during the forecast period. This projected growth is attributed to the increased funding allocations for research endeavors, encouraging the adoption of advanced live cell imaging technologies for diverse biological studies. Furthermore, academic institutions often serve as early adopters of pioneering imaging tools owing to their focus on pioneering research, fostering ongoing innovation in the field. Collaborations between academia and industry further facilitate technology transfer, empowering academic institutes to utilize sophisticated imaging platforms, thus expanding their applications and driving segment growth during the forecast period.

By Region

On the basis of region, North America dominated the global live cell imaging market in terms of revenue in 2022, owing to advanced healthcare infrastructure, substantial investments in research and development, presence of major key players offering advanced live cell imaging systems and the presence of leading biotechnology and pharmaceutical companies. In addition, robust funding environment, coupled with supportive government initiatives, has propelled the adoption of innovative imaging techniques such as live cell imaging in academic and research institutions. Furthermore, the high prevalence of chronic diseases, increasing emphasis on personalized medicine, and a well-established pharmaceutical industry contribute to the strong demand for live cell imaging solutions.

On the other hand, Asia-Pacific is expected to register fastest CAGR during the forecast period owing to increase in research and development activities, with a focus on life sciences and biotechnology. Growth in investments in healthcare infrastructure, rise in awareness of advanced imaging technologies, and an expanding biopharmaceutical sector have contributed to the heightened adoption of live cell imaging across Asia-Pacific region.

In addition, large population base of the region provides a vast pool of patients for clinical trials and research studies, further driving the demand for live cell imaging solutions in preclinical and clinical settings. Government initiatives supporting scientific research, coupled with collaborations between regional and international players, have fostered innovation in live cell imaging technologies, positioning Asia-Pacific as a dynamic and high-potential during the live cell Imaging market forecast period.

Asia-Pacific offers profitable live cell Imaging market opportunity for key players operating market, thereby registering the fastest growth rate during the forecast period, owing to the developments in healthcare infrastructure, rise in research and development activities, as well as well-established presence of domestic companies in the region. In addition, the rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the live cell imaging market, such as Sartorius AG, PerkinElmer Inc., Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Etaluma, Inc., Bruker Corporation, Merck KGaA, Nikon Corporation, Carl Zeiss AG and Danaher Corporation, are provided in the report. Major players have adopted collaboration, product launch, expansion, partnership, and acquisition as key developmental strategies to improve the product portfolio of the live cell imaging market.

Recent Product Launch in Live Cell Imaging Market

In May 2020, Sartorius, a leading international supplier for the biopharmaceutical industry, launched the new Incucyte SX5 Live-Cell Analysis System, the latest in the line of live-cell analysis products of the company.

Recent Acquisition in Live Cell Imaging Market

In January 2023, Bruker Corporation announced the acquisition of ACQUIFER Imaging GmbH, a pioneer in big-data management solutions for bioimaging and high-content microscopy. This acquisition adds high-performance on-premise processing, secure storage and networking technology that complements advanced fluorescence microscopy imaging products of Bruker, such as light-sheet and super-resolution microscopy products, which generate high information content.

Recent Partnership in Live Cell Imaging Market

In June 2020, InnoME, Gmbh and Etaluma, Inc. announced their partnership to bring entry level incubator cell imaging to the Americas.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the live cell imaging market analysis from 2022 to 2032 to identify the prevailing live cell imaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the live cell imaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global live cell imaging market trends, key players, market segments, application areas, and market growth strategies.

Live Cell Imaging Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.2 billion |

| Growth Rate | CAGR of 8.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 285 |

| By Product Type |

|

| By Application |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Merck KGaA, Agilent Technologies, Inc., Thermo Fisher Scientific Inc. , Sartorius AG, Danaher Corporation, Bruker Corporation, Nikon Corporation, Carl Zeiss AG, PerkinElmer, Inc., Etaluma, Inc. |

Analyst Review

This section provides various opinions in the global live cell imaging market. The live cell imaging market is being propelled by several key drivers, facilitating its rapid expansion and adoption across diverse industries and research domains. Technological advancements play a pivotal role, with continuous innovations in imaging modalities, microscopy techniques, and software solutions enhancing the precision, resolution, and speed of live cell imaging. These advancements enable researchers to observe cellular processes in real-time with exceptional detail, driving the demand for innovative imaging systems.

In addition, the rise in focus on drug discovery, personalized medicine, and understanding complex cellular mechanisms fuels the market growth. Live cell imaging facilitates in-depth studies of cellular dynamics, disease pathology, and drug responses, significantly impacting pharmaceutical, biotechnology, and academic research. Moreover, increased government funding for life sciences research, expanding applications in clinical diagnostics, and the growth in prevalence of chronic diseases further contribute to the upward trajectory of the live cell imaging market, fostering its continuous evolution and widespread adoption.

North America dominated the global live cell imaging market in terms of revenue in 2022, owing to advanced healthcare infrastructure, substantial investments in research and development, presence of major key players offering advanced live cell imaging systems, and the presence of leading biotechnology and pharmaceutical companies. In addition, robust funding environment, coupled with supportive government initiatives, has propelled the adoption of innovative imaging techniques such as live cell imaging in academic and research institutions.

On the other hand, Asia-Pacific is expected to register the fastest CAGR during the forecast period owing to an increase in research and development activities, with a focus on life sciences and biotechnology. Growth in investments in healthcare infrastructure, rise in awareness of advanced imaging technologies, and an expansion of biopharmaceutical sector have contributed to the heightened adoption of live cell imaging across Asia-Pacific region. Government initiatives supporting scientific research, coupled with collaborations between regional and international players, have fostered innovation in live cell imaging technologies, positioning Asia-Pacific as a dynamic and high-potential market during the forecast period.

The total market value of live cell imaging market is $2.3 billion in 2022.

The market value of live cell imaging market in 2032 is $5.2 billion.

The forecast period for live cell imaging market is 2023 to 2032.

The base year is 2022 in live cell imaging market.

Top companies such as Danaher Corporation, Carl Zeiss AG, Nikon Corporation and Sartorius AG held a high market position in 2022. These key players held a high market position owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The accessories and consumables segment is the most influencing segment in live cell imaging market owing to rise in demand for fluorescent dyes, imaging reagents and specialized cell culture media and wide availability of various consumables.

The major factors driving the growth of live cell imaging market are advancements in technology, increase in applications of live cell imaging in various research fields and rise in demand for real-time analysis of cellular processes.

Live cell imaging is a sophisticated biological technique that enables real-time visualization and analysis of dynamic cellular processes within living cells.

Loading Table Of Content...

Loading Research Methodology...