Livestock Parasiticides Market Research, 2031

The global livestock parasiticides market size was at $2.6 billion in 2021, and is projected to reach $4.9 billion by 2031, growing at a CAGR of 6.7% from 2022 to 2031.

The livestock parasiticides market is meant to provide the chemical substances that remove parasites other than fungi and bacteria in livestock. These chemicals are generally inert ingredients that are made in a formulation and consist of one or more than one active ingredients in it. Most of the parasiticidal have active ingredients, which have similar chemical structures and have many of the common features among them. They are grouped into different chemical classes and families as well. The importance of livestock parasiticides has been recognized for the protection and the cure of parasitic diseases in animals. Many key players and companies throughout the world are coming up with various new formulations and products in the livestock parasiticides market to remove the increasing prevalence of food-borne diseases.

Market Dynamics

The volume of production of meat has increased from 317.2 million metric tons to 330.5 million metric tons worldwide which is the major driver for the livestock parasiticides market. The increasing demand for meat is mainly attributed to the rising demand for livestock products in developing countries. The demand for livestock-derived foods is increasing by a remarkable 80% in the last two decades due to the increasing population in the respective countries. In addition, the diseases caused by endoparasites prove to be dangerous for the livestock which ultimately results in lower production of milk and meat. So, to prevent the spread and the infection caused by endoparasites among the food-producing animals coupled with the growing demand for animal protein worldwide at the key factors for the growth of the livestock parasiticides market. The livestock health market is observed to be growing in the past few years due to the growing awareness and the rising concerns over the diseases caused by viruses, bacteria’s, parasites and fungi. Due to the growing livestock parasiticides market demand for effective drugs, is the key attraction for the leading market players with the huge investments in the Livestock Parasiticides industry. Also, it is one of the major drivers increasing R&D efforts in the animal health industry. At present many leading market players are focusing on R&D to develop new drugs. It was also founded that globally the spending on R &D in the animal healthcare is about 7 to 8% of the total revenue of individual market players. And according to the European international federation of animal health it was founded that the major players are spending about 12% of their annual sales on the R&D activities on other hand 6% of annual sales are invested in R&D activities by the small and the medium players. The major market players are also focusing on expanding their global footprints by establishing R&D centers and the production facilities also with the acquisitions with regional market players and with the agreements and the partnership in these high growth markets. Zoonotic diseases are growing concern are given by multiple factors such as their unpredictable nature their ability to emerge anywhere and spread rapidly around the globe. Climate seasonality and weather events such as pressure humidity and wind speed and the direction also influences zoonotic spread. The climate change has increased the range and the number of viruses and bacteria to which animals may be exposed as well as competent vectors and the receiver species. Livestock parasiticides provide diverts benefits for treatment of zoonotic diseases which can be used by veterinary physicians and the hospital staff. The key players are offering livestock parasiticides and are developing value added features such as effective spray, dips, collars, etc. These rising concerns about zoonotic diseases due to the increasing number of livestock farms and the rise in demand for meat and animal by-products in the global market.

In many countries throughout the globe the use of parasiticides in livestock animals is subject to federal regulations. Sometimes the extra use of these parasiticides could leave residue that on consumption by human beings have side effects. As a result, the use of these parasiticides especially endoparasites are regulated by the government and the related authorities. Safe residue concentration and withdrawal periods for antiparasitic used in food producing animals are standardise and also the slaughter animals need to be monitored for possible and safe residues.Globally it was observed that rise in the level of obesity and the other chronic disorders related to it are increasing. Due to this many people are shifting toward vegetarian diet from predominantly non vegetarian diet. According to the reports of livestock parasiticides market trends the interest of the consumers is increasing for the veganism.Changing eating habits and increasing exposure to global cuisines are also driving the shift toward vegetarian diets. In addition, the increasing number of bird flues and the infection caused by the meat consumption has led to decrease in the meat consumption.

Emerging countries such as China and India are having robust livestock markets. According to the report of National dairy development board milk production in India has increased and the region have become the world's largest milk producer accounting the major share of the global market. China is the world's largest pork producer which is producing about 55 million metric tons of pork. Also, the production and the consumption of the milk in China is also increasing at a rapid pace.

With the search in companion animal population the growing demand for animal food products the increasing population of livestock animals and the increasing livestock health expenditure in the emerging countries showcase high growth opportunity for the players in livestock parasiticides market. For the assurance that the parasiticides do not have any side effects on the animal health and are of sufficient quality and efficiency several authorities collectively have set stringent regulations to approve animal parasiticides. Some of the major regulatory bodies such as US FDA, Canadian food agency, European medical agency, ministry of agriculture, forestry and fishery that approve medicine used for veterinary purposes.

The veterinary international committee also plays a significant role in bringing together regulatory authorities in the US, Europe and Japan it also set the guidelines and the technical requirements to register veterinary products. Typically, the approval of veterinary pharmaceuticals in the US and the Europe market may take up to 5 to 11 years. The process is time consuming and is also expensive in nature but is good for the long-time business and the health of the animals as well as for the health of the consumers.

Segments Overview

The livestock parasiticides market size is segmented into type, livestock, end user, and region. On the basis of type, the market is fragmented into ectoparasiticides, endoparasiticides , and endectocides. On the basis of livestock, the market is categorized into cattle, pigs, poultry, sheep, and goats. On the basis of end user, the market is bifurcated into veterinary clinics & hospitals and animal farms.

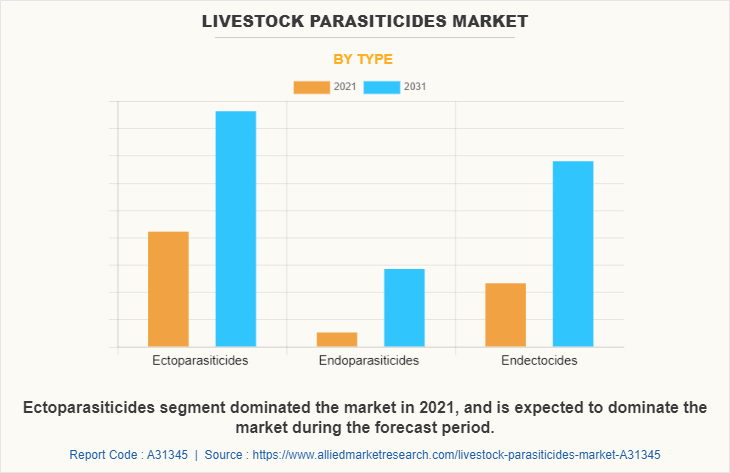

By Type

The ectoparasiticides segment was the highest revenue contributor to the market, owing to rise in infestation of fleas, ticks, and other ectoparasites to livestock, which increases the chances of bacterial, viral, and parasitic disease transmission to humans. Therefore, the usage of ectoparasiticides is inevitable and important for livestock. These factors are expected to drive the segment growth during the livestock parasiticides market forecast. The global ectoparasiticide market is growing due to several factors such as increasing prevalence of animal and the zoonotic diseases, and the growing rate of parasitic infections to animals. On addition raising awareness of the animal health and the welfare in the development of parasiticides for animal parasitic infections is likely to promote the growth of ectoparasiticide market.

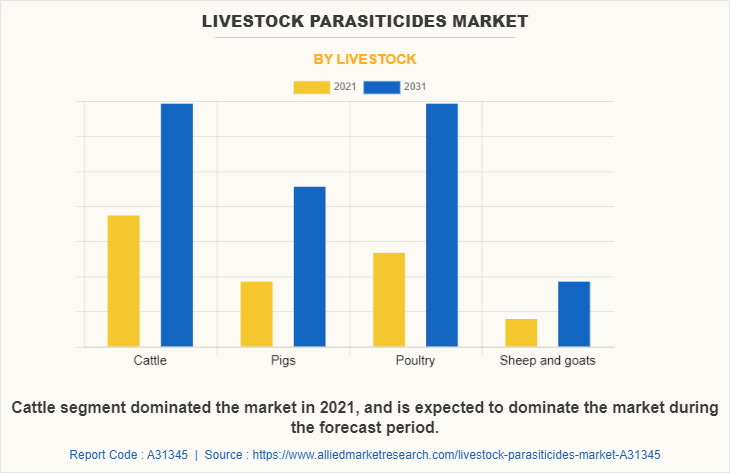

By Livestock

The cattle segment was the highest revenue contributor to the livestock parasiticides market, owing to rising population that has led to rising demand of meat. Also poultry segment is expected to grow at highest CAGR of 8.3% during forecast period, owing to rising demand of meat from developing nations such as India, China, and Africa. The increasing demand for the animal derived food products such as meat and milk across the globe led to the higher number of cattle feeding and cattle raising as livestock throughout the world. This increase in livestock population ultimately creates positive impact on the livestock parasiticides market share. The volume production of meat has increased from 317.2 million metric tons to 330.5 million metric tons worldwide which is the major driver for the livestock parasiticides industry. The increasing demand for meat is mainly attributed to the rising demand for the livestock products in developing countries. The demand for livestock derived foods is increasing by remarkable 80% in the last two decades due to the increasing population in the respective countries.

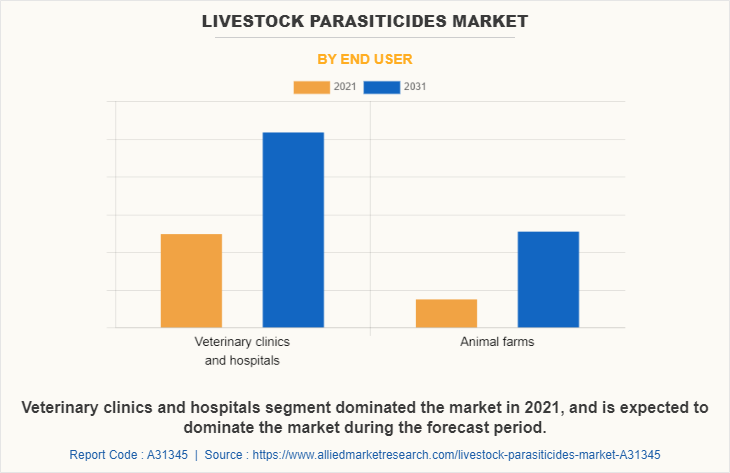

By End User

On the basis of end user, the livestock parasiticides market is bifurcated into veterinary clinics & hospitals and animal farms. The veterinary clinics and hospitals segment was the highest revenue contributor to the market, as this clinics provide increasing livestock population is driving the need for veterinary clinics and hospital across the world. The increasing livestock population is driving the need for veterinary clinics and hospital across the world. In addition, lockdown destructions due to Covid-19 pandemic resulted in an increase animal health awareness. Increasing demand for livestock products among consumer across the globe also drives the livestock parasiticides market growth. In addition, increase meat standards in developing nation has increased spending on livestock which in turn has impacted the market growth.

By Region

Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, The Netherlands , Switzerland and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Thailand, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, & Africa). The North America market is studied across country such as U.S., Canada, Mexico. It was observed that the market livestock parasiticides market share is increasing due to its well-established base of animal health industry are the key drivers to the market in the region. There are around 94.4 million cattle in U.S. thus raising awareness among farm owners regarding livestock hygiene and strict government regulation are the key market driver. The technological advancement and the rising incidence of zoonotic diseases and an increasing number of livestock are the key drivers to boost the market growth in the region. Also, the major companies are enhancing their R&D capabilities and ensuring the high-quality standards making positive impact to the livestock parasiticides market in this region.

Competitive Analysis

The key players in the livestock parasiticides market include Elanco animal health Incorporated, Boehringer Ingelheim Gmbh, Zoetis Inc. Merck & Co.Inc, virbac, Vetoquinol S.A., Petiq, Llc, Sequent Scientific Limited, Krka Group, Eco Animal Health Group Plc, Ceva Santé Animale, Chanelle Pharm, Bimeda Animal Health and Norbrook.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the livestock parasiticides market analysis from 2021 to 2031 to identify the prevailing livestock parasiticides market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the livestock parasiticides market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global livestock parasiticides market trends, key players, market segments, application areas, and market growth strategies.

Livestock Parasiticides Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4.9 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 290 |

| By Type |

|

| By Livestock |

|

| By End user |

|

| By Region |

|

| Key Market Players | Elanco, Virbac, Krka, Norbrook, Vetoquinol, Ceva, Bimeda, Inc., PETIQ, LLC, Merck & Co., Inc., ECO Animal Health Ltd, Kyoritsuseiyaku, SeQuent, Chanelle Pharma, Zoetis, C.H. Boehringer Sohn AG & Co. KG. |

Analyst Review

According to the CXO's of the top companies, the livestock parasiticides market is expected to grow due to the significant rise in the demand for protein food or the animal derived food and also the increasing incidence of zoonotic and food-borne diseases. Furthermore, the escalating number of livestock animals for the purpose of food production in the emerging economies is leading to rising demand for animal healthcare products. Moreover, the increasing animal healthcare expenditure for animal welfare to improve the health of livestock animals further fuels the overall livestock parasiticides market. Furthermore, livestock sector is a highly dynamic and significant global asset. Livestock products contribute 17% to kilocalorie consumption and 33% to protein consumption globally; however, this varies across developed and developing countries.

The CXO's further added that the market is given by the product innovation that by the development of technology advancement in veterinary healthcare such as efficient information management system, animal owner mobile technology and the vaccine banks.

The rise in focus on innovation and introduction of new and effective products for animal health is expected to boost the market demand. The surge in demand for effective drugs on livestock parasiticides among livestock owners is the key attraction of leading market players that will lead to huge investment in the livestock parasiticides industry in the coming years. The key players in the industry are focusing on expanding their global footprints by establishing R&D centers and production facilities in countries such has as India, Australia, Brazil, and other where livestock production is huge is expected to play vital role in the market growth during the forecast period.

Rise in demand for meat and meat food products, Increasing investments by private players are the upcoming trends of Livestock Parasiticides Market

The end user segment is mainly divided into veterinary clinics and hospitals, and animal farms. The veterinary clinics and hospitals segment was the highest revenue contributor to the market, as this clinics provide increasing livestock population is driving the need for veterinary clinics and hospital across the world.

orth America was the highest revenue contributor, accounting for $1,041.9 million in 2021, owing totechnological advancement and the rising incidence of zoonotic diseases and an increasing number of livestock are the key drivers to boost the market growth in the region. Also, the major companies are enhancing their R&D capabilities and ensuring the high-quality standards making positive impact to the market in this region.

The livestock parasiticides market size was valued at $2,607.4 million in 2021, and is projected to reach $4,855 million by 2031, registering a CAGR of 6.7% from 2022 to 2031. The livestock parasiticides market is meant to provide the chemical substances that remove parasites other than fungi and bacteria in livestock. These chemicals are generally inert ingredients that are made in a formulation and consist of one or more than one active ingredient in it.

The key players in the livestock parasiticides industry include Elanco animal health Incorporated, Boehringer Ingelheim Gmbh, Zoetis Inc. Merck & Co.Inc, virbac, Vetoquinol S.A., Petiq, Llc, Sequent Scientific Limited, Krka Group, Eco Animal Health Group Plc, Ceva Santé Animale, Chanelle Pharm, Bimeda Animal Health and Norbrook.

Loading Table Of Content...

Loading Research Methodology...