LNG Carrier Market Research, 2033

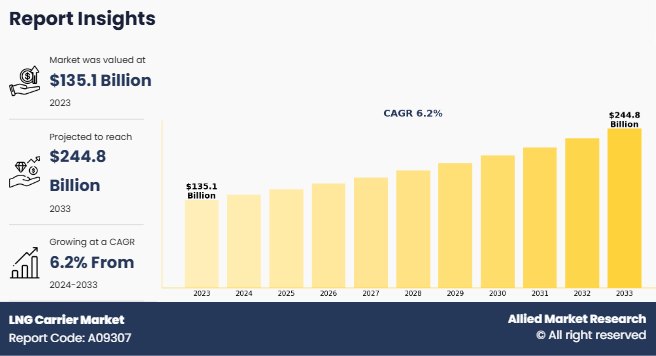

The global LNG carrier market size was valued at $135.1 billion in 2023, and is projected to reach $244.8 billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033. A Liquefied Natural Gas (LNG) carrier is a specialized ship designed to transport liquefied natural gas (LNG) at cryogenic temperatures (-162°C or -260°F). These vessels are built with insulated tanks to maintain the LNG in its liquid state, reducing its volume by approximately 600 times compared to its gaseous form, thereby making transportation more efficient. LNG carriers are a crucial component of the global energy supply chain, facilitating the movement of natural gas across oceans and continents.

Introduction

The primary function of LNG carriers is to transport natural gas from production sites to consumer markets worldwide. LNG is a cleaner alternative to coal and oil, playing a significant role in the global energy transition. As countries shift toward sustainable energy sources, LNG carriers enable the seamless supply of natural gas to regions lacking direct pipeline connectivity. Increase in demand for LNG, particularly in Asia and Europe, has led to technological advancements in LNG carrier designs, including the development of more fuel-efficient vessels with reduced carbon emissions.

The maritime sector is experiencing a shift toward LNG as a marine fuel due to its lower emissions compared to conventional fuels such as heavy fuel oil (HFO) and marine diesel oil (MDO). LNG-fueled ships have become popular due to stringent environmental regulations, such as the International Maritime Organization (IMO) sulfur cap. LNG carriers transport LNG and play a role in refueling LNG-powered vessels, supporting the industry’s move toward greener shipping solutions.

Key Takeaways

- The LNG carrier market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global LNG carrier market forecast and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the LNG carrier industry are Samsung Heavy Industries Co. Ltd, Hyundai Samho Heavy Industries Co. Ltd, Mitsubishi Heavy Industries Ltd, Kawasaki Heavy Industries Ltd, China Shipbuilding Trading Co. Ltd, Japan Marine United Corporation, BW Group, Golar LNG Limited, Flex LNG Ltd, and Knutsen Group. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

Advancements in LNG Carrier technologies is expected to drive the LNG carrier market growth. LNG carrier technologies has significantly improved the efficiency, safety, and sustainability of transporting liquefied natural gas across global markets. LNG & Energy Transition makes as advancements is the introduction of Q-Max and Q-Flex LNG carriers, which have revolutionized LNG shipping with their increased storage capacities and fuel efficiency. Q-Max carriers, with a capacity of up to 266,000 cubic meters, are among the largest LNG vessels, capable of transporting 80% more LNG than conventional carriers while reducing transportation costs per unit. Similarly, Q-Flex carriers, with capacities ranging from 210,000 to 217,000 cubic meters, offer substantial efficiency gains. Both types incorporate onboard reliquefaction systems, allowing them to minimize boil-off gas (BOG) losses by converting evaporated LNG back into liquid form, reducing cargo loss and enhancing cost-effectiveness.

In September 2024, Mitsui O.S.K. Lines, Ltd. (MOL) and Chevron Shipping Company LLC announced an agreement to install the Wind Challenger system hard sail wind-assisted propulsion technology developed by MOL and Oshima Shipbuilding on a new LNG carrier. This vessel, under construction at Hanwha Ocean Co., Ltd.'s Geoje Shipyard, is scheduled for delivery in 2026 and will be the world's first LNG carrier equipped with such a system. The Wind Challenger's unique telescopic sails are designed to reduce fuel consumption and GHG emissions. Additional safety measures include a fully enclosed navigation bridge and a lookout station on the foredeck to enhance visibility. The installation is designed to minimize impacts on existing mooring arrangements and ship-shore compatibility.

However, high initial capital investment is expected to hamper the growth of LNG carrier market. One of the primary barriers to entry in the LNG carrier market is the high initial capital investment required for vessel construction, infrastructure development, and associated technologies. The cost of building an LNG carrier typically ranges between $200 million and $250 million per vessel, depending on size, containment system, and onboard reliquefication technology. These costs are significantly higher than those for conventional oil tankers or dry bulk carriers due to the specialized design, advanced insulation systems, and stringent safety measures required for transporting liquefied natural gas at ultra-low temperatures (-162°C). In addition, shipowners must invest in boil-off gas (BOG) management systems to minimize cargo losses and ensure operational efficiency, further increasing capital expenditures.

Segments Overview

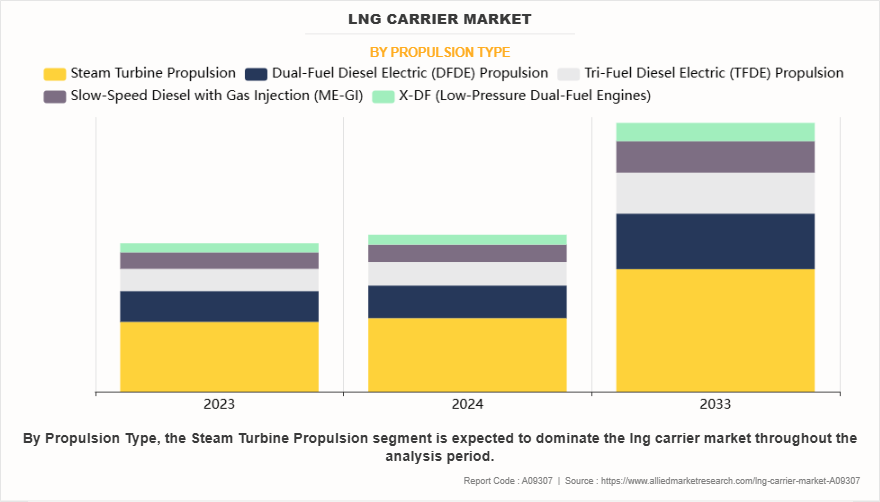

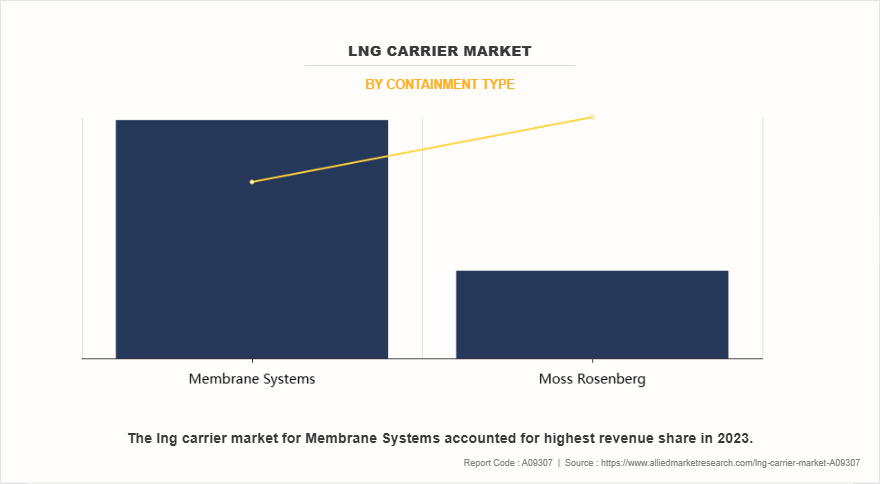

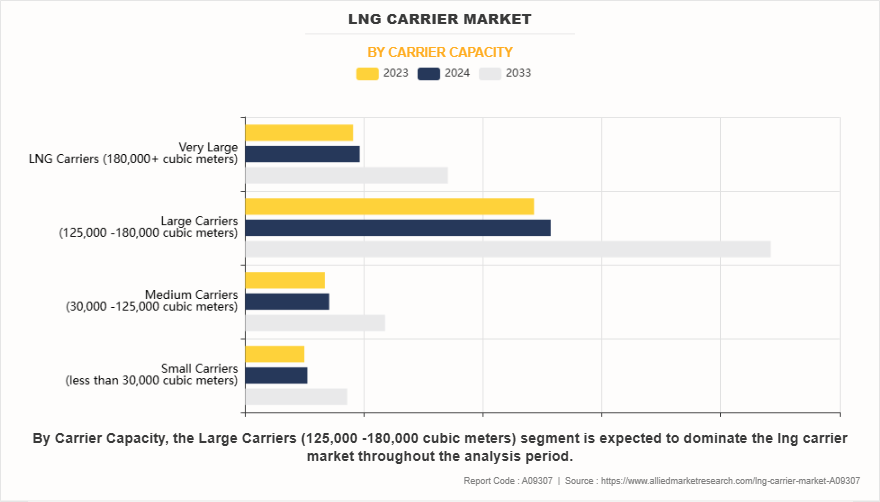

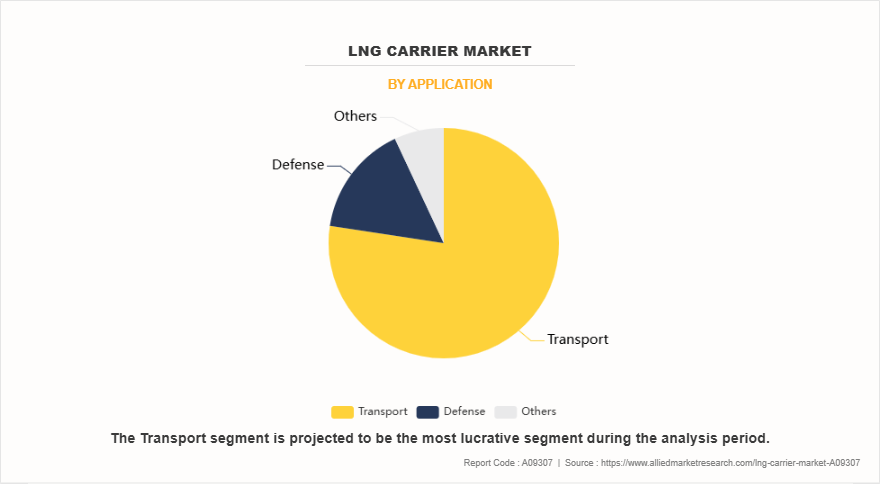

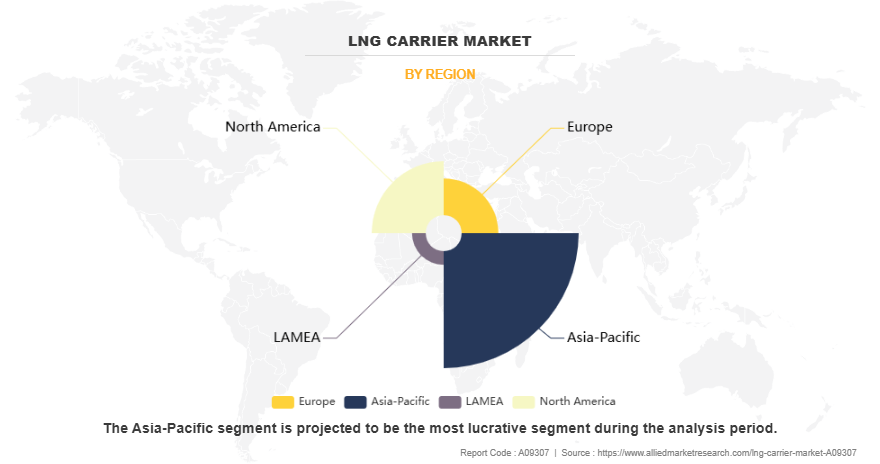

The LNG carrier market is segmented into propulsion type, containment type, carrier capacity, application and region. On the basis of propulsion type, the market is divided into dual-fuel diesel electric (DFDE) propulsion, tri-fuel diesel electric (TFDE) propulsion, slow-speed diesel with gas injection (ME-GI), and X-DF (low-pressure dual-fuel engines). On the basis of containment type, the market is categorized into membrane systems, and moss rosenberg. Based on carrier capacity, the market is classified into small carriers (less than 30,000 cubic meters), medium carriers (30,000 - 125,000 cubic meters), large carriers (125,000 - 180,000 cubic meters), very large LNG carriers (180,000+ cubic meters). On the basis of application, the market is divided into transport, defense, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of propulsion type, the steam turbine propulsion segment dominated the market in 2023. Steam turbine propulsion has been a preferred choice for LNG carriers for several decades due to its unique advantages, particularly its ability to efficiently utilize boil-off gas (BOG) as a fuel source. As LNG for power generation is used transported at cryogenic temperatures, a portion of it naturally evaporates during transit, creating BOG. Steam turbine systems are well-suited to use this gas without the need for complex reliquefication systems, reducing waste and improving fuel efficiency. In September 2022, Empresa Naviera Elcano received Approval in Principle (AiP) from Lloyds Register for a patented design that converts steam-powered LNG carriers to a hybrid system. This transformation integrates a dual-fuel generator with the existing steam turbine, supplying electrical power to the ship's switchboard and coupling electric propulsion motors to the propulsion gearbox or shaft. The hybrid system also incorporates energy recovery devices that harness exhaust gases and engine cooling systems, integrating them into the existing steam plant. This conversion aims to enhance energy efficiency and reduce greenhouse gas emissions, ensuring compliance with IMO's Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII) regulations.

On the basis of containment type, the membrane systems segment dominated the market in 2023. Membrane systems allow for a higher cargo-to-hull ratio, making them more suitable for larger LNG carriers. This design improves the vessel's economic viability by increasing the volume of LNG transported per voyage, thereby reducing overall transportation costs. In addition, the flexible nature of membrane systems allows for the design of larger capacity LNG carriers, which is essential as global demand for LNG continues to rise. In May 2024, Air Products introduced the PRISM® GreenSep LNG membrane separator for bio-LNG production. This technology eliminates the need for intermediate purification methods such as amine scrubbing or thermal swing adsorption, resulting in higher bio-LNG yields and reduced operational expenses and energy consumption. Bio-LNG, derived from organic sources such as food, animal, or municipal waste, benefits from this advancement through increased production efficiency and sustainability.

On the basis of carrier capacity, the large carriers (125,000 - 180,000 cubic meters) segment dominated the market in 2023. The usage of large LNG carriers, typically ranging from 125,000 to 180,000 cubic meters in capacity, has grown significantly due to the increasing global demand for liquefied natural gas (LNG). These vessels serve as the backbone of international LNG trade, enabling the transportation of gas from production hubs, such as Qatar, the U.S., and Australia, to key importing nations such as China, Japan, South Korea, and European countries. Large LNG carriers offer economies of scale, making them more cost-effective for long-haul voyages by reducing per-unit transportation costs. The adoption of advanced containment systems, such as membrane and Moss-type tanks, ensures the safe and efficient transport of LNG while minimizing cargo loss due to boil-off gas. Mitsui O.S.K. Lines (MOL) announced plans to build the world's first wind-assisted LNG carrier. The vessel, under construction at Hanwha Ocean's Geoje Shipyard, is expected to feature MOL's Wind Challenger hard sail system and is scheduled for delivery in 2026. This initiative aims to reduce greenhouse gas emissions in LNG maritime transport, aligning with MOL's goal of achieving net-zero GHG emissions by 2050.

On the basis of application, the transport segment dominated the market in 2023. Liquefied Natural Gas (LNG) carriers play a crucial role in the transportation of natural gas across the globe, facilitating the movement of this vital energy source from production regions to consumer markets. These specialized vessels are designed to transport LNG in a liquid state at extremely low temperatures (-162°C) to ensure efficiency and safety. The use of LNG carriers has grown significantly due to the increasing demand for cleaner energy sources, as LNG emits lower carbon dioxide and sulfur compounds compared to traditional fossil fuels such as coal and oil. In August 2023, China Energy Shipping Investment (CESI), a collaboration between COSCO Shipping and Sinopec, announced plans to order three 175,000 cubic meter LNG carriers, valued at approximately $761 million.

By region, Asia-Pacific dominated the LNG carrier market in 2023. The Asia-Pacific region plays a crucial role in the global LNG carrier market, driven by its increasing energy demand, supply chain complexities, and government policies promoting cleaner fuels. One distinct characteristic of LNG carrier usage in the region is the dominance of short-haul routes, particularly between Australia and East Asia (Japan, China, and South Korea). Australia, as the world's largest LNG exporter, supplies a significant portion of its LNG to neighboring countries, reducing voyage times compared to long-haul routes from the Middle East or the U.S. This results in a higher frequency of LNG carrier trips and a growing demand for small- and mid-scale LNG carriers designed for regional trade.

Competitive Analysis

The major prominent players operating in the LNG carrier market include Samsung Heavy Industries Co. Ltd, Hyundai Samho Heavy Industries Co. Ltd, Mitsubishi Heavy Industries Ltd, Kawasaki Heavy Industries Ltd, China Shipbuilding Trading Co. Ltd, Japan Marine United Corporation, BW Group, Golar LNG Limited, Flex LNG Ltd, and Knutsen Group.

- IN April 2022, Hyundai Samho Heavy Industries Co. Ltd, a subsidiary of Korea Shipbuilding & Offshore Engineering (KSOE), clinched a 545.8 billion-won ($449 million) deal to build two LNG carriers for a European client, with delivery anticipated in the first half of 2025.

- In December 2024, Kawasaki revised its Japan-Australia hydrogen supply chain project, suspending plans to use hydrogen derived from Australian brown coal due to construction approval delays. The company now intends to source hydrogen produced in Japan or potentially from the Middle East and will utilize smaller liquefied hydrogen carriers with a capacity of 40,000 cubic meters, down from the initially planned 160,000 cubic meters.

- In September 2022: Samsung Heavy Industries projected an annual demand for 35 new LNG carrier orders by 2030, driven by the rising global need for liquefied natural gas.

Overview of Regulatory Frameworks in LNG Carrier

- IGC Code: Established in 1983 and revised in 2014, this code applies specifically to LNG carriers. It mandates safety standards for cargo tank location, fire protection, and personnel safety, classifying LNG as a Type 2G hazardous cargo.

- IGF Code: Implemented in 2017, this code addresses LNG-fuelled ships (e.g., bulk carriers, ferries). It imposes stricter requirements, categorizing LNG fuel as Type 1G (higher hazard) and emphasizing machinery safety, fuel supply systems, and risk assessments.

Key Regulatory Gaps

Risk Assessment Requirements

The IGF Code mandates formal risk assessments for LNG-fuelled ships, while the IGC Code does not require them for LNG carriers unless operating in specialized roles (e.g., floating storage units)1. This creates inconsistencies in hazard management practices.

Tank Location and Safety Distances

- IGC Code: Requires LNG cargo tanks to maintain a minimum distance of B/5 or 11.5 m (whichever is smaller) from the ship's side and B/15 or 2 m from the bottom hull for Type 2G cargo.

- IGF Code: Classifies LNG fuel tanks as Type 1G, enforcing stricter distances of B/5 or 11.5 m from the side and B/15 or 6 m from the bottom.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lng carrier market analysis from 2023 to 2033 to identify the prevailing lng carrier market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lng carrier market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lng carrier market trends, key players, market segments, application areas, and market growth strategies.

~

LNG Carrier Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 244.8 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 490 |

| By Containment Type |

|

| By Carrier Capacity |

|

| By Application |

|

| By Propulsion Type |

|

| By Region |

|

| Key Market Players | Knutsen Group, BW Group, Kawasaki Heavy Industries Ltd., Mitsubishi Heavy Industries, LTD, China Shipbuilding Trading Co. Ltd, Flex LNG Ltd, Golar LNG Limited, Japan Marine United Corporation, Hyundai Samho Heavy Industries Co. Ltd, Samsung Heavy Industries Co. Ltd. |

Analyst Review

According to the opinions of various CXOs of leading companies, rise in global demand for LNG is expected to drive the growth of market. The global demand for liquefied natural gas (LNG) is experiencing significant growth as countries seek cleaner energy alternatives to reduce carbon emissions and enhance energy security. LNG is increasingly recognized as a crucial transition fuel, helping nations move away from high-emission fossil fuels such as coal and oil while they expand their renewable energy capacity. This shift is particularly evident in Asia, where major economies such as China, Japan, South Korea, and India are driving LNG consumption. China, the world’s largest LNG importer, is rapidly expanding its LNG infrastructure to replace coal in power generation and industrial applications, aligning with its carbon neutrality goals. The U.S. Department of Energy, during Donald Trump's presidency, granted approval for Venture Global LNG to export natural gas from its planned CP2 facility in Louisiana. This decision was in line with the administration's "energy dominance" strategy, which focused on increasing U.S. oil and gas production and exports. Under the Biden administration, the CP2 project had encountered delays due to environmental considerations.

However, geopolitical & trade barriers in LNG trade is expected to hamper the growth of LNG carrier market. Geopolitical tensions and trade barriers have a significant impact on LNG trade flows, affecting both suppliers and importers. Sanctions on major LNG-producing countries, such as Russia, have reshaped global LNG supply chains, forcing buyers to seek alternative sources. Following Russia’s invasion of Ukraine, Western sanctions on Russian energy exports led to a sharp decline in pipeline gas supplies to Europe, increasing the region’s dependence on LNG imports from the U.S., Qatar, and Australia. This shift caused price volatility, supply chain disruptions, and infrastructure bottlenecks, as European nations rushed to secure LNG contracts and expand their regasification capacities. In addition, restrictions on Russian LNG projects, such as Novatek’s Arctic LNG 2, have hindered their ability to export, further altering global supply dynamics.

The major prominent players operating in the LNG carrier market include Samsung Heavy Industries Co. Ltd, Hyundai Samho Heavy Industries Co. Ltd, Mitsubishi Heavy Industries Ltd, Kawasaki Heavy Industries Ltd, China Shipbuilding Trading Co. Ltd, Japan Marine United Corporation, BW Group, Golar LNG Limited, Flex LNG Ltd, and Knutsen Group.

The global LNG carrier market was valued at $135.1 billion in 2023, and is projected to reach $244.8 billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033.

Asia-Pacific is the largest regional market for LNG carrier.

Transport is the leading application of LNG carrier market.

Growth in floating LNG (FLNG) projects are the upcoming trends of LNG carrier market.

Loading Table Of Content...

Loading Research Methodology...