Loan Brokers Market Research, 2031

The global loan brokers market size was valued at $251 billion in 2021, and is projected to reach $1,061.79 billion by 2031, growing at a CAGR of 15.7% from 2022 to 2031.

A loan broker is an intermediary between a financial institution that offers loans that are secured with real estate and individuals interested in buying real estate who need to borrow money in the form of a loan to do so. The mortgage broker will work with both parties to get the individual approved for the loan. They also collect and verify all of the necessary paperwork that the lender needs from the individual in order to complete the home purchase. A mortgage broker typically works with many different lenders and can offer a variety of loan options to the borrower they work with.

Loan brokers provide the best loans to the borrowers according to their financial goals. In addition, loan brokers save time and effort of the borrowers for finding a loan with a low interest rate. Moreover, loan brokers have better access to a large number of lenders, and therefore chances of getting good deals on loans are much higher rather than the borrower themselves applying for a loan. Therefore, these are the major driving factor for the growth of the loan brokers market. However, loan brokers often charge huge fees or commission from their clients for providing their services which often stops clients from taking their services. In addition, chances of fraud is higher in case of hiring a broker, if the broker is not trustable then they might charge extra money from their clients. Therefore, these are the major factors limiting the growth of the loan broker market. On the contrary, growing need for loans by customers expected to provide lucrative growth opportunities in the coming years.

Segment Review

The loan brokers market is segmented on the basis of component, enterprise size, application, end user and region. By component, it is segmented into products and services. Based on enterprise size, it is segregated into large enterprises, and small and medium-sized enterprises. By application, the market is divided into home loans, commercial & industrial loans, vehicle loans, loans to governments, and others. By end user, the loan brokers market is segmented into businesses and individuals. The businesses segment is further sub segmented into commercial loan brokers, startup loan brokers, invoice factoring broker, and equipment financing brokers. The commercial loan brokers segment is further bifurcated into unsecured lending and secured lending. By region, it is analyzed across Asia-Pacific, Europe, North America, and LAMEA.

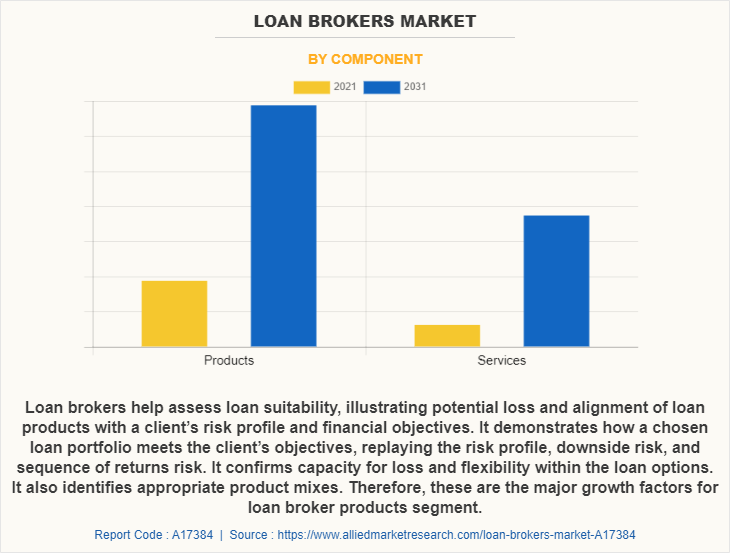

Based on component, the products segment attained the highest growth in 2021. This is attributed to the fact that loan brokers helps borrowers identify and communicate risk to make appropriate planning decisions and select loan options which are suitable for clients’ financial needs and risk profiles. Furthermore, loan brokers offers products that can be configured to provide a client-specific assessment of the risk and return characteristics of a particular portfolio and help align loan choices to a client’s capacity for loss.

Based on region, North America attained the highest growth in 2021. This is attributed to the fact that consumer demand for mortgages in the North America region has boosted, due to surge in home buying during the COVID-19 pandemic and as a result of low interest rates that have made refinancing attractive over the past two years. Furthermore, housing prices generally follow cyclical trends, and demand for finance brokers increases with improving macroeconomic variables. In addition, low interest rates, combined with falling unemployment and growing capital markets, have increased the housing market and thus strong demand for mortgages and loans for which clients are hiring lending broker for getting good deals in loans.

The report focuses on growth prospects, restraints, and trends of the loan brokers market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the loan brokers industry.

The report includes the profiles of key players operating in the loan brokers market analysis such as Ally Financial Inc., Bank of America Corporation, Caliber Home Loans, Inc., Flagstar Bank, Interactive Brokers LLC, JPMorgan Chase & Co., LendingTree, LLC, loanDepot.com, LLC, LaGray Finance, Macquarie Group Limited, Mortgage Choice Pty Limited, PennyMac Loan Services, LLC, Rocket Mortgage, LLC. , The PNC Financial Services Group, Inc, Wells Fargo, Moneypark, and Hypomo. These players have adopted various strategies to increase their market penetration and strengthen their position in the loan brokers market forecast.

COVID-19 impact analysis

COVID-19 pandemic had a negative impact on the loan brokers market as large number of people incurred huge losses due to closure of business, and there was a reduction in number of loans taken by the customers. Moreover, a large number of customers postponed their plans to take home loans, car loans and others. This was majorly due to lack of funds with the customers. Therefore, the services of a loan broker also reduced during the pandemic. Therefore, these were the major trends in the lending broker market pertaining to the COVID-19 pandemic.

Top impacting factors

Loan brokers save time and efforts of borrowers

Loan brokers saves lots of time and efforts of the borrowers on finding the right lenders that offer a better interest rate on loans. As loan brokers have a regular contact with the lenders they can find the right lender and save time of their clients. Moreover, they even take care of all the paperwork related to the loan. In addition, the clients do not have to worry about all the legislative work related to the loan which can be effectively taken care by the broker. Moreover, the client can be relaxed about getting the best loan by hiring a finance brokers. Therefore, this is one of the major driving factor of the loan brokers market.

Loan brokers charge huge fees or commission

Loan brokers often provide their services in exchange of a fees or a commission. This commission is sometimes very high as per the clients which cannot be afforded by them. Moreover, sometimes these commissions can be higher depending upon the type of loan the client wants. Therefore, most of the times clients prefer to avoid finance brokers because of this high fees they charge and choose to find a loan by themselves. Therefore, this is a major limiting factor for the loan brokers market.

Chances of fraud is higher in case of hiring a broker

There are numerous cases of fraud by the loan brokers to their clients. A large number of brokers charge money from their clients and scam them by disconnecting their calls and leaving the city. Moreover, there are brokers that charge money but do not provide services as promised by them. Therefore, most of the times customers hesitate from hiring a broker because of the higher chances of fraud. Hence, hiring a broker who is trustable is advised to the customer. Therefore, this is a major factor hampering the loan brokers market growth.

Rising demand for loans by customers

There is a rising demand for different types of loans by customers such as home loans, personal loans, car loans and others. In addition, customers want the best deals on these loans with the lowest possible interest. Therefore, the demand for brokers is growing in the market. Moreover, with the rising need for loans, the demand for brokers will also increase. Therefore, these factors will provide major lucrative opportunities for the growth of loan brokers market in the upcoming years.

Key benefits for stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the loan brokers market share from 2021 to 2031 to identify the prevailing loan brokers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the loan brokers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global loan brokers market trends, key players, market segments, application areas, and market growth strategies.

Loan Brokers Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Enterprise Size |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Ally Financial Inc., The PNC Financial Services Group, Inc, LaGray Finance, Macquarie Group Limited, Caliber Home Loans, Inc., Wells Fargo, JPMorgan Chase & Co., PennyMac Loan Services, LLC, Hypomo, LendingTree, LLC, loanDepot.com, LLC, Rocket Mortgage, LLC., Moneypark, Interactive Brokers LLC, Mortgage Choice Pty Limited, Bank of America Corporation, Flagstar Bank |

Analyst Review

A mortgage broker offers a wide range of loans from a number of different lenders. Greater the broker’s experience and network, the better the borrower’s opportunity to obtain the loan product and the interest rate that best suits their needs. Moreover, a broker navigates clients through any situation, handling the process and smoothing any hindrances while obtaining a loan. For instance, if borrowers have credit issues, brokers will know, which lender offers best products to meet their needs. Furthermore, borrowers who need bigger loans instead of having a bad credit score also benefit from a broker’s knowledge and ability to successfully obtain the loan. In addition, a loan broker offers loans on a wholesale basis from lenders, therefore, offering best rates available in the market, typically making the total loan cost lower for clients. A reputable broker discloses how they are paid for their services, as well as detail total costs for loans.

Furthermore, personalized service is a differentiating factor while selecting a loan broker. Clients should expect their brokers to help smooth the way, be available to them, and advise them throughout the closing process. Therefore, borrowers should check qualifications and experiences of brokers, ask for references, and rely on referrals from their attorneys, accountants, real estate agents, or financial planners. Some key players profiled in the report include Ally Financial Inc., Bank of America Corporation, Caliber Home Loans, Inc., Flagstar Bank, Interactive Brokers LLC, JPMorgan Chase & Co., LendingTree, LLC, loanDepot.com, LLC, LaGray Finance, Macquarie Group Limited, Mortgage Choice Pty Limited, PennyMac Loan Services, LLC, Rocket Mortgage, LLC. The PNC Financial Services Group, Inc, Wells Fargo, Moneypark, and Hypomo. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loan brokers have better access to a large number of lenders, therefore, chances of getting good deals on loans are much higher rather than borrowers themselves applying for a loan. Therefore, these are the major trends in loan brokers market.

Based on component, the products segment attained the highest growth in 2021. This is attributed to the fact that loan brokers helps borrowers identify and communicate risk to make appropriate planning decisions and select loan options which are suitable for clients’ financial needs and risk profiles. Furthermore, loan brokers offers products that can be configured to provide a client-specific assessment of the risk and return characteristics of a particular portfolio and help align loan choices to a client’s capacity for loss.

Based on region, North America attained the highest growth in 2021. This is attributed to the fact that consumer demand for mortgages in the North America region has boosted, due to surge in home buying during the COVID-19 pandemic and as a result of low interest rates that have made refinancing attractive over the past two years. Furthermore, housing prices generally follow cyclical trends, and demand for finance brokers increases with improving macroeconomic variables. In addition, low interest rates, combined with falling unemployment and growing capital markets, have increased the housing market and thus strong demand for mortgages and loans for which clients are hiring lending broker for getting good deals in loans.

The global loan brokers market size was valued at $251.00 billion in 2021, and is projected to reach $1,061.79 billion by 2031, growing at a CAGR of 15.7% from 2022 to 2031.

Ally Financial Inc., Bank of America Corporation, JPMorgan Chase & Co., LendingTree, LLC, and Wells Fargo holds major share in the loan brokers market.

Loading Table Of Content...