The global loitering munition system market size was valued at $1.6 billion in 2022, and is projected to reach $4.4 billion by 2032, growing at a CAGR of 10.9% from 2023 to 2032. Top Imapcting Facters: Owing to a surging demand for loitering munition system in forces of special operations, the wide-ranging operational capabilities of kamikaze drones for various units and forces. On the other hand, rise in deployment of antiballistic missile and drone systems are projected to hinder the market growth.

Report Key Highlighters

- The loitering munition system market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market

- The loitering munition system market share is marginally fragmented, with players such as Rheinmetall AG; AeroVironment, Inc.; WB Group; Israel Aerospace Industries Ltd.; UVision Air Ltd.; Paramount Group; Embenation; Savunma Teknolojileri Mühendislik ve Ticaret A.S..; ZALA Aero group, and Elbit Systems Ltd. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Surging Demand for Loitering Munition System in Forces of Special Operations is Boosting the Market Growth

Loitering munition offers enabling quick reaction upon target recognition, especially for targets that are in the firing line for a brief duration, such as an antiaircraft missile launcher or a moving command vehicle. Without exposing valuable people-operated platforms, such as attack helicopters, kamikaze drones can be used to detect targets. These systems boost demand and accelerate market growth since they are utilized against the target without causing human casualties.

Homing ammunition is increasingly employed for purposes apart from Suppression of Enemy Air Defenses (SEAD) missions. As direct sustenance carried "in the backpack" by light infantry and special operations forces (SOF) troops, ammunition is being loitered. The autonomous rocket's presence will remain above Earth for a while in order to locate a target and launch an attack in response to suggestions from outside sources, including other unmanned platforms and soldiers from Special Operations Force. Suicide drones and kamikaze drones are other names for this weapon.

For example, Israel's UVISION Company will supply Italy's Special Forces with Hero -30 Loitering Ammunition as part of its defense aims. According to the defense services, it is essential that weapons for self-defense be made available to Tier 1 Special Forces stationed in fighting areas in case they come across an enemy threat that poses a risk of harm.

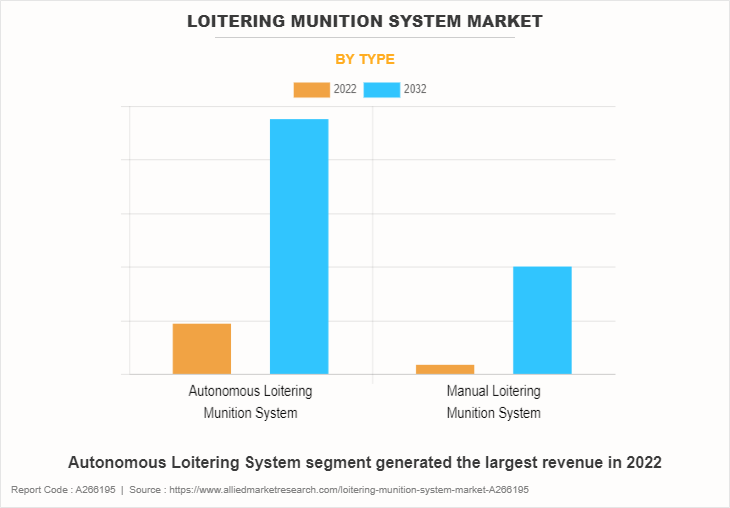

The loitering munition system market is segmented into Type and Platform.

On the basis of type, the loitering munition system market analysis is bifurcated into autonomous loitering munition system and manual loitering munition system.

Rise in Deployment of Antiballistic Missile and Drone Systems Could Hamper Market

Anti-drone technologies function as drone detection tools, tracking drone activity through passive surveillance and disrupting drone communication to neutralize the threat. These devices detect approaching drones fast and offer useful information to defend against them. As a result, the growing use of these systems is impeding market growth.

Surface-to-air antiballistic missiles are made to thwart missile defense systems. Growth in the market is hindered by using this technique to intercept and eliminate missile threats. For instance, in October 2023, U.S. has deployed an antiballistic missile defense system and several Patriot missile battalions to the Middle East. In addition, the Taiwan Ministry of Defense approved an allocation of $146 million in 2022 to purchase the defensive systems, which were to be deployed in 45 military bases across the island until 2026.

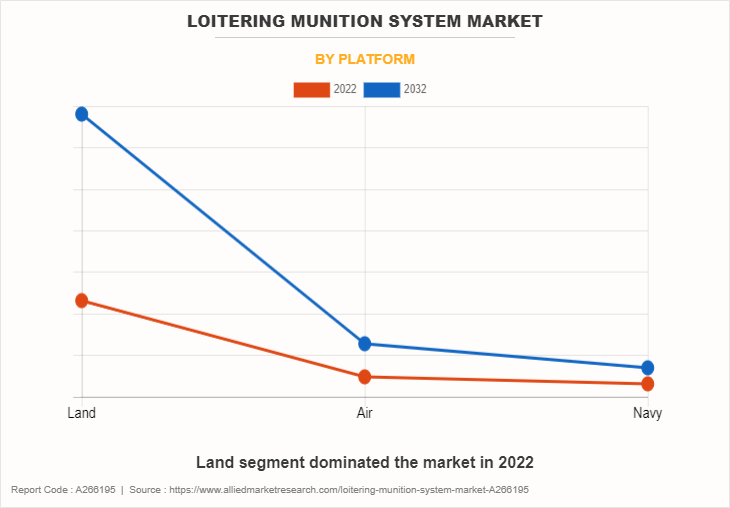

On the basis of platform, the market is divided into land, air, and navy.

The Wide-Ranging Operational Capabilities of Kamikaze Drones for Various Units and Forces Driving the Market Demand

Precision munitions systems are essential for current warfare because they can manage or recall ammunition in the event of a final strike, as well as detect and intercept threats that are important enough. These needs can increase the demand for loitering ammunition, stimulating growth in the loitering munition system market. Modern warfare depends heavily on loitering munition, which offers maximum tactical flexibility. This system provides the armed forces with an extremely precise munition system, along with the capacity to fire autonomously, and high-caliber intelligence, surveillance, and reconnaissance.

In April 2023, Elbit Systems Ltd. announced that it had been awarded a $150 million contract to supply an international customer with PULSTM (Precise and Universal Launching Systems) rocket launchers and a bundle of precision-guided long-range rockets. The deal was to be completed over a three-year timeframe. The PULS from Elbit Systems was a complete and cost-efficient solution that could launch unguided rockets, precision-guided munitions, and missiles with effective ranges of up to 300 kilometers.

In addition, in September 2022, the U.S. signed a contract worth $2.2 million with AeroVironment, Inc. to supply 600 Switchblade kamikaze drones for Ukraine. The U.S. declared that the shipments conducted fell within the framework of the U.S.' provision of security support to Ukraine, which was carried out through two authorities: the Ukraine Security Assistance (USAI) and the Presidential Drawdown Authority (PDA).

The several dimensions of land and marine pressures can be addressed by the HERO series, which offers customized operating solutions. HERO may be used for a wide range of missions and has demonstrated its effectiveness in leading combat units, including those of powerful NATO nations, through deployments.

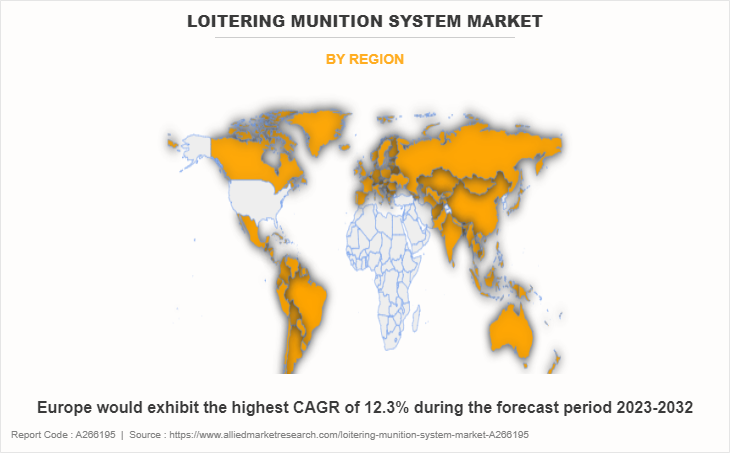

Region wise, the loitering munition system market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, Italy, Spain and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

On the basis of region, North America is expected to be the largest market shareholder with a CAGR of 10.07% from 2022 to2032 owing to the constant increase in civil expenditure to integrate advanced technologies across loitering munition system.

In order to preserve their supremacy, the world's most powerful armies concentrate on obtaining cutting-edge weapons that can locate, capture, and follow a low-signature hostile target over a prolonged period of time without interference from other sources.

For instance, in September 2023, Rheinmetall and UVision launched a loitering munition called the HERO series. The HERO hovering munition hovers over the operational area, follows and identifies the enemy, investigates possible targets to assist in identifying the most crucial ones, ascertains the ideal assault angle and timing, and executes precise attacks in real time.

Impact of Russia-Ukraine War on Loitering Munition System Industry

Geopolitical tensions and conflict between Russia and Ukraine are expected to cause economic uncertainty in the impacted regions. Budgets and plans for implementing automation solutions may be impacted by economic instability, which may also have an impact on the choices made by airports, airlines, and technology suppliers about investments. Furthermore, projects pertaining to the expansion and upgrading of airports, among other infrastructure development initiatives, may be postponed or delayed in areas where there is a conflict between Russia and Ukraine.

In addition, Ukraine has utilized loitering munitions to defend its territory and target enemy positions, demonstrating their tactical value in asymmetric warfare. For instance, in October 2023, U.S. security provided assistance package to Ukraine which includes funding for additional weapons to take down Russian unmanned aerial systems. The equipment is part of a $425 million tranche of military aid, which includes $125 million worth of equipment from Defense Department stocks, plus $300 million in Ukraine Security Assistance Initiative (USAI) funds.

The conflict has also spurred advancements in loitering munition technology, as both sides seek to enhance their capabilities to gain a strategic edge. This includes improvements in autonomy, precision, and range, as well as the development of countermeasures to mitigate the effectiveness of enemy loitering munitions.

In addition, the Russia-Ukraine conflict has attracted international attention to the role of loitering munitions in modern conflicts, leading to increased interest and investment in these systems by other countries and defense contractors. As a result, the market for loitering munitions has experienced growth, with an emphasis on improving performance and reducing costs to meet the evolving demands of modern warfare. In October 2023, Russia developed First-Person-View (FPV) kamikaze drones with thermal imagers for night attacks to enhance their capabilities in conflicts in smoke or dust. Moreover, the cost of thermal imagers considerably increased the price of FPV drones. This development reflected a significant technological progression toward thermal-imaging-equipped drones, although affordability remained challenging.

Competitive Analysis

Competitive analysis and profiles of the major global loitering munition system market players that have been provided in the report include Rheinmetall AG; AeroVironment, Inc.; WB Group; Israel Aerospace Industries Ltd.; UVision Air Ltd.; Paramount Group; Embenation; Savunma Teknolojileri Mühendislik ve Ticaret A.Åž; ZALA Aero group, and Elbit Systems Ltd. The key strategies adopted by the major players of the global market are product launch and mergers & acquisitions.

Historical Data and Information

The global loitering munition system market is highly competitive, owing to the strong presence of existing vendors. Vendors of the global market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments/ Strategies in Loitering Munition System

- In April 2023, Ministry of Defense, Government of India awarded a contract to Solar Industries, India wholly owned Economic Explosives subsidiary for the loitering munition supply. It's the first loitering munition to be manufactured by a company in India. In developing products in the future, it highlights the company's capacity to take advantage of new technologies and being flexible. The contract is to be completed in one year and has a value of USD 2020 million.

- In May 2023, the first indigenously designed and developed loitering munitions have been delivered to the Indian Air Force by Tata Advanced Systems Ltd. The weapon has a distinct vertical takeoff and landing VTOL technology, capable of operating in all terrains, including higher altitude areas, of taking down targets over 50 km. The weapon has autonomy and precision, so it can strike precisely but minimizes the risks for personnel.

- In February 2023, EDGE Group entity, HALCON, a regional leader in the design and production of guided weapons systems and beyond, has signed a deal worth AED USD 299 million to deliver HUNTER 2-S (swarming), HUNTER 5, and HUNTER 10 loitering munitions to the UAE Armed Forces. HALCONs HUNTER family of fixed-wing loitering munitions are designed for intelligence, surveillance, reconnaissance (ISR), and aerial strike missions.

- In May 2023, with the acquisition of Long-range Loitering Missiles, Estonia has enhanced its defense capability to reinforce its indirect fire capabilities. The first deliveries of long-range loitering munitions are expected to be made in 2024, with the necessary training to be provided to the defense forces before their deployment.

- In April 2023, The American Militarys Tactical Aviation and Ground Munitions Project Office provided AeroVironment with additional funding of USD 64.7 million to procure Switchblade 300 Low Loitering Missile Systems. The U.S. Army's Contracting Command, Redstone Arsenal, will manage this contract, and the equipment is to be delivered by July 2024.

Key Benefits for Stakeholders

- This study comprises analytical depiction of the global loitering munition system market size of loitering munition system along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in the loitering munition system.

The report includes the market share of key vendors and the global loitering munition system industry.

Loitering Munition System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.4 billion |

| Growth Rate | CAGR of 10.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 274 |

| By Type |

|

| By Platform |

|

| By Region |

|

| Key Market Players | UVision Air Ltd., Embenation, AeroVironment, Inc., ZALA Aero group, Elbit Systems Ltd, Israel Aerospace Industries Ltd., STM Savunma Teknolojileri Mühendislik ve Ticaret A.?., WB Group, Paramount Group, Rheinmetall AG |

The autonomous loitering munition system is the leading munition system market.

The upcoming trends of Loitering Munition System Market includes surging demand for loitering munition system in forces of special operations and rise in need for autonomous loitering munition system.

North America is the largest regional market for loitering munition system.

The global loitering munition system market was valued at $1.55 billion in 2022.

Rheinmetall AG; AeroVironment, Inc.; WB Group; Israel Aerospace Industries Ltd.; UVision Air Ltd.; Paramount Group are the top companies in the loitering munition system market.

Loading Table Of Content...

Loading Research Methodology...