Luggage Market Research, 2035

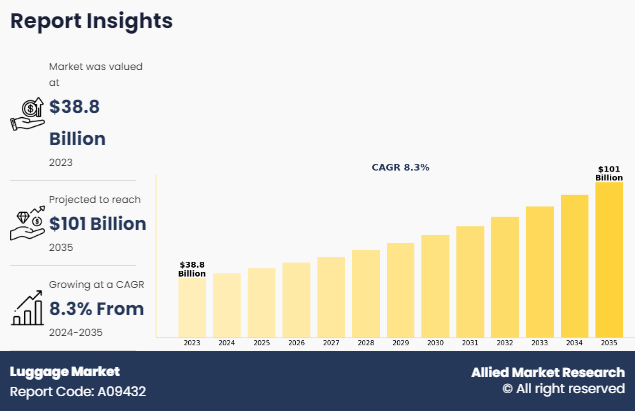

The global luggage market was valued at $38.8 billion in 2023, and is projected to reach $101 billion by 2035, growing at a CAGR of 8.3% from 2024 to 2035. Increase in domestic and international travel, coupled with rise in disposable incomes, fuels demand for durable and stylish luggage options. Technological advancements in materials and design enhance product durability and functionality, further driving the market growth. In addition, changing consumer preferences toward convenience and customization contribute to the growth of the luggage market.

Luggage are types of bags and containers designed for transporting personal belongings during travel. These items come in various forms, including suitcases, backpacks, duffel bags, and briefcases, each tailored to specific needs of individuals. Luggage is made from durable materials such as fabric, leather, and hard plastics, that often features compartments, pockets, and handles for efficient organization and carrying. Luggage bags are available with options ranging from practical and utilitarian to fashionable and luxurious bags.

Key Takeaways

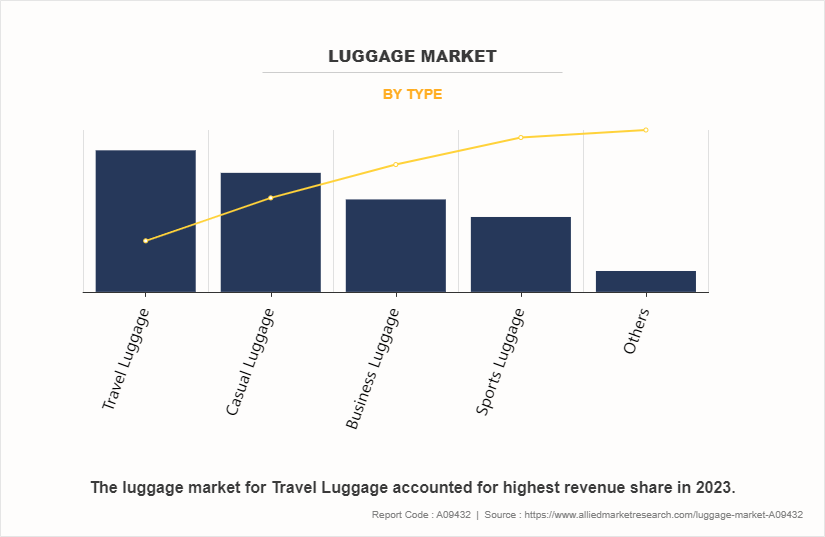

By type, the travel luggage segment was the highest revenue contributor to the market in 2023.

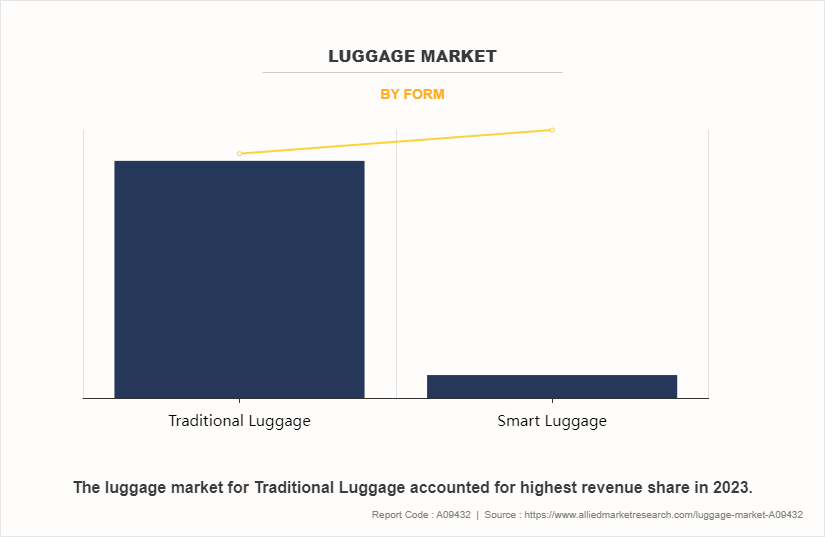

By form, the traditional luggage segment was the largest segment in the global luggage market during the forecast period.

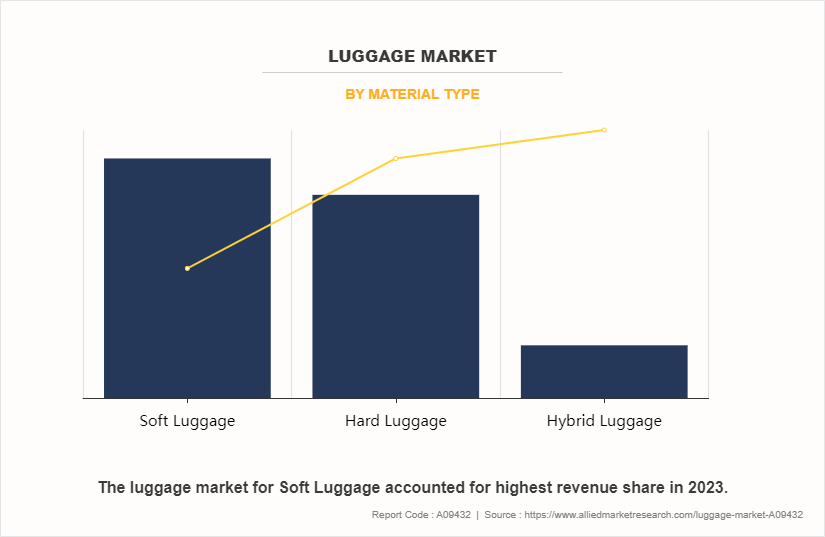

By material type, the soft luggage segment was the largest segment in 2023.

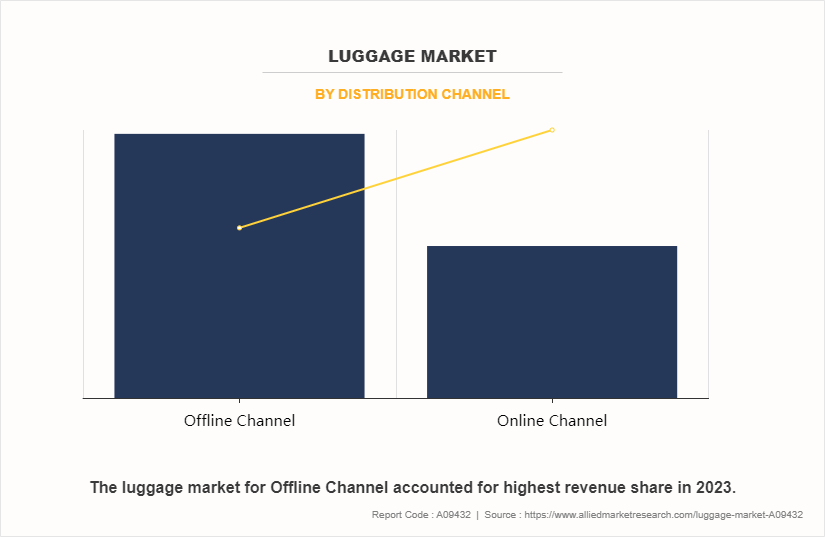

By distribution channel, offline segment was the largest segment in 2023.

Region-wise, Asia-Pacific was the highest revenue contributor in 2023.

Market Dynamics

Increase in international tourism has significantly boosted the global luggage market. International tourism recovered nearly 90.0% of its pre-pandemic levels by the end of 2023. According to the data from the United Nations World Tourism Organization (UNWTO), approximately 975 million tourists traveled internationally between January and September 2023, which represented a 38.0% increase as compared to the same period in 2022. As more people travel for leisure, business, and education purposes, the demand for reliable and durable luggage is anticipated to increase. Tourists need suitcases, backpacks, duffel bags, and other travel accessories to carry their belongings efficiently and securely, which drives the global Luggage Market Size.

In addition, the rise in tourism has driven the need for specialized luggage designed for specific purposes. For instance, adventure travelers seek rugged, durable bags that can withstand harsh conditions, while business travelers look for sleek, functional cases that accommodate their professional needs. Diversification in different types of luggage allows companies to tap into niche markets and meet the unique demands of various traveler segments. Moreover, surge in travel activities prompts manufacturers to innovate and offer diverse products catering to different types of travelers, such as lightweight luggage for convenience, smart luggage with built-in technology for tech-savvy users, and fashionable luggage for style-conscious customers. As a result, the luggage market has experienced rapid growth in sales volumes in recent years. Furthermore, an increase in travel activities has encouraged consumers to invest in higher-quality, long-lasting luggage, which has boosted the overall revenue of the luggage market.

However, the presence of counterfeit luggage poses a significant restraint on the Luggage Market Demand. Counterfeit products reduce consumer trust and confidence in the market, leading to dissatisfaction with the quality, durability, and performance of the product. Moreover, the proliferation of counterfeit goods contributes to revenue losses for legitimate manufacturers and retailers, as well as potential legal and financial liabilities associated with intellectual property rights infringement.

In addition, the presence of counterfeit luggage creates unfair competition within the market, as counterfeiters undercut prices and offer seemingly identical products at a lesser cost. The price difference leads to unfair competition, which affects the revenue and profitability of genuine brands and suppresses innovation and investment in product development. Furthermore, sale of counterfeit luggage undermines efforts to ensure consumer safety and compliance with regulatory standards, as counterfeit products may not undergo rigorous quality control measures or adhere to safety regulations, posing potential risks to and safety of consumer belongings. Thus, the rise in prevalence of counterfeit luggage represents a significant challenge for the global luggage market, hindering the market growth, damaging brand reputation, and compromising consumer trust and safety.

Moreover, the increase in demand for smart luggage presents significant opportunities in the global luggage market, which drives innovation and reshapes consumer expectations. Smart luggage integrates technology into traditional luggage designs, that offers features such as GPS tracking, built-in scales, USB charging ports, and remote locking systems. These advanced functionalities cater to the needs of modern travelers seeking convenience, connectivity, and security during their journeys. As travelers become more tech-savvy and reliant on digital solutions, the demand for smart luggage is expected to rise, which is anticipated to create a lucrative market opportunity for manufacturers and retailers operating in the global luggage market.

Segmental Overview

The luggage market is segmented into type, form, material type, distribution channel, and region. By type, the market is categorized into casual luggage, travel luggage, business luggage, sports luggage, and others. By form, it is bifurcated into traditional luggage and smart luggage. By material type, it is categorized into hard luggage, soft luggage, and hybrid luggage. By distribution channel, the market is divided into offline and online. By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, UK, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Thailand, Malaysia, Indonesia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, Argentina, rest of LAMEA).

By Type

By type, the travel luggage segment dominated the global luggage market in 2023 and is anticipated to maintain its dominance during the Luggage Market Forecast period. Increase in affordability and accessibility of travel opportunities has encouraged more people to explore domestic and international destinations, driving the need for reliable travel luggage solutions. Evolving travel preferences, such as the rise of experiential and adventure travel, require luggage that can withstand diverse environments and activities. Moreover, advancements in design and technology have led to innovative features in luggage, such as lightweight materials, built-in charging ports, and smart tracking systems, enhancing convenience and functionality for travelers. In addition, changes in lifestyles, including the growth of remote work and digital nomadism, have created a demand for versatile luggage options that cater to both professional and leisure travel needs, which has incresed the Luggage Market Share.

By Form

By form, the traditional luggage segment dominated the global luggage market in 2023 and is anticipated to maintain its dominance during the forecast period. The growth of the travel and tourism industry has significantly increased the need for reliable and functional luggage solutions. As more people travel for leisure, business, and other purposes, there is a continuous demand for traditional suitcases and bags that can securely transport belongings. Advancements in transportation infrastructure, such as airports, railways, and highways, have made travel more accessible to a broader population. The ease of accessibility, in turn, has further driven the Luggage Market Growth for traditional luggage that is able to withstand the rigors of various modes of transportation.

By Material Type

By material type, the soft luggage segment dominated the global luggage market in 2023 and is anticipated to maintain its dominance during the forecast period. The lightweight and flexible construction of soft luggage has made it easier to plan and pack, appealing to travelers who prioritize convenience and versatility. Soft luggage also tends to be more affordable than hard shell options, which makes it accessible to a broader range of consumers. In addition, soft luggage often features expandable compartments, that allows travelers to maximize packing space when needed. The fabric exterior of soft luggage provides some level of flexibility that makes it easier to fit into overhead compartments or tight spaces.

Moreover, the rise in casual travel and adventure tourism has increased the demand for soft luggage among outdoor enthusiasts and backpackers who require durable yet lightweight bags for their expeditions. Thus, the combination of affordability, versatility, and practicality drives the continued demand for soft luggage in the luggage industry.

By Distribution Channel

By distribution channel, the offline segment dominated the global luggage market in 2023 and is anticipated to maintain its dominance during the forecast period. The tactile nature of luggage products allows customers to physically inspect the quality, design, and features before making a purchase decision. The hands-on experience available in offline stores is often preferred by consumers, especially when it comes to items such as luggage, which are considered significant investments for travel. Offline stores provide opportunities for personalized customer service, where sales staff can offer expert advice, recommendations, and assistance in selecting the right luggage for individual needs. Moreover, the level of interaction builds trust and confidence in the purchase, leading to higher conversion rates.

In addition, offline stores often host promotional events, seasonal sales, and exclusive offers that attract customers seeking discounts and deals on luggage. These marketing strategies help drive foot traffic to stores and stimulate impulse purchases. Thus, the combination of tangible product experience, personalized service, and promotional incentives contributes to drives the sales of luggage in offline stores.

By Region

Region-wise, Asia-Pacific is anticipated to dominate the global luggage market with the largest share during the forecast period. Rise in middle class population and rise in disposable incomes have fueled increase in domestic and international travel in the region, driving the need for reliable and stylish luggage solutions. As more people take leisure trips, business travel, and educational journeys, there is rise in demand for suitcases and bags that offer durability, functionality, and aesthetic appeal. The rapid urbanization and expansion of transportation infrastructure in Asia-Pacific countries have facilitated travel accessibility, further boosting the demand for luggage products. In addition, the rise in e-commerce platforms and digital marketplaces has made it easier for consumers to access a wide range of luggage options, providing convenience and flexibility in shopping in the Asia-Pacific region.

Competitive Analysis

The key players operating in the luggage industry include Ace Co., Ltd., Adidas AG, LVMH, Nike Inc., Samsonite International S.A, Travelpro Products, Inc., VF Corporation, Victorinox, VIP Industries Limited, and United States Luggage Company LLC. Several well-known and upcoming brands are vying for market dominance in the expanding luggage industry. Smaller, niche firms are more well-known for catering to consumer demands and preferences. Large conglomerates, however, control most of the market and often buy innovative start-ups to broaden their product lines.

Recent Developments in Luggage Market

In June 2023, VF Corporation launched operations at its new distribution center in Ontario, California, with Vanderlande Industries to employ about 550 people during peak periods. Initially catering to Vans and The North Face, the center has a 76-million-unit annual shipping capacity, and it can dispatch 485,000 units daily, offering next-day e-commerce fulfillment across California, Nevada, Arizona, and southern Utah.

In February 2023, Samsonite launched a licensed collection with New Balance to offer a range of bags and luggage in Asia Pacific progressively over the coming years.

In January 2023, Victorinox launched its innovative Crosslight collection a new generation to strengthen the category of softside luggage for effortless and functional traveling.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the luggage market analysis from 2023 to 2035 to identify the prevailing luggage market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the luggage market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global luggage market trends, key players, market segments, application areas, and market growth strategies.

Luggage Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 101 billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2023 - 2035 |

| Report Pages | 380 |

| By Type |

|

| By Form |

|

| By Distribution Channel |

|

| By Material Type |

|

| By Region |

|

| Key Market Players | VF Corporation, United States Luggage Company, LLC., Victorinox, ACE Co., Ltd., LVMH, Nike Inc., Samsonite International SA, Adidas AG, VIP Industries Limited, Travelpro Products, Inc. |

Analyst Review

As per the perspective of top-level CXOs, the global luggage market is expected to offer various business opportunities in the developing economies such as India and China. CXOs have emphasized the impact of increase in travel and tourism, both for business and leisure, as a major driver of the global luggage market. With more people traveling frequently, the demand for high-quality, durable, and stylish luggage is on the rise. Leaders also point to the growing middle-class populations in emerging economies, especially in Asia-Pacific, as a significant contributor. As disposable incomes rise, consumers are more willing to invest more in premium luggage brands.

In addition, CXOs stated that the expansion of e-commerce platforms plays a crucial role in the luggage market expansion. Online sales channels make it easier for consumers to access a wide range of luggage options, compare prices, and read reviews, thereby boosting market growth. Sustainability trends are also influencing the market, with eco-friendly luggage made from recycled materials gaining popularity among environmentally conscious consumers. Moreover, CXOs believe sustainability has become a major factor in the industry. Top leaders recognize the growing consumer demand for eco-friendly luggage made from recycled or sustainable materials. Companies are investing in green technologies and practices to meet this demand, which attracts environmentally conscious consumers and also aligns well with global sustainability trends in recent years.

The forecast period in the luggage market report is 2024 to 2035.

The global luggage market was valued at $38,818.1 million in 2023, and is projected to reach $100,969.0 million by 2035, registering a CAGR of 8.3% from 2024 to 2035.

The travel luggage segment is the most influential segment in the luggage market report

The base year calculated in the luggage market report is 2023.

The top companies analyzed for the global luggage market report are Ace Co.,Ltd., Adidas AG, LVMH, Nike Inc., Samsonite International S.A, Travelpro Products, Inc., VF Corporation, Victorinox, VIP Industries Limited, and United States Luggage Company LLC.

Loading Table Of Content...

Loading Research Methodology...