Lumpectomy Market Research, 2033

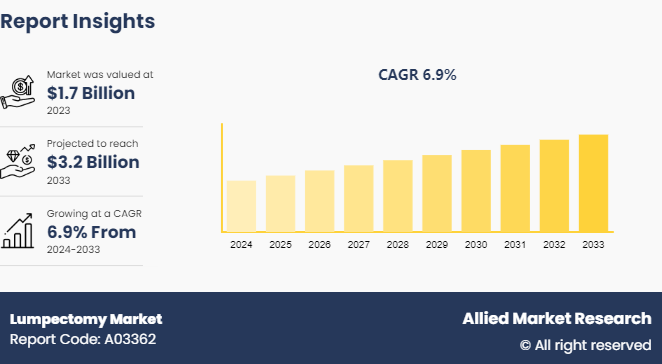

The global lumpectomy market size was valued at $1.7 billion in 2023 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033.

Market Definition and Overview

Lumpectomy is a surgical procedure to remove a mass (cancerous or non-cancerous) , typically in the breasts, without removing the surrounding healthy breast tissue. Also known as breast-conserving surgery, it aims to remove the tumor while maintaining the natural appearance of the breast. This approach is often preferred over mastectomy for early-stage breast cancer. Lumpectomies are followed by radiation therapy to reduce the risk of cancer recurrence. They offer a balance between effective treatment and preserving breast aesthetics and function, making them a common choice for many patients with small tumors or early-stage breast cancer.

Key Takeaways

- The lumpectomy industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major lumpectomy industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Market Dynamics

The lumpectomy market growth is driven by the escalating incidence of breast cancer worldwide. With breast cancer diagnoses on the rise, there is a corresponding surge in demand for breast-conserving procedures such as lumpectomies. This increase in prevalence not only point out the urgent need for effective treatment options but also highlights the preference for less invasive surgical interventions that preserve breast tissue. As awareness campaigns and screening programs detect more cases, the lumpectomy market continues to expand, driven by the imperative to provide patients with advanced, yet minimally invasive, treatment modalities tailored to their individual needs.

Limited awareness poses a significant restraint to the lumpectomy market expansion. Both patients and healthcare professionals may lack knowledge regarding the advantages and accessibility of lumpectomy procedures. This lack of awareness is projected to impede the expansion of the market, as potential patients may opt for alternative treatments or remain unaware of this breast-conserving option. Addressing this gap through education and outreach initiatives is essential to ensure that individuals are informed about the benefits and availability of lumpectomy procedures.

The lumpectomy market opportunity presents a promising landscape for key players with ongoing advancements in surgical techniques. Minimally invasive and robotic-assisted procedures are revolutionizing lumpectomies, enhancing both efficacy and safety. These techniques offer precise tumor removal while minimizing damage to surrounding healthy tissue, reducing post-operative complications and improving patient outcomes. The demand for such advanced methods is increasing, driven by the desire for less invasive treatments and faster recovery times. As healthcare providers and patients seek innovative solutions, there exists a significant opportunity for companies to develop and market cutting-edge technologies in the lumpectomy field. By capitalizing on these advancements, companies can meet the evolving needs of the medical community and contribute to improved standards of care for breast cancer patients.

Public Policies in the Global Lumpectomy Market

Public policies play a crucial role in shaping the global lumpectomy market by influencing various aspects such as healthcare accessibility, reimbursement policies, and regulatory frameworks. Here are some key points regarding public policies in the context of the lumpectomy industry:

- Healthcare Accessibility: Public policies can impact the accessibility of lumpectomy procedures by ensuring that healthcare services, including breast cancer treatment, are available and affordable to all segments of society. Policies promoting universal healthcare coverage or subsidizing breast cancer screening and treatment can increase access to lumpectomy procedures, particularly for underserved populations.

- Reimbursement Policies: Reimbursement policies set by government healthcare agencies or private insurers determine the financial coverage provided for lumpectomy procedures. Favorable reimbursement policies that adequately cover the costs of lumpectomy surgeries and related services can incentivize healthcare providers to offer these procedures and facilitate patient access.

- Regulatory Frameworks: Regulatory agencies establish guidelines and standards for the approval, manufacturing, and marketing of medical devices and technologies used in lumpectomy procedures. Stringent regulatory requirements ensure the safety, efficacy, and quality of devices, fostering trust among healthcare professionals and patients.

Market Segmentation

The market is segmented into product, end user, and region. On the basis of product, the market is divided into surgical tools and lumpectomy systems. As per end user, the market is classified into hospitals, clinics, and ambulatory surgical centers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The North America lumpectomy market size growth is primarily driven by the increasing prevalence of breast cancer and growing awareness about early detection and treatment options. Advancements in medical technology and surgical techniques have improved the success rates and outcomes of lumpectomies. In addition, supportive government initiatives and funding for breast cancer research, along with rising healthcare expenditure, are contributing to market growth. The demand for minimally invasive procedures and personalized treatment plans further boosts the expansion of the lumpectomy market share in this region.

- In February 2023, Gilead Sciences, Inc. obtained FDA approval for Trodelvy to address inoperable locally advanced or metastatic breast cancer. This approval signifies a significant advancement in breast cancer treatment options, potentially impacting lumpectomy procedures. With Trodelvy's approval, patients facing advanced stages of breast cancer may have expanded therapeutic options, potentially influencing treatment decisions, including lumpectomy considerations, and ultimately improving patient outcomes.

- In November 2021, AstraZeneca and Merck Sharpe & Dohme's application for Lynparza (Olaparib) received Priority Review in the U.S. for adjuvant treatment of high-risk early breast cancer patients with BRCA mutations. This collaboration enhances both companies' market positions and complements lumpectomy procedures, offering comprehensive treatment options for breast cancer patients.

Competitive Landscape

The major players operating in the lumpectomy market include Vector Surgical, Novian Health, Inc, ClearCut Medical, Dune Medical Devices, Sanarus, iCAD, Hologic, Inc., Medtronic PLC, Hologic, ZEISS, and others.

Recent Key Strategies and Developments

- In September 2023, Hologic Inc. and Bayer joined forces to introduce contrast-enhanced mammography solutions aimed at enhancing breast cancer detection for women across Canada, Europe, and Asia-Pacific. This strategic partnership expands access to advanced screening technologies, potentially complementing lumpectomy procedures by improving early detection rates and treatment outcomes for breast cancer patients.

- In October 2021, Susan G. Komen awarded a $1.5 million grant for three new research projects focused on metastatic breast cancer. This funding contributes to advancing understanding and treatment options for advanced stages of the disease, complementing lumpectomy by addressing broader aspects of breast cancer care and management.

Industry Trends

- In April 2023, JUNE Medical secured a deal with a leading U.S. hospital consortium to supply Galaxy II self-retaining surgical retractors to over 1, 600 hospitals nationwide. This innovative device promises enhanced safety and ease in surgical retraction, benefitting patients and medical staff. With its ergonomic design, it streamlines surgical procedures, appealing to group purchasing organizations seeking high-quality, budget-friendly solutions for their hospital networks.

- In May 2020, the Sarcoma Foundation of America (SFA) unveiled its allocation of $750, 000 in research grants for the 2020 SFA Research Grant program. This initiative targets the critical need for research funding in the field of sarcoma, aiming to propel advancements towards finding a cure. By bridging the funding gap, the foundation empowers scientists and researchers to pursue innovative studies and accelerate progress in understanding and treating sarcoma, ultimately fostering hope for patients affected by this rare cancer.

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Releases

- Research Papers

- D&B Hoovers

- Lumpectomy Investment & Trade Reports

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lumpectomy market share analysis from 2023 to 2033 to identify the prevailing lumpectomy market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lumpectomy market analysis segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global lumpectomy market forecast period.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global lumpectomy market trends, key players, market segments, application areas, and market growth strategies.

Lumpectomy Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.2 Billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 290 |

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | Zeiss, ClearCut Medical, iCAD, vector surgical, Sanarus, Dune Medical Devices, Medtronic PLC, Novian Health, Inc, Hologic, Hologic, Inc. |

The upcoming trends of lumpectomy market is growing preference for minimally invasive lumpectomy procedures to reduce recovery time and improve outcomes. Addtionally, increased adoption of personalized lumpectomy plans based on genetic testing and individual patient profiles.

The leading application of the lumpectomy market is the treatment of early-stage breast cancer, offering a breast-conserving surgery option that removes cancerous tissue while preserving most of the breast.

North America is the largest regional market for Lumpectomy.

The estimated industry size of Lumpectomy is valued at $1.7 billion in 2023.

Vector Surgical, Novian Health, Inc, ClearCut Medical, Dune Medical Devices are the top companies to hold the market share in Lumpectomy

Loading Table Of Content...