Lutein and Zeaxanthin Market Research, 2031

The global lutein and zeaxanthin market size was valued at $397,606.1 thousand in 2021 and is projected to reach $627,779.55 thousand by 2031, growing at a CAGR of 4.9% from 2022 to 2031.

Lutein and zeaxanthin are carotenoids, which are found in the human eye, and are responsible for clear vision. These carotenoids can be obtained by intake of vegetables and fruits, in a proper proportion, which are beneficial for eye health. In addition, these carotenoids are extracted by various extraction techniques, and further have applications in pharmaceuticals, cosmetics, supplements, food, feed, and beverages industries. Lutein and zeaxanthin have advantages in prevention of eye disorders, such as cataract and age-related macular denegation, skin diseases, and maintaining brain function.

Historical overview

The market was analyzed qualitatively and quantitatively from 2021-2031. The lutein and zeaxanthin market size grew at a CAGR of around 4.9% during 2022-2031. Most of the growth during this period was derived from Asia-Pacific owing to improving health awareness, rising disposable incomes, and well-established presence of domestic companies in the region.

Market dynamics

The lutein and zeaxanthin market growth is attributed to increase in demand for dietary supplements, rise in prevalence of age-related macular degeneration (AMD), and rise in adoption of lutein and zeaxanthin in the cosmetic industry. In recent years, there has been a huge rise in demand for the nutraceuticals and dietary supplements. As more people in the developed and developing countries are becoming aware of the advantages organic nutraceuticals, there is rise in adoption of these nutraceuticals. Also, sales of nutraceuticals increased during the COVID-19 pandemic period. For instance, according to the data published by National Center for Biotechnology Information (NCBI), in the U.S., dietary supplement sales increased by 5% in 2019 as compared to 2018. This rise was mainly attributed to the shift of people towards preventive therapies, as there existed a high risk of coronavirus while visiting the hospitals. Thus, hospital visits reduced during the pandemic period, and major population around the globe adopted nutraceuticals for the prevention and treatment of diseases. This also included rise in demand for lutein and zeaxanthin for prevention of eye disorders, such as cataract and age-related macular degeneration. Thus, rise in sales of nutraceuticals also lead to increase in sale of lutein and zeaxanthin products across the globe.

Increase in number of skin cancer cases due to UV radiation increases the demand for lutein and zeaxanthin-containing skin care products. In addition, lutein and zeaxanthin also provide protection against oxidative and DNA-damaging effects of blue light. Also, increased blue light absorption by the skin is expected to lead to increase in melanin production, which causes tanning on the skin, skin aging, and skin cancer. However, the skin tone of individuals consuming lutein and zeaxanthin is significantly lightened and overall skin tone is improved, showing subsequent reduction of melanin production. Thus, this application of lutein and zeaxanthin augments the growth of the market.

Though many factors are driving the growth of the market, some factors such as stringent rules and regulations associated with nutraceuticals hinder the growth of the market. On the other hand, in recent years, increase in R&D activities in the dietary and nutraceutical sectors is anticipated to drive the lutein & zeaxanthin market growth during the forecast period. There is also growing interest of the key players in the pharmaceutical industry towards nutraceuticals products, which offers health benefits and is an alternative to modern medicine. Companies are focusing on manufacturing high-quality products having high effectiveness and in addition, companies are aware of the changing trends, which are due to the advantages of these compounds, which is anticipated to drive the market during the forecast period.

The COVID-19 outbreak is anticipated to have a positive impact on the growth of the lutein & zeaxanthin market. The COVID-19 pandemic led to increase in research activities that help in prevention and management of the effects of the virus. In addition, the study named, ‘The landscape of potential health benefits of carotenoids as natural supportive therapeutics in protecting against coronavirus infection’, presented results that highlighted the use of carotenoids as natural supportive therapeutics in protection against coronavirus infection. Thus, such researches led to rise in demand for lutein and zeaxanthin products during the pandemic.

Also, during the pandemic, patient visits to hospitals and eye clinics reduced due to increased risk of transmitting the COVID-19 infection, which led to shift of people towards nutraceuticals, such as lutein and zeaxanthin, for prevention of eye disorders, and further management of eye health. Thus, leading to rise in sales of lutein and zeaxanthin supplements during the pandemic.

Furthermore, regularization of supply chain of medications and medical devices by key players and rise in the number of patient visits for investigation and treatment of various diseases and disorders post-pandemic are anticipated to fuel the growth of the market during the forecast period.

Segmental Overview

The lutein & zeaxanthin market is segmented on the basis of type, application, and region. By type, the market is categorized into lutein and zeaxanthin. On the basis of application, the market is segmented into supplements, cosmetics, pharmaceuticals, and others. Region-wise, the lutein & zeaxanthin market is analyzed across North America (U.S., Canada and Mexico), Europe (Germany, France, UK, Italy, Spain and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia and Rest of Asia-pacific), and LAMEA (Brazil, South Africa, Saudi Arabia and Rest of LAMEA).

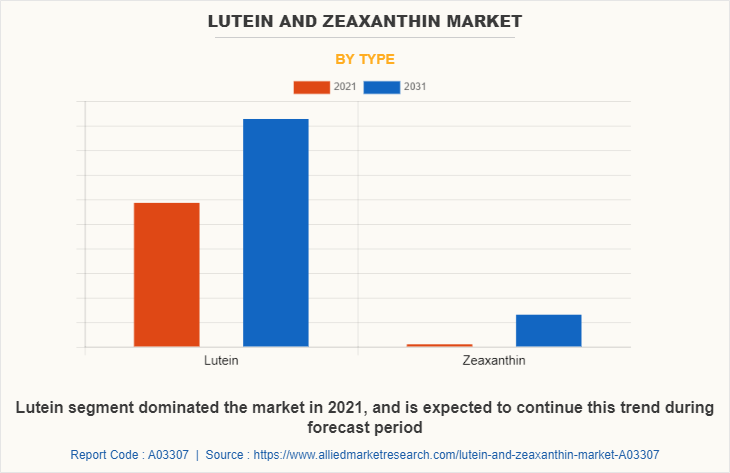

By Type

The market is segmented into lutein and zeaxanthin. The lutein segment dominated the global market in 2021, whereas the zeaxanthin segment is anticipated to grow at the fastest rate during the forecast period, owing to increase in rate of prescribing zeaxanthin by healthcare professional, registered dietitian, pharmacist, or doctor to treat, cure, or prevent diseases related to eyes and skin. In addition, there is increase in popularity of zeaxanthin-containing supplements for eye health as it increases the amount of the macular pigment in the eye. Thus, owing to the wide applications of zeaxanthin carotenoid, there is rise in demand for zeaxanthin supplements and tablets, which further propels the growth of the lutein and zeaxanthin market

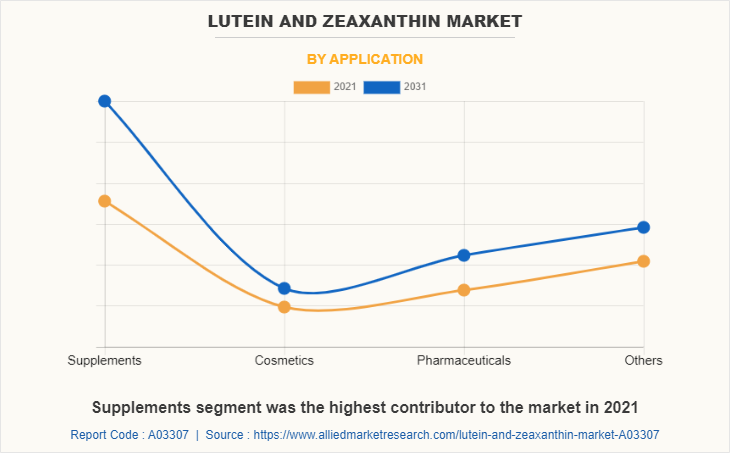

By Application

The market is segregated into supplements, cosmetics, pharmaceuticals, and others (food, feed, beverages, and others). The supplements segment dominated the global market in 2021 and is anticipated to grow at the fastest rate during the forecast period. Rise in innovations related to lutein and zeaxanthin and its wide application in maintaining eye, skin, and brain health is driving the growth of the segment. In addition, brain functions, such as processing speed and working memory weaken with increasing age. Also, abnormal brain functions can be prevented to some extent by supplementing lutein for brain health, thus, further rising its demand in the market.

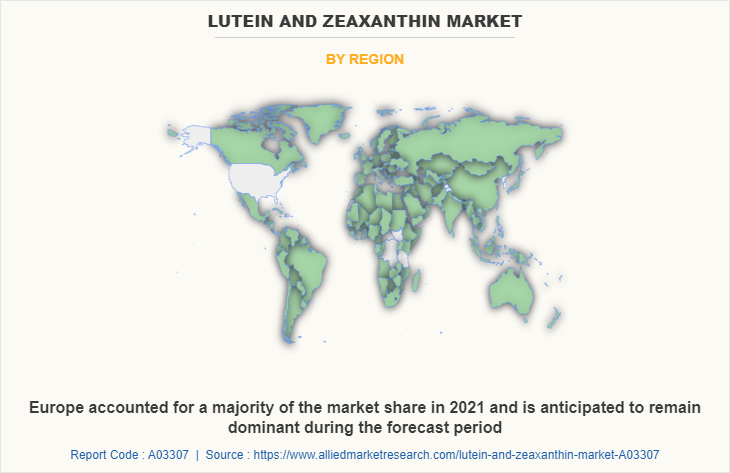

By Region

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Europe accounted for a major lutein and zeaxanthin market share in 2021 and is expected to maintain its dominance during the forecast period. In European region, rest of Europe dominated the market in 2021 and UK is expected to grow at the fastest rate, during the forecast period.

There is rapid increase in adoption of lutein and zeaxanthin products by the people in the Europe region, owing to rise in prevalence of age-related macular degeneration (AMD) in Europe. For instance, according to an article, ‘Prevalenceand incidence of age-related macular degeneration in Europe’, published in the British Journal of Ophthalmology in 2019, the leading cause of irreversible blindness and severely impaired eyesight age-related macular degeneration is expected to affect 77 million Europeans by 2050. This highlights the prevalence of AMD in European people, which drives the demand for lutein and zeaxanthin products for prevention and treatment of AMD.

Furthermore, presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption of nutraceuticals are expected to drive the market growth. Furthermore, product launch, mergers, collaborations, and acquisitions adopted by the key players in this region boost the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the lutein and zeaxanthin market forecast, owing to presence of pharmaceutical companies in the region and growth in the purchasing power of populated countries, such as China and India. For instance, Biomed Ingredients, India Glycols Limited, Prakruti Products, Bio-gen Extracts Private Limited, and others are few of the major key players of lutein and zeaxanthin in this region. Furthermore, the Asia-Pacific region exhibits the largest medicine supply and the largest pharmaceuticals industry with the availability of raw material in abundance, which can be easily accessed by manufacturers of lutein and zeaxanthin. This, in turn, drives the growth of the market.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the lutein and zeaxanthin industry, such as Allied Biotech Corporation, IOSA, BASF SE, Divi's Laboratories Limited, Jarrow Formulas, Inc., Kemin Industries, Inc., Kalsec Inc., Zhengzhou Meiya Chemical Products Co., Ltd, Lycored, OmniActive Health Technologies are provided in this report. There are some important players in the market such as Biomed Ingredients, India Glycols Limited, Prakruti Products, Vidya Herbs and Bio-gen Extracts Private Limited, and others. Major players have adopted product launch, product approval, partnership, strategic alliance, clinical trials, branding and expansion as key developmental strategies to improve the product portfolio of the lutein & zeaxanthin market.

Some examples of product launches in the market

In September 2021, OmniActive Health Technologies announced the U.S. commercial launch of Nutritears, a proprietary combination of ingredients that is used in treating occasional dry eyes.

In June 2021, OmniActive Health Technologies announced the launch of Integrative Actives, a platform, which facilitates the delivery of multiple actives into concentrated smaller doses. Nutritears, a lutein and zeaxanthin product, is the first product developed using Integrative Actives platform.

Product approval in the market

In September 2019, OmniActive Health Technologies announced that Lutemax 2020, lutein and zeaxanthin isomers, obtained Foods with Function Claims (FFC) approval by Japan’s Consumer Affairs Agency, which is used for eye health (Macular Pigment Optical Density [MPOD]), to reduce eye fatigue, and improved visual performance (contrast sensitivity, glare recovery), as well as supporting sleep quality.

Clinical Trials in Market

In September 2019, OmniActive Health Technologies announced that Lutemax 2020 showed to have a positive effect on cognitive performance, according to a new publication entitled, Effects of macular xanthophyll supplementation on brain-derived neurotrophic factor, pro-inflammatory cytokines, and cognitive performance, which was published in the journal Physiology and Behavior.

Strategic Alliance in Market

In October 2019, OmniActive Health Technologies announced a global strategic alliance with JXTG Nippon Oil & Energy, to develop and commercialize unique, branded carotenoid compositions, which help to deliver powerful antioxidants for human health benefits including eye, skin, and cognition.

Partnership in Market

In December 2019, OmniActive Health Technologies entered into a distribution partnership with Shanghai Prochin in China, which is expected to positively affect the distribution of Lutemax 2020, a lutein and zeaxanthin isomers to all segments of the nutraceutical industry in China.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lutein and zeaxanthin market analysis from 2021 to 2031 to identify the prevailing lutein and zeaxanthin market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lutein & zeaxanthin market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lutein and zeaxanthin market trends, key players, market segments, application areas, and market growth strategies.

Lutein and Zeaxanthin Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 627.8 million |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 174 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Zhengzhou Meiya Chemical Products Co.,Ltd, Jarrow Formulas, Inc., BASF SE, Lycored, Kemin Industries, Inc., Allied Biotech Corporation, Divi's Laboratories Limited, IOSA, OmniActive Health Technologies, Kalsec Inc. |

Analyst Review

According to the insights of the CXOs, the lutein & zeaxanthin market is expected to exhibit high growth potential attributable to factors, such as rise in R&D activities in pharmaceutical and nutraceutical industries for manufacturing of the dietary supplements and medications. In addition, increase in prevalence of age-related macular degeneration disease cases and rise in incidences of skin conditions related to sun exposure and surge in number advancements in nutraceuticals are driving the growth of the market. Furthermore, the lutein & zeaxanthin market has gained interest of many pharmaceutical and nutraceutical companies, owing to surge in demand for lutein and zeaxanthin as a measure for preventive health.

In addition, increase in research activities related to lutein and zeaxanthin boosts the growth of the market. The key market players are investing on a large scale in extraction of lutein and zeaxanthin. Also, few players are collaborating with research institutes to innovate new formulations, thereby attracting consumers, which led to rise in the sale of lutein & zeaxanthin. However, strict rules and regulations in manufacturing of nutraceuticals is anticipated to provide hindrance to the market. The CXOs further added that Europe was the largest contributor to the market in 2021, due to the rise in demand for lutein and zeaxanthin from European countries and also due to the presence of major player such as BASF SE in this region. On the contrary, Asia-Pacific is expected to register highest growth during the forecast period, due to rise in prevalence of health issues related to eyes and skin in population within the region.

Factors such as increase in demand for dietary supplements, rise in prevalence of age-related macular degeneration (AMD),and rise in adoption of lutein and zeaxanthin in the cosmetic industry drive the growth of lutein & zeaxanthin market

The forecast period for lutein & zeaxanthin market is 2022 to 2031.

Europe is the largest regional market for Lutein & Zeaxanthin

The total market value of lutein & zeaxanthin market is $343300.02 thousand in 2021.

BASF SE, Divi's Laboratories Limited, and Kemin Industries, Inc., are some of the top companies in the market

Loading Table Of Content...