The global luxury car market size was valued at $0.54 trillion in 2021, and is projected to reach $1.03 trillion by 2031, growing at a CAGR of 6.6% from 2022 to 2031.

Luxury cars can be defined as passenger vehicles that are intended to provide passengers with advanced features, high quality, a higher level of equipment, and enhanced comfort. Luxury cars are available in all vehicle categories such as hatchbacks, sports utility vehicles, sedans, and others. In addition, luxury cars offer features such as a heated steering wheel, automatic safety features, entertainment systems, and integrated seat massagers. Moreover, luxury cars are expensive compared to traditional automobiles and have typically high-end materials and finishes on the interior and exterior of the car.

Factors such as a rise in demand for luxury vehicles and increased demand for comfortable driving experiences boost the growth of the market. However, the high cost of luxury cars is anticipated to hinder the growth of the market. Further, the production of electric luxury cars and the growing adoption of autonomous driving technology in luxury cars provide a remarkable growth opportunity for the market players operating in the market.

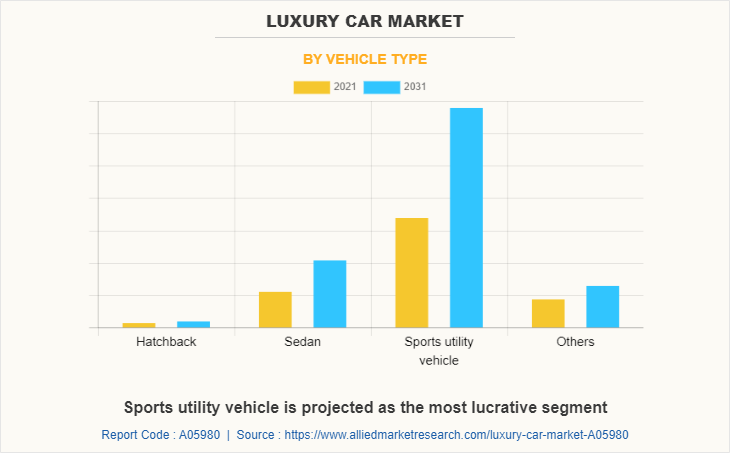

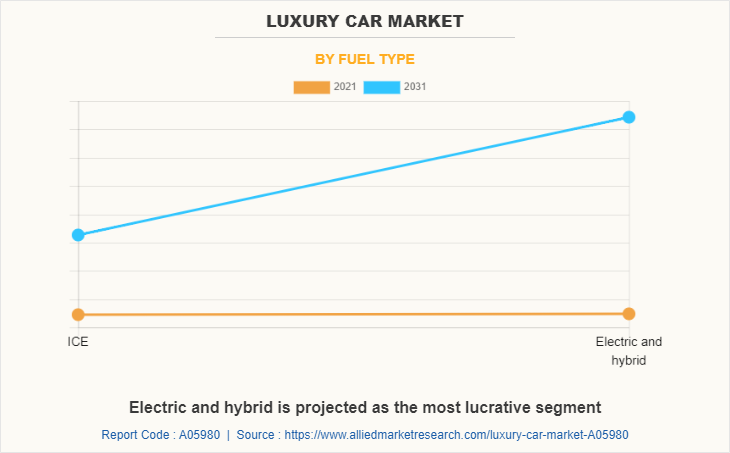

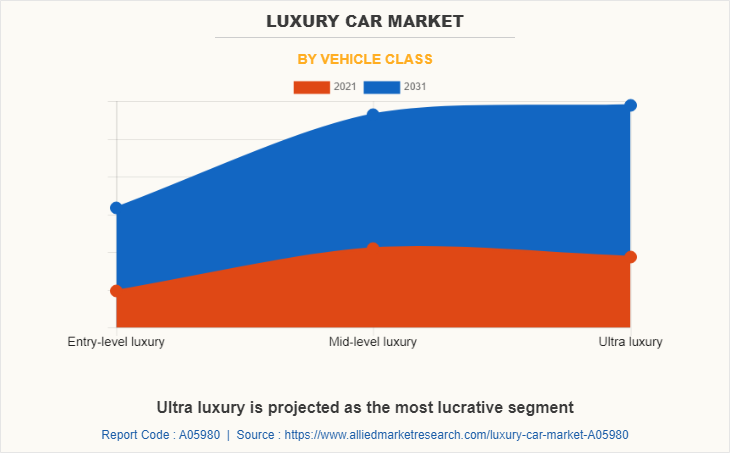

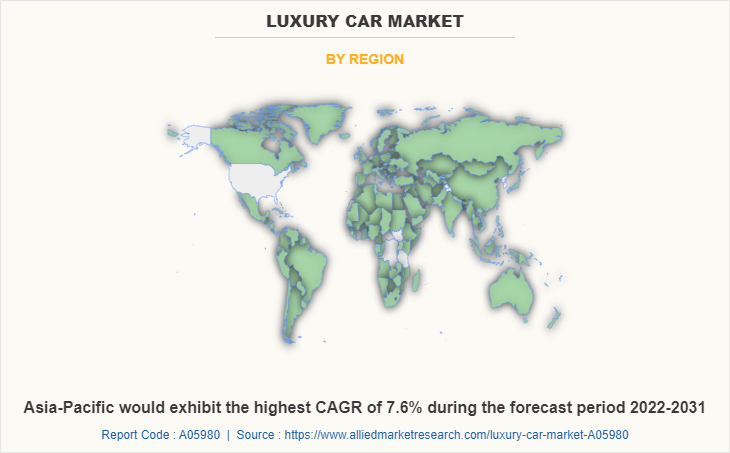

The luxury car market is segmented on the basis of vehicle type, fuel type, vehicle class, and region. By vehicle type, it is categorized into hatchback, sedan, sport utility vehicle, and others. By fuel type, it is categorized into ICE, and electric and hybrid. By vehicle class, it is divided into entry-level luxury, mid-level luxury, and ultra-luxury. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Europe comprises the UK, Germany, France, Netherlands, Norway, and the Rest of Europe. Automakers operating in the luxury car market in Europe are incorporating new plants for the manufacturing of luxury cars, which boosts the market in Europe. In addition, the launch of a new range of eco-friendly luxury vehicles propels the growth of the market. Increasing demand for luxury vehicles and rising demand for comfortable driving experience is propelling the growth of the luxury vehicle market. Moreover, there is a rise in the introduction of electric luxury cars owing to strong global demand for electric vehicles. For instance, in May 2022, electric carmaker Lucid Group plans to launch luxury sedans in Europe. The company is expected to launch its Lucid Air Dream Edition P and R sedans in limited numbers in Germany, the Netherlands, Switzerland, and Norway.

North America includes the U.S., Canada, and Mexico. In addition, the entry of new players in the market and the incorporation of new luxury car stores in the region is anticipated to propel its growth. The rise in the expansion of rising competitive intensity due to the growing importance of new players is expected to drive the growth of the market. Leading automobile manufacturers are launching a new range of luxury electric cars, which, in turn, is anticipated to create growth opportunities for players operating in the luxury car market in North America.

Leading luxury car manufacturers are aiming to increase the luxury car market share with sales of luxury vehicles in the U.S. For instance, a luxury car manufacturer, Mercedes-Benz outsold BMW AG, a major player in the market, for the second consecutive month in November 2019 by surpassing BMW with 2,508 vehicles. Moreover, manufacturers are developing electric luxury cars to compete with other players. For instance, in June 2021, Lucid Motors announced the launch of 2021 Lucid Air, an electric luxury vehicle. Such developments are expected to drive the growth of market growth.

Numerous companies expanded their presence in the country and plan to launch luxury vehicles in the Mexican market. For instance, in November 2022, BYD announced the launch of the HAN EV luxury sedan and TANG EV all-electric SUV at a test drive event held in Mexico. In addition, BYD has announced partnerships with eight local retailers in Mexico: Grupo Continental, Grupo Clever, Grupo Dalton, Grupo Excelencia, GrupoFarella, Grupo Fame, Liverpool, and Grupo del Rincon. Major players are incorporating new stores for luxury cars in Mexico, which is anticipated to propel the growth of the market in Mexico. For instance, on April 25, 2019, Lexus, a luxury vehicle division of automotive giant Toyota, incorporated its first stores in the largest Mexican cities, namely, Mexico City, Monterrey, and Guadalajara. Such factors are expected to drive the growth of the luxury vehicles market, which in turn boosts the growth of the luxury car market.

Growing awareness of the benefits and features of luxury cars is increasing the adoption of luxury cars which is expected to boost demand in the market. Increasing demand for a comfortable driving experience and increasing penetration of electric mobility are expected to increase the adoption of luxury vehicles in the UK during the forecast period. Various luxury car manufacturers are expanding in Germany to develop luxury and performance cars. For instance, in May 2021, British luxury car brand Aston Martin announced the expansion of its European network with new dealerships in Germany, Monaco, France, and Sweden. Such factors are expected to drive the growth of the market in Germany.

The leading luxury car manufacturers are announcing expansion plans which are expected to increase the development of luxury cars. For instance, in December 2019, Volkswagen incorporated its new smart manufacturing initiative, which was launched in March at three of its manufacturing facilities. This initiative is a five-year strategy to create a more agile production base using a combination of sensor-laden equipment, sensor-laden equipment, machine learning, and big data.

Some leading companies profiled in the luxury car market report comprise Volkswagen AG, Daimler AG, Lexus, Infiniti, BMW AG, Volvo Car, Rolls-Royce plc, Aston Martin Lagonda, Tesla, and Ferrari N.V.

The leading companies are adopting strategies such as product launches to strengthen their market position. In June 2022, Lexus announced the launch of the All-New RX, a luxury crossover SUV through the digital online program.

Rise in demand for luxury vehicles

Luxury vehicles are almost an obligatory status symbol for ultra-rich individuals, as these are more expensive than other vehicles. In addition, luxury vehicle sales in developing countries are exhibiting remarkable growth. Moreover, there is an increase in demand for luxury vehicles owing to a rise in incomes and evolving customer needs. In addition, numerous luxury car manufacturers witnessed an increase in sales of luxury cars due to growth in the economy. For instance, Audi India delivered 4,187 units in 2022, a growth of 27% on sale year-on-year basis. Moreover, the global sales for the luxury car maker, Porsche in 2022 were 309,884 units, an increase of 3% from the sale in 2021. Further, the growth of luxury vehicle sales is significantly faster than the overall passenger vehicle market. Thus, such a rise in demand for luxury vehicles in developing countries is anticipated to boost market growth during the forecast period.

Growth in demand for a comfortable driving experience

Consumers are inclined toward comfort while driving due to an increase in their purchasing power. Luxury vehicles are majorly made by using the latest technologies, the best materials, and powerful engines. In addition, luxury vehicles offer technologies such as satellite radio, intelligent remote entry, and adaptive cruise control, which provides a comfortable driving experience. Further, features such as active suspension, executive rear seats, remote start, and massaging seats are provided in luxury cars for an enhanced comfortable driving experience. There is a rise in customer interest in advanced and comfort-providing features such as champagne chillers, reclining seats, and others. Moreover, with growing customer preference towards a comfortable driving experience, luxury car manufacturers introduce comfort features such as car-to-touch-command control consoles for infotainment and comfort, mood lighting, and others. For instance, in luxury cars, the BMW 7-series comes with a rear seat entertainment experience with a 31.3-inch touchscreen. Thus, growth in demand for comfortable and luxurious driving experiences is anticipated to propel the growth of the market during the forecast period.

High manufacturing and maintenance cost

Luxury cars are significantly more expensive compared to traditional vehicles, owing to their advanced and luxurious features such as superior quality parts and expensive materials used in them. In addition, the cost of building a car with luxury options and features is higher than building a car with generic features. Luxury cars have many features that provide drivers with a unique range, prestige value and high performance, safety, and security. It is equipped with high-quality curtain airbags, an anti-lock braking system, standard stability control, traction control, and side front airbags. Luxury cars are built with expensive parts of the highest quality, made from the finest materials. For instance, the luxury car Ferrari 458 Italia Sport is equipped with a V-8 engine. The car is machined from aluminum, with a hand-stitched leather interior and diamond-carbon-covered tappets. Furthermore, as luxury cars are sold in very low volumes, a good portion of the selling price goes toward the covering of its developmental costs, which, in turn, makes these types of vehicles even costlier. Thus, the high cost of luxury vehicles is anticipated to hinder the growth of the market during the forecast period.

Production of electric luxury cars

Most major automakers are initiating new investments that are expected to significantly accelerate the transition to electrification in the luxury car market. Moreover, there is a rise in the adoption of electric vehicles in the luxury vehicles segment because buyers are less price-sensitive. Luxury car makers are increasingly introducing electric luxury cars with autonomous technologies. For instance, in August 2020, Human Horizons announced the launch of its premium all-electric vehicle, known initially by its prototype name, HiPhi through HiPhi brand at the 2020 Beijing Auto Show. Moreover, in September 2021, it became China’s most popular luxury electric vehicle (EV). In addition, government-supportive initiatives and regulations are expected to boost the adoption of electric luxury cars which in turn drives the growth of the market during the forecast period.

The luxury car market is segmented into Vehicle Type, Fuel Type, and Vehicle Class.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the luxury car market analysis from 2021 to 2031 to identify the prevailing luxury car market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the luxury car market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global luxury car market trends, key players, market segments, application areas, and market growth strategies.

Luxury Car Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1035 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 398 |

| By Vehicle Type |

|

| By Fuel Type |

|

| By Vehicle Class |

|

| By Region |

|

| Key Market Players | Tesla, Daimler AG, Volkswagen AG, Aston Martin Lagonda, INFINITI (NISSAN MOTOR CORPORATION), BMW AG, Rolls-Royce plc, Ferrari N.V., Volvo Car Corporation, Lexus (TOYOTA MOTOR CORPORATION) |

Analyst Review

The global luxury car market is expected to witness growth owing to rising demand for safety features in automobiles and comfortable driving experience. Moreover, there has been an increase in demand for luxury cars and product launches from various luxury car manufacturers. The demand for luxury cars is increasing significantly due to new product launches. In addition, premium and luxury car sales have been growing significantly in key global markets such as China and the United States.

Furthermore, there is a rise in popularity of autonomous electric luxury cars to increase safety and improve comfort. Manufacturers are inclined towards installing autonomous driving systems in luxury cars that use artificial intelligence, light detection and ranging (LiDAR), and radar technology to observe and capture their environment. For instance, in February 2022, Cadillac, a luxury car manufacturer announced the new InnerSpace prototype, an autonomous luxury car. The autonomous system in the luxury car is a combination of sensors, driver assistance, and software tools to control vehicle navigation and driving, reduce human intervention while driving. For instance, in April 2022, Audi release a concept car called Audi Urbansphere, a luxury autonomous car for the Chinese megacities. The car is expected to feature level four autonomous driving. The Urbansphere is driven by dual electric motors and is constructed from sustainable material. Therefore, the rise in demand for safety, improved vehicle performance and enhanced driving experience is expected to drive the adoption of autonomous luxury cars which is expected to provide significant opportunities for the growth of the market

The estimated industry size of Luxury Car Market is $546,361.9 million in 2021.

The top companies to hold the market share in Luxury Car are Volkswagen AG, Daimler AG, Lexus, Infiniti, BMW AG, Volvo Car, Rolls-Royce plc, Aston Martin Lagonda, Tesla, and Ferrari N.V

Electric luxury cars and autonomous luxury cars are the upcoming trends in the Luxury Car Market.

The leading vehicle class of Luxury Car Market is mid-level luxury.

The largest regional market for Luxury Car is Europe.

Loading Table Of Content...