Market Introduction and Definition

The global luxury goods market size was valued at $328.1 billion in 2023 and is projected to reach $447.3 billion by 2033, growing at a CAGR of 3.2% from 2024 to 2033. Luxury goods are high-end products characterized by superior quality, craftsmanship, exclusivity, and high price points. These items include designer clothing, jewelry, watches, cars, and other premium products. The market for luxury goods thrives due to several key benefits: status symbol, perceived higher quality, and unique design. Consumers purchase luxury goods to express wealth, social status, and personal taste. The allure of owning something rare or exclusive also drives demand. Additionally, the craftsmanship and superior materials often associated with luxury goods justify their higher cost and enhance their appeal. This market's existence is sustained by the aspirational nature of consumers who seek to differentiate themselves and enjoy the prestige that comes with luxury brands.

Key Takeaways

The luxury goods market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the forecast period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major luxury goods industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

Aspirational consumption is a significant driver for the luxury goods market growth. Consumers often purchase luxury items to signify success, status, and wealth. The desire to own premium products that reflect personal achievements and social standing propels demand. Luxury brands capitalize on this by creating exclusive and high-status products that appeal to consumers' aspirations. The perception of luxury items as symbols of prestige and accomplishment ensures a steady demand among individuals seeking to elevate their social image and distinguish themselves in their social and professional circles.

The increasing wealth among affluent individuals globally drives the luxury goods market. Economic growth in emerging markets, alongside wealth accumulation in developed countries, has expanded the customer base for luxury brands. High net-worth individuals and the rise of the middle class with disposable income fuel the demand for luxury products. This wealth growth enables consumers to indulge in premium goods, reinforcing the luxury market's expansion. As more people achieve financial stability and prosperity, their spending on luxury items increases, contributing to luxury goods market demand.

Globalization has significantly expanded the luxury goods market. Brands are reaching new markets through e-commerce, international retail stores, and strategic marketing, tapping into emerging economies with growing affluent populations. The ability to access luxury goods globally, combined with targeted marketing strategies, enhances brand visibility and customer reach. This global expansion allows luxury brands to cater to diverse consumer bases, increasing sales and market presence. The interconnected global economy facilitates the distribution and consumption of luxury goods, driving market growth as brands penetrate new regions and demographics.

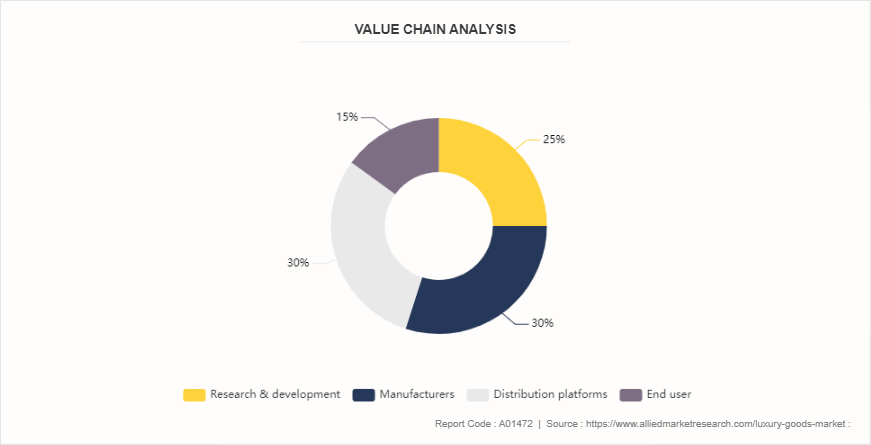

Value Chain Analysis

The value chain of the luxury goods market includes various stakeholders such as ingredient manufacturers and other raw material suppliers, goods manufacturers, distributors, and end users. Each of these players adds a specific value at their point of operation, which, in turn, contributes to the competitive value of the product. The R&D activities, innovations, and constant efforts in improvement collectively enhance the value associated with the final deliverable of a product.

Research & development

Luxury goods products must meet overall objectives of adequate performance, cost value, ease of use, as well as the functional and comfort requirements. The R&D department conducts various research activities to develop new cost-effective technologies and helps OEM to develop innovative products. In addition, it assists in finding innovative solutions for raw material usage.

Manufacturers

These players are responsible for designing, manufacturing, and packaging end-to-end products catering to all the requirements. Manufacturing companies in the luxury goods market are L’Oréal International, LVMH Group, Kering SA, Prada S.p.A., Luxottica, Swatch Group, and others that widen their operational boundaries across different countries in the world. Companies innovate and launch new products to meet customer demands by analyzing consumer behavior and preferences. These luxury goods manufacturers add a larger share of value to the final product with their efforts and innovations to manufacture a product.

Distribution platforms

The luxury goods manufacturers collaborate closely with the dealers and distributors. Distributors of luxury products consist of different entities such as retail stores, including supermarkets, departmental stores, drug stores, specialty stores (brand outlets) , and online stores such as manufacturer-owned online web portals or e-commerce websites. However, many players in the market majorly depend on online sales of their products. Online stores are emerging as a channel of distribution, which can be a convenient medium for customers to buy a product.

End-user

End users or customers are the last stakeholders in the luxury goods value chain. The users of these products consist of individuals (both men and women) of different age groups. Changing climatic conditions and lifestyle of human are promoting men along with women to use luxury goods such as champagne & spirits, cosmetic & beauty products, and others in their daily lives. Designer apparel and hair care products are used by both men and women.

Market Segmentation

The luxury goods market has been segmented based on product type, mode of sale, gender, and region. Based on product type, the luxury goods market is bifurcated into designer apparel, jewelry & timepieces, accessories, cosmetics, fine wines/champagne, and spirits. Based on the mode of sale, the market is segmented into retail and online. Based on gender, the market is divided into the male and female. Region-wise, the market is divided into North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

Regional Market Outlook

Europe held the major luxury goods market share in 2023. European market still dominates in the fashion industry, with the majority of the top luxury goods companies headquartered in UK, Italy, France, and Switzerland. For Europe, the rise in the tourism industry had a positive impact on tourist shopping, resulting in the growth in demand for luxury goods in the region.

Competitive Landscape

The major players operating in the luxury goods market include Compagnie Financire Richemont Sa, Shiseido Company, Limited, Prada S.P.A., Loral International, Ralph Lauren Corporation, Kering Sa, Luxottica Group S.P.A., The Estee Lauder Companies Inc., Swatch Group, Lvmh Group

Industry Trends

Luxury brands are increasingly adopting digital technologies to enhance customer experiences. This includes the use of augmented reality (AR) for virtual try-ons, artificial intelligence (AI) for personalized shopping, and comprehensive e-commerce platforms to reach a global audience. For instance, LVMH has partnered with Google Cloud to enhance its AI and machine learning capabilities, improving customer personalization and operational efficiency. Gucci has developed its AR app for virtual try-ons and uses AI for personalized recommendations.

Sustainability is becoming a central focus in the luxury goods industry. Brands are prioritizing eco-friendly materials, reducing carbon footprints, and promoting ethical sourcing to appeal to environmentally conscious consumers. for instance, LVMH’s LIFE 360 program sets ambitious environmental goals across its brands. Gucci’s Equilibrium platform aims to integrate social and environmental sustainability into their business practices, including carbon neutrality and responsible sourcing of materials.

Consumers increasingly desire unique, personalized luxury items. Brands are offering bespoke services, limited editions, and customization options to cater to individual preferences, enhancing the sense of exclusivity and personal connection to the brand. For instance, Burberry allows customers to personalize their trench coats and scarves. Gucci’s DIY service lets customers customize their own shoes and bags, reflecting their unique style and preferences.

There is a shift from merely owning luxury goods to experiencing luxury. This includes exclusive events, personalized services, and luxurious travel experiences that deepen customer engagement and loyalty. For instance, Chanel emphasizes in-store experiences with personalized services and exclusive events. Burberry has hosted live-streamed fashion shows and offers VIP access to exclusive events and experiences for their loyal customers.

Recent Key Strategies and Developments

In November 2023, Kering completed the acquisition of a 30% shareholding in Valentino.

In July 2023, Compagnie Financière Richemont SA acquired a controlling stake in Gianvito Rossi, one of the world’s leading luxury shoes Maisons.

In July 2023, Kering and Mayhoola announced that Kering becomes a significant shareholder of Valentino as part of a broader strategic partnership.

In March 2023, Richemont launched Enquirus, a neutral, global digital platform designed to help reduce watch and jewelry related crime.

In June 2021, Richemont acquired Delvaux, the renowned Belgian and oldest luxury leather goods Maison in the world.

In February 2021, L'Oréal finalized the acquisition of Takami Co. This company develops and markets under license products from the Takami skincare brand.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the luxury goods market segments, current trends, estimations, and dynamics of the luxury goods market analysis from 2024 to 2033 to identify the prevailing luxury goods market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the luxury goods market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global luxury goods market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global luxury goods market trends, key players, market segments, application areas, and market growth strategies.

Luxury Goods Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 447.3 Billion |

| Growth Rate | CAGR of 3.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 310 |

| By Product Type |

|

| By Mode Of Sale |

|

| By Gender |

|

| By Region |

|

| Key Market Players | SWATCH GROUP, KERING SA, RALPH LAUREN CORPORATION, LORAL INTERNATIONAL, LUXOTTICA GROUP S.P.A., LVMH GROUP, PRADA S.P.A., SHISEIDO COMPANY, LIMITED, THE ESTEE LAUDER COMPANIES INC., COMPAGNIE FINANCIRE RICHEMONT SA |

Analyst Review

There is a rapid growth in the luxury goods industry owing to the luxury goods market trends such as increasing urbanization, the vitality of high-end marketing channels, and the swift rise of the middle class in the developing markets such as in Asia-Pacific. In addition, innovation in wearables, increased exposure to social media, and demand for hi-tech luxury goods have fueled this market. However, price differences, geo-political instability, and fluctuation in currencies could hamper the market growth.

Increased tourism in Asia-Pacific and Europe has contributed to the sales of luxury goods. Moreover, growth in demand for designer apparels, jewelry, watches, and exquisite beauty products such as makeup and perfumes drive this market owing to the increase in beauty consciousness and purchasing power of consumers. In addition, attractive packaging, innovative marketing strategies, and product launch boost market growth. For instance, in June 2016, Shiseido Company Limited launched new series “Fearless Beauty” that has further strengthened the makeup product line of the company.

The global luxury goods industry has witnessed prominent adoption in developed regions owing to swift change in consumer lifestyle and increase in disposable income. Europe generated the maximum revenue and is expected to lead throughout the forecast period. However, Asia-Pacific countries such as India, China, and Japan are the most lucrative market for luxury good companies as they have indicated an increase in beauty consciousness and rise in disposable income.

The key market players have developed high-quality and innovative products to cater the changing consumer needs and lifestyle. Moreover, they are shifting to online portals as it is a popular medium to buy luxury products.

The luxury goods market was valued at $328.1 billion in 2023 and is estimated to reach $447.3 billion by 2033, exhibiting a CAGR of 3.2% from 2024 to 2033.

The luxury goods market has been segmented based on product type, mode of sale, gender, and region. Based on product type, the luxury goods market is bifurcated into designer apparels, jewelry & timepieces, accessories, cosmetics, fine wines/champagne, and spirits. Based on mode of sale, the market is segmented into retail and online. Based on gender, the market is divided into the male and female. Region wise, the market is divided into North America, Europe, Asia-Pacific, Latin America, Middle

Europe is the largest regional market for luxury goods

The luxury goods market has been segmented based on product type, mode of sale, gender, and region. Based on product type, the luxury goods market is bifurcated into designer apparels, jewelry & timepieces, accessories, cosmetics, fine wines/champagne, and spirits. Based on mode of sale, the market is segmented into retail and online. Based on gender, the market is divided into the male and female. Region wise, the market is divided into North America, Europe, Asia-Pacific, Latin America, Middle

The global luxury goods market report is available on request on the website of Allied Market Research.

Loading Table Of Content...