Lysosomal Disease Treatment Market Research, 2031

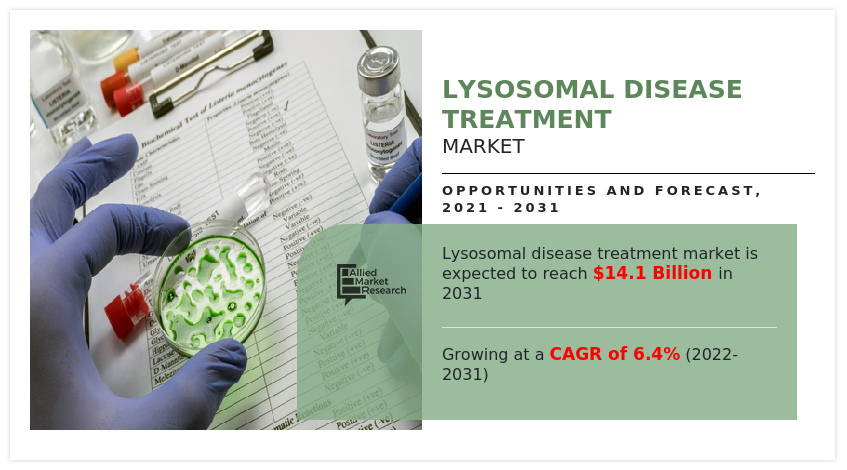

The global lysosomal disease treatment market was valued at $7.6 billion in 2021, and is projected to reach $14.1 billion by 2031, growing at a CAGR of 6.4% from 2022 to 2031.

Lysosomal diseases are metabolic disorder transmitted genetically from parent to offspring. This is caused due to excessive accumulation of substrate in various organ in excess amount due to insufficient lysosomal enzyme production. There are more than 50 lysosomal diseases in humans. The various lysosomal diseases include Gaucher’s disease, Pompe’s disease, Mucopolysaccharidoses (MPS) disease, Fabry disease & various other diseases. The insufficient lysosomal enzyme activity can cause various changes in the normal human functioning affecting heart, brain, skeletal muscles, skin & central nervous system. In addition, the development and research for the treatment of lysosomal diseases is increased, this are the factor responsible to drive the lysosomal disease treatment market growth.

Lysosomal disease is group of inherent diseases affects the normal body fuctions of brain, skeletal and central nervous system. During the covid-19 period the need for lysosomal disease treatment decreased significantly. However, the diagnostic methods used for the lysosomal diseases are enzyme assay activity, optical fluorometry, mutation scanning, mass spectroscopy and DNA sequencing. In various hospitals screening of newborn for various test including lysosomal disease test is mandatory. According to the U.S. National Library of Medicine 1 in 40,000 to 60,000 males have Fabry's disease. Pompe’s syndrome is affecting about 1 in 40,000 people in the U.S. according to the National Organization for Rare Disorders.

Moreover, Pompe’ syndrome affects about 1 in 40,000 people in the U.S., according to the National Organization for Rare Disorders. A set of inherited metabolic diseases known as lysosomal storage disorders are brought on by enzyme deficits in different body cells. Key driver for growth of the global lysosomal disease treatment market size includes increasing diagnosis rate, owing to increase in awareness and financial incentives for orphan drug development, which treats lysosomal diseases. In addition, rise in prevalence of lysosomal diseases, affordable product cost, increase in pharmaceutical companies for development of novel medications to treat lysosomal diseases are also responsible for growth of the market. Lack of treatment for lysosomal diseases and high cost of treatments are the factors that restrain growth of the market.

The growth of lysosomal disease treatment industry is driven by increased research & development activities, spread of awareness among the people about lysosomal diseases, the newly developed diagnosis methods contribute positively to market revenue growth during the forecast period. Furthermore, the increasing investment in research and development to intensifies the healthcare infrastructure also contribute to the global market growth.

Impact of COVID-19 on the Market

Coronavirus Severe acute respiration syndrome (SARS-CoV-2) is an infectious disease caused by the novel coronavirus (COVID-19), which originated in the Wuhan district in China in the late 2019, and since has spread to 212 countries. The virus was initially referred to as “novel coronavirus 2019” (2019-nCoV) by the WHO, However, on February 11, 2020, it was given the official name of SARS-CoV-2 by the International Committee on Taxonomy of Viruses. WHO declared COVID-19 as pandemic on March 11, 2020, and by September 1, 2020, over 28.1 million people have been infected globally with over 909,000 deaths. COVID-19 symptoms include fever, cough, and shortness of breath.

Nearly all industries have been impacted by the global public health epidemic COVID-19. As coronavirus crises sweep the globe and force healthcare organizations to devote the majority of their funds to fighting COVID-19, the outbreak of COVID-19 has resulted in a significant decline in demand for the lysosomal disease treatment market size across several sectors, particularly the health and pharmaceutical sector. The main cause of the interruptions experienced by patients getting treatment for lysosomal storage disorder in hospitals was the risk of infection. As a result, the COVID-19 outbreak will slow global market growth for treatments for lysosomal diseases, which will have a negative effect on the market's value in 2022 and beyond.

The lysosomal disease treatment market share is segmented on the basis of type of disease, type of therapy, end user & region. By type of the disease, it is segmented into Gaucher’s disease, Pompe’s syndrome, Mucopolysaccharidosis and others. By type of therapy the market is bifurcated into enzyme replacement therapy, stem cell therapy, substrate reduction therapy and others. By end users the market is fragmented into hospitals, clinic and others. The others segment is further segmented into research organization and diagnostic labs.

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Disease Type

Fabry Diseases segment is projected to be the dominating segment throughout the forecast period.

Disease Type Segment Review

By type, the Gaucher’s disease segment was the highest revenue contributor to the market. The increasing Gaucher’s disease prevalence is the primary factor driving the market growth during lysosomal disease treatment market forecast. In addition, growth of this segment is driven by strong approved medicine and other therapies in pipeline.

By Type Of Therapy

Enzyme Replacement Therapy segment was the leading segment during forecast period.

Type of Therapy Segment Review

By type of therapy, the enzyme replacement therapy segment was the highest revenue contributor to the market, due to sufficient availability of medicines. The major market growth is driven by newly approved therapies by the industry leaders. For instance, Takeda receives approval for Idursulfase for treatment of Hunter syndrome in 2019 by FDA.

By End User

Hospitals segment Enterprises segment was the highest revenue contributor during the forecast period.

End User Segment Review

By end user, the hospitals segment was the highest revenue contributor to the market, owing to rise in patients seeking treatments for lysosomal diseases from hospitals.

By Region

North America segment is projected as one of the most lucrative segment.

Region Type Segment Review

Region wise, North America was the highest revenue contributor. As the prevalence of the lysosomal disease is high in North America. The growth of this segment is driven by availability of new medicinal therapies, diagnostic methods, and increased awareness about the lysosomal diseases.

Major key players that operate in the global lysosomal disease treatment market are Amicus Therapeutics, Inc, Alexion Pharmaceuticals, Inc, BioMari, Chiese Farmaceutici SpA, Eli Lilly Company, Horizon Therapeutics Plc, Johnson & Johnson (Actelion Pharmaceuticals Ltd), Leadient Biosciences, Inc Novartis AG, Orphazyme A/S, Pfizer Inc, Recordati SpA, Sanofi (Genzyme Corporation), Sigilon Therapeutics, Inc, and Takeda Pharmaceutical Company Limited (Shire Plc) Valerion Therapeutics, Llc, Viatris Inc (Mylan NV).

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lysosomal disease treatment market analysis from 2021 to 2031 to identify the prevailing lysosomal disease treatment market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lysosomal disease treatment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lysosomal disease treatment market trends, key players, market segments, application areas, and market growth strategies.

Lysosomal Disease Treatment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 14.1 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 319 |

| By Disease Type |

|

| By Type of Therapy |

|

| By End User |

|

| By Region |

|

| Key Market Players | Sanofi, Takeda Pharmaceutical Company Limited, Amicus Therapeutics, Inc., Sigilon Therapeutics, Inc, Johnson & Johnson, Pfizer Inc., BioMarin Pharmaceutical Inc., Eli Lilly and Company, Alexion Pharmaceuticals, Inc, Novartis AG |

Analyst Review

A vast category of disorders known as lysosomal diseases (LDs) occur, owing to lack of certain enzymes required for breakdown of materials found in lysosomes. They have an impact on lysosomes, a component of cells that digests materials including proteins, carbohydrates, and old cell components so the body can recycle them. The creation of lysosomal material must be downregulated as part of substrate reduction therapy through enzyme catabolism. Small compounds that can attach to and stabilize the misfolded enzymes are foundation of chemical chaperone therapy.

The amount and type of accumulated substance determines clinical symptoms of various diseases; often, the disease is named for the kind of undegraded substrate. Inheritance pattern for majority of LDs is autosomal recessive. X-linked conditions include Fabry disease, Danon disease, and Mucopolysaccharidosis type II. To treat the underlying causes of the disorders, various treatment methods have been employed in the past, including intravenous injection of exogenous enzymes derived from human tissues, infusion of leukocytes, and implantation of skin fibroblasts or amniotic cells. Important enzymes are absent in people with these diseases (proteins that speed up reactions in the body).

According to perspectives of CXOs of leading companies in the market, attention has been switched away from essential medications toward a new business model known as niche busters, sometimes known as orphan treatments, as a result of the current economic climate and increased generic competition. The impact of revenue losses brought on by blockbuster medicine patent expirations may be lessened by orphan drugs for pharmaceutical corporations. Orphan diseases are those that have few approved pharmacological treatment choices and a limited patient population, making them "orphaned" by the pharmaceutical industry. Many times, orphan diseases are so uncommon that a doctor might only see one case per year or less. By focusing on creating orphan medications, academic physician-scientists have attempted to fill this therapeutic gap.

According to CXOs, increase in awareness regarding lysosomal disorders and rise in knowledge about orphan diseases are expected to boost demand for lysosomal disease treatment. Therefore, use of lysosomal disease treatment market is expected to increase in the future.

The upcoming trends of Lysosomal Disease Treatment Market includes increasing Gaucher’s disease prevalence, newly approved therapies by the industry leaders and increased awareness about the lysosomal diseases.

The leading application of lysosomal disease treatment market are Gaucher's Diseases, Fabry Diseases, Pompe’s Disease, and Mucopolysaccharidosis.

North America is the largest regional market for Lysosomal Disease Treatment.

Lysosomal disease treatment market is expected to reach $14,090.39 million by 2031, with a CAGR of 6.4% from 2022 to 2031.

Major key players that operate in the global lysosomal disease treatment market are Amicus Therapeutics, Inc, Alexion Pharmaceuticals, Inc, BioMari, Chiese Farmaceutici SpA, Eli Lilly Company, Horizon Therapeutics Plc, Johnson & Johnson (Actelion Pharmaceuticals Ltd), Leadient Biosciences, Inc Novartis AG, Orphazyme A/S, Pfizer Inc, Recordati SpA, Sanofi (Genzyme Corporation), Sigilon Therapeutics, Inc, and Takeda Pharmaceutical Company Limited (Shire Plc) Valerion Therapeutics, Llc, Viatris Inc (Mylan NV).

The base year is 2021 in Lysosomal Disease Treatment market.

The forecast period in the Lysosomal Disease Treatment market is 2022-2031

Loading Table Of Content...

Loading Research Methodology...