Machine Glazed Paper Market Research: 2031

The Global Machine Glazed Paper Market Size was valued at $11.8 billion in 2021, and is projected to reach $18.3 billion by 2031, growing at a CAGR of 4.5% from 2022 to 2031.

Machine glazed paper is a type of uncoated paper having one side coarse, and other highly glossy. Typically, there are two types of machine glazed papers: tissue and kraft. Tissue is soft in nature and is used for producing napkins, paper towels, and others. Kraft paper on the other hand is very strong and has high tensile strength, making it suitable for industrial applications mostly for manufacturing bags, flexible packaging, and protective packaging, and for extrusion coating and lamination applications.

Market Dynamics

Machine glazed paper market has been witnessing rapid growth for the last two decades, largely due to increased demand for sustainable packaging media. Packaging is made from various materials such as paper, plastic, metal, and others. Out of these, plastic is used the most owing to its cheaper manufacturing cost, lightweight, and wide-scale availability. However, the cons of plastic easily overweigh its pros. According to UN Environment Programme, around 36% of all plastics produced are used for packaging purpose, out of which 85% or 400 million tones ends up in landfills or as unregulated waste. And, about five trillion plastic bags are used worldwide every year, half of which are designed for single-use purposes. 98% of single-use plastic products are produced from fossil fuels, resulting in increased greenhouse gas emissions. In addition to negatively impacting the environment, plastic waste is detrimental to wild and ocean life.

According to World Wide Fund Australia, about 100,000 marine mammals are killed every year due to plastic, and 81 out of 123 marine mammal species are known to have eaten or been entangled in plastic. Pollution is a major concerning issue for mankind; therefore, governments across the world are implementing policies to restrict the use of plastic products including packaging. In addition to this, people across the world are getting aware of global warming, pollution, and environmental degradation. This has forced the companies to produce sustainable packaging media mostly made of paper. For instance, in September 2021, Valmet, an industrial machinery manufacturer for the paper and pulp industry, supplied MG paper machine technology to Muda Paper Mills Sdn. Bhd in Malaysia, for the production of food packaging grade machine glazed paper.

Moreover, since the paper is based on wood, it is truly a sustainable product. The pulp & paper and print value chain are the lowest industrial emitters in the world, contributing to only around 1% of the world’s greenhouse gas emissions. Machine glazed paper has high mechanical strength and flexibility, and is easy to print, making it adaptable to a wide range of industrial and consumer products packaging applications. Food and beverages, personal care products, pharmaceuticals, and other industries are the major users of machine glazed paper, and with the rising disposable income of masses, and increasing population, the demand for machine glazed paper has increased.

However, volatility in raw material prices is anticipated to restrain the machine glazed paper market growth. Moreover, various developments such as government’s initiatives to encourage the use of environmentally sustainable packaging are expected to provide lucrative opportunities for players that operate in the machine glazed paper market. For example, in Canada, Paper Excellence received $4.5 million from the Investments in Forest Industry Transformation (IFIT) program of Canada. The company will invest this money in expanding its food packaging production capacity.

The demand for machine glazed paper decreased in the year 2020, owing to low demand from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic had shut-down the production of various products for the machine glazed paper end-user, mainly owing to prolonged lockdowns in major global countries. This has hampered the growth of the machine glazed paper market significantly during the pandemic.

The major demand for machine glazed paper was previously noticed from giant manufacturing countries including the U.S., Germany, Italy, the UK, and China, which was badly affected by the spread of coronavirus, thereby halting demand for machine glazed paper. However, owing to the introduction of various vaccines, the severity of the COVID-19 pandemic has significantly reduced. As of 2022, the number of COVID-19 cases has diminished significantly. This has led to the full-fledged reopening of machine glazed paper manufacturing companies, and its end user sector at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

Segmental Overview

The machine glazed paper market is segmented on the basis of paper type, grade, end-user, and region. By paper type, it is divided into tissue paper, and kraft paper. By grade, the machine glazed paper market is bifurcated into unbleached and bleached. By end-user, it is classified into food and beverages, healthcare, electrical and electronics, personal care & cosmetics, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Paper Type:

The machine glazed paper market is divided into tissue paper and kraft paper. In 2021, the tissue paper segment is expected to grow with a higher CAGR during the forecast period. The kraft paper segment dominated the machine glazed paper market in 2021, in terms of revenue. The tissue paper segment includes the use of machine glazed paper for producing products such as napkins, paper towels, face wipes, toilet paper, and other similar items. Companies such as Jani Sales Pvt. Ltd., SSG Paper Mills LLP, and others offer a wide range of machine glazed tissue paper. Witnessing high demand for machine glazed tissue paper, companies are expanding their tissue paper production capacities. For instance, in July 2021, Meghna Pulp & Paper Mills of India, ordered new tissue and machine glazed paper production plant from Recard, a producer of paper and pulp machinery. Moreover, kraft paper is a high GSM paper ranging between 70 to 300 GSM and is used for manufacturing consumer and industrial packaging, such as corrugated boxes, paper bags, pouches, void fillers, and others.

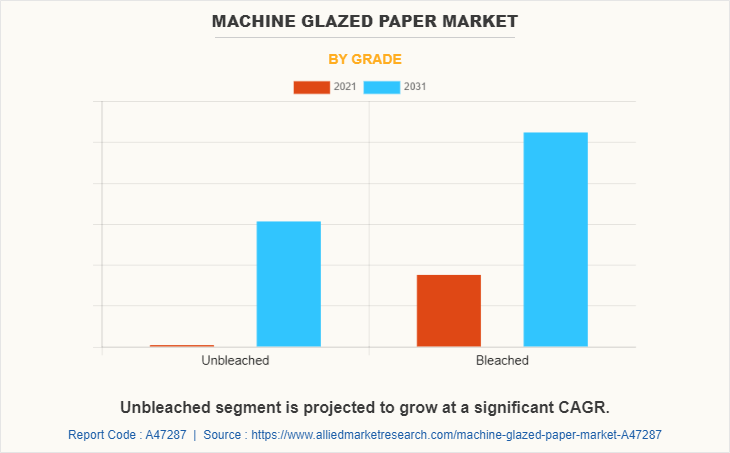

By Grade:

The machine glazed paper market is bifurcated into unbleached and bleached machine glazed paper. The bleached machine glazed paper segment registered a higher revenue share in 2021. Bleached machine glazed paper is made from chemically treated pulp in order to reduce the content of lignin; thus, eventually producing clean white paper. Its white color makes it highly desirable for companies that print their packaging with vibrant colors. Companies such as Smurfit Kappa, Jani Sales Pvt. Ltd., Asia Pulp & Paper (APP) Sinar Mas., and others offer bleached machine glazed paper. Moreover, unbleached paper is cheaper than bleached paper, and has slightly higher tensile strength; therefore, opening a bigger market space for unbleached paper. This is the reason why unbleached paper is expected to grow with a higher CAGR during the forecast period.

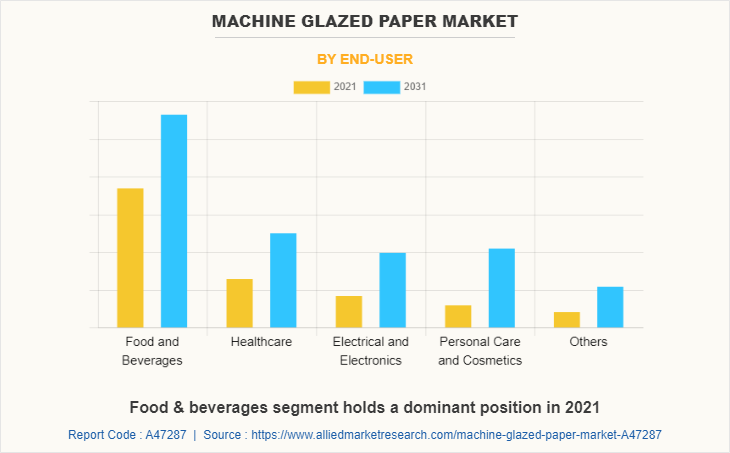

By End-User:

On the basis of end-user, the machine glazed paper market is classified into food and beverages, healthcare, electrical and electronics, personal care & cosmetics, and others. The food and beverages segment dominated the market in 2021, and the personal care & cosmetics segment is expected to grow with a higher CAGR during the forecast period. The food and beverages industry is significantly large owing to a larger number of people who consumes fast-foods, order food online, or takeaway the food. This has been a profound reason for the introduction of various food grade packaging made form machine glazed paper. Moreover, increasing disposable income and growth in e-commerce are playing a crucial role in the growth of the personal care & cosmetics industry. Various players are launching their sustainable machine glazed kraft paper packaging. For instance, in August 2020, UFlex, an Indian multinational in the flexible packaging manufacturer launched ‘Kraftika’ a paper-based tube pack.

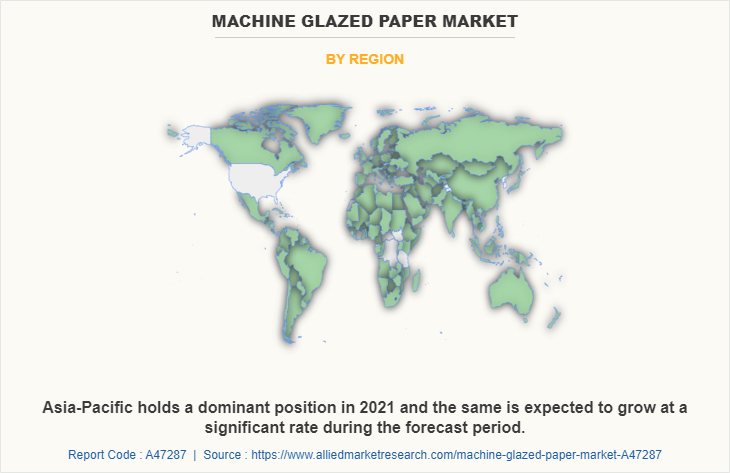

By Region:

The machine glazed paper market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest machine glazed paper market share and is anticipated to secure the leading position during the forecast period, due to a large manufacturing sector including food and beverages, electrical and electronics, healthcare, and others. India, China, and Vietnam are a few of the major manufacturing hubs in Asia-Pacific, owing to relatively easy statutory guidelines. Therefore, major players are striving to develop manufacturing units in these markets to improve production quantities as well as serve the industries in Asia-Pacific. Moreover, various government initiatives to ban or restrict the usage of single-use plastic products and bags are also playing a crucial role in driving the demand for machine glazed paper. In July 2022, the Indian government banned single-use plastic items. Furthermore, in May 2022, Kerala Paper Products Ltd (KPPL), a manufacturer of paper products invested 126 million to increase its production capacity of packaging grades of kraft paper. Similarly, in January 2021, Sun Paper Group brought online a new machine glazed paper machine PM 40 supplied by Voith Group. This machine will enhance the production capacity of Sun Paper Group.

Competition Analysis

Competitive analysis and profiles of the major players in the machine glazed paper market, such as BillerudKorsnas AB, Burgo Group S.p.A. (Mosaico S.p.A.), Heinzel Group, International Paper Company, Jani Sales Pvt. Ltd., Mondi Group, Nordic Paper Holding AB, SCG Packaging, Smurfit Kappa Group PLC, and Stora Enso Oyj are provided in this report. Major players have adopted business expansion and acquisition as key developmental strategies to improve the product portfolio of the machine glazed paper market. For instance, in March 2022, BillerudKorsnas AB a major Swedish business in paper and packaging materials manufacturing, acquired Verso Corporation, a U.S. based manufacturer of coated groundwood, coated freesheet, and specialty products including machine glazed paper. This acquisition will help BillerudKorsnas AB to grow in the North America.

Key Benefits For Stakeholders

The report provides an extensive analysis of the current and emerging machine glazed paper market trends and dynamics.

In-depth machine glazed paper market analysis is conducted by constructing market estimations for key market segments between 2021 and 2031.

Extensive analysis of the machine glazed paper market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing machine glazed paper market opportunity.

The machine glazed paper market forecast analysis from 2022 to 2031 is included in the report.

The key players within the machine glazed paper market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the machine glazed paper industry.

Machine Glazed Paper Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 18.3 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 293 |

| By Grade |

|

| By End-user |

|

| By Paper Type |

|

| By Region |

|

| Key Market Players | Nordic Paper Holding AB, BillerudKorsnas AB, Smurfit Kappa Group PLC, SCG Packaging, International Paper Company, Burgo Group S.p.A. (Mosaico S.p.A.), Stora Enso Oyj, Heinzel Group, Jani Sales Pvt. Ltd., Mondi Group |

Analyst Review

The machine glazed paper market has witnessed significant growth in the past few years, owing to a surge in demand for sustainable packaging medium for food & beverage, personal care & cosmetics products, and other industrial and non-industrial products.

Plastic packaging has been used for many decades, which has severely impacted the earth’s environment. Therefore, governments across the globe have either banned plastic packaging or are discouraging its use by imposing additional taxes. Other than the packaging, machine glazed paper is also used for producing hygiene related items such as napkins, paper towels, toilet paper, and others, which are witnessing an increase in their demand. The products from food & beverages are consumed across the globe; thus, it is fueling the demand for machine glazed papers in developed countries.

Furthermore, the personal care products such as cosmetics being non-essential product witnesses a high demand where the masses have higher disposable income. This includes countries such as U.S., Canada, and countries in Europe. This drives demand for machine glazed paper in these countries.

Increase in demand for sustainable packaging materials, and high demand for kraft papers for production of corrugated boxes, are a few of the upcoming trends of Machine Glazed Paper Market in the world.

Machine glazed papers are largely used for producing paper packaging in various industries. In addition, tissue-type machine glazed papers are used for the production of napkins, toilet papers, and others.

Asia-Pacific is the largest regional market for Machine Glazed Paper.

The global machine glazed paper market was valued at $11,781.5 million in 2021.

BillerudKorsnas AB, Burgo Group S.p.A. (Mosaico S.p.A.), Heinzel Group, International Paper Company, Jani Sales Pvt. Ltd., Mondi Group, Nordic Paper Holding AB, SCG Packaging, Smurfit Kappa Group PLC, and Stora Enso Oyj, are the top companies to hold the market share in Machine Glazed Paper.

By end-user, food & beverages industry holds the maximum market share of the Machine Glazed Paper Market in 2021.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The global machine glazed paper market is projected to reach $18,296.0 million by 2031.

Loading Table Of Content...