Machine Safety Market Overview, 2032

The global machine safety market was valued at $5.5 billion in 2022, and is projected to reach $10.3 billion by 2032, growing at a CAGR of 6.5% from 2023 to 2032. Machine safety refers to the practices and policies used to guarantee the secure use of tools and machinery in the workplace. This includes implementing safety rules & procedures, teaching staff on safe machine operation, and designing machinery & equipment with safety features such as guards, interlocks, and emergency stops to reduce the risk of accidents or injuries.

Machine safety is particularly crucial in the fields such as manufacturing, construction, and mining where powerful machinery is used. Employers can assist in preventing accidents and injuries, safeguard their workers, and lower the risk of accidents or injuries that result in financial losses for the company by implementing proper safety measures and procedures. This covers costs such as workers' compensation claims, medical bills, missed productivity, damage to property & equipment, as well as attorney fees and settlements from court cases or legal action.

Machine safety is particularly crucial in fields such as manufacturing, construction, and mining where powerful machinery is used. Employers can assist in preventing accidents and injuries, safeguard their workers, and lower the risk of accidents or injuries that result in financial losses for the company by implementing proper safety measures and procedures. This covers costs such as workers' compensation claims, medical bills, missed productivity, damage to property & equipment, as well as attorney fees and settlements from court cases or legal action.

The demand for machine safety products and services is influenced by rise in automation and the adoption of Industry 4.0 technology. Automation is driven by the desire to enhance productivity, reduce costs, and improve efficiency by using machines, robots, and automated systems. However, ensuring the safety of both machines and workers becomes crucial as automation expands. This leads to an increased demand for machine safety goods and services such as safety barriers, interlock systems, emergency stop devices, and safety training.

Segment Overview

The machine safety market is segmented into Component, Implementation and Industry Vertical.

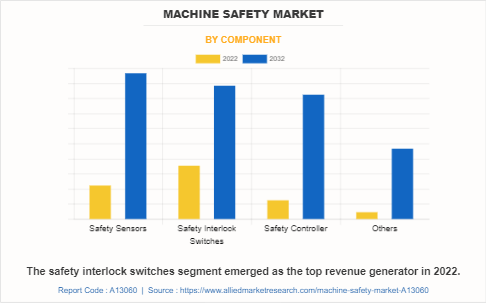

By component, the market is divided into safety sensors, safety interlock switches, safety controllers, and others. Among these, the safety interlock switches segment emerged as the top revenue generator in 2022.

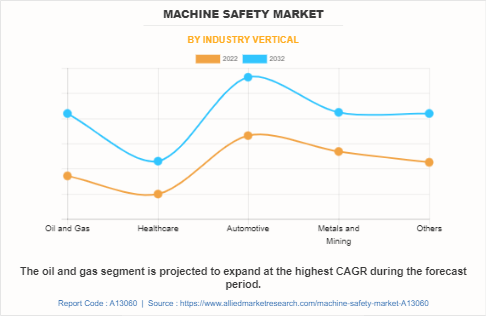

The machine safety market is segmented into component, implementation, industry vertical, and region. By component, the market is divided into safety sensors, safety interlock switches, safety controllers, and others. On the basis of implementation, it is bifurcated into individual and embedded. Depending on industry vertical, it is segregated into oil & gas, healthcare, automotive, metals & mining, and others. Region wise, the machine safety market trends is analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

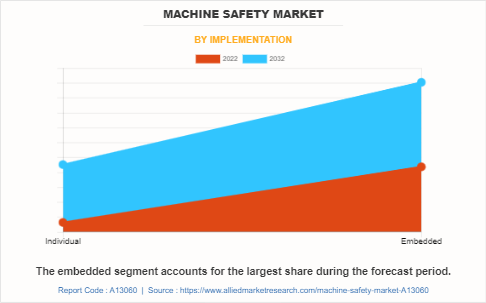

On the basis of implementation, the machine safety market is bifurcated into individual, and embedded. The embedded segment was the highest revenue contributor to the market.

Country-wise, the U.S. acquired a prime machine safety market size in North America and is expected to grow at a significant CAGR during the forecast period. This is attributed to the strong presence of several established machine safety solution providers in the country. For instance, companies such as Rockwell Automation, Honeywell, and Siemens have a significant market presence and offer a wide range of machine safety products and services. These companies have invested heavily in R&D and have developed advanced machine safety systems that cater to the specific needs of various industries.

Depending on the industry vertical, the machine safety industry is segregated into oil & gas, healthcare, automotive, metals & mining, and others. The automotive segment was the highest revenue contributor to the market.

The growing awareness of environmental sustainability and energy efficiency has further contributed to the demand for machine safety products and services. Safety measures often incorporate energy-saving features and eco-friendly technologies, aligning with businesses' broader sustainability objectives.

Moreover, implementation of stringent worker safety regulations and strict liability regulations has prompted organizations to invest in robust machine safety solutions. Thus, implementing effective safety measures helps businesses mitigate legal risks, avoid costly lawsuits, and maintain a favorable reputation in the machine safety market.

In Asia-Pacific, China is expected to emerge as a significant market for the machine safety industry, with a rapidly expanding manufacturing industry and a government that is actively working to improve workplace safety. As numerous Western companies manufacture goods for sale in China, it is essential to have a consistent and effective regulatory regime that prioritizes workplace safety. For instance, China's State Administration of Work Safety has implemented various measures to improve safety in workplaces, such as enhancing safety inspections and increasing penalties for non-compliance. Furthermore, China's Ministry of Industry and Information Technology has introduced guidelines for the safety of automated machinery in manufacturing to ensure that safety standards are upheld while integrating technology into the workplace.

In LAMEA, Latin America dominated the machine safety market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. The key driver for this dominance is the growing awareness among industries about the significance of ensuring worker safety. Governments in these countries have introduced strict regulations to enforce worker safety, which has resulted in a surge in demand for machine safety systems. For example, the Brazilian Association of Technical Standards (ABNT) has established precise standards for machine safety that companies must adhere to.

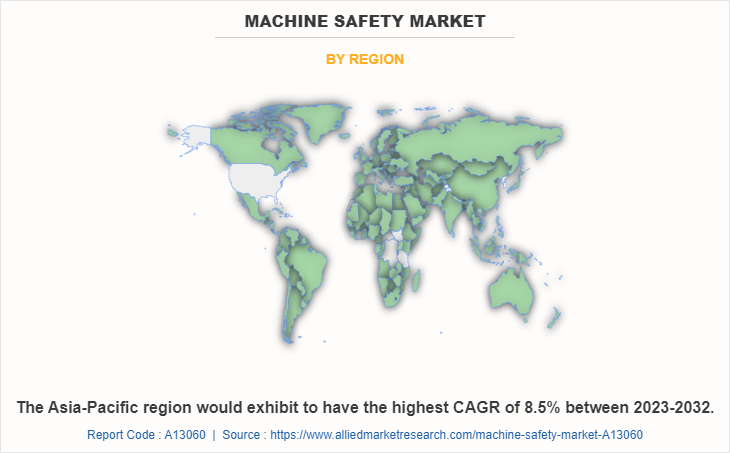

By region, the machine safety market is analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). The North America region was the highest revenue contributor to the market.

Country-wise, the U.S. acquired a prime share in the machine safety market in the North American region and is expected to grow at a significant CAGR during the forecast period of 2023-2032. One of the main reasons for the U.S.'s strong position in the North American machine safety market is the presence of several established machine safety solution providers in the country. Companies such as Rockwell Automation, Honeywell, and Siemens have a significant market presence and offer a wide range of machine safety products and services. These companies have invested heavily in R&D and have developed advanced machine safety systems that cater to the specific needs of various industries.

In Europe, France, dominated the machine safety market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. The increased demand for advanced machine safety solutions across various sectors, such as aerospace, automotive, and manufacturing, has led to a rise in the adoption of these solutions in the country. The French government has been taking several initiatives to promote worker safety and has implemented strict regulations to ensure the same. In Europe, France, dominated the machine safety market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. The increased demand for advanced machine safety solutions across various sectors, such as aerospace, automotive, and manufacturing, has led to rise in the adoption of these solutions in the country. Moreover, the French Government has been taking several initiatives to promote worker safety and has implemented strict regulations to ensure the same. The Ministry of Labor has established specific standards for machine guarding that companies must comply with to prevent injuries to workers. For example, the "General Regulation for the Protection of Workers" (RGPT) outlines guidelines for the safe use of machinery in the workplace. These regulations require employers to provide adequate training to their employees for using machinery safely and to implement safety measures to prevent injuries.

In Asia-Pacific, China is expected to emerge as a significant market for the machine industry, with a rapidly expanding manufacturing industry and a government that is actively working to improve workplace safety. As numerous Western companies manufacture goods for sale in China, it is essential to have a consistent and effective regulatory regime that prioritizes workplace safety. For instance, China's State Administration of Work Safety has implemented various measures to improve safety in workplaces, such as enhancing safety inspections and increasing penalties for non-compliance. Additionally, China's Ministry of Industry and Information Technology has introduced guidelines for the safety of automated machinery in manufacturing, to ensure that safety standards are upheld while integrating technology into the workplace.

In LAMEA region, Latin America dominated the machine safety market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. The key driver for this dominance is the growing awareness among industries about the significance of ensuring worker safety. Governments in these countries have introduced strict regulations to enforce worker safety, which has resulted in a surge in the demand for machine safety systems. For example, the Brazilian Association of Technical Standards (ABNT) has established precise standards for machine safety that companies must adhere to.

The primary factors influencing the demand for machine safety goods and services are rise in trend of automation and rapid uptake of Industry 4.0 technology. Furthermore, businesses are increasingly relying on automation technologies, including robotics and machine vision as they seek to increase the productivity and efficiency of their operations. To ensure secure operation of machines and equipment, these technologies necessitate the implementation of safety measures.

However, lower level of industrialization in certain regions, which may result in limited demand from smaller or less advanced companies that have fewer resources to invest in expensive safety systems, hamper the growth of the market. In addition, these companies may not be subject to same level of regulatory requirements as larger and more established companies, thus limiting the demand for machine safety products and services.

On the contrary, increase in emphasis on workplace safety is expected to escalate the demand for safety-related goods and services. Furthermore, the demand for machine safety goods and services is anticipated to rise significantly as more businesses realize how important it is to have safety measures in place to safeguard their employees and adhere to safety legislation and requirements. Thus, all these factors collectively are anticipated to present profitable opportunities for market expansion during the forecast period.

Top Impacting Factors

The major factors impacting the growth of the machine safety market include increase in adoption of digital technologies and rise in trend of automation in industrial processes. Moreover, complexity and interconnectedness of machines and processes increase potential risks and hazards, which fuel the demand for smart safety solutions to prevent accidents, provide alerts, and offer insights about machine performance and maintenance, resulting in significant cost savings for manufacturers.

Furthermore, the high cost of implementing safety measures in the manufacturing industry affects machine safety market growth. In addition, the increase in adoption of hazardous machinery and equipment in various industries, particularly in developing countries, influences the market growth. Thus, each of these factors is expected to have a definite impact on the machine safety market growth.

Competitive Analysis

The machine safety market is highly competitive, owing to the strong presence of existing vendors. Vendors of the machine safety market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as product launches, strategic alliances, innovations and different strategies adopted by key vendors increase. Competitive analysis and profiles of the major machine safety market players that have been provided in the report include ABB Ltd., Emerson Electric Co., Honeywell International Inc., KEYENCE CORPORATION, Mitsubishi Electric Corporation, OMRON Corporation, Rockwell Automation Inc., Schneider Electric SE, SICK AG, Siemens AG, and B&R Automation.

Key Developments/ Strategies

According to the latest machine safety market outlook, ABB Ltd., Schneider Electric SE, Rockwell Automation Inc., Emerson Electric Co., and Siemens AG are the top 5 key players in the machine safety market. Top market players have adopted various strategies, such as product launches, business developments, and innovations to expand their foothold in the machine safety industry.

In April 2022, Mitsubishi Electric Corporation launched a new digital cockpit, Inca Jay, that showcases a suite of technologies for Advanced Driver Assistance Systems (ADAS), cabin safety and enhanced User Experience (UX), that will shape the future of connectivity and usability in vehicles. The Inca Jay cockpit is powered by the 3rd Generation Snapdragon Cockpit Platform, which utilizes Green Hills Software’s INTEGRITY real-time operating system for performance, safety, and security.‐¯

In October 2022, Rockwell Automation added three new members to its Machine Safety System Integrator program, which connects companies with system integrators that have expertise in current safety standards and a track record of designing safety systems. The program now has 45 members located around the world.‐¯

In May 2022, Emerson Electric Co. launched the TopWorxTM DX PST, which incorporates HART 7 technology and offers important valve data and diagnostic information to facilitate the digitalization of process applications. The new DX PST is compatible with existing valves and control systems, enabling operators to obtain crucial valve data, trends, and diagnostics that can aid in anticipating and planning maintenance.

Key Benefits for Stakeholders

This study comprises analytical depiction of the machine safety market size along with the current trends and future estimations to depict the imminent investment pockets.

The overall machine safety market analysis is determined to understand the profitable trends to gain a stronger foothold.

The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

The machine safety market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

The Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the machine safety market.

The report includes the share of key vendors and machine safety market trends.

Machine Safety Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.3 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 403 |

| By Component |

|

| By Implementation |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | B&R Automation, Emerson Electric Co., OMRON Corporation, Honeywell International, Inc., Siemens AG, Schneider Electric SE, KEYENCE CORPORATION, Rockwell Automation, ABB Ltd., Mitsubishi Electric Corporation, SICK AG |

Analyst Review

The machine safety market holds significant potential for growth. Recent discoveries and innovations have created vast opportunities for numerous players to step into the machine safety market. Surge in demand for presence-sensing safety devices, rise in penetration of IoT, and increase in emphasis on industrial safety and proactive safety measures are the key drivers of the market. However, surge in competition and lack of awareness about the importance of machine safety act as key deterrent factors of the market. On the other hand, increase in awareness of the need for machine safety and rise in concern for safety are opportunistic for the market growth.

Further, the market is highly competitive due to the strong presence of existing vendors. Machine safety vendors with access to extensive technical and financial resources are anticipated to gain a competitive edge over their rivals as they have the capacity to cater to market requirements. The competitive environment in this market is expected to further intensify with rapid technological innovations, product extensions, and different strategies adopted by key vendors.

The global machine safety market is projected to reach $10.3 billion by 2032.

The Machine Safety Market is expected to grow at a CAGR of 6.5% from 2023-2032.

The top companies to hold the market share in Machine Safety are ABB Ltd., Schneider Electric SE, Rockwell Automation Inc., Emerson Electric Co., and Siemens AG.

North America is the largest regional market for Machine Safety, with U.S. being the largest contributor to the region's growth.

The barcode reader market is anticipated to depict a prominent growth during the forecast period, owing to various factors, such as an increase in adoption of handheld barcode readers that fuels the demand for barcode reader market. In addition, the market is influenced by growth in investments in the retail sector and rise in urbanization to drive the market growth.

Loading Table Of Content...

Loading Research Methodology...