Managed Services Market Overview

The global managed services market size was valued at USD 205.5 billion in 2021, and is projected to reach USD 594.8 billion by 2031, growing at a CAGR of 11.3% from 2022 to 2031.

Key Market Trends & Insights

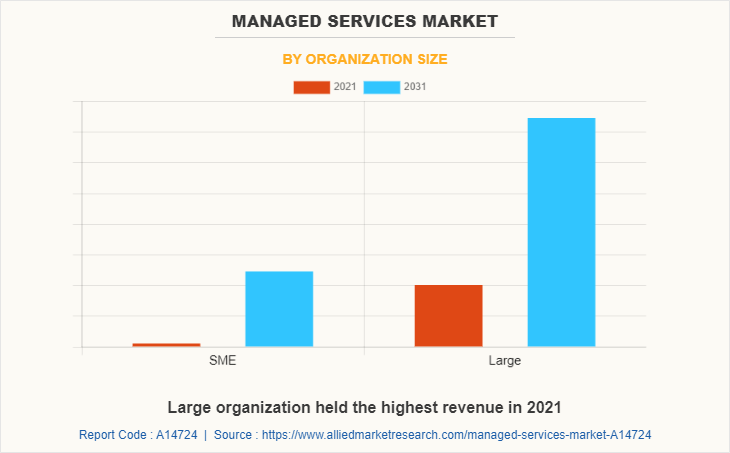

- By organization size, the SME sub-segment is anticipated to be the fastest growing during forecast period.

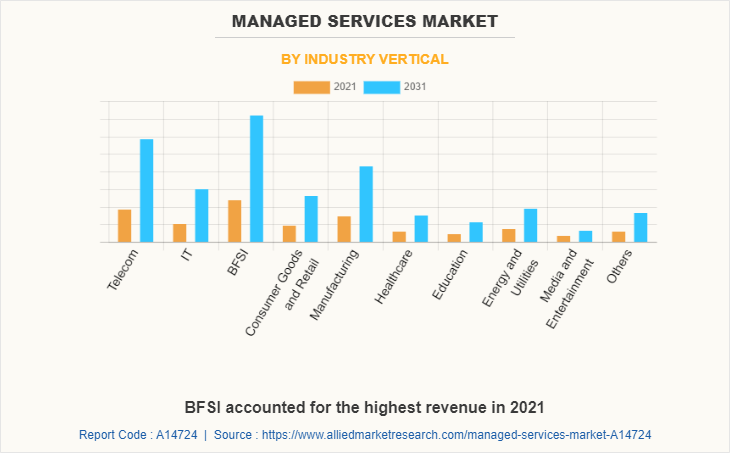

- By industry vertical, telecom sub-segment is predicted to show the fastest growth during forecast period.

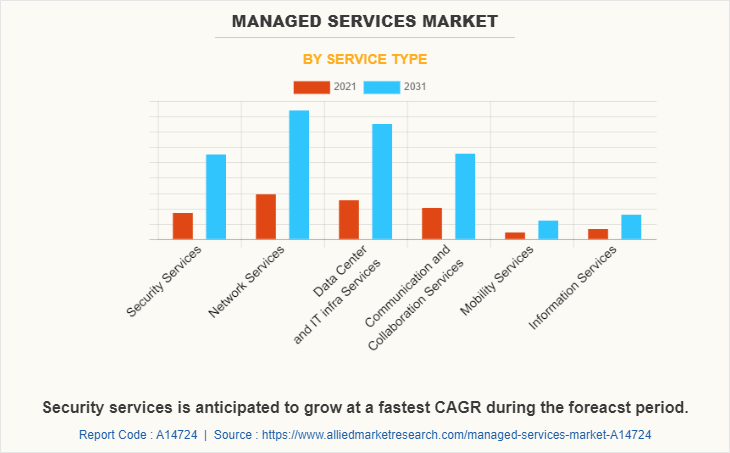

- By service type, security services sub-segment is predicted to show the fastest growth in the upcoming years.

- Region wise, Asia-Pacific predicted to show the fastest growth during the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 205.5 Billion

- 2031 Projected Market Size: USD 594.8 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 11.3%

What is Managed Services?

The term ‘managed services’ describes the practice of giving a third-party service provider control over some aspects of an organization's IT infrastructure and/or other business activities to maintain, optimize, and manage them. The service provider is in charge of offering a variety of services to the organization, such as proactive monitoring, troubleshooting, and problem-solving, keeping up with system upgrades and patches, and giving the organization frequent reports and performance metrics.

The complexity of IT infrastructure is leading to an increase in demand for managed services. Companies frequently find themselves managing a large number of IT systems and devices as they develop and expand, which may be burdensome and challenging to handle internally. Companies may manage and maintain their IT infrastructure more efficiently with the aid of managed services providers (MSPs), which provide a variety of services. MSPs can offer knowledge in a variety of fields, including network management, security, data backup and recovery, and application management. Companies may concentrate on their core business operations while leaving the maintenance of their IT infrastructure to the professionals by outsourcing these tasks to a managed services provider. This improves operational effectiveness while simultaneously lowering expenses and minimizing downtime.

The managed services business is facing a substantial problem due to the lack of qualified workers. Professionals with knowledge of networking, cloud computing, cybersecurity, and other fields are needed for managed services. The potential for the managed services industry to develop may be constrained due to the high demand and limited supply for these specialists. Companies frequently have to pay a premium to recruit and retain great personnel since there is a fierce amount of competition for qualified employees. These factors are anticipated to hamper the managed services market revenue growth during the forecast period.

The data and systems of their clients are often protected by enhanced security measures provided by managed services providers (MSPs). Firewalls, intrusion detection and prevention (IDP) systems, anti-virus and anti-malware software, and data backup and recovery tools are some of the security measures. Businesses may have access to these sophisticated security features by working with an MSP without having to make their own costly hardware and software purchases. In order to remain ahead of the most recent dangers, MSPs frequently employ specialized security teams who regularly analyze and update their security protocols. Businesses may prevent costly data breaches and other security concerns that could harm their brand and financial standing by enhancing security. MSPs may offer round-the-clock threat detection, response, and security monitoring, which can assist find and fix security problems before they get out of hand.

Managed Services Market Segment Overview

The managed services market is segmented on the basis of organization size, deployment type, service type, industry vertical, and region. By organization size, the market is divided into SME and large. By deployment type, the market is classified into clouds and on-premise. By service type, the market is divided into security services, network services, data center & IT infra services, communication & collaboration services, mobility services, and information services. By industry vertical, the market is classified into telecom, IT, BFSI, consumer goods & retail, manufacturing, healthcare, education, energy & utilities, media & entertainment, and others. By region, the market is analyzed across regions North America Europe Asia Pacific and LAMEA.

By organization size, the large enterprises sub-segment dominated the managed services market in 2021. Large enterprises are increasingly looking for managed service providers (MSPs) to outsource their IT services to cut costs and boost productivity. MSPs can offer a variety of services, such as monitoring and administration of IT infrastructure, application management, security, and disaster recovery. Internal IT system management for organizations gets increasingly challenging as IT systems become more sophisticated. To manage complex systems and keep them operating efficiently and safely, MSP providers can offer specialized skills and tools. Large enterprises frequently need to handle a variety of company operations. SMEs may concentrate on their main business operations by outsourcing IT services while leaving IT management to professionals. These are predicted to be the major factors affecting the managed services market size during the forecast period.

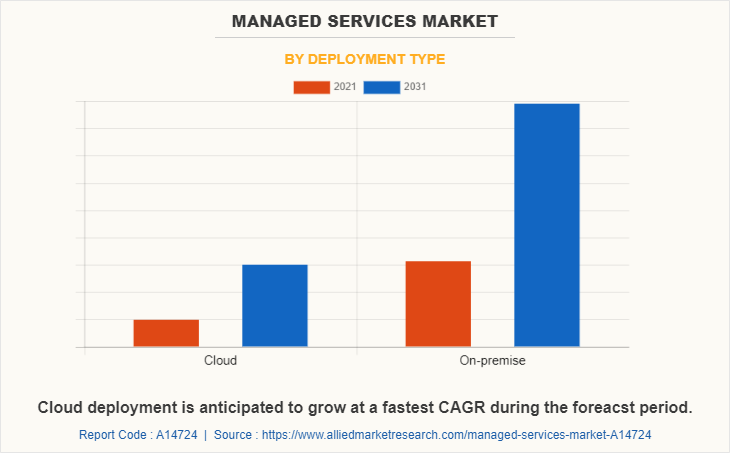

By deployment type, the cloud sub-segment is anticipated to show a fastest CAGR during the forecast period. Cloud services allow organizations to reduce their IT costs by eliminating the need for software licenses, expensive hardware, and maintenance. MSPs provide scalable, affordable cloud-based solutions that let companies only pay for the resources they utilize. Without incurring any up-front expenditures or responsibilities over an extended period, the cloud enables organizations to scale their IT infrastructure up or down per their needs. This adaptability is especially helpful for firms when demand is unpredictable. Any device with an Internet connection can access cloud services from anywhere, at any time. Due to this, companies may operate remotely and access important apps and data while on the go.

By service type, the security services sub-segment dominated the global managed services market share in 2021. A managed security service includes outsourced management and monitoring of security systems and devices. Managed Security Service Providers (MSSPs) are third-party organizations that offer services to a company. These services include intrusion detection, vulnerability scanning, managed firewalls, anti-viral services, and others. MSSP uses high-availability security operation centers to provide 24/7 services aimed at reducing the number of operational security employees that a company must hire, train, and retain to maintain an acceptable security posture.

By industry vertical, the BFSI sub-segment dominated the global managed services market share in 2021. It is difficult for banks to manage and maintain its systems due to the rising complexity of IT infrastructure. A variety of services, including network monitoring, data backup, security management, and help desk assistance, are provided by organizations with the aid of managed service providers (MSPs). MSPs help banks enhance their competences and improve their business operations. Moreover, MSPs enable banks to reduce in-house IT expenses, restructure IT systems, and automate business processes, allowing them to meet their business objectives.

By region, North America dominated the global market in 2021 and is projected to remain the fastest growing region during the forecast period. The managed services market in North America offers businesses a wide range of services, such as IT infrastructure management, network monitoring, cloud services, security management, and others. The regional market is driven by a number of reasons, such as the need for cost-effective solutions, the complexity of IT systems, and the rising demand for outsourcing IT services. Several organizations in the region are moving their apps and data to the cloud to maintain the availability and security of their systems.

Managed Services Industry Top Impacting Factors

Increase in Cybercrime Activities

- Cybercrime is on the rise globally. Despite the increase in sophistication of attacks and the complexity of the IT network, businesses continue to depend on antiquated data protection measures. Bring-Your-Own-Device (BYOD), cellphones, social media, and cloud service usage, among other technical innovations and practices, have significantly complicated the overall data security process. Nowadays, organized cybercriminal operations are on the rise, with well-funded organizations that are competent, coordinated, and motivated, which push cybercrime. Businesses suffer enormous financial losses as a result of cybercrime, as well as a negative impact on their brand image.

- Moreover, there is an increase in cyber-attacks on the healthcare facility systems and their medical devices along with personal data of the patient that are critical for hospitals and patient privacy. Healthcare networks often support a number of endpoints running antiquated applications and operating systems. These endpoints are difficult to repair, making it costly to maintain adequate security posture. Healthcare endpoint security has become increasingly important for data protection and protection of systems from unauthorized manipulation and preventing use of malicious software, such factors drive growth of the managed services market.

Cost Effectiveness of Managed Security Services Providers

- Data breaches and a number of sophisticated assaults have increased dramatically in the previous 8-10 years, to the point that enterprises in every industry must assure the security of their information and network infrastructure. With so many threat and vulnerability monitoring systems on the market, deciding whether to employ an in-house or cloud-based security solution is crucial in the security monitoring and management process. Due to budget restrictions, most businesses are attempting to build an in-house security infrastructure with just part-time employees. This may not be enough to ensure efficient and effective data security, as part-time employees may lack the necessary expertise.

- As a result, companies are increasingly outsourcing data security activities to managed security services providers (MSSP). Along with being cost-effective, this security management option enables the firm to continue real-time network traffic monitoring by IT security specialists. MSSPs supply these services to several clients on a shared basis, lowering the cost per client. As a result, managed security services (MSS) are accessible to companies of all sizes, thus driving growth of the managed services market.

Key Managed Services Companies:

The following are the leading companies in the managed services market.

- IBM Corporation

- HCL Technologies

- TCS

- Atos

- AT&T

- Cisco Systems

- Fujitsu

- Ericsson

- Accenture

- Dimension Data.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the managed services market analysis from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the managed services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global managed services market trends, key players, market segments, application areas, and provides data which contribute to the market growth strategies.

Managed Services Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 594.8 billion |

| Growth Rate | CAGR of 11.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Organization Size |

|

| By Deployment Type |

|

| By Service Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Atos, AT&T, Ericsson, Dimension Data, Fujitsu, TCS, HCL, IBM, Cisco, Accenture |

Analyst Review

Network administration, security, cloud computing, and other IT solutions are just a few of the services that managed service providers provide to help organizations run smoothly across numerous locations. Businesses can get the infrastructure and assistance they need from managed services providers to operate successfully across borders while still adhering to local rules and laws. By avoiding the need to maintain their IT infrastructure internally, which can be a difficult and expensive task, businesses can save time, money, and resources. In addition, managed services providers may give organizations scalability and flexibility, allowing them to modify their IT systems, as necessary. In accordance with the budget and business requirements, the companies can also prioritize services and solutions in collaboration with their managed services provider. Moreover, labor expenses may be cheaper in emerging economies, which might cut the cost of managed services. To stay competitive in the market as demand for managed services rises, companies could also offer more affordable pricing. These are the factors expected to hamper the market growth during the forecast period. As more organizations outsource their IT requirements, managed services offer significant opportunities for MSPs. Various services, such as network management, data backup and recovery, security, and cloud computing, are offered by MSPs. MSPs can establish long-term relationships with clients and generate a consistent flow of recurring income by providing these services.

Among the analyzed regions, North America accounted for the highest revenue in 2021, followed by Europe, Asia-Pacific, and LAMEA. With the rise of cyber threats and data breaches, organizations in the regions are looking for reliable and proactive solutions to protect their systems and data. These are the key factors responsible for the leading position of North America and Europe in the global managed services market.

The global managed services market size was valued at USD 205.5 billion in 2021, and is projected to reach USD 594.8 billion by 2031.

The global managed services market is projected to grow at a compound annual growth rate of 11.3% from 2022-2031 to reach USD 594.8 Billion by 2031

IBM, HCL, TCS, Atos, AT&T, Cisco, Fujitsu, Ericsson, Accenture, and Dimension Data are the major players in the managed services market.

Asia-Pacific is the largest regional market & will provide more business opportunities for the global managed services market in the future.

Rising demand for IT services, increasing adoption of cloud computing services by businesses, and the growing need for cost-effective managed services solutions are the major factors predicted to boost the growth of the global managed services market during the forecast period.

Loading Table Of Content...

Loading Research Methodology...