Marine Lubricant Market Research, 2033

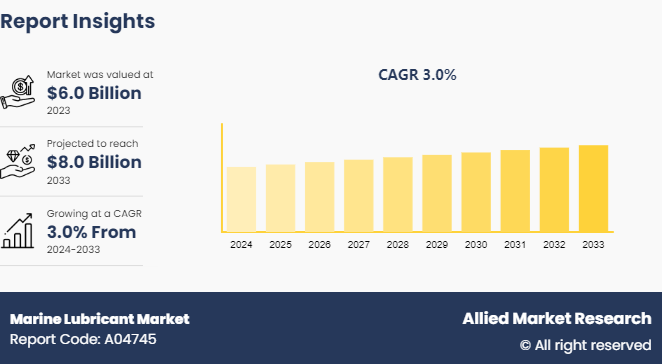

The global marine lubricant market was valued at $6.0 Billion in 2023, and is projected to reach $8.0 Billion by 2033, growing at a CAGR of 3% from 2024 to 2033.

Market Introduction and Definition

Marine lubricants are specialized fluids used in various components of marine machinery to reduce friction, prevent wear and tear, dissipate heat, and maintain operational efficiency in harsh marine environments. Typically, marine lubricants are formulated to withstand the challenges posed by saltwater corrosion, high temperatures, and heavy loads encountered in marine applications.

These lubricants exhibit several properties essential for marine operations. They possess excellent lubricity to reduce friction between moving parts, ensuring smooth operation of engines, gears, and other machinery. In addition, marine lubricants have high thermal stability to withstand the elevated temperatures generated during prolonged operation. They also demonstrate superior corrosion resistance, protecting metal surfaces from the corrosive effects of seawater and salt air. Furthermore, these lubricants have good water separation properties, allowing water to be efficiently removed from the lubrication system to prevent emulsification and maintain lubricant effectiveness. Lastly, marine lubricants often feature additives that provide enhanced protection against rust, oxidation, and foaming, extending the service life of components and reducing maintenance requirements.

Key Takeaways

- The marine lubricants market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major marine lubricants industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The increase in seaborne traffic around the world is a major factor driving the global need for marine lubricants. With more than 80% of global trade handled by water, shipping volumes and fleet size have increased to meet rising transportation demands. According to numbers from the United Nations Conference on Trade and Development (UNCTAD) , overall seaborne trade volumes reached 11 billion tons in 2021, up by 4.3% from the previous year. The increase in maritime trade volumes has directly resulted in larger shipping fleets. UNCTAD estimates that from 2020 to 2022, the number of ships in the global commerce fleet increased by 4.3% to 98, 000. With more ships traversing the oceans every day, there is an increasing demand for special grade lubricants that can endure harsh marine conditions while ensuring the smooth running of these vessels.

Marine lubricants serve an important function in decreasing friction between machinery parts and engine component corrosion when exposed to salt water. They help to lengthen equipment life, improve fuel efficiency, and reduce maintenance downtime aboard ships. According to the United Nations Conference on Trade and Development, global seaborne trade is expected to grow by 3-4% each year during the medium term, until 2030. Multiple variables, including expanding globalization, increased energy transportation, and the expansion of e-commerce, are expected to maintain the growth pace. As shipping companies expand their capacity, the number of new ships supplied each year will increase. As fleet sizes grow, so will the usage of marine lubricants on cruise ships, tankers, bulk carriers, and other vessels. With increased demand from the growing maritime logistics industry, the global marine lubricants market is expected to rise gradually in the next few years.

Environmental concerns about marine lubricant disposal are severely limiting the growth of the global marine lubricants market. Strict environmental restrictions throughout the world are driving companies to produce greener, more sustainable lubricant solutions. International laws, such as MARPOL Annex I, regulate operational discharges of oil and oily waste from ships. This agreement prohibits any unlawful discharge of lubricants or lubricant-contaminated bilge water. Violations can result in severe penalties, requiring ship owners and operators to adopt safer disposal techniques. The issue of marine contamination caused by dumping spent lubricants into oceans has received more attention in recent years.

The increased demand for environmentally friendly and sustainable marine lubricants creates a significant opportunity for the global marine lubricant market. Bio-based and synthetic lubricants made from renewable biological sources, such as plant oils, have various advantages over conventional petroleum-based lubricants. They have been shown to be biodegradable and less hazardous if released into the aquatic environment during ship operations or mishaps. As environmental rules become stricter around the world, shipping corporations face increasing pressure to minimize pollution and carbon emissions from their fleet. This demand for greener solutions extends beyond fuel options to include operational lubricants. Synthetic esters and plant-based compositions are gradually replacing traditional petroleum distillate oils.

With ever-increasing regulatory tailwinds and consumer demands for sustainability, bio-based marine lubricants are projected to take a significant portion of the industry in the next years. Leading shipping companies and national navies have already started experimental programs, and commercial adoption will pick up as supply chains improve to meet growing demand for ecologically friendly lubricating solutions. The global transition to a low-carbon blue economy could not present a better opportunity for bio-based marine lubricant manufacturers.

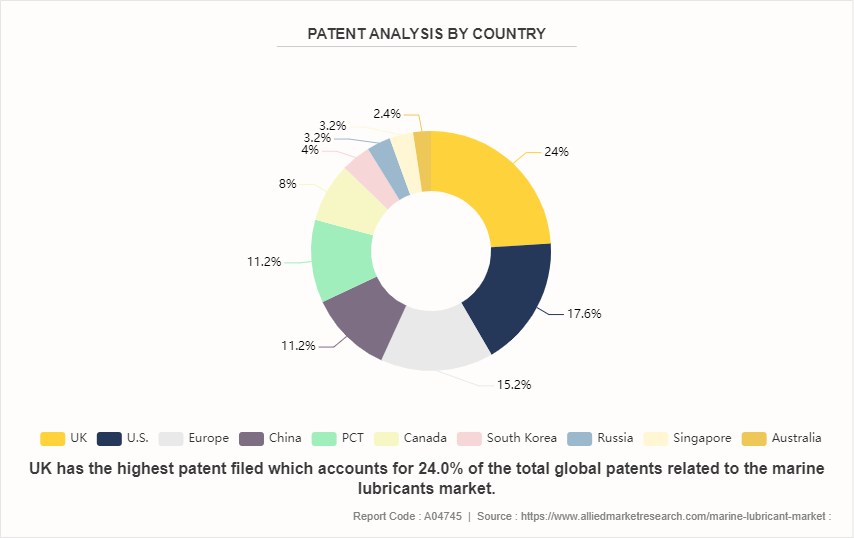

Patent Analysis of Global Marine Lubricants Market

In the marine lubricants market, patent activity is led by the UK, which holds 24.0% of the patents, showcasing its robust innovation capacity in this sector. The U.S. follows with 17.6%, highlighting its significant contribution to technological advancements. The European Patent Office accounts for 15.2%, reflecting the collaborative efforts of European countries in marine lubricant innovation. Both China and the Patent Cooperation Treaty (PCT) system represent 11.2% each, indicating substantial participation from China and international applicants. Canada holds 8.0%, signifying its active engagement in this market. The Republic of Korea contributes 4.0%, demonstrating its growing interest in marine lubricants. The Russian Federation and Singapore each have a 3.2% share, showing their niche but important contributions. Lastly, Australia holds a 2.4% share, illustrating its involvement in the global marine lubricants industry. These percentages highlight the diverse and international nature of patent filings in the marine lubricants market.

Market Segmentation

The marine lubricants market is segmented into oil type, application, and region. Based on oil type, the market is classified into mineral oil-based, synthetic oil-based, and bio-based oil-based. By application, the market is divided into engine oils, compressor oils, gear oils, turbine oils, hydraulic fluids, greases, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The Asia-Pacific region is witnessing a surge in demand for marine lubricants, driven by the expansion of maritime trade, industrial activities, and a growing shipping fleet. Key factors include increased cargo transportation, particularly in China and India, and heightened regulatory standards for emissions. This trend is further fueled by advancements in lubricant technology and the need for efficient vessel operations, highlighting the region's critical role in the global maritime industry. Consequently, major players are investing significantly to capitalize on this growth.

- According to the United Nations Conference on Trade and Development (UNCTAD) , China, the Republic of Korea, and Japan account for around 94% of globally shipbuilding activities in terms of deadweight tonnage (DWT) . Furthermore, Bangladesh and India accounted for almost 71% of global ship recycling.

- According to UNCTAD, China had 1, 15, 154 merchant ships in 2022, an increase of around 6.1% from 1, 08, 481 in 2021. As a result, it is projected that the marine lubricants industry will experience increased demand.

- In June 2022, China's third sophisticated air carrier, Fujian, was launched from Shanghai's Jiangnan Shipyard. The Fujian is China's first domestically designed and constructed catapult aircraft carrier.

- Invest India reports that as of January 2021, 161 projects worth $12 billion had been completed in the marine industry, while 178 projects worth $26, 595 million (INR 1, 96, 578 crores) were in the process of being implemented.

- The Ministry of Shipping was allotted $257.22 million (INR 1, 800 crores) in the Union Budget 2020–2021. Furthermore, under the Shipbuilding Financial aid Policy (SBFA) , the Indian government approved financial aid totaling $20.13 million (Rs 1.55 billion) for 47 ships. These vessels have a cumulative contract value of $110.39 million (about Rs 8.5 billion) . Thus, more government spending in the marine industry is contributing to its growth.

Competitive Landscape

The major players operating in the marine lubricants market include Exxon Mobil Corporation, Royal Dutch Shell plc., Chevron Corporation., TotalEnergies SE., Lukoil, Sinopec Corp., ENEOS Corporation, BP p.l.c., Repsol, Gulf Oil International Ltd. Other players in the marine lubricants market include Valvoline, Bel-Ray Co. Inc, and Indian Oil Corporation Ltd.

Recent Key Strategies and Developments

- In February 2023, Luberef announced that it will expand its base oil production in Yanbu' al Bahr, Saudi Arabia, increasing capacity by 230, 000 metric tons per year. The refiner, a subsidiary of Saudi Aramco, stated that the initiative would also improve the facility, allowing it to produce API Group III base stocks.

- In January 2023, an agreement was reached between TotalEnergies SE and CEPSA for the purchase of the latter's upstream business assets in the United Arab Emirates (UAE) .

- In March 2022, Shell plc, originally known as Royal Dutch Shell plc, is a British multinational oil and gas business based in London, United Kingdom. The corporation is an integrated oil and gas company with a primary listing on the London Stock Exchange (LSE) and a strong global presence. Shell plc has agreed to acquire PANOLIN's Environmentally Considerate Lubricants) business, a lubricant manufacturer situated in Switzerland. The acquisition encompasses the PANOLIN brand, ECL product formulations, intellectual property, technical experience, and technology. The global market for ECLs is likely to expand rapidly in the next years, and the acquisition will boost Shell's position in mining, construction, agriculture, renewable energy, hydropower, and offshore wind.

- In August 2021, Wilhelmsen Holding ASA (an international marine firm) partnered with Klüber Lubrication (a lubricant manufacturer based in the United States) . Wilhelmsen Holding ASA is a Norwegian international marine firm based in Lysaker, Norway. The company works as a completely owned subsidiary of Wilhelmsen Holding ASA. Wilhelmsen will sell and distribute Kluber's maritime lubricant range exclusively as part of the partnership.

Favorable Industry Scenarios For Marine Lubricants Market:

Several reports by the United Nations Environment Program (UNEP) and the World Wildlife Fund (WWF) have emphasized the negative impact of petroleum hydrocarbon contamination on marine ecosystems and biodiversity. For example, a 2022 UNEP assessment study discovered that plastic micropollution has grown by an order of magnitude in some ocean environments since 1980, with used lubricants being a major cause. The growing public awareness of such environmental damage is placing pressure on producers to provide more sustainable lubricant solutions that can be safely disposed without damaging water bodies. Furthermore, severe IMO requirements under the International Convention for the Prevention of Pollution from Ships (MARPOL) require the separate collection and storage of bilge water and sludge containing lubricants. To treat such oily pollutants before discharge or disposal on land, ships must use flag-state-approved processing equipment. Compliance with such complex standards raises operating costs for ship owners. This serves as a barrier to the broad use of traditional marine lubricants and emphasizes the need for ecologically responsible lubricant solutions. Tightening laws and more environmental consciousness present major challenges to the global marine lubricants market's long-term growth prospects.

According to the UN Conference on trade and Development in 2020, ships transport over 80% of global commerce volume, putting enormous pressure on the marine industry to meet the International Maritime Organization's ambitious emission reduction targets. The growth of global regulations promoting the use of environmentally friendly lubricants presents an opportunity for bio-based marine lubricant manufacturers. EALs accredited by organizations such as the American Bureau of Shipping assure ship owners of a minimal influence on water quality and safety. Leading lubricant makers have responded enthusiastically, providing a diverse portfolio of bio-based and synthetic alternatives for various engine and industrial applications. According to European Bio Economy Statistics published in 2023, the production of bio-based marine lubricants in Europe has increased by more than 15% per year since 2020, indicating sector-wide acknowledgment of the regulatory compliance and marketing benefits provided by these greener solutions.

Global Government Regulations of Marine lubricants Market

- International Maritime Organization (IMO) Regulations: The IMO sets global standards for the safety, security, and environmental performance of international shipping. Key IMO regulations related to marine lubricants include:

- MARPOL Annex VI: This regulation aims to prevent air pollution from ships and includes limits on sulfur content in marine fuels. The use of low-sulfur fuels can impact the choice and formulation of marine lubricants to ensure compatibility and performance.

- Ballast Water Management Convention: This convention addresses the transfer of harmful aquatic organisms via ballast water. Though primarily focused on ballast water treatment systems, it indirectly affects lubricant formulations used in such systems.

- European Union (EU) Regulations: The EU has implemented stringent regulations to minimize environmental impact:

- EU Sulfur Directive (2012/33/EU) : This directive limits the sulfur content in marine fuels used in EU waters, necessitating the use of lubricants compatible with low-sulfur fuels.

- REACH Regulation (EC 1907/2006) : Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) ensures the safe use of chemical substances, including those used in marine lubricants. Manufacturers must provide detailed information on the properties and safe use of their substances.

- U.S. Environmental Protection Agency (EPA) Regulations: The EPA enforces regulations to protect the environment and public health:

- Vessel General Permit (VGP) : This permit regulates discharges incidental to the normal operation of vessels. It includes requirements for the use of environmentally acceptable lubricants (EALs) in oil-to-sea interfaces unless technically infeasible.

Key Industry Trends:

- The global marine lubricants market is growing due to increased trade and stricter environmental regulations. Advanced greases and fluids are crucial, reducing friction and enhancing performance under extreme conditions. These lubricants improve fuel efficiency, lower maintenance costs, and extend service intervals. New formulations with synthetic base oils and advanced additives reduce greenhouse gas emissions by 2-3%, addressing both technological and environmental needs.

- According to data from the United Nations Conference on Trade and Development (UNCTAD) , the global fleet of container ships expanded from over 6, 000 in 2015 to over 8, 000 in 2021. Similarly, the overall dry bulk carrier fleet has increased from approximately 8, 400 ships in 2015 to more than 11, 500 vessels by 2021.

- Stringent global fuel efficiency and emission norms, particularly from the IMO, are reshaping the marine lubricants market. Regulations like EEDI and SEEMP require ships to use low sulfur fuels, prompting demand for advanced low viscosity lubricants that enhance efficiency and reduce friction. This shift drives research into bio-based and synthetic lubricants to cut greenhouse gas emissions and meet IMO's 2030 targets.

- For instance, TotalEnergies, a French multinational integrated energy and petroleum firm, works globally and engages in a variety of energy-related activities, including oil and gas exploration and production, power generating, transportation, refining, petroleum product marketing, and international crude oil and product trading. TotalEnergies created biodegradable Esterex RS marine cylinder oil using hydrotreated esters and fatty acids to achieve the same excellent performance as mineral oils. Such industry activities are anticipated to shape the progress of marine lubricant technology in the next few years.

Key Sources Referred

- United Nations Conference on Trade and Development (UNCTAD)

- United Nations Environment Program (UNEP)

- United States Department of Agriculture

- CIMAC

- The International Maritime Organization (IMO)

- Invest India

- Union Budget 2020-2021

- European Union (EU) Regulations

- United States Environmental Protection Agency (EPA) Regulations

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the marine lubricant market analysis from 2023 to 2033 to identify the prevailing marine lubricant market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the marine lubricant market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the Global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes analysis of the regional as well as Global marine lubricant market trends, key players, market segments, application areas, and market growth strategies.

Marine Lubricant Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.0 Billion |

| Growth Rate | CAGR of 3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Oil Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Royal Dutch Shell PLC, Exxon Mobil Corporation, Lukoil, TotalEnergies SE., Gulf Oil International Ltd, ENEOS Corporation, Sinopec Corp., Chevron Corporation, BP p.l.c., Repsol |

Loading Table Of Content...