Massive IoT Market Statistics, 2031

The global massive iot market size was valued at $71.1 billion in 2021, and is projected to reach $521.2 billion by 2031, growing at a CAGR of 22.5% from 2022 to 2031.

Rising popularity of NB-IoT (Narrowband-IoT) and LTE-M technologies and rapid advancement of 5G technology are driving the massive IoT market growth. In addition, the growing demand for industrial automation is fueling the growth of the massive IoT market. However, interoperability issues between number of IoT devices and high cost associated with implementation and maintenance of IoT platform limits the growth of this market. Conversely, the increasing rate in development of smart city initiatives are anticipated to provide numerous opportunities for the expansion of the market during the forecast period.

Massive IoT is a type of Internet of Things (IoT) deployment that involves the connection of a vast number of devices to the internet. These devices can range from sensors and smart home devices to industrial equipment and transportation systems, and are used to collect and transmit data that can be analyzed to optimize operations and improve efficiency. On the other hand, massive IoT is characterized by many connections such as small data volumes, infrequent transmissions, low-cost devices and stringent requirements on energy consumption.

The report focuses on growth prospects, restraints, and analysis of the global massive IoT market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global massive IoT market share.

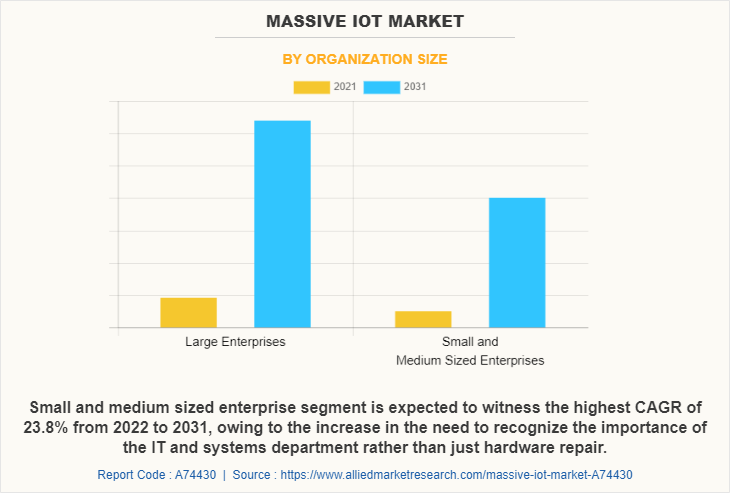

The global massive IoT market analysis is segmented into component, organization size, platform, industry verticals, and region. Depending on the component, the market is divided into solutions and services. Based on organization size, it is categorized into large enterprises and small-& medium size enterprises (SMEs). By industry vertical, it is divided into retail, e-commerce, & consumer electronics, energy & utility, healthcare, transportation & logistics, it & telecom, manufacturing and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on the organization size, the large enterprise segment dominated the massive IoT market share in 2022 and is expected to continue this trend during the forecast period, due to their ability to invest significant resources in research and development, manufacturing, and marketing. However, the small-& medium size enterprises (SMEs) segment is expected to witness significant growth in the upcoming years, SMEs are often more agile than larger enterprises, allowing them to quickly adapt to changing market conditions and take advantage of new opportunities.

Region-wise, the massive market was dominated by North America in 2021 and is expected to retain its position during the forecast period, as it is considered home to many large technology companies that are heavily involved in IoT development and deployment, such as Microsoft, Amazon, and Google, these companies have significant resources and expertise to invest in the massive IoT industry, which is the driving factor in the region. However, Asia Pacific is expected to witness significant growth during the forecast period, as the region is experiencing rapid economic development, with many countries in the region rapidly industrializing and urbanizing. Thus, these factors are expected to witness considerable growth during the forecast period.

The global massive IoT industry is dominated by key players such as Cisco Systems, Inc., Ericsson, Google LLC (Alphabet), Huawei Technologies Co., Ltd., IBM Corporation, Intel Corporation, Microsoft Corporation, Qualcomm Technologies Inc., SAP SE, Verizon Communications Inc., ScienceSoft USA Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Top Impacting Factors -

Rising popularity of NB-IoT (Narrowband-IoT) and LTE-M technologies

Rising trend of NB-IoT and LTE-M is driving the growth of massive IoT market, as both of these technologies are cellular IoT technologies designed to provide low-power, wide-area (LPWA) connectivity for IoT devices. Additionally, in order to meet the rising demand for LPWA connectivity, telecommunications providers globally are expanding the NB-IoT networks. For instance, according to the Global Mobile Suppliers Association (GSA) in February 2022, in 64 countries, 140 operators have established and launched NB-IoT or perhaps the competing LTE-M network. This expansion enables NB-IoT more accessible for businesses which are looking to implement Massive IoT solutions. Several telecommunication businesses and government sectors around the globe are adopting various strategies to develop NB-IoT solutions for massive IoT transformation.

For instance, in December 2020, India's government-run telecom company, BSNL partnered with Skylotech India, through this alliance companies have launched a satellite-based "Narrow Band-Internet of Things" (NB-IoT). With this solution, India will now have access to a widespread network of connection for millions of machines, sensors, and industrial IoT devices of unconnected machines. Thus, such developments further likely to contribute to the growth of massive IoT market globally.

Furthermore, NB-IoT and LTE-M is being increasingly adopted in industrial IoT applications, such as asset tracking and predictive maintenance. The technology is highly suitable for these types of applications due to its low power consumption, extended battery life, and consistent communication. For instance, in August 2020, ABI Research, a tech consultancy company, surveyed 43 leading manufacturers and discovered that 82 percent of its asset monitoring systems include cellular LPWA connection. It is stated that both NB-IoT and LTE-M deployments on LTE-based and 5G-compatible networks have increased, with 154 networks currently operating one or the other. Therefore, such advancements in manufacturing industries further expected to contribute in driving growth of massive IoT market on the global scale.

Rapid Advancement of 5G Technology

The rapid development of 5G technology is anticipated to fuel the massive IoT market by enabling the creation of new IoT applications and services that were not feasible with earlier generations of wireless technology. Additionally, IoT devices will be able to analyses and transmit massive volumes of data in real time due to 5G technology's faster data transfer speeds and lower latency. This in turn, will allow for the development of new solutions in fields like remote healthcare, smart cities, and driverless cars.

In addition, the increasing demand of autonomous cars is expected to drive the use of 5G technology, as 5G technology can enable communication between autonomous cars and infrastructure, such as traffic lights and road signs, enabling real-time traffic management and improved safety. For instance, according to the McKinsey report published in 2020, the complete adoption of autonomous cars in the U.S. alone will provide $800 million in annual public benefits by 2030. Which includes the rehabilitation of unused parking spaces, reduced commute time for employees, reduced environmental impact, and safer streets. Thus, such factors are expected to drive the massive IoT by accelerating the development and adoption of IoT technologies that enable autonomous driving, and by creating new opportunities for innovation in the IoT industry.

Furthermore, many governments around the globe are accelerating the usage of 5G technology in their countries by implementing policies and initiatives to promote the deployment of 5G infrastructure and services. For instance, in August 2022, Government of India offered the use of 5G Test Bed free of cost for start-ups and MSMEs over the next six months until January 2023, with an objective of improving the 5G ecosystem in the country. Therefore, the deployment of 5G infrastructure is seen as a key motivator for the development of IoT technologies, which further expected to propel the driving need of massive IoT market globally.

Digital Capabilities

Massive IoT is highly relevant to advanced technologies such as Artificial intelligence (AI) & Machine Learning (ML) and Augmented reality (AR) and virtual reality (VR). As it enables the collection and analysis of large amounts of data from a wide variety of sources, which can then be used to optimize systems, improve efficiency, and enable new applications and services. Additionally, AI and ML technologies can be used to analyze the vast amounts of data generated by massive IoT networks, and derive insights and identify patterns that can be used to optimize the systems. For instance, AI and ML technologies is used to predict equipment failures before they occur, optimize energy usage in smart buildings, or enable personalized health monitoring and supervision. Moreover, by processing and analyzing data in real-time, AI and ML can also enable faster and more informed decision-making, and reduce the need for human intervention in many cases.

Furthermore, many technology organizations are taking different initiatives to support the digital generation, recognizing that digital transformation is critical for their long-term success. Companies such as Samsung, Google, and Amazon are continue innovating in cloud computing, artificial intelligence, and other digital technologies, and providing tools and platforms that enable other organizations to adopt these technologies. For instance, in March 2023, Samsung India launched ‘Samsung Innovation Campus’ Program, at the BNM Institute of Technology (BNMIT) in Bengaluru.

In addition, the program's goals are to encourage innovation, promote teamwork, and develop the next generation of engineers in emerging tech fields including AI, the IoT, big data, and coding & programming. Samsung's commitment to the government's Skill India project is strengthened by this initiative as part of its #PoweringDigitalIndia vision. Such innovations further expected to contribute to the growing adoption of AI & ML technologies in massive IoT market. As massive IoT networks continues to grow in size and complexity, AI and ML will become increasingly important in enabling organizations to derive value from the vast amounts of data generated by these networks.

End-User Adoption

The growing digitally enabled tools & services and the digital acceleration that organizations are experiencing is increasing end user focus on massive IoT. The rapid growth of digital technologies such as cloud computing, AI, and the IoT has created new opportunities for organizations to adopt massive IoT and gain a competitive advantage. For instance, according to the article published by Mckinsey, in July 2019, businesses that use IoT technologies have increased from 13% in 2014 to approximately 25% in current economy. Such factors further expected to help growing adoption of massive IoT to the end users. In addition, as the adoption of digital technologies continues to accelerate, end users are increasingly looking for ways to leverage these technologies to improve their operations and achieve the business objectives. Additionally, there are many industry applications of massive IoT such as smart city, agriculture, manufacturing, healthcare and others.

Furthermore, end users are increasingly investing in IoT technologies, particularly in the form of smart home devices, smart hospitality and others. For instance, in August 2022, Saudi Arabia’s sovereign wealth fund, Public Investment Fund (PIF) and UK-based investment firm, Cain International (Cain) have raised $900 million in hotelier company Aman Group, to assist in the brand's luxury hotel and branded residence global expansion. Similarly, in April 2022, Saudi Telecom Co., stc partnered with its largest shareholder, the Public Investment Fund, in a $131 million deal to further support internet-connected IoT devices. This brings key values needed in IoT networks such as automation, flexibility, faster time to market, managing complex networks, and better customer experience increasing the end-user experience.

Government Initiatives

Various companies and government bodies are investing to strengthen R&D in the various industry such as manufacturing, retail and healthcare with evolving productive alliances that lead to indigenous design, development, manufacturing, and deployment of cost-effective IoT products and solutions. For instance, in February 2019, The UK government raised $121.58 million investment in 'security by design' for all IoT devices used by organizations and individuals will support improvements in the security of hardware, chip devices, and IoT technologies. At the same time, the government also committed to spend an additional $37.47 million to protect the privacy and security of smart gadgets with internet access, 420 million of which will be installed in the UK over the forecast period. Thus, such investments in IoT technology can help governments improve the efficiency and effectiveness of public services, reduce costs, and enhance the quality of life for citizens.

Furthermore, there is growing investments by the government to develop and expand the internet connections and to support the 6G research. For instance, in November 2022, the government of Japan is investing $450 millions to support the research activities into future 6G communications systems. Prior to this statement, Japanese businesses NTT Docomo, NTT, NEC, Fujitsu, and Finnish telecom equipment manufacturer Nokia planned to conduct experimental trials of new mobile communications technology. Similarly, in March 2023, the Government of Canada raised almost $1.74 millions in combined federal-provincial funding for Cogeco Connexion, to provide Campbellville, Ontario, with high-speed internet connection for just under 300 houses. Therefore, such increasing rate of investments by several governments further expected to propels the market growth.0

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global massive IoT market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global massive IoT trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2022 to 2031 is provided to determine the market potential.

Massive IoT Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 521.2 billion |

| Growth Rate | CAGR of 22.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 353 |

| By Platform |

|

| By Component |

|

| By Industry Vertical |

|

| By Organization Size |

|

| By Region |

|

| Key Market Players | Intel Corporation, Cisco Systems, Inc., Ericsson, Microsoft Corporation, Huawei Technologies Co., Ltd., Google LLC (Alphabet), ScienceSoft USA Corporation, SAP SE, IBM Corporation, Verizon Communications Inc., Qualcomm Technologies Inc. |

Analyst Review

Massive IoT refers to the large-scale deployment of interconnected devices, sensors, and machines that are designed to transmit data over the internet. These devices are typically low-cost, low-power devices that can be deployed in large numbers to collect and transmit data from a variety of sources. Additionally, industrial automation is the most prevalent application of massive IoT, allowing machines to communicate with one another without the need for human intervention. This allows companies to be able to remotely handle large machinery or automate repetitive operations.

Key providers in the massive IoT market are Cisco Systems, Inc., Ericsson and Google LLC (Alphabet), With the growth in demand for massive IoT services, various companies have established partnerships to increase their solutions offerings in IoT enabled network. For instance, in January 2023, Cisco partnered with Energybox, providing sustainability solutions for multi-site businesses, including those with an emphasis on hospitality and retail, storage, commercial, and healthcare facilities. Such strategic partnership further expected to drive the market growth.

In addition, with the surge in demand for massive IoT, various companies have expanded their current product portfolio to continue with the rising demand in the market. For instance, in November 2022, Ericsson’s in partnership with Thales, launched IoT Accelerator Device Connect, a service that provides generic eSIMs that have been separated from specific Service Providers. Enterprises speed to market for IoT implementations is significantly accelerated by this new business model.

For instance, in May 2022, Tech Mahindra partnered with Microsoft, to enable cloud-based 5G core network modernization for telecom operators globally. The development of 5G core use cases and fulfillment of the increasing technical demands of its consumers, including those related to edge computing, augmented reality, virtual reality, and VR, can be enabled by the 5G core network transition. This strategic partnership are expected to drive market growth.

The massive IoT market is estimated to grow at a CAGR of 22.5% from 2022 to 2031.

The massive IoT market is projected to reach $521.15 billion by 2031.

Rising popularity of NB-IoT (Narrowband-IoT) and LTE-M technologies, the rapid advancement of 5G technology, and growing demand for industrial automation contribute toward the growth of the market.

The key players profiled in the report include Cisco Systems, Inc., Ericsson, Google LLC (Alphabet), Huawei Technologies Co., Ltd., IBM Corporation, Intel Corporation, Microsoft Corporation, Qualcomm Technologies Inc., SAP SE, Verizon Communications Inc., ScienceSoft USA Corporation.

The key growth strategies of massive IoT market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...