Massive MIMO Market Research, 2032

The global massive MIMO market was valued at $2.9 billion in 2022 and is projected to reach $63.6 billion by 2032, growing at a CAGR of 36.5% from 2023 to 2032.

A massive MIMO network is more responsive to devices that operate in higher frequency bands due to improved coverage. This has considerable benefits for obtaining a strong signal indoors. The antennas in a massive MIMO industry also make it far more resistant to interference and intentional jamming than current systems that only utilize a handful of antennas. Therefore, the beam formation technology by massive MIMOs enables targeted use of the spectrum.

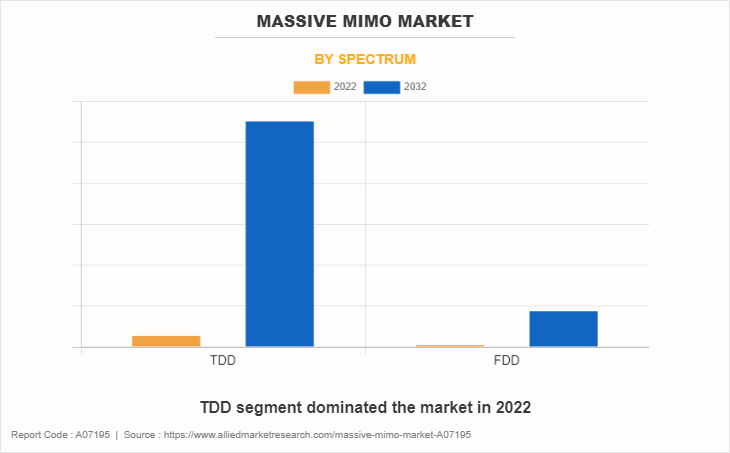

The global massive MIMO superiority is expected to register a significant growth rate during the forecast period, owing to the rise in adoption of 5G technology in developed and developing regions across the world, massive MIMO offers technical superiority with a higher number of antenna array type, and ease in deployment of massive MIMO 5G with reduced usage of energy. Furthermore, numerous advantages of massive MIMO such as higher capacity, minimized manpower, low network congestions, and beam-formation technology fuel the growth of the massive MIMO industry. However, the dominance of usage for the FDD spectrum globally in comparison to the TDD spectrum is expected to restrain the market growth. Moreover, potential of the emerging markets such as Asia-Pacific and Southeast Asia and the development of indoor massive MIMOs for increasing the network capacity is anticipated to provide lucrative global massive MIMO market opportunities for the market in the coming years.

The need for constant connectivity is also fueled by the technical advancements in network generations, from LTE to 5G. Market participants may still profit from 4G FDD networks while also improving the performance of 5G FDD networks owing to the deployment of massive multiple input multiple output in the networks. It is anticipated that throughout the forecast period. The massive MIMO market demand is anticipated to rise at the lead of telecom's increased attention on pushing 5G massive MIMO antenna during the forecast period.

Segment Review

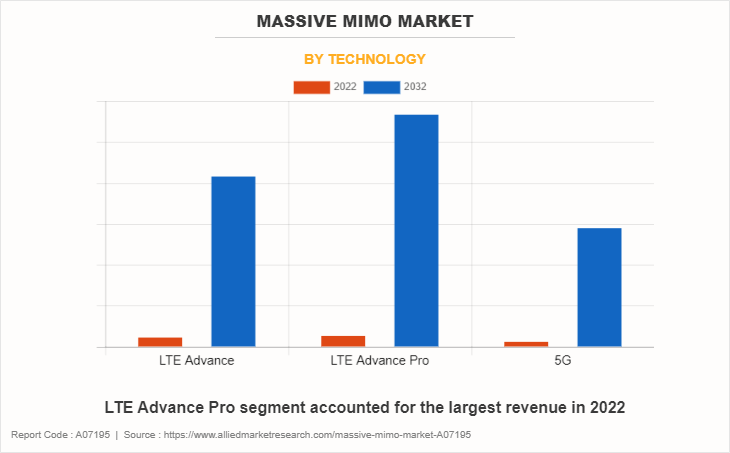

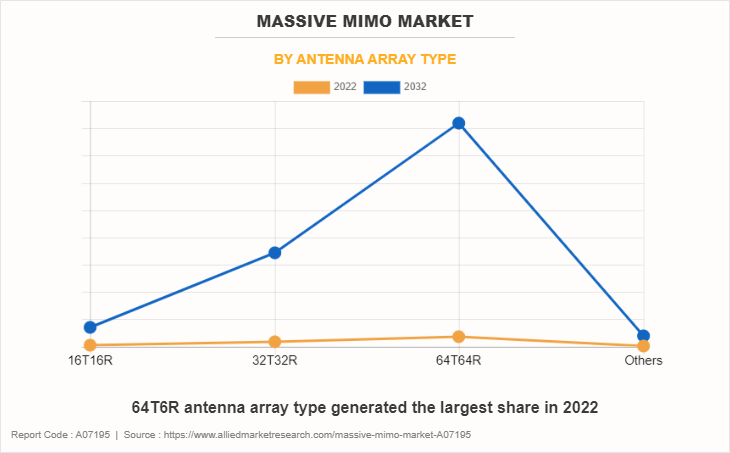

The massive MIMO market analysis is segmented into Technology, Antenna Array Type and Spectrum.

Based on the technology, the market is divided into LTE Advance, LTE Advance Pro, and 5G. LTE Advance Pro accounted for the largest share in 2022.

By antenna array type, the market is classified into 16T16R, 32T32R, 64T64R, and others. The 64T64R generated the largest revenue in 2022.

Based on spectrum, the market is bifurcated into TDD and FDD. The TDD segment garnered a significant market share in 2022.

Country Analysis

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country-wise, the U.S. acquired a prime share in the massive MIMO market in the North American region and it is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, the UK dominated the massive MIMO market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. However, Germany is expected to emerge as the fastest-growing country in Europe's surrounding massive MIMO market with a CAGR of 38.13%.

In Asia-Pacific, China, is expected to emerge as a significant market for the massive MIMO market industry, owing to a significant rise in investment by prime players due to the increase in growth of TDD spectrum massive MIMO in rural and urban regions.

In the LAMEA region, the Middle East garnered a significant market share in 2022. The LAMEA massive MIMO market has witnessed an improvement, owing to the growth in the inclination of prime vendors towards utilizing the massive MIMO across this region. Moreover, the Middle East region is expected to grow at a high CAGR of 36.22% from 2023 to 2032.

Competitive Analysis

Competitive analysis and profiles of the major global telecom network infrastructure market players that have been provided in the report include Nokia, ZTE Corporation, Deutsche Telekom AG, Samsung C&T Corporation, Telstra, Verizon, Telefonaktiebolaget LM Ericsson, Airtel, Huawei Technologies Co., Ltd., and CommScope Holdings. These key players adopt several strategies such as new product launch & development, acquisition, partnership & collaboration, and business expansion to increase the massive MIMO market share during the forecast period. These key players adopt several strategies such as new product launch & development, acquisition, partnership & collaboration, and business expansion to increase the massive MIMO market share during the forecast period.

Top Impacting Factors

The massive MIMO market is expected to witness notable growth, adoption of 5G network technology, and ease in deployment of massive MIMOs. Moreover, the development of indoor massive MIMO is expected to provide a massive MIMO market opportunity for the growth of the market during the forecast period. However, the lack of TDD spectrums around the world limits the growth of the massive MIMO market.

Historical Data & Information

The global massive MIMO market is highly competitive, owing to the strong presence of existing vendors. Vendors of the massive MIMO market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Nokia, ZTE Corporation, Deutsche Telekom AG, Samsung C&T Corporation, and Telstra. are the top companies holding a prime share in the telecom network infrastructure market. Top market players have adopted various strategies, such as product launches to expand their foothold in the massive MIMO marke growth.

In October 2023, Ericsson launched a software toolkit to strengthen 5G Standalone network capabilities and enable premium services with differentiated connectivity. The portfolio enhancement comes as the growth of new use cases and rising mobile user expectations on the quality of the 5G experience are putting greater demands on network capacity and performance.

In September 2021, Ericsson launched its Massive MIMO portfolio, such as the ultra-lightweight antenna-integrated radio AIR 3268, for easier and more efficient 5G mid-band deployments in dense urban and suburban areas.

In January 2023, Huawei deployed its third-generation 5G Massive MIMO outside China, with the Philippines being the first major recipient. The major product in the 5G RAN series, MetaAAU, achieves the best performance and lowest power consumption by applying a wide range of leading wireless technologies and represents a key path for evolution to a 5.5G network.

Key Benefits For Stakeholders

- This study comprises analytical depiction of the massive MIMO market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall massive MIMO analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current massive MIMO market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the massive MIMO.

- The report includes the market share of key vendors and massive MIMO market trends.

Massive MIMO Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 63.6 billion |

| Growth Rate | CAGR of 36.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 310 |

| By Technology |

|

| By Antenna Array Type |

|

| By Spectrum |

|

| By Region |

|

| Key Market Players | Huawei Technologies Co., Ltd., Deutsche Telekom AG, Telstra, Telefonaktiebolaget LM Ericsson, CommScope Holding Company, Inc., ZTE Corporation, Verizon, Nokia, Samsung C&T Corporation, Airtel India |

Analyst Review

The massive MIMO market is expected to leverage high potential for the TDD spectrum and FDD spectrum during the forecast period. A massive MIMO network is more responsive to devices which operates in higher frequency bands due to improved coverage. This has considerable benefits for obtaining a strong signal indoors. The greater number of antennas in a massive MIMO network also make it far more resistant to interference and intentional jamming than current systems that only utilize a handful of antennas. Therefore, the beam formation technology by massive MIMOs enables targeted use of spectrum.

The factors such as adoption of 5G network technology, technical advantages of massive MIMO, and ease in deployment boost the growth of the massive MIMO market. However, lack of usage of TDD spectrum across the world hampers the massive MIMO market growth. On the contrary, development of indoor massive MIMO is expected to create lucrative market opportunities.

As per the massive MIMO market trend, rise in adoption of 5G technology in developed and developing regions across the world, massive MIMO offers technical superiority with higher number of antenna array type, and ease in deployment of massive MIMOs with reduced usage of energy. Furthermore, numerous advantages of massive MIMO such as higher capacity, minimized manpower, low network congestions, and beam-formation technology fuel the growth of the massive MIMO market.

Key massive MIMO market leaders profiled in the report include Nokia, ZTE Corporation, Deutsche Telekom AG, Samsung C&T Corporation, Telstra, Verizon, Telefonaktiebolaget LM Ericsson, Airtel, Huawei Technologies Co., Ltd., and CommScope Holdings.

LTE advance Pro is the leading technology of massive MIMO market.

The upcoming trends of massive MIMO market includes adoption of 5G network technology and ease in deployment of massive MIMOs.

North America is the largest regional market for massive MIMO.

The massive MIMO market was valued at $2.9 Billion in 2022.

Nokia, ZTE Corporation, Deutsche Telekom AG, Samsung C&T Corporation, Telstra are the top companies to hold the market share in Massive MIMO.

Loading Table Of Content...

Loading Research Methodology...