Meat Substitute Market Research, 2035

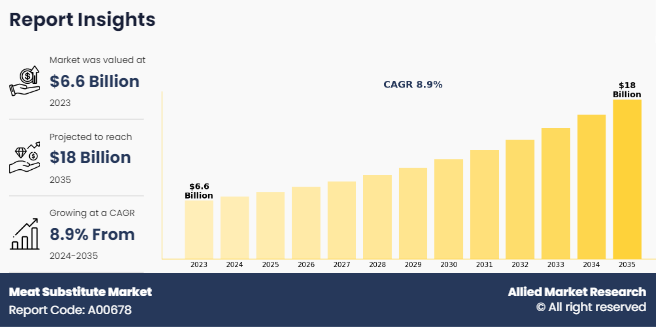

The global meat substitute market size was valued at $6.6 billion in 2023, and is projected to reach $18 billion by 2035, growing at a CAGR of 8.9% from 2024 to 2035. Meat substitutes are products designed to imitate the taste, texture, and appearance of traditional animal meats while being entirely plant-based or made up of alternative protein sources. These substitutes usually contain ingredients such as soy, wheat gluten, pea protein, or mycoprotein, which is derived from fungi like Quorn. Meat substitutes come in various forms, such as burgers, sausages, nuggets, and ground meat alternatives, providing consumers with familiar meal options without relying on animal products.

Key Takeaways

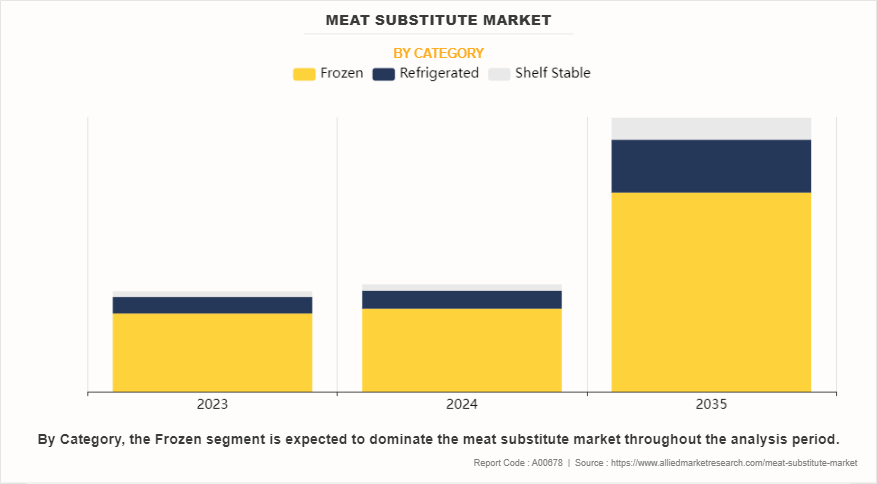

By category, the frozen segment was the highest revenue contributor to the market in 2023 and is expected to grow at a significant CAGR during the forecast period.

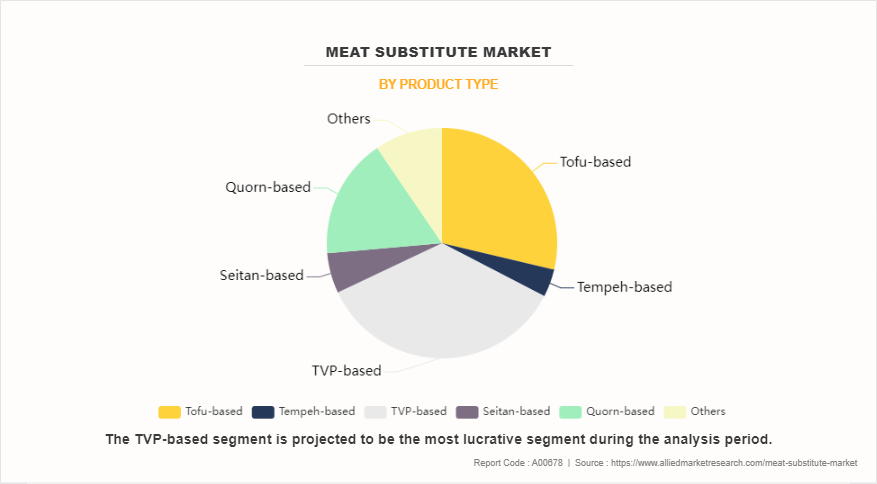

- By product type, the TVP-based segment was the highest revenue contributor to the meat substitute industry in 2023 and is expected to grow at a significant CAGR during the forecast period.

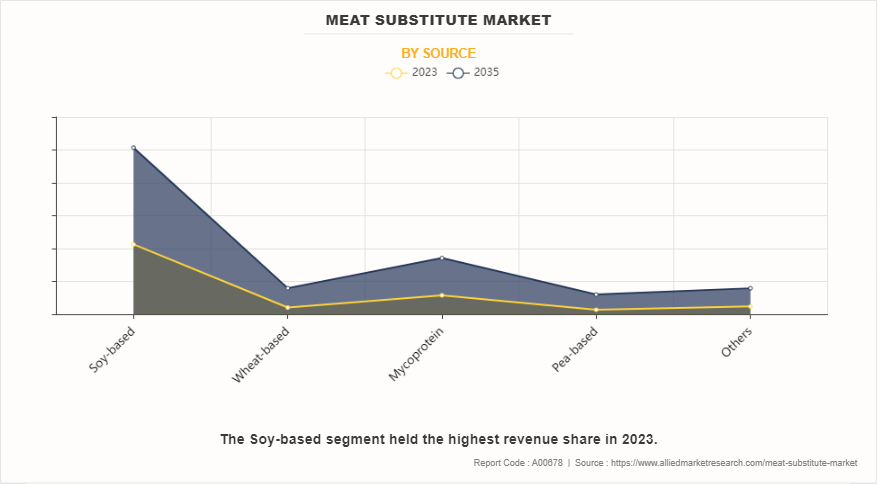

- By source, the soy-based segment was the highest revenue contributor to the market in 2023 and is expected to grow at a significant CAGR during the forecast period.

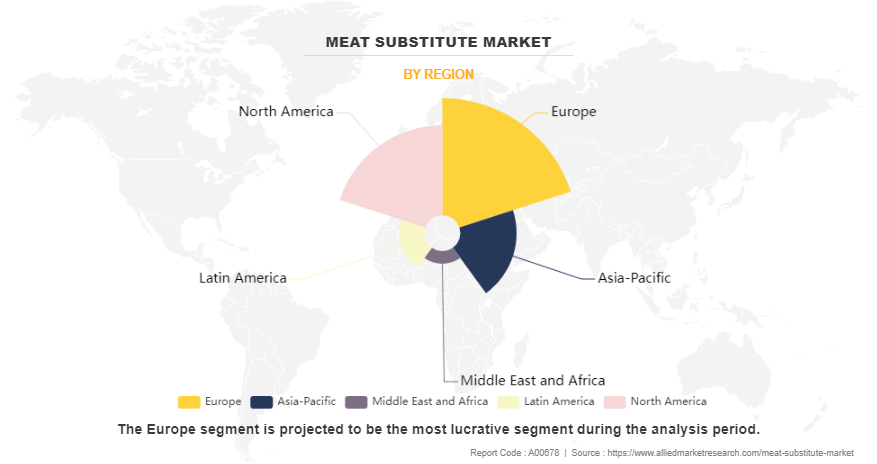

- By region, Europe was the highest revenue contributor to the market in 2023 and is expected to grow at a significant CAGR during the forecast period.

Market Dynamics

The meat substitute market is expanding rapidly due to the growing consumer demand for plant-based options. More people are becoming health-conscious and environmentally aware, which is driving them to seek alternatives to traditional meat products. Plant-based meat substitutes offer an attractive solution as they provide a source of protein without the associated health concerns of red and processed meats, such as cardiovascular diseases and certain cancers. Additionally, consumers are looking for more sustainable alternatives due to the environmental impact of meat production, including deforestation, water usage, and greenhouse gas emissions.

As consumer preferences shift towards plant-based diets, food companies are investing in research and development to create innovative plant-based products that closely mimic the taste, texture, and appearance of meat. This shift in demand has led to surge in sales for meat substitutes. The rise in adoption of plant-based diets drives the meat substitute market growth. Furthermore, the meat substitute market is experiencing rapid growth globally, due to rise in popularity of vegetarian and vegan diets.

In 2020, sales of plant-based foods in the U.S. alone amounted to $7 billion, according to reports from the Plant-Based Foods Association and The Good Food Institute. As more people adopt vegetarian and vegan diets for ethical, environmental, and health reasons, there is an ever-increasing demand for high-protein meat alternatives. This has spurred innovation and investment in the meat substitute market, leading to various plant-based options such as burgers, sausages, and meatless nuggets. As a result, the meat substitute market is thriving, catering to the preferences of a rapidly growing population that is focused on plant-based diets.

In addition, the meat substitute industry is experiencing significant growth with increase in the availability of meat alternatives in supermarkets and restaurants. To meet the rising demand for plant-based options, grocery stores and supermarkets are expanding their product offerings, dedicating more shelf space to meat substitutes, and partnering with manufacturers to introduce new products. Moreover, major restaurant chains are also adding plant-based options to their menus to cater to the growing number of consumers seeking meat-free alternatives.

The easy and wide availability of meat substitutes makes it easier for consumers to incorporate plant-based options into their diets, whether they are cooking at home or dining out. Consequently, more people are experimenting with meat substitutes and integrating them into their meals, contributing to the overall growth of the market. As consumer demand for plant-based options continues to rise, the wider availability of meat substitutes in both retail and food service channels is expected to drive the market expansion.

However, challenges in replicating the taste and texture of meat accurately pose a significant restraint on the market demand and growth of the meat substitute industry. Consumers often compare meat substitutes directly to real meat, expecting a similar sensory experience. If meat substitutes do not meet these expectations, it can lead to lower customer satisfaction and repeat purchase rates. Furthermore, the perception of inferior taste or texture may discourage some consumers from embracing meat substitutes as viable alternatives to meat.

In addition, collaborating with fast-food chains to offer plant-based menu options presents a significant opportunity in the meat substitute market. As consumers increasingly seek healthier and more sustainable dining choices, fast-food restaurants recognize the importance of catering to this growing demand. By partnering with meat substitute manufacturers, fast-food chains can expand their menu offerings to include plant-based alternatives to traditional meat-based items like burgers, nuggets, and sandwiches.

In 2019, Burger King joined hands with Impossible Foods to launch the Impossible Whopper, which is a plant-based version of their signature burger. This partnership was very successful, as Burger King saw a considerable increase in foot traffic and sales after introducing the Impossible Whopper. Such collaborations not only expand the reach of meat substitute products but also contribute to changing consumer perceptions and behaviors, ultimately fueling further innovation and investment in the meat substitute market.

Segments Overview

The meat substitute industry is segmented on the basis of product type, source, category, and region. By product type, it is classified into tofu-based, tempeh-based, TVP-based, seitan–based, Quorn-based, and others. By source, it is divided into soy-based, wheat-based, mycoprotein, pea-based, and others. By category, it is categorized into frozen, refrigerated, and shelf stable. By region, it is studied across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

By Category

By category, the frozen segment accounted for a major meat substitute market share in 2023 and is expected to maintain its dominance during the forecast period. Frozen products are becoming more and more popular among busy consumers who are looking for quick and easy meal solutions with a longer shelf life. Frozen meat substitutes are particularly appealing as they retain their nutritional value and flavor during storage, ensuring consistent quality. The frozen segment of the meat substitute market offers a wide variety of options, including burgers, nuggets, and meatballs, catering to diverse consumer preferences. With the increasing popularity of plant-based diets and the growing demand for convenient food options, the frozen segment is experiencing significant growth.

By Product Type

By product type, the TVP-based segment gained a major share in the global market in 2023 and is expected to sustain its market share during the forecast period. TVP (Textured Vegetable Protein) is a protein-rich food source that is derived from soybeans. It is a cost-effective and versatile option for manufacturers. TVP can be easily flavored and textured to resemble different meat products, giving consumers a wide range of options. With the growing trend of plant-based diets and the demand for healthier meat replacement, the TVP-based segment is becoming increasingly popular in the meat substitute market. It provides a convenient and nutritious solution for those seeking to make healthier and more sustainable food choices.

By Source

By source, the soy-based segment held the major share in 2023 and is expected to maintain its dominance during the forecast period. Soy is a great source of protein and contains all the essential amino acids needed by the body, making it a perfect alternative to meat. Soy-based products are widely available and cost-effective, making them attractive to both manufacturers and consumers. Furthermore, soy-based meat substitutes are highly versatile and can be made into various forms, like burgers, sausages, and nuggets, providing consumers with a wide range of options. The popularity of plant-based diets and concerns about sustainability have led to an increase in demand for soy-based meat substitutes in the market.

By Region

By region, Europe dominated the meat substitute market in 2023 and is expected to remain dominant during the meat substitute market forecast period. Europe has a large and growing population of environmentally conscious consumers who are increasingly adopting plant-based diets for health and sustainability reasons. Additionally, government initiatives promoting sustainable food choices and reducing meat consumption further drive the demand for meat substitutes in the region. For instance, France passed legislation requiring that all school menus offer at least one vegetarian meal per week. Europe held the largest share of the meat substitute market due to its well-established food industry infrastructure, strong consumer awareness, and extensive availability of plant-based products across various retail channels.

Competitive Analysis

Major players such as Amy’s Kitchen, BeyondMeat, Cauldron Foods, and Garden Protein International, Inc. have adopted product approval, partnership, agreement, and acquisition as key developmental strategies to improve the product portfolio of the meat substitute market.

Recent Developments in the Meat Substitute Industry

In September 2023, House Food Groups Inc. completed the acquisition of Keystone Natural Holdings, LLC ("KNH"), a prominent manufacturer of tofu and plant-based foods in North America. This strategic move is aimed at facilitating the company's expansion in the U.S. and Europe, with tofu positioned as its flagship product.

In July 2023, Beyond Meat diversified its product range in Germany by introducing two new plant-based chicken-style offerings, such as Beyond Nuggets and Beyond Tenders. These products became available in over 1,600 REWE stores across Germany, enhancing Beyond Meat's presence in the European market.

In April 2023, Beyond Meat, renowned for its innovative plant-based meat alternatives, unveiled the launch of Beyond Pepperoni and Beyond Chicken Fillet. These additions to their product lineup followed the successful introduction of Beyond Steak, demonstrating the company's commitment to offering a diverse range of plant-based protein options.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the meat substitute market analysis from 2023 to 2035 to identify the prevailing meat substitute market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the meat substitute market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global meat substitute market trends, key players, market segments, application areas, and market growth strategies.

Meat Substitute Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 444 |

| By Category |

|

| By Product Type |

|

| By Source |

|

| By Region |

|

| Key Market Players | Beyond Meat, Inc., GARDEN PROTEIN INTERNATIONAL, INC., Kellogg Company, AMY’S KITCHEN, INC., MEATLESS B.V., Archer Daniels Midland Company, IMPOSSIBLE FOODS INC., MGP Ingredients, Inc., SONIC BIOCHEM EXTRACTIONS LTD., CAULDRON FOODS |

Analyst Review

According to the CXOs, the global meat substitute market has witnessed notable growth in the past few years. Developed markets, including North America and Europe, have witnessed a decline in per capita consumption of meats. However, the preference of consumers toward meat substitutes has increased considerably. Innovative product launches, such as artificial duck, beef, chicken, turkey, and other meats resembling real meats in terms of taste and texture, have not only gained popularity amongst vegan consumers but have also attracted more non-vegetarians.

Leading companies in the meat substitute market, such as Beyond Meat, Quorn Foods, Amy’s Kitchen, and others, have witnessed a double-digit growth in their business in the past few years. Moreover, other players operating in the fast-food industry, such as KFC, McDonald’s, Burger King, and others, are anticipated to strengthen their vegan food product line with artificial meat/meat substitute-based products to address the growing demand for vegetarian food. Players operating in the meat substitute market have focused on development and launch of highly innovative substitutes of chicken, beef, pork, turkey, and other meats to attract a greater number of customers. Moreover, innovative marketing and positioning strategies of players have helped to increase the overall market size.

The global meat substitute market size was valued at $6.6 billion in 2023, and is projected to reach $18 billion by 2035

The global Meat Substitute market is projected to grow at a compound annual growth rate of 8.9% from 2024 to 2035.

Major players such as Amy’s Kitchen, BeyondMeat, Cauldron Foods, and Garden Protein International, Inc. have adopted product approval, partnership, agreement, and acquisition as key developmental strategies to improve the product portfolio of the meat substitute market.

By region, Europe dominated the meat substitute market in 2023 and is expected to remain dominant during the meat substitute market forecast period.

Growing health consciousness and awareness of environmental impact, Rising adoption of vegetarian and flexitarian diets, Increasing concerns about animal welfare and ethical considerations

Loading Table Of Content...

Loading Research Methodology...