Medical Billing Outsourcing Market Research, 2033

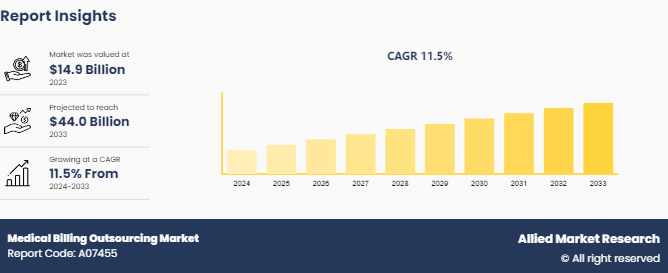

The global medical billing outsourcing market size was valued at $14.9 billion in 2023, and is projected to reach $44.0 billion by 2033, growing at a CAGR of 11.5% from 2024 to 2033. The growth of the medical billing outsourcing market is driven by an increase in complexity of healthcare billing processes, the rise in need to reduce operational costs, and the surge in focus on compliance with regulatory standards. Healthcare providers are increasingly outsourcing billing to specialized firms to improve efficiency, reduce errors, and focus more on patient care. In addition, the adoption of advanced technologies such as AI and automation in billing processes, along with the need for accurate and timely claims management, further propels the market growth.

Market Introduction and Definition

Medical billing outsourcing involves delegating the process of managing and submitting claims to insurance companies, as well as handling patient billing, to third-party service providers. Healthcare organizations, including hospitals, clinics, and private practices, often choose to outsource their medical billing to reduce administrative burdens and improve revenue cycle management. By outsourcing, healthcare providers can focus more on patient care, while the outsourced company ensures accurate and timely claim submissions, reduces billing errors, and manages denials effectively. This practice can lead to improved cash flow, reduced operational costs, and enhanced compliance with healthcare regulations.

In addition, outsourcing can provide access to specialized expertise and advanced billing technologies, which may not be available in-house. As the healthcare industry becomes more complex with evolving regulations and coding standards, medical billing outsourcing has become a strategic move for many healthcare providers seeking an efficient billing system.

Key Takeaways

- The medical billing outsourcing market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major medical billing outsourcing industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

According to medical billing outsourcing market forecast analysis the key factors driving the growth of the market are rising demand for healthcare services, growing focus on revenue cycle management optimization, and reduction in billing errors. As the geriatric population increases and the prevalence of chronic diseases surges, there is an increase in demand for healthcare services. According to Center of Disease Control and Prevention, about 139.8 million patient visited emergency department in 2021 in U.S. The rising demand for healthcare services puts pressure on healthcare providers to manage an increasing volume of patient information and billing processes efficiently.

However, handling these tasks in-house can be challenging and resource-intensive, leading many healthcare facilities to outsource their medical billing processes to specialized third-party service providers. Outsourcing allows healthcare providers to focus on core clinical activities while ensuring that billing is handled accurately, efficiently, and in compliance with regulatory requirements.

In addition, the increasing complexity of healthcare reimbursement processes, driven by frequent changes in regulations and coding standards, further propels the need for professional medical billing services. Thus, the rise in demand for healthcare services is expected to contribute significantly to the medical billing outsourcing market growth.

According to medical billing outsourcing market opportunity analysis the growing focus on revenue cycle management (RCM) optimization is a significant driver for the growth of the market. According to a 2023 article by the National Library of Medicine, healthcare providers use revenue cycle management (RCM) to track patient billing and revenue. Effective system integration improves revenue and financial stability. Healthcare providers are increasingly recognizing the importance of efficient RCM processes to maintain financial stability and ensure seamless operations.

Optimizing RCM involves streamlining billing processes, reducing errors, improving cash flow, and enhancing patient satisfaction. As the healthcare landscape becomes more complex, with evolving regulations and reimbursement models, many organizations are turning to outsourcing as a viable solution to manage these challenges effectively.

By outsourcing medical billing, healthcare providers can leverage the expertise of specialized firms that are equipped with advanced technology and industry knowledge, allowing them to focus on core medical services while ensuring accurate and timely billing. This shift toward RCM optimization not only reduces administrative burdens but also maximizes revenue collection. Thus, the growing focus on revenue cycle management (RCM) optimization is expected to contribute significantly to the medical billing outsourcing market size.

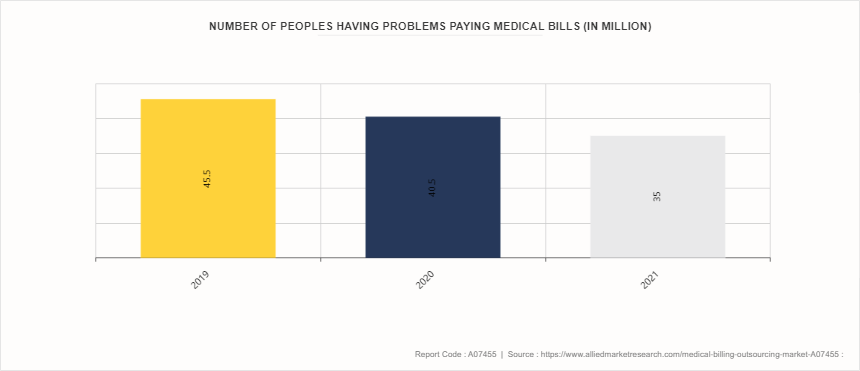

Number of Peoples Having Problems Paying Medical Bills

As the financial burden of medical expenses has become a critical concern for many, healthcare providers are increasingly turning to outsourcing services to manage billing processes more efficiently. This shift is evident in the declining number of people facing difficulties in paying medical bills, which dropped from 45.5 million in 2019 to 40.5 million in 2020, and further to 35 million in 2021. The adoption of medical billing outsourcing services has played a crucial role in this trend, as these services streamline billing operations, reduce errors, and ensure quicker processing of claims, easing the financial strain on patients. By leveraging specialized expertise and technology, medical billing outsourcing not only improves the financial health of healthcare providers but also enhances patient satisfaction by reducing the stress associated with billing issues. As more providers recognize these benefits, the demand for medical billing outsourcing services is expected to continue growing, further alleviating the challenges faced by patients in managing their medical expenses.

Market Segmentation

The medical billing outsourcing industry is segmented into service, end user, and region. By service, the market is classified into front end, middle end, and back end. By end user, it is segregated into hospitals, physicians’ office, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the medical billing outsourcing market share in 2023. The U.S. healthcare system is one of the most complex in the world, with a multitude of insurance plans, billing codes, and regulatory requirements. This complexity drives healthcare providers to outsource billing to specialized firms that can handle the intricacies of the process efficiently. In addition, Asia Pacific is witnessing rapid growth in healthcare infrastructure, driven by government investments and private sector participation. As the healthcare sector expands, there is an increasing need for efficient billing processes, which is fueling the demand for outsourcing services.

- According to 2021 National Health Statistics Reports, around 35 million people in U.S. faced problems paying medical bills.

- According to an article by U.S. Centers for Medicare & Medicaid Services, U.S. health care spending reached $4.5 trillion in 2022.

- According to Invest India, Healthcare industry in India is expected to grow at the CAGR of 18.24% from 2021 to 2027.

- According to article by Staffingly, Inc. a leading outsourcing services provider, India receives up to $30–40 million in outsourcing each year.

Industry Trends

- According to a 2021 article by QWAY Healthcare, leading healthcare software provide in U.S., the U.S. could face a labor shortage of around 3.2 million people for healthcare billing services by 2026.

- According to a 2023 article by Capline Healthcare Management, medical practices adopting outsourcing services noticed a 16.9% decrease in their billing-related costs.

- According to an article by Medical Group Management Association, 55% of healthcare practitioner reported that the patient volume has increased in 2022 as compared to 2021.

- According to an article by the U.S. Centers for Medicare & Medicaid Services, U.S. health care spending grew 4.1% in 2022.

Competitive Landscape

The major players operating in the medical billing outsourcing market include as R1RCM Inc. Veradigm, LLC, Oracle, eClinicalWorks Kareo, Inc., McKesson Corporation, Quest Diagnostics Incorporated, Promantra Inc., Cerner Corporation, Athenahealth, and AdvancedMD, Inc. Other players in the medical billing outsourcing market are Experian Information Solutions Inc., and Allscripts Healthcare Solutions Inc.

Recent Key Strategies and Developments

- In March 2022, Omega Healthcare, a prominent healthcare management services and solution firm, acquired Reventics, a revenue cycle management solution developer that delivers provider engagement solutions to increase physician reimbursement & compliance.

- In July 2021, R1 RCM Inc., a supplier of technology-driven solutions that enhance healthcare providers' patient experiences and financial performance, announced the completion of its purchase of VisitPay, a digital payment solution provider. The purchase integrates VisitPay's customer payments infrastructure with R1's leading patient access technology, allowing providers to offer their patients a smooth financial journey.

- In April 2021, Cerner Corporation completed its acquisition of Kantar Health, a Kantar Group company, for $375 Mn in cash, depending on adjustment. Kantar Health's extensive life sciences experience will be paired with Cerner's substantial library of real-world data (RWD) & technology, with the goal of accelerating innovation and development in life sciences research and improving patient outcomes globally.

- In March 2021, eClinicalWorks, a pioneer in healthcare IT solutions, announced that Soma Medical Center, P.A., which provides a comprehensive range of medical services to families in Palm Beach County, Florida, has deployed its integrated cloud platform and services for its 50+ providers. Soma Medical Center's clinicians now have more efficient methods to communicate with patients and their families due to eClinicalWorks' patient engagement and automation solutions, which help to ensure that therapy is delivered consistently. Since eClinicalWorks EMR is cloud-based, Soma Medical Center can keep practice and patient data secure and accessible in every scenario.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical billing outsourcing market analysis from 2024 to 2033 to identify the prevailing medical billing outsourcing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical billing outsourcing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical billing outsourcing market trends, key players, market segments, application areas, and market growth strategies.

Medical Billing Outsourcing Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 44.0 Billion |

| Growth Rate | CAGR of 11.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Service |

|

| By End User |

|

| By Region |

|

| Key Market Players | Athenahealth, McKesson Corporation, Quest Diagnostics Incorporated, Cerner Corporation, Promantra Inc, eClinicalWorks Kareo, Inc, R1RCM Inc, AdvancedMD, Inc., Oracle, Veradigm, LLC |

The global medical billing outsourcing market size was valued at $14.9 billion in 2023

The market value of Medical Billing Outsourcing Market is projected to reach $44.0 billion by 2033

The forecast period for Medical Billing Outsourcing Market is 2024-2033.

Major key players that operate in the Medical Billing Outsourcing Market are R1RCM Inc. Veradigm, LLC, Oracle, and Quest Diagnostics Incorporated

The base year is 2023 in Medical Billing Outsourcing Market

Loading Table Of Content...