Medical Courier Market Insights, 2032

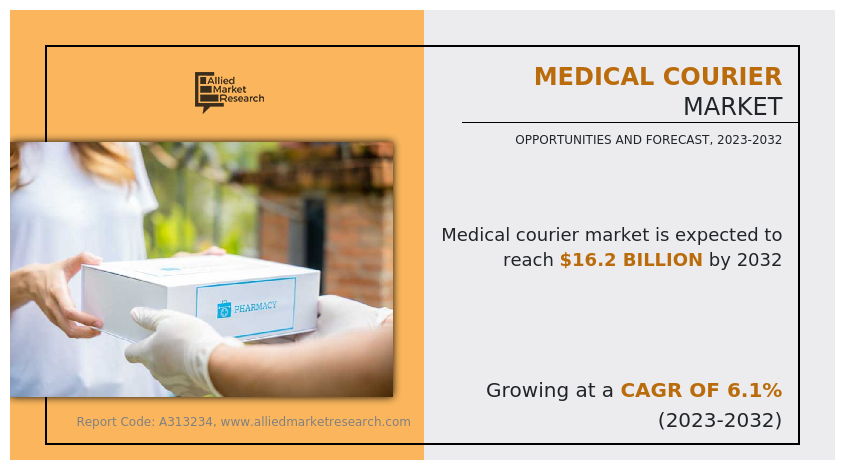

The global medical courier market size was valued at $9277.34 million in 2022, and is projected to reach $16237.27 million by 2032, registering a CAGR of 6.42% from 2023 to 2032.

Report Key Highlighters:

The global medical courier market report covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The global medical courier market share is highly fragmented, into several players including Affordable Courier Solutions, Inc., Aylesford Couriers, CitySprint (UK) Ltd, IntelliQuick Delivery, Inc., Blaze Express Courier Service, Cencora, Inc., DHL International GmbH, FedEx Corporation., MNX, Reliant Couriers & Haulage Ltd.

The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

A medical courier provides a secure transport service for vital medical and healthcare materials, encompassing the urgent delivery of medical equipment, samples, and specimens such as urine, blood, organs, and tissues for transplant. These couriers undergo routine testing and possess specialized knowledge for the secure handling and transportation of medical specimens. This involves compliance with CAP and HIPAA standards, emphasizing the crucial elements of maintaining medical specimens at the right temperatures, minimizing transport durations, ensuring a secure chain of custody, and protecting private health information.

Factors such as the development of the e-commerce industry, rise in trade-related agreements, and increase in demand for the fast delivery of packages supplement the growth of the market. However, poor infrastructure and higher logistics costs and lack of control of manufacturers on logistics services are the factors expected to hamper the growth of the market. In addition, technological advancements in delivery services and emergence of last-mile deliveries coupled with logistics automation create market opportunities for the key players operating in the market.

The medical courier industry is experiencing growth owing to growth of pharmaceutical sector, increase in international trade activities. In addition, poor infrastructure and higher logistics cost acts as a restraint on market expansion. However, the growing demand for temperature sensitive pharmaceutical drugs is creating opportunities for market growth.

The Latin America medical courier market analysis is divided based on service type, product type, end users and region. Service type include domestic and international. Product type encompass medical supplies and equipment, lab specimens, medical notes and others. By End Users the market is segmented into hospital and clinics, diagnostic labs, blood and tissue banks, pharmacy, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Development of E-Commerce Industry:

E-commerce is a virtual store where goods & services do not need any physical space and are sold through websites. Although the e-commerce industry utilizes courier, services to manage and oversee the supply chain of e-commerce companies. Moreover, easy availability, convenient shopping experiences, and heavy discounts, offers & deals make e-commerce a popular medium for purchasing various medical products. These factors have collectively contributed to the growth of the medical courier industry for e-commerce services. Furthermore, rising cross-border trade channels have boosted international trade, especially in developing nations.

Growth in Pharmaceutical Sector:

Pharmaceuticals manufacturers increasingly focus on product quality and sensitivity as it is one of the major demand in medical courier. Factors such as development of complex biological-based medicines and shipments of hormone treatments, vaccines, and complex proteins that require specific result in need of special transportation and warehousing. Temperature controlled logistics of pharmaceutical products and medical devices is the significantly growing part of the healthcare logistics industry. Moreover, the increase in need for effective cold chain logistics services to maintain the quality of goods fuels the growth of the medical courier market.

Poor Infrastructure and Higher Logistics Costs:

An efficient pharmaceutical logistics ecosystem demands sophisticated infrastructure, a well-organized supply chain, and trade facilitation policies. Without these, logistics firms have to invest in building more stock reserves and working capital, which can strongly affect national and regional competitiveness due to high financial costs. In addition, lack of infrastructure development in various nations hinders logistics, as it increases costs and reduces supply chain reliability are the growing opportunities in medical courier industry. Factors such as inefficiencies in transport management systems, poor condition of storage infrastructure, complex tax structure, low rate of technology adoption in the logistics sector, and low proficiency of logistics professionals in using digitalization tools hamper the pace and productivity of medical courier companies.

Emergence of Last-Mile Deliveries Coupled with Logistics Automation:

Last mile logistics refers to the final step of the delivery process from a distribution center or facility to the end user. With the continuously increasing proliferation of e-commerce companies, the provision of efficient last-mile deliveries is witnessing a significant upswing in the medical courier market. Predictive route planning and optimization are pivotal in the medical courier industry. Moreover, rising pharmaceuticals e-commerce industries are also witnessing a greater emphasis on last mile delivery options across the medical courier industry.

The rapid growth of the e-commerce sector in countries such as U.S., Canada and others is the primary driver for the growth of the medical courier. With the growth of the e-commerce sector in the U.S., start-ups related to on-demand and cloud-based warehousing, such as Stord, Flexe, and Flowspace, are gaining popularity. These companies are also being awarded long-term projects by their customers and some companies also offer fulfilment services. For instance, in December 2020, Flexe, an on-demand warehousing and technology platform used by retailers, such as Walmart, has raised $70 million in funding to make logistics networks more elastic in the U.S. The funding comes amid an e-commerce boom that has led the U.S. digital sales to jump by 30% in 2020.

In addition, increasing cross-border trade & transportation activity in the country is the primary factor driving the growth of the market in country such as Canada. In addition, the Canadian government is investing heavily to strengthen transportation infrastructure in the country as well as launching various trade & transportation initiatives, further propelling the market growth. For instance, in 2019, the Canadian government invested $2.1 billion for the Trade and Transportation Corridors Initiative (TTCI) to build stronger, more efficient transportation corridors to international markets. The core element of the TTCI is the merit-based National Trade Corridors Fund (NTCF) which will provide $2 billion over 11 years to strengthen Canada’s trade infrastructure, including ports, waterways, airports, roads, bridges, border crossings, rail networks, and interconnectivity between them.

Augmented global trade and strong economic environment predominantly drive the market in Europe. In addition, increasing trade activities between Europe and the Americas are driving the growth of the market in this region. Moreover, growth in express and small parcels deliveries due to structural shift toward online retail is expected to offer lucrative growth opportunities for the market in Europe. For instance, in November 2020, South Korea-based real estate investment company, Vestas Investment formed $272 million blind fund for logistics centres in Europe amid growing demand for online e-commerce.

Rising demand for cold chain logistics and intra-logistics services is expected to drive the market growth in countries of Latin America. Moreover, development of the e-commerce industry and increase in reverse logistics operations boost the market growth. For instance, in 2017, United Parcel Service (UPS), a logistics company, opened up a new, 76,000 square-foot healthcare facility in Bogtota, Colombia. This facility is geared toward helping pharmaceutical, biopharma, and medical device companies with their supply chains and intra-transport. The facility comprises state-of-the-art technology for storing temperature-sensitive healthcare products and offers best-in-class distribution services & warehouse management.

Key Developments in Medical Courier Industry

In September 2022, The German parcel delivery company DHL acquired a majority stake in the Dutch order processor Monta. Monta supplies, among other things, software for warehouse management and order processing for small and medium-sized web shops.

In June 2022, DHL Parcel UK announced a new partnership with ZigZag, the technology platform specializing in ecommerce returns. ZigZag’s network of over 100 retailers, including Selfridges, GAP and Superdry, will now have access to DHL’s Just Right Returns service, a fast, convenient and high-quality returns solution.

In July 2021, Deutsche Post DHL Group has opened an approximately 32,000-square-meter logistics center in Florstadt, Germany, located 35 kilometers north of Frankfurt, Germany. The new building expands the current capacity of the multi-user campus for pharmaceuticals and medical products in Florstadt to over 70,000 square meters in total and will service markets across Europe.

In December 2020, Deutsche Post AG (DHL Group) entered into a strategic partnership with UK logistics provider Baxter Freight for freight transport in the UK and between the UK and continental Europe. DHL customers will benefit from Baxter’s wide network and transport capacities in the UK.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the analysis from 2022 to 2032 to identify the prevailing medical courier market trends and opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Medical Courier Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 16.2 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 298 |

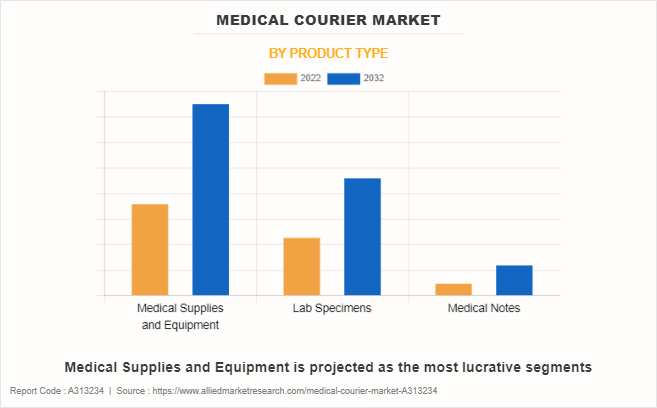

| By Product Type |

|

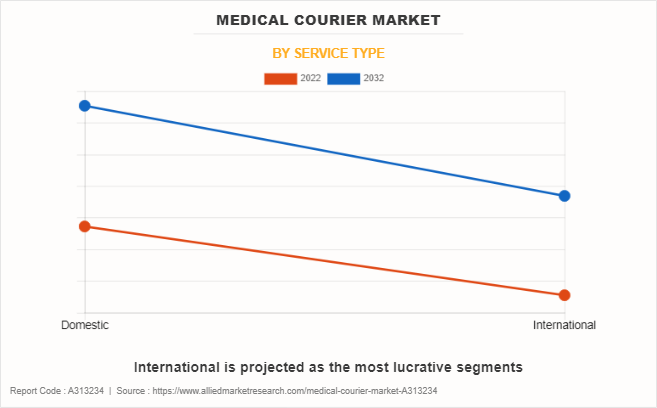

| By Service Type |

|

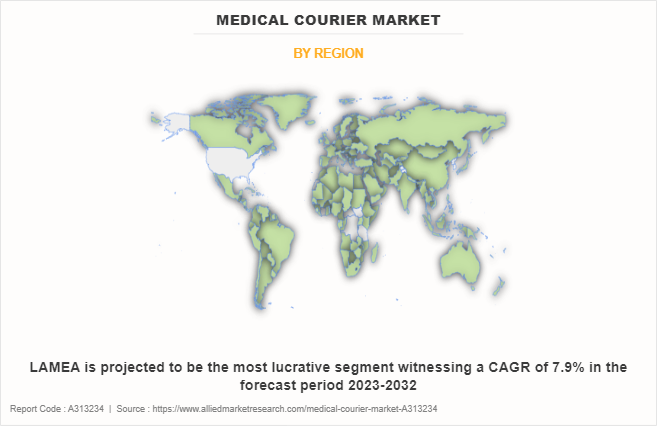

| By Region |

|

| Key Market Players | FedEx Corporation, Reliant Couriers & Haulage Ltd, CitySprint (UK) Ltd, Blaze Express Courier Service, Aylesford Couriers, MNX, DHL International GmbH, Cencora, Inc., intelliquick delivery, inc., Affordable Courier Solutions, Inc. |

Domestic is the leading application of Medical Courier Market.

Asia-Pacific is the largest regional market for Medical Courier.

$9 billion is the estimated industry size of Medical Courier.

DHL is the top companies to hold the market share in Medical Courier

Medical Supplies And Equipment is the upcoming trends of Medical Courier Market in the world.

Loading Table Of Content...

Loading Research Methodology...