Medical Device Analytical Testing Outsourcing Market Research, 2031

The global medical device analytical testing outsourcing market size was valued at $4,744.84 million in 2021 and is estimated to reach $7,956.99 million by 2031, growing at a CAGR of 5.3% from 2022 to 2031.Outsourcing analytical testing for medical devices helps in monitoring and maintaining the equipment's performance, accuracy, and precision. A medical device manufactures outsources the medical devices testing as part of a quality control process. This testing includes a complete analysis, assessment, and evaluation of the device to checks that medical devices works properly and is it fit for practical usage. Analytical testing for medical devices includes physical testing, bioburden testing, extractables & leachable testing and others which are used for cardiovascular devices, orthopedic devices, and many others.

“The medical device analytical testing outsourcing market was decreased during the lockdown period owing to decrease in demand for medical devices due to pandemic. Disruption in the supply of medical device, raw materials and finished products this had led to negatively impact on market growth during covid-19”

Historical Overview

The market was analyzed qualitatively and quantitatively from 2021-2031. The medical device analytical testing outsourcing market size will grow at a highest CAGR from 2022-2031. Most of the growth during this period was derived from the Asia-Pacific owing to the rise in health awareness, rise in disposable incomes, as well as well-established presence of domestic companies in the region.

Market Dynamics

Growth & innovations in the pharmaceutical industry for the manufacturing of medical devices owing to rise in prevalence of chronic diseases. Rise in adoption of strategies such as acquisition by various key players across the globe to expand the business is set to affect the medical device analytical testing outsourcing market growth positively. For instance, in March 2022, Pace Analytical Services a division of Pace Science and Technology Company announced the acquisition of Specified Testing Laboratories, LLC. This acquisition gives Pace customers in New York and surrounding states multiple opportunities for analytical and environmental testing services.

The growth of the medical device analytical testing outsourcing market is expected to be driven by high potential in untapped, emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs, and surge in demand for medical devices. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure, and development of the medical tourism industry in emerging countries.

The demand for medical device analytical testing outsourcing is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the medical device analytical testing outsourcing market. Factors such as availability of professional outsourcing organizations that meet the regulatory criteria and rise in demand for aesthetic procedures which further requires the medical devices are the factors responsible for the growth of the market. Moreover, high adoption of cardiac devices such as cardiac stents, IV kits, and knee implants due to rise in incidence of cardiovascular diseases this has led to rise in adoption of medical devices analytical testing services. Furthermore, increase in preference of medical device manufactures for subcontracting the analytical testing services further supports the market growth. In contrast late approvals for medical devices due to lengthy procedure and requires longer time may hamper the medical device analytical testing outsourcing market growth.

The pandemic rendered a significant impact on the medical device testing. Due to the Covid-19 induced lockdown and social distancing norms, the clinics had to shut down their operations for a moderate period of time. However, As the pandemic situation improved with time, the demand for medical devices analytical testing and their services resumed. Due to COVID-19, a restriction to the use of medical devices, the most of surgeries have stopped. This crisis has caused a delay in many aesthetic operations, the majority of which are cosmetic surgeries including liposuction, breast implantation, and elective dental procedures led to decrease in demand for medical devices which negatively impacted on medical device analytical testing outsourcing market growth. Hospitals have delayed or cancelled the several elective procedures, particularly those thought to be non-essential or non-urgent, in order to make room for patients receiving treatment for the virus.

Although the pandemic had a largely negative influence in many areas. For example, the MedTech industry has seen ups and downs during the crisis. Medical device manufacturers are not immune to the pandemic's consequences. Medical device makers, like pharmaceutical companies, rely significantly on healthcare organizations to collect data from clinical studies which further requires more time for approval due to pandemic also hamper the medical device analytical testing outsourcing market growth. Medical device firms find it difficult to decide on their products, supply networks, and regulatory duties in the face of uncertainty as the COVID-19 epidemic persists.

Segments Overview

The medical device analytical testing outsourcing industry is segmented into service, end user and region. By service, the market is categorized into physical testing, bioburden testing, sterility testing, and others. On the basis of end user, the market is segregated into medical device manufacturer and pharmaceutical companies. Region wise, the medical device analytical testing outsourcing market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

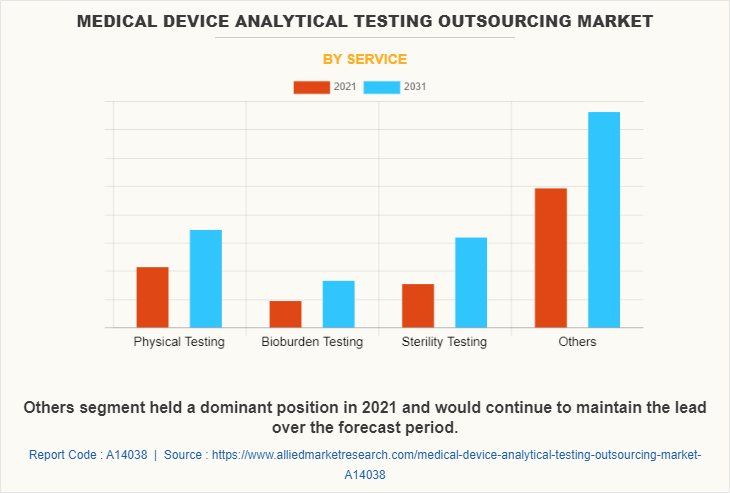

By Service

By service the medical device analytical testing outsourcing market is segmented into physical testing, bioburden testing, sterility testing, and others. The others segment further includes material characterization, extractable & leachable, electron microprobe and SEM analytical services. The others segment dominated the global share in 2021 and is expected to remain dominant throughout the medical device analytical testing outsourcing market forecast period, owing to strict guidelines regarding the medical devices for analytical testing increases the demand for several medical devices testing. For instance, the Food and Drug Administration has stated that all medical devices must follow the strict guidelines regarding extractables and leachable for medical devices. However, the sterility testing segment is projected to register highest CAGR during the forecast period. This is attributed to high adoption of sterility testing for medical devices due to strict government guidelines.

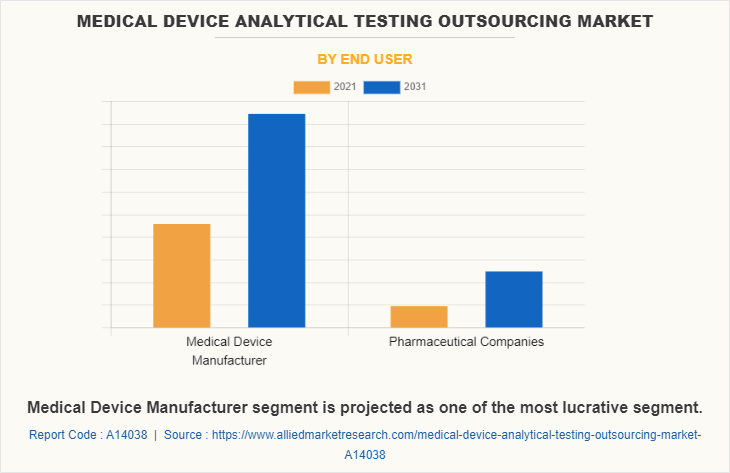

By End User

By end user medical device analytical testing outsourcing market is segregated into medical device manufacturer and pharmaceutical companies. The medical device manufacturer segment dominated the global market in 2021 and is anticipated to continue this trend during the forecast period. This was attributed to rise in medical device manufactures companies led to increases the adoption of analytical testing services for testing the medical devices.

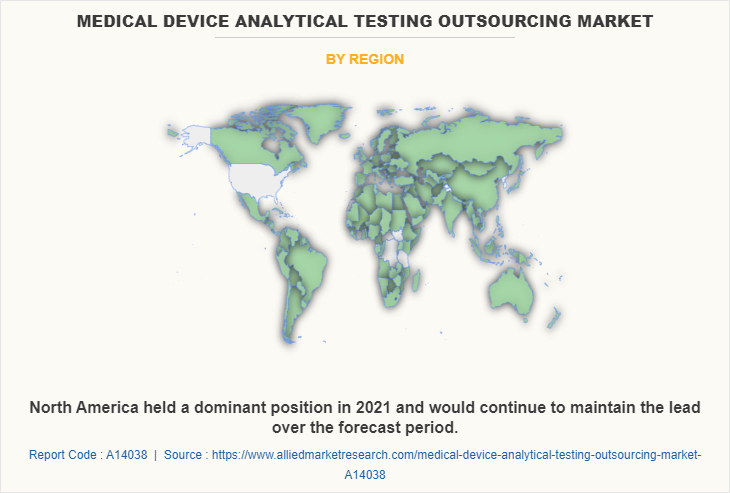

By Region

By region the medical device analytical testing outsourcing market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major market share in 2021 and is expected to maintain its dominance during the forecast period.

Presence of several major players, such as Pace Analytical, North American Science Associates, LLC, Charles River Laboratories International, Inc., The Smithers Group Inc. and advancement in technology for medical device analytical testing in the region drive the growth of the medical device analytical testing outsourcing market. Furthermore, presence of well-established healthcare infrastructure, high purchasing power for medical devices, and rise in development of modern technology devices such as surgical microscopes, surgical robots, neurological devices, and ophthalmic surgical devices are needed for the analytical testing, which are expected to drive the market growth.

Furthermore, acquisitions and integration adopted by the key players in this region boost the growth of the medical device analytical testing outsourcing market. For instance, in August 2022, Pace Life Sciences, LLC, a full-service contract development and manufacturing organization (CDMO) and division of Pace Science and Technology Company, announced that it has acquired Meridian BioGroup (Meridian). This acquisition helps them to develop and maintain biopharmaceutical operations and quality management systems that meet regulatory requirements.

Asia-Pacific expected to grow at the highest rate during the forecast period. The medical device analytical testing outsourcing market growth in this region is attributable to presence of medical devices manufacture companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, rise in personalized medicine expenditure and adoption of high-tech processing to improve the production of medical devices, drive the growth of the market. Asia-Pacific offers profitable opportunities for key players operating in the medical device analytical testing outsourcing market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rise in disposable incomes, as well as well-established presence of domestic companies in the region. In addition, rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region. In addition, stringent government regulations regarding medical devices testing further propels the market growth.

Competitive Analysis

Competitive analysis and profiles of the major players in the medical device analytical testing outsourcing, such as Charles River Laboratories International, Inc., Element Materials Technology, Eurofins Scientific, Intetek Group plc, Pace Analytical, Medistri SA, North American Science Associates, LLC, SGS SA, The Smithers Group Inc., and WuXi AppTec. Major players have adopted acquisitions, expansion, and integration as key developmental strategies to improve the portfolio of the medical device analytical testing outsourcing market.

Some examples of acquisitions in the market

In August 2022, Pace Life Sciences, LLC, a full-service contract development and manufacturing organization (CDMO) and division of Pace Science and Technology Company, announced that it has acquired Meridian BioGroup (Meridian). This acquisition helps them to develop and maintain biopharmaceutical operations and quality management systems that meet regulatory requirements.

In March 2022, Pace Analytical Services a division of Pace Science and Technology Company announced the acquisition of Specified Testing Laboratories, LLC. This acquisition gives Pace customers in New York and surrounding states multiple opportunities for analytical and environmental testing services.

In December 2022, Pace Analytical Services, a division of Pace Science and Technology Company specializes in-lab, mobile, and emergency onsite specialty-contaminant and regulatory testing and analysis services has announced the acquisition of Special Pathogens Laboratory to provide testing and analytical solutions to protect our environment and improve the health.

Intertek Group plc announced the acquisition with SAI Global Assurance, a leading provider of assurance services. This acquisition strengthens the Intertek’s Assurance offering by providing additional scale, enhanced geographic coverage and new capabilities.

Element Materials Technology has acquired Singapore Test Services (STS), a subsidiary of ST Engineering, leading company in testing, inspection, calibration, and certification provider. This acquisition strengthens the Element’s business in Southeast Asia.

Expansion in The Market

In March 2021, The Smithers Group Inc, a provider of testing, consulting, information, and compliance services has opened the new physical and functional medical device testing laboratory in Akron, Ohio to expand its business portfolio.

Integration

Element Materials Technology announced the integration of Admaterials Technologies. This integration provides testing to the construction sector, as well as chemical, environmental, mechanical testing, and certification services.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical device analytical testing outsourcing market analysis from 2021 to 2031 to identify the prevailing medical device analytical testing outsourcing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical device analytical testing outsourcing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the medical device analytical testing outsourcing market players.

- The report includes the analysis of the regional as well as global medical device analytical testing outsourcing market trends, key players, market segments, application areas, and market growth strategies.

Medical Device Analytical Testing Outsourcing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 8 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 218 |

| By Service |

|

| By End User |

|

| By Region |

|

| Key Market Players | Medistri SA, WuXi AppTec, Pace Analytical, Charles River Laboratories International, Inc., The Smithers Group Inc., SGS SA, Element Materials Technology, Eurofins Scientific, North American Science Associates, LLC, Intetek Group plc |

Analyst Review

This section provides various opinions of top-level CXOs in the global medical device analytical testing outsourcing market. The medical device analytical testing outsourcing services is used for testing the medical devices’ quality and accuracy.

The medical device analytical testing outsourcing market has gained interest of the healthcare industry, owing to rise in usage of cardiovascular devices such as stents, grafts, occluders, and vena cava filters, which has led to increase in the demand for medical device analytical testing services across the globe. In addition, increase in number of surgical procedures conducted that require the several medical devices, leads to high adoption of analytical testing services are expected to significantly boost the growth of the medical device analytical testing outsourcing market. On the contrary, unmet medical demands in developing countries are expected to provide remunerative opportunities for market expansion.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing to rise in healthcare infrastructure, and presence of key players. However, Asia-Pacific is anticipated to witness notable growth, owing to unmet medical demands, and increase in public–private investments in the healthcare sector, and medical device companies have focused on expanding their presence in emerging economies, which is anticipated to drive the market growth.

The upcoming trends of Medical Device Analytical Testing Outsourcing Market in the world are rise in number of key players manufacturing medical devices and high adoption of analytical testing services for medical devices.

The leading applications of Medical Device Analytical Testing Outsourcing Market are diseases such Cardiology and Orthopedic.

North America is the largest regional market for Medical Device Analytical Testing Outsourcing.

Medical Device Analytical Testing Outsourcing market is estimated to reach $7,956.99 million by 2031, exhibiting a CAGR of 5.3% from 2022 to 2031.

Major Key players that operate in the global medical device analytical testing outsourcing market are Charles River Laboratories International, Inc., Element Materials Technology, Eurofins Scientific, Intetek Group plc, Pace Analytical, Medistri SA, North American Science Associates, LLC, SGS SA, The Smithers Group Inc., and WuXi AppTec.

The base year is 2021 in Medical Device Analytical Testing Outsourcing market

Yes, the Medical Device Analytical Testing Outsourcing market report provides PORTER Analysis

Loading Table Of Content...