Medical Disposable Products Market Research, 2033

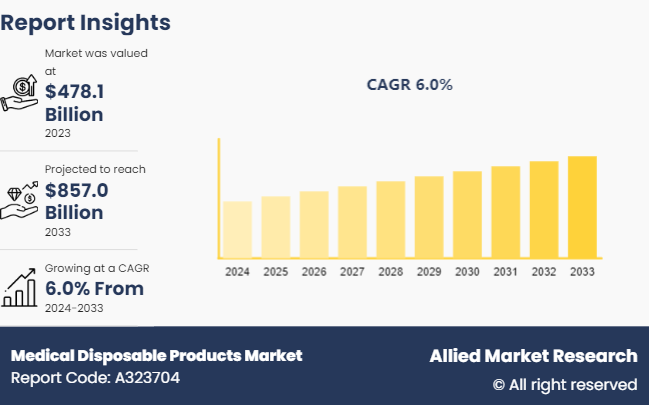

The global medical disposable products market size was valued at $478.1 billion in 2023, and is projected to reach $857.0 Billion by 2033, growing at a CAGR of 6% from 2024 to 2033. Rising prevalence of hospital-acquired infections, growing awareness of hygiene and infection control in healthcare settings, and advancements in product manufacturing are the major factors which drives the market growth.

Market Introduction and Definition

Medical disposable products are items designed for single-use in healthcare settings, such as gloves, masks, syringes, and gowns. They are intended to prevent the spread of infections and maintain hygiene standards by reducing the risk of cross-contamination between patients and healthcare workers. These products are typically made from materials such as plastic, latex, or paper and are disposed of after use to prevent the transmission of pathogens. Medical disposable products play a crucial role in infection control protocols, ensuring the safety of patients and healthcare providers while facilitating efficient and effective healthcare delivery.

Key Takeaways

The medical disposable products market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major medical disposable products industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The medical disposable products market growth is driven by widespread use of disposable items such as gloves, masks, and gowns to minimize the risk of cross-contamination and nosocomial infections within healthcare facilities. In addition, the rise in prevalence of infectious diseases, coupled with emerging pathogens and antibiotic resistance, further underscores the importance of stringent infection control practices, necessitating the continuous availability and utilization of medical disposable products. Furthermore, the increasing prevalence of chronic diseases and the growing aging population worldwide drive the demand for medical interventions and procedures, consequently fueling the need for disposable medical supplies used in diagnostics, treatment, and patient care which drives the growth during medical disposable products market forecast.

Moreover, advancements in medical technology and procedures, such as minimally invasive surgeries and diagnostic techniques, require specialized disposable instruments and devices to ensure safety, precision, and efficiency during medical interventions, thereby contributing to the demand for medical disposable products. However, regulatory challenges and the need for stringent quality control measures also add complexity to the production and distribution of medical disposable products which negatively impacted the market growth.

On the other hand, technological innovations and product advancements, such as antimicrobial coatings, biodegradable materials, and smart packaging, enhance the efficacy, safety, and sustainability of medical disposable products, driving market growth and providing an opportunity to the market growth. Moreover, strategic collaborations, mergers and acquisitions, and partnerships among key stakeholders, including manufacturers, distributors, and healthcare providers, facilitate market expansion, product innovation, and supply chain optimization in the medical disposable products industry. Further, the rapid expansion of healthcare infrastructure in developing regions and the continuous evolution of outpatient and home healthcare services create significant medical disposable products market opportunity.

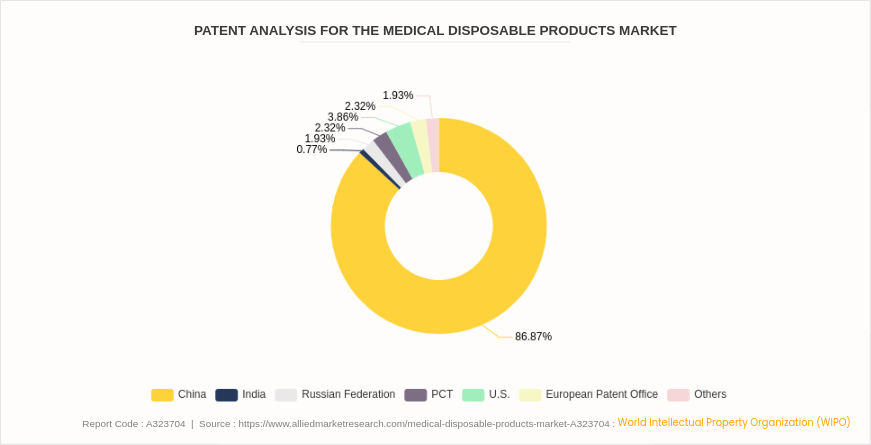

Patent Analysis for the Medical Disposable Products Market

According to the World Intellectual Property Organization (WIPO) patent analysis for medical disposable products from 2021 to 2024, China dominated the market with 86.87% of the patents. This significant lead underscores China's robust focus on innovation and production capacity in the medical disposables sector. The U.S. follows with 3.86%, reflecting its continued investment in healthcare technologies. Other countries, such as the Russian Federation (1.93%) , and regions such as the European Patent Office and PCT, each with 2.32% also contribute to the global landscape of medical disposable products.

India and Japan, each with 0.77%, and Finland, Canada, and Poland, each with 0.39%, show more modest patent activity. This distribution highlights the global emphasis on developing advanced medical disposable products, driven by the increasing demand for efficient and hygienic medical solutions. The widespread innovation across various countries indicates a collaborative effort to enhance the quality and accessibility of medical disposables, essential for improving patient care and healthcare systems worldwide.

Market Segmentation

The medical disposable products market size is segmented into product, application, end user, and region. On the basis of product, the market is categorized into wound management products drug delivery products, diagnostic and laboratory disposables, dialysis disposables, incontinence products, respiratory supplies, sterilization supplies, non-woven disposables, disposable masks, disposable eye gear, disposable gloves, hand sanitizers, and others. As per application, the market is divided into cardiovascular, cerebrovascular, ophthalmology, gynecology, urology, orthopedics, and others. On the basis of end user, the market is classified into hospitals, ambulatory surgery centers, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America holds a substantial medical disposable products market share driven by advanced healthcare infrastructure, high patient awareness, and stringent regulations on infection prevention. Europe follows closely, with countries such as Germany, France, and the UK investing heavily in healthcare systems and innovations in medical disposable technology. In the Asia-Pacific region, rapid economic development, particularly in China and India, coupled with expanding healthcare facilities and rising health consciousness among the population, is propelling market growth. In addition, government initiatives aimed at improving public health and the expansion of medical tourism in these countries further boost demand.

- The Centers for Medicare & Medicaid Services (CMS) finalized a proposed rule in 2021 to provide financial assistance to hospitals buying domestically produced N95 masks. This was aimed at encouraging domestic PPE manufacturing and reducing reliance on foreign supplies.

Industry Trends

As per an article published by Uteshiya Medicare in 2024, the government had created financial incentives such as tax breaks, subsidies and grants to promote R&D, technology acquisition and manufacturing in the medical devices sector. Foreign direct investment (FDI) inflows into medical and surgical appliances were $2.8 billion from April 2000 to March 2023.

The Food and Drug Administration (FDA) finalized two guidance on March 24, 2023, focusing on the transition plan for medical devices falling within enforcement policies issued during the COVID-19 public health emergency and those issued for emergency use authorizations related to COVID-19. These actions reflect the government's efforts to regulate and manage the use of medical disposables in the context of public health emergencies and healthcare settings.

Competitive Landscape

The major players operating in the medical disposable products market include Medline Industries, Inc., Smith+Nephew, Bayer AG, BD, 3M, Cardinal Health, B. Braun SE, Boston Scientific Corporation, Narang Medical Limited, and Terumo Corporation. Other players in medical disposable products market includes AMMEX Corporation, ANSELL LTD and so on.

Recent Key Strategy and Development in Medical Disposable Products Industry

- In January 2023, BIOCORP, a Novo Nordisk company based in France and specialized in the design, development, and manufacturing of innovative medical devices, announced that they have received 510 (K) clearance from the U.S. Food & Drug Administration (FDA) to market SoloSmart, Sanofi’s smart medical device that connects SoloStar insulin pens.

Key Sources Referred

National Center for Biotechnology and Information (NCBI)

Centers for Medicare & Medicaid Services (CMS)

National Health Service (NHS)

Australian Government Department of Health and Aged Care

Government of Canada's Health and Wellness

Ministry of Health and Family Welfare (MoHFW)

National Health Mission (NHM)

Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

Centers for Disease Control and Prevention (CDC)

Food and Drug Administration (FDA)

National Institutes of Health (NIH)

World Health Organization (WHO)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical disposable products market analysis from 2024 to 2033 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the medical disposable products market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global medical disposable products market trends, key players, market segments, application areas, and market growth strategies.

Medical Disposable Products Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 857.0 Billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 231 |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | 3M, B. Braun SE, Terumo Corporation, Smith+Nephew, Cardinal Health, Medline Industries, Inc., Becton Dickinson & Company, Bayer AG, Narang Medical Limited, Boston Scientific Corporation |

Medical disposable products are single-use items used in healthcare settings for patient care, surgery, and diagnostic purposes. They are designed to prevent infection, cross-contamination, and ensure patient safety.

Factors include the increasing prevalence of infectious diseases, growing emphasis on infection control measures in healthcare facilities, rise in outpatient surgeries, and advancements in healthcare infrastructure globally

The global medical disposable products market was valued at $478.1 billion in 2023, and is projected to reach $857.0 Billion by 2033, growing at a CAGR of 6% from 2024 to 2033.

Asia Pacific is expected to exhibit the fastest CAGR during the forecast period.

North America dominated the medical disposable products market share in 2023. This dominance is primarily driven by extensive healthcare infrastructure, high healthcare spending, stringent infection control regulations, and a significant demand for disposable medical supplies across various healthcare settings in the region.

Bayer AG, Becton, Dickinson and Company, Smith & Nephew PLC, Cardinal Health, Medline Industries, Inc. and 3M are the top key players of medical disposables market.

Loading Table Of Content...