Medical Endoscope Image Processor Market Research, 2033

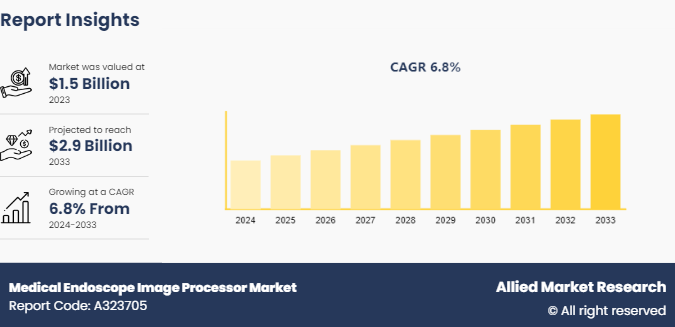

The global medical endoscope image processor market size was valued at $1.5 billion in 2023, and is projected to reach $2.9 billion by 2033, growing at a CAGR of 6.8% from 2024 to 2033. Advancements in endoscopic equipment, rising prevalence of gastrointestinal and other chronic diseases increases, and growing awareness and early diagnosis are the major factors which drives the market growth.

Market Introduction and Definition

A medical endoscope image processor is a specialized device used in conjunction with endoscopic systems to enhance and manage the visual data captured during endoscopic procedures. This processor plays a crucial role in converting the raw video signals from the endoscope's camera into high-quality images that can be displayed on a monitor in real time. It employs advanced technologies such as digital signal processing, noise reduction, and image enhancement algorithms to provide clear, detailed visuals, enabling healthcare professionals to accurately diagnose and treat conditions within the body. The image processor also integrates functionalities such as zoom, freeze-frame, and color adjustment to support various diagnostic and therapeutic applications. By ensuring superior image quality and functionality, medical endoscope image processors significantly improve the efficacy and precision of minimally invasive surgeries and diagnostic procedures, ultimately enhancing patient outcomes.

Key Takeaways

The medical endoscope image processor market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major medical endoscope image processor industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The major factors for medical endoscope image processor market growth include increase in prevalence of minimally invasive surgeries (MIS) , which rely heavily on endoscopic technologies for diagnostics and treatments. Minimally invasive procedures are favored over traditional surgeries due to their benefits, including reduced recovery times, lower risk of infection, and minimal scarring. As the global healthcare industry moves towards MIS, the demand for high-quality imaging systems, including endoscope image processors, rises correspondingly.

In addition, advancements in imaging technology also play a significant role in propelling the market forward. Continuous innovations in digital signal processing, high-definition (HD) and ultra-high-definition (UHD) imaging, and 3D visualization capabilities have significantly enhanced the clarity and accuracy of endoscopic images. These technological improvements allow for better diagnosis and precision in surgical procedures, driving the adoption of advanced image processors thereby drives growth during the medical endoscope image processor market forecast.

Moreover, the growing awareness and emphasis on early diagnosis and preventive healthcare led to a surge in endoscopic examinations which drive the market growth. Early detection of diseases often necessitates the use of endoscopy, which relies on efficient image processing to provide clear and accurate images for proper assessment. As healthcare providers focus more on early diagnosis and prevention, the demand for reliable endoscope image processors continues to grow. However, the high cost associated with medical endoscope image processors may limit the adoption rate. Advanced endoscopic systems and their processors can be prohibitively expensive for many healthcare providers, particularly smaller clinics and hospitals with limited budgets. This financial barrier limit the adoption of these technologies which restrain the market growth.

On the other hand, the continuous advancements in high-definition (HD) and ultra-high-definition (UHD) imaging technologies, coupled with the rising trend of minimally invasive surgeries, further amplify the need for state-of-the-art image processors which provide medical endoscope image processor market opportunity. These factors collectively open up avenues for innovation and extensive adoption of medical endoscope image processors globally.

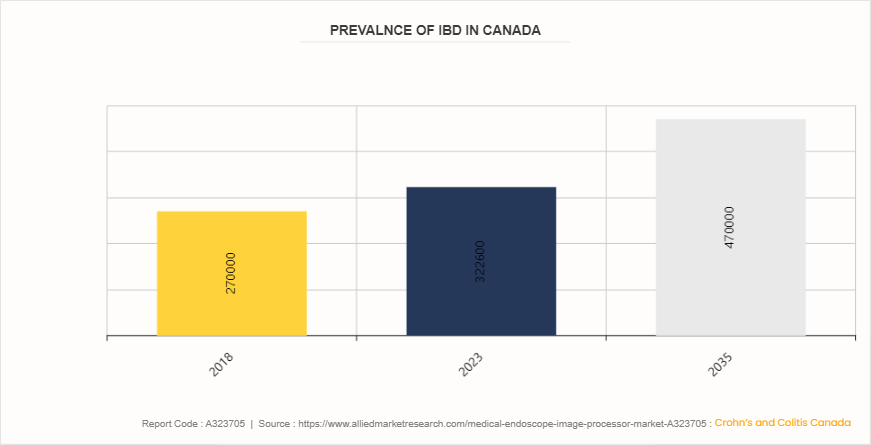

Prevalence Statistics of Inflammatory Bowel Disease in Canada

According to Crohn’s and Colitis Canada, the prevalence of Inflammatory Bowel Disease (IBD) in Canada has been steadily increasing. In 2018, there were 270, 000 people diagnosed with IBD, which rose to 322, 600 by 2023, and is projected to reach 470, 000 by 2035. This significant rise highlights the growing need for advanced medical technologies to manage and diagnose IBD effectively. One crucial tool in this field is the medical endoscope image processor. As the number of IBD cases increases, so rises the demand for endoscopic procedures, which are essential for diagnosing and monitoring the disease. This growth in demand underscores the importance of investing in medical technology to improve patient outcomes and manage the increasing prevalence of IBD.

Market Segmentation

The medical endoscope image processor market size is segmented into product type, application, and region. On the basis of product type, the market is categorized into HD image processors, 3D image processors, and others. As per application, the market is divided into gastroenterology, orthopedics, cardiology, urology, gynecology, and others. On the basis of end user, the market is classified into hospital & clinics, ambulatory surgical centers, diagnostic centers, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the medical endoscope image processor market share in 2023, owing to its advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and strong focus on minimally invasive surgeries. Europe follows closely, driven by substantial healthcare investments, and robust regulatory frameworks supporting medical innovations. The Asia-Pacific region is expected to experience the fastest growth, fueled by increasing healthcare expenditures, expanding medical tourism, and rapid advancements in healthcare infrastructure in countries such as China, India, and Japan.

In December 2023, FUJIFILM India proudly announced its partnership with GVN Hospital to introduce a groundbreaking mobile endoscopy unit called Endo Bus, revolutionizing the early detection of gastrointestinal (GI) cancer across India.

An article published by Nation Health Service (NHS) England in 2023, by March 2025, the all regions had a minimum of 3.5 diagnostic endoscopy rooms per 100, 000 population aged 50 years and over, and at least 10% more endoscopy units will be Joint Advisory Group (JAG) accredited compared to the March 2022 baseline.

Industry Trends

In 2023, The National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) , a government organization, provides information on upper GI endoscopy, including how to prepare for the procedure, what to expect during and after, and potential risks.

The NHS in England invested in dedicated endoscopy capital for the years 2022/23 to 2024/25, aiming to shape GI endoscopy services for future delivery and need.

According to National Center for Biotechnology and Information (NCBI) , the National Institutes of Health (NIH) allocated $3.1 billion for gastrointestinal research, which accounted for 7.5% of the NIH budget in 2020.

Competitive Landscape

The major players operating in the medical endoscope image processor market include Olympus, FUJIFILM Corporation, Stryker, Medtronic, HOYA Group, Cook, CONMED Corporation, Ambu A/S, STERIS, and SonoScape Medical Corp. Other players in medical endoscope image processor market includes ASP India Private Ltd. and others.

Recent Key Strategies and Developments in Medical Endoscope Image Processor Industry

In May 2024, Olympus, a global medical technology company, announced the launch of two bronchoscopes as part of the EVIS X1 Endoscopy System. The EVIS X1 Endoscopy System represents the latest in diagnostic and therapeutic bronchoscopy from Olympus.

In March 2024, NTT Corporation (NTT) and Olympus Corporation (Olympus) announced that the two companies jointly begun a demonstration experiment of a cloud endoscopy system that enables image processing on the cloud.

In January 2024, Canon Medical Systems Corporation and Olympus Corporation (Olympus) announced an agreement to collaborate on Endoscopic Ultrasound Systems. Canon Medical is expected to develop and manufacture diagnostic ultrasound systems used in Endoscopic Ultrasonography1 (EUS) , and Olympus will perform the sales and marketing efforts.

Key Sources Referred

National Center for Biotechnology and Information (NCBI)

Centers for Medicare & Medicaid Services (CMS)

National Health Service (NHS)

Australian Government Department of Health and Aged Care

Government of Canada's Health and Wellness

Ministry of Health and Family Welfare (MoHFW)

National Health Mission (NHM)

Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

Centers for Disease Control and Prevention (CDC)

Food and Drug Administration (FDA)

National Institutes of Health (NIH)

World Health Organization (WHO)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical endoscope image processor market analysis from 2024 to 2033 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the medical endoscope image processor market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global medical endoscope image processor market trends, key players, market segments, application areas, and market growth strategies.

Medical Endoscope Image Processor Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.9 Billion |

| Growth Rate | CAGR of 6.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 231 |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | SonoScape Medical Corp., Cook Group, Stryker, STERIS, Medtronic, Ambu A/S, FUJIFILM Corporation, HOYA Group, Olympus , CONMED Corporation |

Loading Table Of Content...