Medical Equipment Rental Market Research, 2032

The global medical equipment rental market was valued at $56.0 billion in 2022, and is projected to reach $94.5 billion by 2032, growing at a CAGR of 5.4% from 2023 to 2032.The medical equipment rental market refers to the industry sector that involves the temporary provision of medical equipment to healthcare facilities, organizations, and individuals on a rental or lease basis. This market serves the purpose of meeting the short-term or long-term medical equipment needs of patients, healthcare providers, and other medical professionals.

Market dynamics

The medical equipment rental market in expected to significant growth owing to the cost efficiency and flexibility of rental medical equipment, increasing focus on home healthcare and increase in the number of disabled patient population. The medical equipment rental market refers to the industry segment that offers rental services for a wide range of medical equipment to healthcare providers, patients, and other entities within the healthcare sector. Rather than purchasing medical equipment outright, healthcare facilities and patients can opt to rent the necessary medical equipment for a specific period, allowing healthcare facilities to access advanced medical technologies without the high upfront costs associated with purchasing or ownership. The medical equipment rental market serves various stakeholders, including hospitals, clinics, long-term care facilities, home healthcare providers, rehabilitation centers, and individual patients.

In the healthcare industry, acquiring and maintaining expensive medical equipment can be a significant financial burden for healthcare facilities. By opting for rental services, healthcare providers can reduce their upfront capital expenditure and allocate their financial resources more effectively. Instead of investing in purchasing equipment outright, healthcare institutes can rent the required medical devices and pay for them on a usage basis. This enables healthcare facilities to access state-of-the-art equipment without the need for large upfront investments, making it particularly advantageous for smaller clinics or facilities with budget constraints. According to Canadian Institute of Health Information, in year 2020 the average annual spending on medical equipment by hospitals was 5.4%. The expenditure on purchasing medical equipment can be significantly reduced by simply renting the medical equipment.

Furthermore, the flexibility provided by medical rentals equipments allows healthcare providers to adapt to changing patient needs and industry advancements. The medical field is constantly evolving, and new technologies and treatment options emerge regularly. Renting medical equipment enables healthcare facilities to stay up to date with the latest advancements without the worry of equipment obsolescence. Hospitals can easily switch to newer models or upgraded versions of equipment as they become available, ensuring that they can deliver the best possible care to their patients. In addition, Flexibility of rental medical equipment in the context of a sudden increase in demand for specific medical equipment, such as during the COVID-19 pandemic when there was a surge in the need for respiratory medical devices, refers to the ability of healthcare providers to quickly respond to the increased demand and scale up their equipment resources. The rise in demand also resulted in a rise in the prices of medical equipment. According to American Hospital Association, between 2019 and 2022 hospital expenses for emergency services supplies experienced a nearly 33% increase. The emergency services supply includes equipment such as ventilators, respirators and other sophisticated equipment that are critical to keeping patients alive in the emergency department. Rental medical equipment offers a crucial advantage in such emergency situations.

In addition, an increase in focus on home healthcare is expected to act as a significant driver for the medical equipment rental market. Home healthcare has gained prominence as an effective and convenient way to provide medical care to individuals in the comfort of their own homes. It allows patients to receive necessary medical treatments and services without the need for extended hospital stays or visits to healthcare facilities. As the demand for home healthcare services continues to grow, there is a corresponding need for medical equipment that can be used in a home setting. Furthermore, medical rental equipment plays a crucial role in supporting individuals during short-term injuries, post-surgical recovery, or temporary medical conditions in home care settings. These situations often require specialized equipment to aid in the healing process and improve comfort and mobility. For example, if someone sustains a leg injury and requires crutches or a knee scooter, renting these devices enables them to move around their home safely and perform daily activities with minimal strain. Similarly, for individuals with temporary mobility challenges, renting wheelchairs or walkers provides the necessary support to navigate their surroundings and carry out daily tasks. The average cost of a standard manual wheelchair is $500, and the cost of a powered wheelchair starts from $1200 and goes as high as $30,000. On the other hand, renting a wheelchair costs an average amount of $10 to $50 per day. Thus, renting is a practical and cost-effective solution to fulfill a temporary need of the medical equipment.

However, stringent regulatory compliances can act as a significant restraint for the medical equipment rental market. The healthcare industry is highly regulated to ensure patient safety and the quality of medical services. According to the U.S. FDA in 2021, only 27 medical devices were approved. Thus, regulatory compliance slows down the approval rate of the medical equipment, which is expected to act as a restraint for the medical equipment rental market.

On the other hand, the rise in preference for telemedicine and remote healthcare services by patients has created lucrative opportunities for the growth of the medical equipment rental market. Telemedicine, which involves remote consultations and diagnosis through video calls or online platforms, has gained significant popularity in recent years. Telemedicine has also enabled healthcare providers to remotely monitor patients with complex medical conditions or post-surgical care needs. In such cases, medical equipment rentals play a crucial role in ensuring that patients receive the necessary care and monitoring at home. This includes devices like continuous positive airway pressure (CPAP) machines for sleep apnea patients, home ventilators, or infusion pumps for administering medications. According to The United States Department of Health and Human Services, a study was conducted from April 14, 2021, to October 11, 2021. The study states that 1 in 4 adults reported to have used telehealth service.

The growth of the medical equipment rental market is expected to continue as telemedicine becomes more mainstream and patient preferences continue to evolve.

The outbreak of COVID-19 resulted in demand for medical equipment, such as respiratory medical equipment due to the sudden surge in COVID-19 cases and the urgent need for resources to treat infected patients. This unprecedented demand put immense pressure on the medical equipment rental market, causing both challenges and opportunities. Increased demand for medical equipment also presented an opportunity for rental market to expand its operations.

Although in post-pandemic era there may be a decrease in the demand for COVID-19-specific equipment, overall demand for rental equipment is anticipated to remain stable. Healthcare facilities are likely to persist in utilizing rental options as a flexible and cost-effective solution to fulfill their equipment requirements, particularly due to the uncertainties surrounding forthcoming healthcare challenges.

Segmental Overview

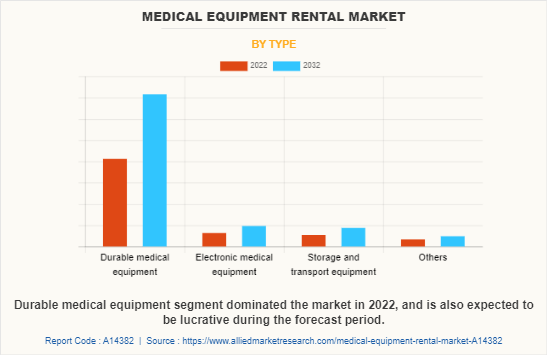

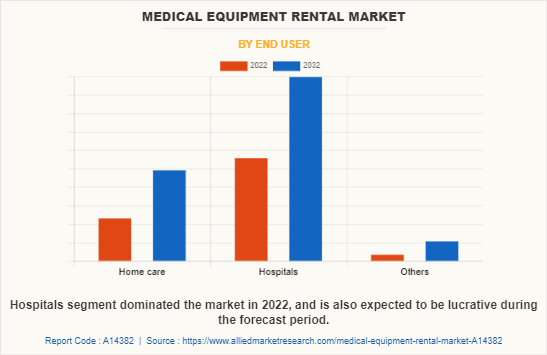

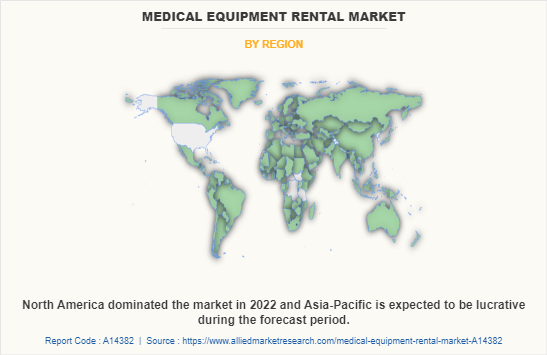

The medical equipment rental is segmented on the basis of product type, end users, and region. On the basis of product type, the market is classified into durable medical equipment, electronic medical equipment, storage and transport equipment and others. On the basis of end users, the market is segmented into hospitals, home care and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Type

The medical equipment rental market is segmented into durable medical equipment, electronic medical equipment, storage and transport equipment and others. Others include diagnostic medical equipment and surgical medical equipment. The durable medical equipment segment dominated the global market in 2022, and is expected to remain dominant throughout the forecast period, owing to increasing demand for long-term patient care and the rising prevalence of chronic diseases such as asthma, paralysis, and diabetes which require the consistent use of specialized equipment such as oxygen supplies, wheelchairs, crutches, and blood testing strips for diabetics respectively.

By End Users

The medical equipment rental market is segregated into hospitals, home care, and others. The others include research institutes and clinics. The hospitals segment dominated the global market in 2022, This is attributed to adoption of rental medical equipment by hospitals because it has emerged as the most cost effective and flexible option. The home care segment is estimated to register highest CAGR of xx % during the forecast period, owing to the preference towards the home care by the geriatric population and the disabled peoples

By Region:

The medical equipment rental market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the medical equipment rental in 2022 and is expected to maintain its dominance during the forecast period.

Presence of several major players, such as Med One Group, LLC, US Med-Equip, Agiliti Health, Inc, USA Medical Supply among others and adoption of various strategies by key players such as partnership and business expansion drive the growth of the market in the region. For instance, in July 2022, US Med-Equip announced expansion in Detroit to meet the growing equipment and service needs of hospitals and other healthcare partners throughout the Midwest. In addition, in August 2022, the U.S. Med-Equip announced the acquisition of Freedom Medical to meet the growing equipment and service needs of hospitals and other healthcare partners throughout the country. The acquisition doubled U.S. Med-Equip’s number of locations, increased its workforce by 50%, and accelerated its national expansion to provide critical equipment to hospitals, in case of need.

In addition, a surge in geriatric population is expected to drive the growth of the market in this region. Many elderly individuals prefer to remain in their homes rather than move to assisted living facilities or nursing homes. Home care services allow seniors to maintain their independence and receive the necessary care and support without having to leave their familiar surroundings. According to the United Health Foundation, in 2021, geriatric population (age 65 and above) accounted for 16.8% of total population. Thus, surge in geriatric population resulted in increase in demand for medical equipment rental due to their preference toward home care services

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributed to growth in medical tourism and development in the healthcare system. The Asia-Pacific region has become a popular destination for medical tourism, with countries such as Thailand, Singapore, and India attracting patients from around the world. Medical tourists often require specialized medical equipment during their treatments and procedures. Instead of purchasing expensive equipment for short-term use, many healthcare facilities prefer to rent the equipment. The growth of medical tourism has thus contributed to the expansion of the medical equipment rental market in the region. Furthermore, many countries in the Asia-Pacific region such as India and China have been investing in the development and improvement of their healthcare systems. This includes expanding healthcare infrastructure, establishing new hospitals and clinics, and upgrading existing facilities. However, setting up a fully equipped medical facility can be costly, especially in the initial stages. Therefore, healthcare providers often opt to rent medical equipment rather than purchasing it outright. This trend has fueled the growth of the medical equipment rental market as healthcare systems continue to evolve in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the medical equipment rental, such as Med One Group, LLC, Baxter International Inc, Portea Medical Pvt. Ltd, Medirent Services Pvt. Ltd, US Med-Equip, Westside Medical Supply, Avante Health Solutions, ArjoHuntleigh AB, and USA Medical Supply. Major players have adopted partnership and acquisition as key developmental strategy to improve the product portfolio and gain strong foothold in the medical equipment rental market.

Recent Partnership in the Medical equipment rental market

In March 2022, Med One Group, an industry leader in medical equipment rental, leasing, and sales, announced the partnership with Partners Cooperative, Inc. The partnership allows Partners Cooperative members to have greater access to rental equipment from Med One. Partners membership consists of over 130 hospitals, healthcare facilities, and clinics.

Recent Acquisition in the Medical equipment rental market

In October 2021, Agiliti Health, Inc., an essential service provider to the U.S. healthcare industry announced that it has completed the previously announced acquisition of Sizewise Rentals, LLC, a manufacturer and distributor of specialty hospital beds, surfaces, and patient-handling equipment.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical equipment rental market analysis from 2022 to 2032 to identify the prevailing medical equipment rental market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical equipment rental market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical equipment rental market trends, key players, market segments, application areas, and market growth strategies.

Medical Equipment Rental Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 94.5 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 233 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Baxter International Inc., Avante Health Solutions, Medirent Services Pvt. Ltd, Portea Medical Pvt. Ltd., Agiliti Health, Inc., US Med-Equip, Med One Group, LLC, USA Medical Supply, Westside Medical Supply, ArjoHuntleigh AB |

Analyst Review

The medical equipment rental market refers to the industry involved in the temporary provision of medical devices, equipment, and supplies to healthcare providers, patients, or other organizations on a rental or leasing basis. It allows healthcare facilities, such as hospitals, clinics, and nursing homes, as well as individuals, to access and utilize a wide range of medical equipment without the need for long-term ownership or significant capital investment. The strategies such as partnership and acquisition adopted by key players positively impacted the market growth.

For instance, in March 2022, Med One Group, an industry leader in medical equipment rental, leasing, and sales announced the partnership with Partners Cooperative, Inc. The partnership allows Partners Cooperative members to have greater access to rental equipment from Med One. Partners membership consists of over 130 hospitals, healthcare facilities, and clinics.

In addition, in October 2021, Agiliti Health, Inc., an essential service provider to the U.S. healthcare industry, announced that it has completed the previously announced acquisition of Sizewise Rentals, LLC, a manufacturer and distributor of specialty hospital beds, surfaces, and patient-handling equipment.

The top companies that hold the market share in medical equipment rental market are Med One Group, LLC, Baxter International Inc, Portea Medical Pvt. Ltd, Medirent Services Pvt. Ltd, US Med-Equip, Westside Medical Supply, Avante Health Solutions, ArjoHuntleigh AB, Agiliti Health, Inc, and USA Medical Supply

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to rise in use of anti-snoring devices due to increase in snoring population

The key trends in the medical equipment rental market are due to the large pool of patient population, rise in medical tourism, and development in healthcare infrastructure.

The base year for the report is 2022.

North America is the largest regional market for medical equipment rental market

The total market value of medical equipment rental market market is $55,950.58 million in 2022 .

The forecast period in the report is from 2023 to 2032

Major restraints in the medical equipment rental market are Stringent Regulatory Compliance

Loading Table Of Content...

Loading Research Methodology...