Medical Isotope Market Research, 2032

The global medical isotope market size was valued at $5.1 billion in 2022, and is projected to reach $11.4 billion by 2032, growing at a CAGR of 8.8% from 2023 to 2032. Medical isotopes are radioactive materials used in a variety of diagnostic and therapeutic purposes in medicine. These isotopes emit radiation, which helps healthcare workers learn about the structure and function of organs and tissues. Medical isotopes are frequently used in diagnostic imaging to provide detailed images of inside structures, which aid in the identification and diagnosis of a variety of medical disorders. In addition, several isotopes have medicinal characteristics and are used to treat disorders like cancer. The controlled and focused use of medical isotopes has become an essential aspect of medical practice, with critical roles in both diagnostic and therapeutic processes. The most commonly used isotope in radiation treatment is cobalt-60. Colbalt-60 is also used in hospitals to sterilize scientific gear such as gowns, gloves, masks, syringes, and implants.

There has been an increase in the prevalence of cardiovascular diseases due to the rising the geriatric population in the developed as well as the developing countries. This increase in occurrence of cardiovascular diseases in the geriatric population has led to an increase in use of nuclear medicine. There has additionally been an increase in the number of cancer patients across the globe which occurs to be a key illness that requires the use of nuclear medicines. The discovery and development of new radioisotopes with improved characteristics for diagnostic purposes provide opportunities for market growth. These emerging isotopes may offer enhanced imaging capabilities or reduced radiation exposure, contributing to their adoption in clinical settings. The shift towards personalized medicine, which tailors treatments based on individual patient characteristics, contributes to the demand for specific medical isotopes used in targeted therapies. Isotopes play a role in delivering precise and targeted treatment in such personalized approaches. All these factors are anticipated to drive the medical isotope market size.

Many clinical isotopes have quick half-lives, making their production and distribution difficult. The limited range of amenities that can be utilized to produce sure isotopes can lead to a shortage, resulting in a decrease in patient care and causing disruptions in medical procedures. The manufacturing of some isotopes involves the use of nuclear reactors, raising concerns about nuclear proliferation and the viable for misuse of radioactive materials. The need for scientific isotopes with ensuring nuclear protection can be a difficult task. All these factors are anticipated to restrain the clinical isotopes market growth in upcoming years.

In addition, various technical breakthroughs have resulted in the creation of novel and improved diagnostic and therapeutic uses for nuclear medicine radioisotopes. This, combined with increased expenditure and demand for nuclear treatments, is driving market expansion. Governments and commercial organizations are making significant investments in nuclear medicine R&D, resulting in the production of new products and applications that are driving market expansion. Furthermore, the industry is being driven by increased patient awareness regarding radiation and radiation therapy. Furthermore, rising healthcare expenditure, the introduction of enhanced product versions, and increased R&D activities by key companies are all contributing to a positive market outlook.

In addition, integration of medical isotopes with advanced healthcare technologies, such as Artificial Intelligence (AI) and molecular imaging, offers opportunities for enhancing diagnostic accuracy and efficiency, contributing to the market growth. The global expansion of nuclear medicine services, including the establishment of new facilities and the adoption of nuclear medicine procedures in emerging markets, leads to increased isotopic demand and creates opportunities for market growth.

The key players profiled in this report include Canadian Nuclear Laboratories (CNL), Curium, GE Healthcare, Jubilant Radiopharma, Nordion (Canada) Inc, IBA Radiopharma Solutions, Mallinckrodt Pharmaceuticals, NorthStar Medical Radioisotopes, Isotopen Technologies München (ITM), and Eczacibasi-Monrol Nuclear Products.

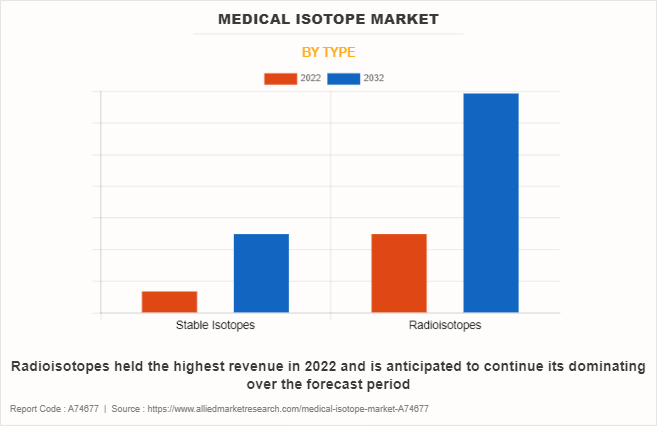

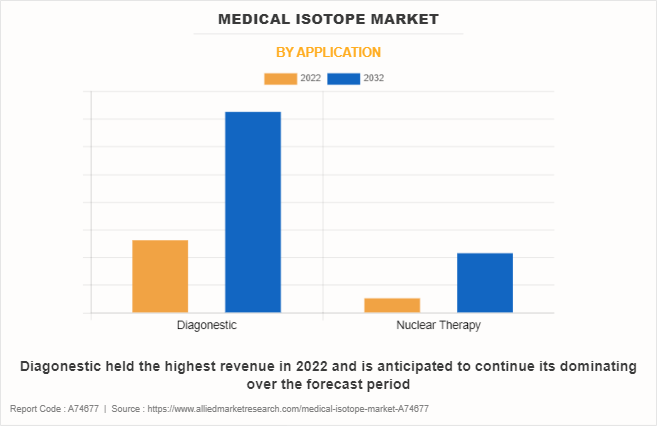

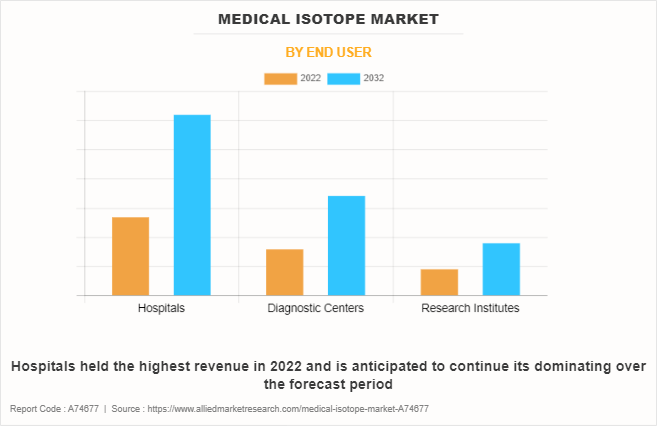

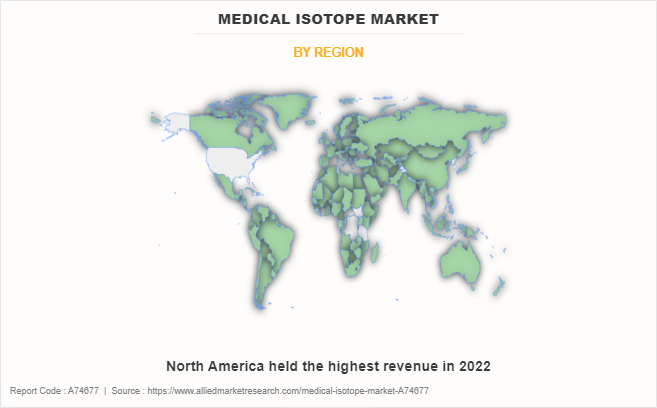

The medical isotope industry is segmented on the basis of type, application, end user, and region. By type, the market is divided into stable isotopes and radioisotopes. By application, the market is classified into nuclear therapy, equipment radioactive source, and diagnosis. By end use, the market is classified into hospitals, diagnostic labs, and research institutes. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The medical isotope market is segmented into Application, Type and End User.

By type, the radioisotopes sub-segment dominated the market in 2022. Acceptance of diagnostic radioisotopes has been facilitated by technological advancements in diagnostic imaging modalities like PET and SPECT. United Imaging, a manufacturer of digital radiotherapy and life science equipment, introduced its uMI 550 digital PET/CT scanner in 2021. The increasing demand for alpha-emitting isotopes such as actinium-225 for targeted alpha therapy is expected to drive market growth. Telix Pharmaceuticals and biotechnology company Tecma Group of Companies, for example, collaborated in 2022, to develop lutetium-177 and actinium-225 in South America. Nuclear medicine radioisotopes are widely used in the diagnosis and treatment of almost all types of cancer. According to the World Health Organization, the total number of cancer patients worldwide in 2018, was approximately 18.1 million, and is estimated to reach 29.5 million by 2040.This is likely to support the growth of nuclear medicine radioisotopes in the medical isotopes market.

By application, the nuclear therapy sub-segment dominated the global medical isotope market share in 2022. Treatment procedures that were postponed during the pandemic were intended to counteract the market's decline over the previous two years, resulting in its recovery. The market is expected to increase significantly in the long term due to an increase in the incidence of cancers, bone abnormalities, and neurological malignancies. This is expected to lead to an increase in the demand for nuclear medicine therapies, driving the market expansion. Therefore, the rising awareness and utility of radioisotopes in nuclear medicine treatment is expected to create R&D opportunities for developing innovative nuclear medicine therapeutics, further driving market growth. The growth of the market is also supported by technological advances and increasing product approvals, as well as partnerships and acquisitions by key players. For example, in March 2022, the U.S Food and Drug Administration (FDA) approved Pluvicto (177Lu-PSMA-617) for the treatment of adults with metastatic prostate cancer, which is expected to drive medical isotope market growth.

By end user, the hospitals sub-segment dominated the global medical isotope market share in 2022. Hospitals are principal diagnostic imaging process sites, and clinical isotopes play an essential function in positron emission tomography (PET) and single-photon emission computed tomography (SPECT). These applied sciences are widely used in hospitals to diagnose and treat a variety of clinical disorders, including cancer and cardiovascular disease. In radiation therapy, cobalt-60 is the most broadly employed isotope. Cobalt 60 is frequently used in hospitals to sterilize clinical equipment like gowns, gloves, masks, syringes, and implants. Hospitals serve as comprehensive healthcare institutions where patients receive a range of medical services, including diagnostic imaging and treatment involving medical isotopes. This multifaceted role enables hospitals to utilize medical isotopes across various medical disciplines. Hospitals often engage in medical research and clinical trials that involve the use of medical isotopes. This research activity further contributes to the dominance of the hospitals sub-segment in the global medical isotope market forecast period.

By region, North America dominated the global medical isotopes market in 2022. The North America market is poised to increase due to increased investment in research and enchantment activities in the industry. In North America, the medical isotopes market is poised for expansion driven by technological advancements, such as hybrid imaging, the introduction of novel radioisotopes for diagnosis, advancements in imaging techniques, and the prominent presence of key market players. The growing prevalence of chronic diseases is a significant factor contributing to the regional market growth. Owing to the crucial role of nuclear medicine in clinically diagnosing individuals with cognitive impairment, the demand for nuclear medicine radioisotopes is expected to rise in tandem with the increasing burden of chronic diseases. Moreover, the region is witnessing a rise in cancer cases, further driving the demand for nuclear medicine radioisotopes in cancer diagnosis. This surge in cancer instances is contributing to the increase in demand for nuclear medicine radioisotopes, reinforcing the growth trajectory of the medical isotopes market in North America.

Impact of COVID-19 on the Global Medical Isotope Industry

- The pandemic disrupted global supply chains, including those related to the production and distribution of medical isotopes. Restrictions on international travel, lockdowns, and other logistical challenges affected the timely transportation of isotopes.

- Many elective medical procedures, including non-urgent imaging and diagnostic tests that use medical isotopes, were postponed or canceled during the pandemic to prioritize resources for COVID-19 patients. This led to a decline in the demand for certain isotopes.

- Nuclear medicine departments in hospitals faced challenges during the pandemic, with staff shortages, resource reallocation, and changes in patient management. This impacted the routine use of medical isotopes in diagnostic and therapeutic procedures.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical isotope market analysis from 2022 to 2032 to identify the prevailing medical isotope market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical isotope market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical isotope market trends, key players, market segments, application areas, and market growth strategies.

Medical Isotope Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.4 billion |

| Growth Rate | CAGR of 8.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 315 |

| By Application |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | northstar medical radioisotopes, llc, Canadian Nuclear Laboratories (CNL), GE Healthcare, Nordion Inc., IBA Radiopharma Solutions , Curium, Jubilant Radiopharma, Isotopen Technologien München (ITM), Eczacibasi-Monrol Nuclear Products, Mallinckrodt Pharmaceuticals |

The increasing prevalence of cancer and cardiovascular diseases worldwide is a significant driver for the demand for medical isotopes. Isotopes play a crucial role in the diagnosis, staging, and treatment of these diseases. Ongoing advancements in nuclear medicine, including the development of new radiopharmaceuticals and imaging techniques, drive the demand for a variety of medical isotopes.

The major growth strategies adopted by the medical isotopes market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global medical isotopes market in the future.

Canadian Nuclear Laboratories (CNL), Curium, GE Healthcare, Jubilant Radiopharma, Nordion (Canada) Inc, IBA Radiopharma Solutions, Mallinckrodt Pharmaceuticals, NorthStar Medical Radioisotopes, Eczacibasi-Monrol Nuclear Products, and Isotopen Technologies München (ITM) are the major players in the medical isotopes market.

The radioisotopes sub-segment of the type acquired the maximum share of the global medical isotopes market in 2022.

Hospitals and medical centers are primary consumers of medical isotopes, utilizing them for diagnostic imaging, cancer treatment, and various therapeutic procedures.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global medical isotopes market from 2022 to 2032 to determine the prevailing opportunities.

Medical isotopes, such as fluorine-18 (F-18), are widely used in PET imaging for the diagnosis and staging of various cancers and neurological disorders. The high sensitivity and specificity of PET scans contribute to accurate disease detection, which is expected to drive adoption of medical isotopes.

Loading Table Of Content...

Loading Research Methodology...