Medical Loans Market Research, 2032

The global medical loans market was valued at $161.9 billion in 2023, and is projected to reach $320.3 billion by 2032, growing at a CAGR of 8.2% from 2024 to 2032. These financial instruments aim to bridge the gap between rise in healthcare costs and the need for accessible funding, enabling patients and healthcare providers to manage expenses effectively.

Market Introduction and Definition

The medical loans market refers to a financial sector specialized in providing loans and financial assistance tailored to the healthcare industry. This niche market focuses on offering funding solutions to individuals, medical practitioners, healthcare facilities, and institutions facing financial challenges related to medical expenses. Medical loan services often encompass a range of financial products, including personal loans for medical procedures, equipment financing for healthcare facilities, and working capital loans for medical professionals.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical loans market analysis from 2023 to 2032 to identify the prevailing medical loans market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical loans market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the Global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as medical loans industry trends, key players, market segments, application areas, and medical loans market growth strategies.

Key Takeaways

The medical loans market industry study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literature, industry releases, annual reports, and other such documents of major medical loans industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Industry Trends:

In October 2023, PayZen, a U.S.-based healthcare-focused fintech launched PayZen Care Card in a bid to solve healthcare affordability, in partnership with Geisinger and University of Texas Medical Branch.

In February 2022, Toronto-Dominion Bank and First Horizon announced the signing of a new contract that will allow Toronto-Dominion Bank to completely acquire First Horizon. The deal is worth $13 billion and will help TD strengthen its hold in the global market.

In December 2021, API Holdings Limited and Piramal Capital & Housing Finance entered a joint collaboration in which the latter will offer its digital platform Retailio to API Holding. This will allow the company to improve its financial assistance services to all stakeholders.

Key market dynamics

The growth of the medical loan service market is propelled by several key drivers. Firstly, increase in cost of healthcare services and medical treatments creates a demand for financial products that alleviate the financial burden on individuals and institutions. Medical loans provide flexible repayment options, competitive interest rates, and quick access to funds, making them a viable solution for those seeking timely financial support. Additionally, the rise of elective medical procedures and the expanding healthcare infrastructure contribute to the market's growth. The segmentation of the market revolves around the diverse needs of borrowers, including patient financing, medical equipment financing, and practice loans for healthcare professionals. As the healthcare industry continues to evolve, medical loan services play a crucial role in ensuring financial accessibility and sustainability across various facets of the healthcare ecosystem.

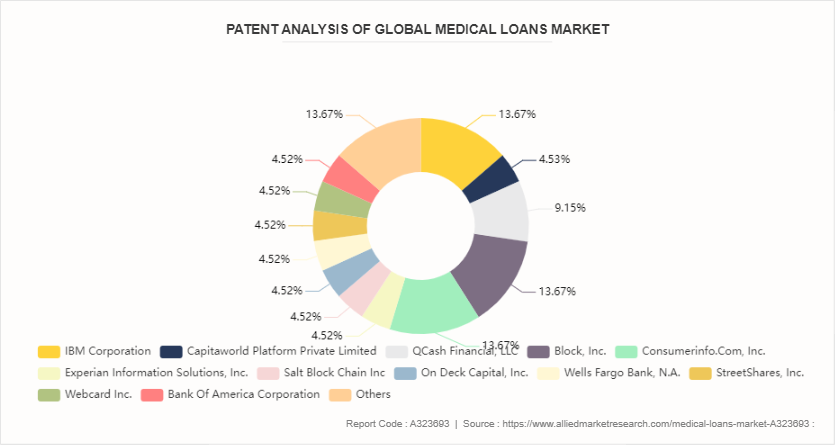

Patent Analysis of Global Medical Loans Market

The medical loan service market is projected to witness substantial growth in the coming years, driven by several key strategies and factors. Market players are increasingly focusing on product innovation and development to meet evolving consumer demands and preferences. Expansion into emerging markets and strategic partnerships or collaborations are also pivotal strategies for market growth. Additionally, investments in research and development to enhance technological advancements and improve product quality play a vital role in the medical loan market. Moreover, the market's future scope looks promising due to the rising adoption of digitalization and the integration of advanced technologies, which are anticipated to open new avenues for growth and innovation.

Market Segmentation

The medical loans market is segmented into type, application, and region. On the basis of type, the market is divided into Amount Below $5,000, Amount $5,000-100,000, and Amount Above $100,000. As per application, the market is segregated into dental surgery, plastic surgery, critical surgery, and bariatric surgery. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The medical loan market is experiencing significant growth, driven by several key factors across different regions. In the U.S., the market is expanding rapidly due to the high cost of healthcare and the increasing demand for elective procedures. Companies such as CareCredit offer specialized financing options, partnering with a vast network of healthcare providers nationwide. This accessibility to financing for procedures such as cosmetic surgeries and dental treatments is a major driver of market growth.

In Europe, the medical loan market is driven by factors such as rise in healthcare costs and the need for timely medical interventions. Germany's robust medical loan market, exemplified by companies such as Deutsche Bank, offers competitive financing options for a wide range of medical expenses. The availability of such loans is crucial for patients seeking treatments not covered by public health systems or insurance.

Similarly, in the UK, the growing demand for medical loans is fueled by the limitations of the National Health Service (NHS) and private insurance. Hitachi Personal Finance, for instance, provides loans for procedures such as fertility treatments and cosmetic surgeries, catering to individuals seeking timely and specialized healthcare services.

In Asia-Pacific, the medical loan market is expanding rapidly, driven by factors such as increasing healthcare awareness and the growing middle class. In India, healthcare financing platforms such as Credihealth facilitate access to medical loans for major procedures such as organ transplants and heart surgeries. The convenience of applying for loans online has made healthcare financing more accessible to a broader population.

Competitive Landscape

The major players operating in the medical loans market include SoFi, LightStream, Upstart, LendingClub, Universal Credit, Prosper Healthcare, CareCredit, Credit Medical, LendingPoint

Other players in the medical loans market include Arogya Finance, American Medical Loans, Latitude Financial, OneMain Financial, HFA, Fairstone, Fair Go Finance, MoneyTap and so on.

Recent Key Strategies and Developments

In January 2024: Introduction of Flexible Payment Options - Several medical loan providers introduced flexible payment options to accommodate varying financial situations of borrowers. These options include extended repayment periods, deferred payments, and customized payment plans based on income.

In February 2024: Expansion of Telehealth Financing - With the rise of telehealth services, many lenders started offering specific financing options for telehealth consultations and treatments. This expansion aimed to support patients seeking remote medical services.

In December 2021: Medical Credit Fund (MCF) , the only debt fund fully dedicated to the African health sector, announced the completion of a $35.1 million fundraise of its second fund (MCF II) . This financing round will expand the Fund’s presence and support to healthcare providers in sub-Saharan Africa, with a focus on primary healthcare services including malaria prevention and treatment and maternal and childcare. The round also caters to expanding its fully digital loan product called ‘Cash Advance.

In May 2024: Implementation of AI-driven Loan Approval Processes - To enhance efficiency and accuracy in loan processing, many medical loan providers started implementing AI-driven algorithms for loan approval. These systems analyze various factors, such as credit history and income, to determine loan eligibility and interest rates, reducing the time required for approval.

Key Sources Referred

Livemint

Achieve.com

AHCJ

OUPblog

Paytient.com

USC Schaeffer Center

Key Benefits for Stakeholders

This report provides a quantitative analysis of the medical loans market segments, current trends, estimations, and dynamics of the medical loans market forecaste from 2022 to 2032 to identify the prevailing medical loans market opportunities.

Market research is offered along with information related to key drivers, restraints, and medical loans market opportunity.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the medical loans market segmentation assists in determining the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global medical loans market share and statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as, medical loans market size, global medical loans market trends, key players, market segments, application areas, medical loans market outlook and medical loans market growth strategies.

Medical Loans Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 320.3 Billion |

| Growth Rate | CAGR of 8.2% |

| Forecast period | 2024 - 2032 |

| Report Pages | 200 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Upstart, SoFi, Universal Credit, Prosper Healthcare, Credit Medical, CareCredit, LendingClub, universal credit services, LightStream, LENDINGPOINT LLC, LendingPoint |

Loading Table Of Content...