Medical Radiation Detection Market Overview 2030

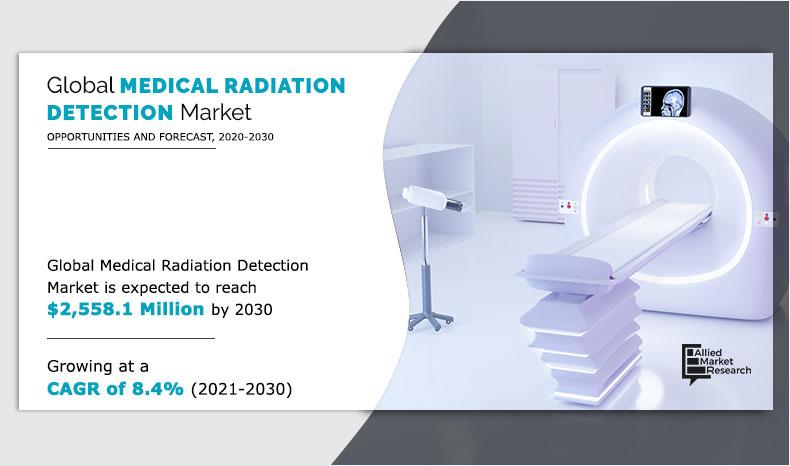

The global medical radiation detection market size was valued at $1,173.0 million in 2020, and is projected to reach $2,558.1 million by 2030, registering a CAGR of 8.4% from 2021 to 2030. Medical radiation detectors are a type of medical equipment that detects the presence of radiation. When a person is exposed to radiation for a considerable length of time, an individual is more prone to develop a number of deadly diseases. This raises the requirement for technology capable of detecting the amount of radiation accumulating in the body. Some of the key detectors for detecting radioactive materials and ionizing radiation include the handheld survey meter (HSM), personal radiation detector (PRD), radiation portal monitor (RPM), and radiation isotope identification device (RIID). As technology advances, various radiation-detecting devices may become available for use at home. Dosimeters are medical radiation detectors that can detect Gamma rays, the most dangerous external radioactive threat.

The increasing prevalence of cancer necessitates the use of medical radiation detectors, which propels the market growth. In addition, increased use of nuclear medicine and radiation therapy for the diagnosis and treatment of acute radiation illness will contribute to the medical radiation detection market growth in the coming years. Furthermore, the number of diagnostic imaging facilities that require medical radiation detectors to avoid excessive radiation exposure has increased significantly, fueling the market growth during the forecast period. Rising awareness regarding safety from prolonged exposure to radiation especially in radiation-prone settings as well as an increase in the number of individuals having medical insurance would propel the growth of the medical radiation market during the forecast period.. The rising cost of medical radiation detection, on the other hand, will stifle market growth. Furthermore, the increased potential for medical radiation detection in emerging markets is expected to help the industry generate more opportunities in the coming years.

The World Health Organization (WHO) declared COVID-19 outbreak a public health emergency of international concern. Medical radiation detection can be used for prevention of excessive radiation exposure due to imaging equipment when suffering from COVID-19. However, workforce shortage as well as resource limitation due to COVID-19 is expected to negatively impact the growth of the industry during the forecast period. In addition, rise in strict government regulations regarding lockdowns has led to the decrease in the growth of the market in the commenced period. Moreover, the need of the hour is to bring up newer products that can help combat with the advent of COVID-19 virus and hinder the medical radiation detection market during the commenced period. There has been a steep growth in research activities to bring new products for detection of radiation, which is expected to propel the growth of the medical radiation detection during the forecast period.

Medical Radiation Detection Market Segmentation

The global medical radiation detection market is segmented on the basis of detection type, product, end user, and region. On the basis of detection type, the market is categorized into gas-filled detectors, scintillators, and solid-state. By product, it is classified into personal dosimeters, area process dosimeters, surface contamination monitors, and others. By end user, it is divided into hospitals, ambulatory surgical centers, clinics, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Region

North America segment held a highest revenue share in 2020, furthermore Asia-Pacific is expected to register the fastest CAGR during the forecast period.

Segment review

On the basis of detection type, the market is categorized into gas-filled detectors, scintillators, and solid-state. In addition, the gas-filled detectors segment is expected to gain highest revenue during the forecast period. This is attributed to the fact that there has been a surge in demand for gas-filled detectors to aid in the management of extreme radiation exposure. In addition, increased use of nuclear medicines is expected to drive the market growth in the coming years. In the medical radiation detection market, scintillators are expected to generate significant revenue share.

By Detection Type

The gas-filled detectors segment is expected to lead the market throughout the forecast period.

Depending on product, the market is classified into personal dosimeters, area process dosimeters, surface contamination monitors, and others. The personal dosimeters segment is anticipated to gain the highest revenue during the forecast period, owing to the advantages offered by personal dosimeters such as an alarm system for radiation exposure throughout the day and the availability of indicators to detect increased susceptibility to harmful radiation. During the forecast period, area process dosimeters are expected to gain significant market share. This is attributed to the rising demand for such dosimeters for early detection of harmful radiation.

By end user, the hospitals segment dominated the global medical radiation detection market in 2020, and is expected to continue this trend in the coming years. This is attributed to increase in number of outpatients and inpatients preferring hospital and higher investment of hospitals for getting improved products for medical radiation detection. Furthermore, surge in adoption of newer products for research purposes led toward the growth of the segment of the medical radiation detection market in the coming years

By End User

The hospitals segment is expected to lead the market throughout the forecast period.

List Of Key Companies

- Mirion Technologies, Inc.

- Sun Nuclear Corporation

- Fortive Corporation

- Biodex Medical Systems, Inc.

- Thermo Fisher Scientific

- Polimaster, Inc.

- IBA Worldwide

- AmRay Group

- PTW Freiburg GmbH

- Infab Corporation.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the medical radiation detection market along with the current trends and future estimations to elucidate the imminent investment pockets.

- The report covers the market analysis from 2020 to 2030, which is expected to enable the stakeholders to capitalize on the prevailing opportunities in the medical radiation detection market.

- A comprehensive analysis of factors that drive and restrain the growth of the market is provided.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook of the medical radiation detection market.

Key Market Segments

By Detection Type

- Gas-Filled Detectors

- Scintilators

- Solid-State

By Product

- Personal Dosimeters

- Area Process Dosimeters

- Surface Contamination Monitors

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Medical Radiation Detection Market Report Highlights

| Aspects | Details |

| By Detection Type |

|

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | Sun Nuclear Corporation, Thermo Fisher Scientific, Inc., Infab Corporation, IBA Worldwide, Biodex Medical Systems, Inc., Fortive corporation., PTW Freiburg GmBH, AmRay Group, Inc., Mirion Technologies, Inc., Polimaster Inc. |

Analyst Review

Medical radiation detectors are a type of medical instrument that is used to detect the presence of radiation. When a person is exposed to radiation for an extended period of time, they are more likely to develop numerous fatal illnesses. As a result, there is an increase in demand for equipment that may be utilized in the development of devices that can quickly detect the quantity of radiation deposited in the body. Handheld Survey Meter (HSM), personal radiation detector (PRD), Radiation Portal Monitor (RPM), and Radiation Isotope Identification Device are some of the major detectors available for identifying radioactive materials and ionizing radiation (RIID). With technological advancements, a variety of radiation detecting equipment may be accessible for use at home. Dosimeters are one type of medical radiation detectors that can detect the presence of Gamma rays, the most dangerous external radioactive threat.

North America gained significant market share in 2020, owing to surge in healthcare spending on respiratory diseases. Furthermore, surge in geriatric population and multidrug resistance among adults and children boost the need for nuclear medicines. This would help the region generate high revenue in the coming years. In addition, Asia-Pacific is anticipated to gain highest market share, owing to rise in patient population and increase in spending on the improvement of healthcare infrastructure.

Medical radiation detection are the devices that can be used for detecting ionizing radiation that is susceptible to harm an individual

Medical radiation detection are used when the healthcare professionals require assistance in preventing exposure to radiation.

The total value of medical radiation detection market was $1,173.0 million in 2020.

The forecast period in the report is from 2021-2030.

The market value of medical radiation detection market in 2030 was $2,558.1 million.

The base year calculated in the report is 2020.

Increased demand for the medical radiation detection for assistance in prevention of exposure to radiation in the population will drive the market over the near future according to the KOLs.

The market has drawn the interest of the healthcare industry, owing to increasing prevalence of different types of pneumonia, rise in R&D in medical radiation detection, and growing awareness among healthcare professionals regarding medical radiation detection

By detection type, gas-filled detectors segment holds the maximum market share.

The market in Asia-Pacific is expected to register lucrative CAGR of 9.7% and highest revenue over the forecast period owing to presence of large population base, increase in awareness regarding medical radiation detection, and rise in disposable income

Loading Table Of Content...