Mental Health Services Market Research, 2033

The global mental health services market size was valued at $0.42 billion in 2023, and is projected to reach $0.60 billion by 2033, growing at a CAGR of 3.9% from 2024 to 2033. The Bureau of Labor Statistics (BLS) projects that employment of counsellors for substance misuse, behavioral disorders, and mental health will increase by 25% between 2019 and 2029 a rate that is significantly faster than the average for all occupations.

Market Introduction and Definition

Mental health services encompass a range of medical, therapeutic, and support services aimed at diagnosing, treating, and managing mental health conditions such as depression, anxiety, bipolar disorder, and schizophrenia. These services include inpatient and outpatient care, counseling, psychotherapy, medication management, and emergency mental health interventions. Offered by healthcare professionals such as psychiatrists, psychologists, social workers, and counselors, mental health services aim to improve individuals' emotional, psychological, and social well-being. Increase in awareness and decrease in stigma around mental health issues have led to a growing demand for these essential services, which are critical for maintaining overall health and quality of life.

Key Takeaways

- The mental health services market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected 2024-2033, mental health services market forecast.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major mental health service industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

One of the primary drivers for mental health services market growth is the increase in prevalence of mental health disorders. Globally, conditions such as depression, anxiety, bipolar disorder, and stress-related issues are on the rise due to various factors including lifestyle changes, social media influence. Thus, growing incidence has heightened the demand for accessible and effective mental health services. Additionally, public awareness campaigns and educational initiatives have significantly reduced the stigma surrounding mental health, encouraging more individuals to seek professional help. Government support through funding and policy initiatives further bolsters the infrastructure needed to provide these essential services.

However, one significant challenge is the high cost of mental health services. Therapy sessions, psychiatric consultations, and medication can be prohibitively expensive, particularly for those without adequate insurance coverage. This financial barrier limits access to necessary care, especially in low-income communities. Additionally, there is a notable shortage of qualified mental health professionals, which exacerbates the accessibility issue. This shortage results in long waiting times for appointments and overburdened healthcare providers, ultimately compromising the quality-of-care patients receive. Moreover, persistent societal stigma and misconceptions about mental health continue to discourage many from seeking help, despite increased awareness efforts.

On the other hand, the integration of telehealth services has revolutionized the way mental health care is delivered, making it more accessible to a broader population. Telehealth platforms enable patients to receive counseling and therapy remotely, breaking down geographical barriers and offering convenience. Additionally, innovations in digital mental health tools, such as mobile apps that provide cognitive behavioral therapy (CBT) techniques and AI-driven mental health support, present significant growth potential. These technologies can supplement traditional therapies, providing continuous support and monitoring for patients. As these digital solutions become more sophisticated and widespread, they offer a promising avenue for addressing some of the market's existing constraints and expanding access to mental health services globally.

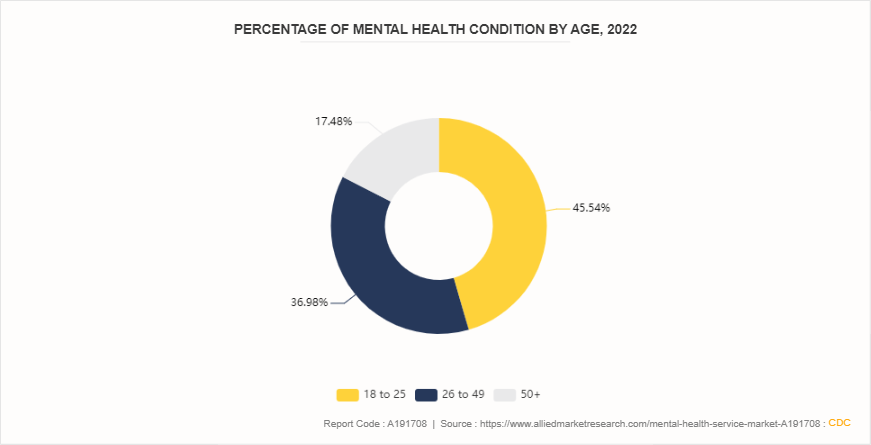

Percentage of mental health condition by age for Mental Health Services market

In 2022, Substance Abuse and Mental Health Services Administration reported that mental health conditions varied significantly across age groups, with the highest prevalence among young adults aged from 18 to 25 years being 36.20%. This suggests a substantial need for mental health services tailored to this demographic driven by factors such as academic pressures, social media influence, and economic uncertainties. The 26 to 49 age group also showed a notable prevalence of 29.40%, reflecting stressors like career challenges and family responsibilities. Individuals aged 50 and above had the lowest prevalence at 13.90%, indicating relatively better mental health but still necessitating targeted support for age-related issues. This data highlights the importance of age-specific mental health services and interventions.

The mental health service industry is segmented into service type, end user, and region. Based on service type, the market is segmented into inpatient services, outpatient services, telehealth services, emergency mental health services, and residential treatment services. As per end user, it is segmented into hospitals and clinics, home healthcare, community centers, educational institutions, and corporate sector. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The mental health services market shows varied growth across regions. North America leads due to high awareness, advanced healthcare infrastructure, and strong government support. Europe follows, driven by increasing mental health initiatives and integration of services into primary care. The Asia-Pacific region is witnessing rapid growth, fueled by rising awareness, urbanization, and expanding healthcare access. Latin America and the Middle East & Africa, though slower in adoption, present significant potential due to increasing healthcare investments and growing recognition of mental health importance.

- According to Substance Abuse and Mental Health Services Administration report, a total of 7.7 million teenagers, or around 29.8% of those between the ages of 12 and 17, required mental health care in 2022. In addition, 56.8% of the 4.8 million teenagers who had a major depressive episode (MDE) over the year—received mental health treatment.

- According to Mental Health foundation, stated that, in 2022/23, an average of 37.1% of women and 29.9% of men reported high levels of anxiety. Thus, contributing to the demand for mental health services.

Industry Trends

- According to the Substance Abuse and Mental Health Services Administration (SAMHSA) , as of 2020, there were around 14, 000 facilities specializing in substance use treatment and 4, 000 facilities focused on mental health treatment in the U.S. These treatment centers provide various levels of care, including outpatient, intensive outpatient, partial hospitalization, residential, and inpatient services.

Competitive Landscape

The major players operating in the Mental Health Services market share include Acadia Healthcare, The MENTOR Network, Universal Health Services, Inc., Behavioral Health Network, Inc., CareTech Holdings PLC, Strategic Behavioral Health, Ascension Seton, North Range Behavioral Health, Pyramid Healthcare, and Promises Behavioral Health. Other players in the mental health services market size include Ginger, Optum, CVS Health and so on.

Recent Key Strategies and Developments

- In June 2023, Mount Sinai Health System inaugurated the newly constructed Mount Sinai-Behavioral Health Center, located at 45 Rivington Street in Lower Manhattan. The facility is aimed to transform behavioral health care in New York City by serving as a comprehensive one-stop shop for mental health care, substance use treatment, and primary care.

- In March 2021, Acadia announced that it has formed a joint venture with Geisinger Health. This partnership will build new facilities with 96-beds, serving the central and northeastern regions of the state. The new freestanding behavioral health facilities will provide comprehensive inpatient services to adult, older adult, adolescent and pediatric patients.

Key Sources Referred

- World Health Organization (WHO)

- Centers for Medicare & Medicaid Services (CMS)

- National Health Service (NHS)

- National Health Mission (NHM)

- Substance Abuse and Mental Health Services Administration

- Bureau of Labor Statistics (BLS)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- Mental Health Foundation

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mental health services market analysis from 2024 to 2033 to identify the prevailing mental health services market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mental health services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global mental health services market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the mental health services market players.

- The report includes the analysis of the regional as well as global mental health services market trends, key players, market segments, application areas, and market growth strategies.

Mental Health Service Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 0.6 Billion |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 216 |

| By Service Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Promises Behavioral Health, CareTech Holdings PLC, Pyramid Healthcare, Ascension Seton, Universal Health Services, Inc., The MENTOR Network, Strategic Behavioral Health, Acadia Healthcare, North Range Behavioral Health, Behavioral Health Network, Inc. |

The total market value of Mental Health services market is $0.42 billion in 2023.

The forecast period for Mental Health services market is 2024 to 2033

The market value of Mental Health services marketin 2033 is $0.46billion

The base year is 2023 in Mental Health services market.

Top companies such as Acadia Healthcare, The MENTOR Network, Universal Health Services, Inc., held a high market position in 2023. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LAMEA.

The inpatient services segment is the most influencing segment in Mental Health services market

Loading Table Of Content...