Mental Health Software Market Research, 2033

The global mental health software market size was valued at $4.8 billion in 2023, and is projected to reach $14.6 billion by 2033, growing at a CAGR of 11.7% from 2024 to 2033. By leveraging advancements, mental health software providers can offer more sophisticated and effective solutions, driving market growth and expanding the scope of mental health care services.

Market Introduction and Definition

Mental health software encompasses a variety of digital tools and applications designed to support the delivery of mental health care services. These software solutions include electronic health records (EHR) , clinical decision support systems (CDSS) , practice management tools, telehealth platforms, and e-prescribing systems. They aim to streamline administrative tasks, enhance clinical decision-making, and improve patient engagement. By providing a comprehensive approach to mental health care, these tools facilitate more efficient and effective management of patient records, treatment plans, and therapy sessions. The increasing demand for mental health services and the integration of technology in healthcare are adopting of mental health software market growth , making it an essential component of modern mental health care delivery.

Key Takeaways

- The mental health software market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected 2024-2033, mental health software market forecast period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major mental health software industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Growth in awareness and acceptance of mental health issues have significantly driven the mental health software market. Increased public education and advocacy have reduced the stigma associated with mental health conditions, encouraging more individuals to seek treatment. This shift has led to a higher demand for mental health services, necessitating effective and efficient management solutions. Mental health software meets this need by providing tools for better diagnosis, treatment planning, and patient management. Moreover, healthcare providers are increasingly recognizing the value of integrating these digital solutions to enhance care delivery, streamline operations, and improve patient outcomes, further propelling market growth.

However, despite the numerous benefits of mental health software, the high cost associated with its implementation and maintenance can be a significant barrier for healthcare providers, especially smaller practices and clinics with limited budgets. The initial investment in software systems, along with ongoing expenses for updates, training, and technical support, can be prohibitive. Additionally, the complexity of integrating new software with existing systems can deter providers from adopting these solutions, potentially limiting the market's growth.

Furthermore, technological advancements in artificial intelligence (AI) and machine learning (ML) present a significant opportunity for the mental health software market. AI and ML can enhance the capabilities of mental health software by enabling more accurate diagnoses, personalized treatment plans, and predictive analytics. For instance, AI-driven tools can analyze patient data to identify patterns and predict potential mental health issues before they become severe. These technologies also facilitate the development of innovative features, such as virtual mental health assistants and automated therapy recommendations, which can significantly improve patient outcomes and streamline clinical workflows.

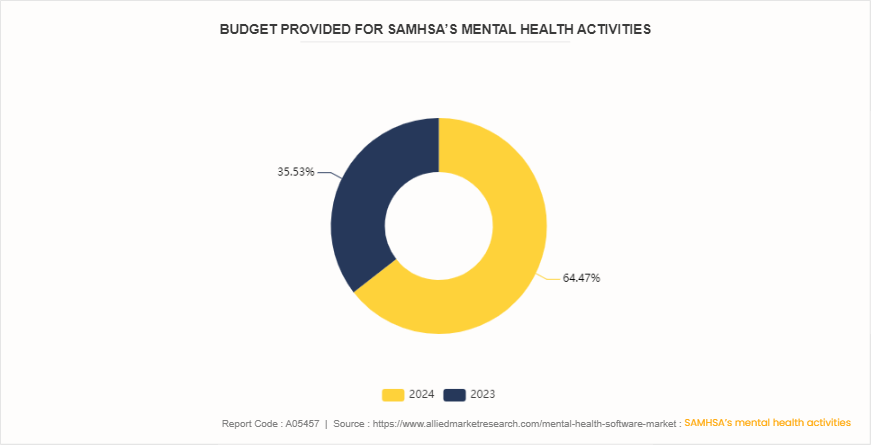

Budget provided for SAMHSA’s mental health activities for Mental Health Software market

The FY 2024 budget allocates $4.9 billion to SAMHSA’s mental health activities, significantly increasing from the $2.7 billion provided in FY 2023. This $2.2 billion increase highlights the rise in recognition of the importance of mental health services and the need for robust support infrastructure. For the mental health software market, this budget boost implies more substantial investment in digital health solutions, including electronic health records (EHR) , telehealth services, and other technological tools. As funding for mental health initiatives rises, the demand for innovative software solutions to enhance patient care, streamline administrative processes, and improve accessibility to mental health services is expected to grow correspondingly.

Market Segmentation

The mental health software industry is segmented into software type, solution, end user and region. By software type, the market is segmented into clinical functionality, administrative functionality, telehealth solutions, e-prescribing, and others. By solution, it is bifurcated into integrated software, and standalone software. As per end user, it is segmented into community clinics, hospitals, and private practices. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The mental health software market share shows varied growth across regions. North America leads due to high awareness, advanced healthcare infrastructure, and strong government support. Europe region is driven by increase in mental health initiatives and integration of services into primary care. The Asia-Pacific region is witnessing rapid growth, fueled by rising awareness, urbanization, and expanding healthcare access. Latin America and the Middle East & Africa, though slower in adoption, present significant potential due to increasing healthcare investments and growing recognition of mental health importance.

- According to Substance Abuse and Mental Health Software Administration report, a total of 7.7 million teenagers, or around 29.8% of those between the ages of 12 and 17, required mental health care in 2022.

Industry Trends

- According to the Substance Abuse and Mental Health Software Administration (SAMHSA) , as of 2020, there were around 14, 000 facilities specializing in substance use treatment and 4, 000 facilities focused on mental health treatment in the U.S. These treatment centers provide various levels of care, including outpatient, intensive outpatient, partial hospitalization, residential, and inpatient services.

- For instance, in May 2022, Osmind, a San Francisco-based firm, raised USD 40 million in Series B financing to expand its technology. With the funding, it will continue to develop and scale the Osmind EHR platform to meet the needs of innovative mental health clinicians, including psychiatrists and other specialties, with tools including streamlined charting workflows, secure patient engagement, and automated outcomes tracking

Competitive Landscape

The major players operating in the mental health software market size include Accumedic Computer Systems Inc., BestNotes, Oracle Corporation, Credible a part of Qualifacts Systems, LLC, Netsmart, Technologies Inc., Planet DDS, Inc. (NXGN Management LLC) , Valant Medical Solutions Inc., Welligent Inc., CloudMD Software & Services Inc., and New Directions Behavioral Health, LLC (Tridiuum Inc.) .Other players in the Mental Health Software market include TELUS Health, Behave Inc., Psyquel and so on.

Recent Key Strategies and Developments

- In May 2022, The Department of Health and Human Services (HHS) announced a nearly $15 million, three-year federal grant to establish a SAMHSA program aimed at enhancing behavioral health care in nursing homes and long-term care facilities. Funded by the Centers for Medicare & Medicaid Services (CMS) , this initiative will create a Center of Excellence to build capacity in caring for residents with behavioral health conditions.

- In September 2023, Headspace and One Medical, a U.S.-based provider of in-office and virtual primary care, formed a strategic partnership. This collaboration aims to develop solutions to reduce anxiety and promote awareness about preventive health screenings.

Key Sources Referred

- World Health Organization (WHO)

- Centers for Medicare & Medicaid Services (CMS)

- National Health Service (NHS)

- National Health Mission (NHM)

- Substance Abuse and Mental Health Software Administration

- Bureau of Labor Statistics (BLS)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- Mental Health Foundation

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mental health software market analysis from 2024 to 2033 to identify the prevailing Mental Health Software Market Opportunity .

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mental health software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global mental health software market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the mental health software market players.

- The report includes the analysis of the regional as well as global mental health software market trends, key players, market segments, application areas, and market growth strategies.

Mental Health Software Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 14.6 Billion |

| Growth Rate | CAGR of 11.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 216 |

| By Software Type |

|

| By Solution |

|

| By End User |

|

| By Region |

|

| Key Market Players | Accumedic Computer Systems Inc, Netsmart Technologies Inc., Credible a part of Qualifacts Systems, LLC, Planet DDS, Inc. (NXGN Management LLC), New Directions Behavioral Health, LLC (Tridiuum Inc.), CloudMD Software & Services Inc., Welligent Inc., Oracle Corporation?, BestNotes, Valant Medical Solutions Inc |

The clinical functionality software segment is the most influencing segment in Mental Health Software Market

The total market value of Mental Health Software Market is $4.8 billion in 2023.

The forecast period for Mental Health Software Market is 2024 to 2033

The market value of Mental Health Software Market in 2033 is $14.6 billion

Top companies such as BestNotes, Oracle Corporation, Credible a part of Qualifacts Systems, LLC, Netsmart, Technologies Inc., Planet DDS, Inc, held a high market position in 2023. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LAMEA.

The market value of Mental Health Software Marketin 2033 is $14.6 billion

Loading Table Of Content...