Metal Cutting Tool Market Research - 2032

The Global Metal Cutting Tool Market was valued at $65.5 billion in 2020, and is projected to reach $107.3 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

Metal cutting tool comes under the category of cutting tools, which is used to remove material form metallic workpiece by the process of shear deformation. Metal cutting tool can be single-point tool or multi-point tool based on the cutting edges available. Shaping tool is an example of single-point tool, whereas drilling tool, milling tool, and broaching tool are examples of multi-point tool.

Market Dynamics

Metal cutting tool should have appropriate hardness, toughness, and wear resistance for its prolonged service life. These tools can be used in machining processes such as drilling, reaming, milling, broaching, tapping, milling, and threading. Common metal cutting tools include hacksaw, jigsaw, grinder, and snips.

Fast-paced industrialization and urbanization in developing and developed have enhanced the growth of many industries including the likes of automotive, and manufacturing, and also aerospace & defense industries. These factors eventually boost the demand for metal-cutting tools during the projected period. Additionally, the population has increased substantially and disposable income has also increased significantly world, primarily in developing countries. These developments have resulted in increased production in manufacturing industries, eventually accelerating the demand for metal-cutting tools.

However, the high cost of acquiring metal cutting tools, as well as the high operating and maintenance costs are key restraints having a negative impact on the market during the forecast period. Along with this, the lack of skilled employees to operate machines equipped with metal-cutting tools and the rise in daily wages hamper the growth of metal cutting tool market. In addition to that, the equipment rental market is also a major restraint for the metal tools-cutting market, due to the cheaper and easy availability of those tools in the equipment rental market.

On the contrary, a rise in demand for energy-efficient metal-cutting tools, which consume less electricity and are safer is a metal cutting tool market opportunity for new product development in the metal-cutting tool market, thereby having positive impact on the metal cutting tool market growth.

The demand for metal cutting tools decreased in 2020, owing to low demand from different industries due to lockdown imposed by government of many countries. COVID-19 pandemic shut-down production of various products in the metal cutting tools industry, mainly owing to prolonged lockdown in major global countries. This has hampered the growth of the metal cutting tools market significantly.

The major demand for equipment and machinery was previously noticed from giant manufacturing countries including the U.S., Germany, Italy, the UK, and China, which was affected by the spread of coronavirus, thereby halting the demand for equipment and machinery.

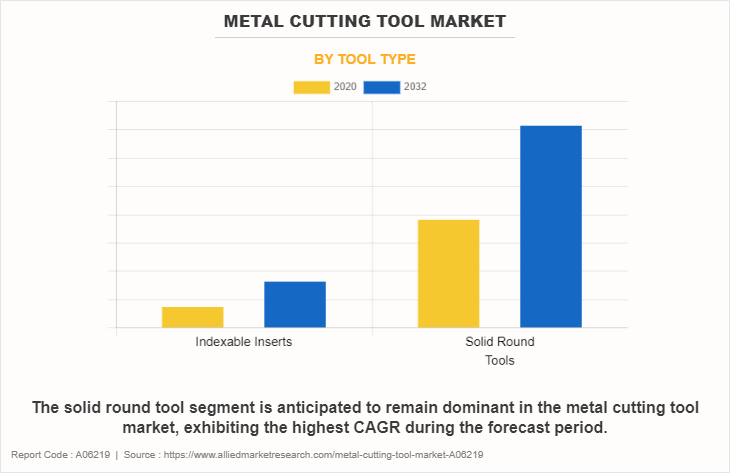

The solid round tool segment contributed to the highest metal cutting tool market share in 2020, accounting for more than half of the metal cutting tool market revenue and is estimated to maintain its leadership status throughout the forecast period. The development of recent materials for ultimate metal removing inserts, which are light weight and have an extended life, is expected to boost the demand for metal cutting tool. In addition, development of new technologies in manufacturing industries which eventually produce high quality tools also help in the market growth. Moreover, rapid growth in the automotive industry is expected to boost the market growth during the forecast period.

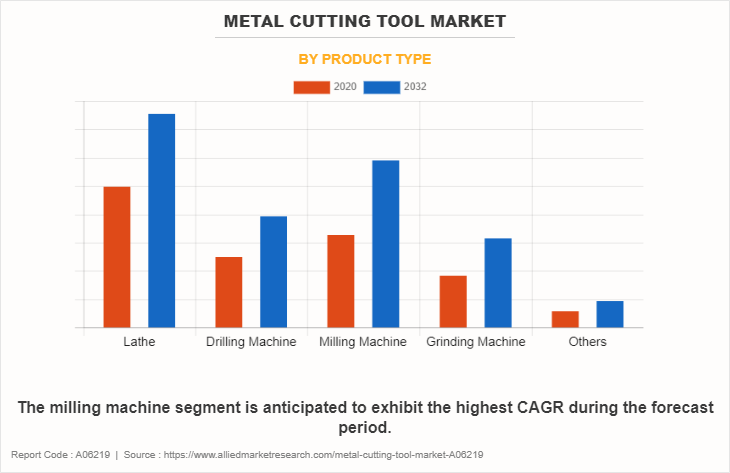

The lathe segment was the highest revenue contributor to the market share in 2020 of the metal cutting tool market. The milling machine segment is estimated to maintain its leadership status throughout the forecast period. This is attributed to the increasing demand for metal cutting tools in the industrial sector.

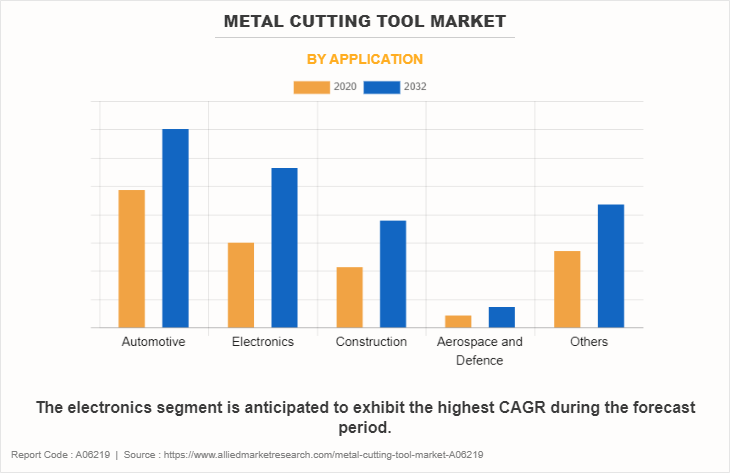

The automotive segment accounted for the largest share in 2020 of the metal cutting tool market revenue, and electronics segment is expected to portray the largest CAGR of 5.3% from 2023 to 2032. The automobile industry has shown significant growth in the developing countries mainly in China and India. Although the industry has reached a stagnation point in the U.S. and European countries, the after-sales services, such as repairing, maintenance, and retrofitting have higher demand in these regions. Such factors propel the demand for metal cutting tool in the automotive industry globally.

Segmental Overview

The metal cutting tool market is segmented into tool type, product type, end user, and region.

By tool type, the metal cutting tool market is categorized into indexable inserts and solid round tools. In 2020, the sound round tools segment dominated the market, in terms of revenue, and is expected to maintain this trend in the coming years.

On the basis of product type, the metal cutting tool market is divided into lathe, drilling machine, milling machine, grinding machine, and others. The milling machine segment is anticipated to dominate the market during the forecast period.

On the basis of end user, the market is categorized into automotive, aerospace & defense, construction, electronics, and others. The electronics segment dominated the market in 2020. Major players are adopting product launch and acquisition as key developmental strategies to improve the product portfolio of metal cutting tool market. For instance, in May 2022, Hilti Corporation introduced new steel circular saw blade for cold, fast, straight cuts in ferrous metal and structural panels. This will improve the product portfolio of the company.

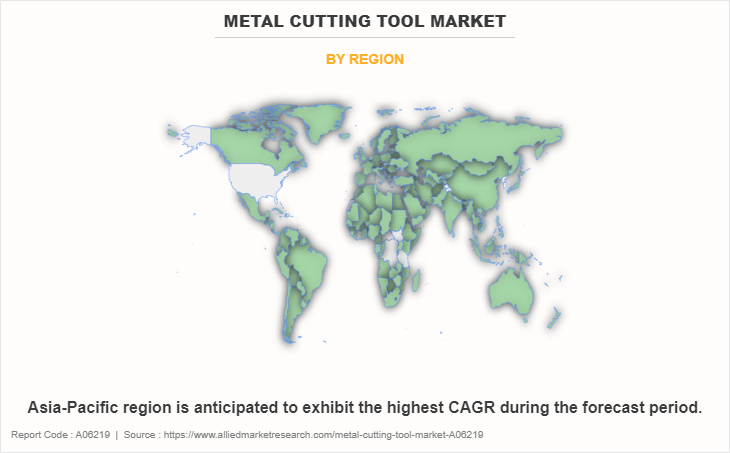

By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region is expected to hold the highest market share during the forecast period. Asia-Pacific accounted for the highest market share in 2020, and is expected to grow with a high CAGR during the forecast period.

Competition Analysis

The key players profiled in the metal cutting tool market report include EHWA DIAMOND, Hilti Corporation, Ingersoll Cutting Tools, Iscar Ltd., Kennametal Inc., Makita Corporation, Robert Bosch GmbH, Sandvik AB, Stanley Black & Decker Inc., and Snap-on incorporated.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging global metal cutting tool market trends and dynamics.

- In-depth metal cutting tool market analysis is conducted by the global metal cutting tool market estimations for key market segments between 2020 and 2032.

- Extensive analysis of the global lathe robots’ market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The global metal cutting tool market forecast analysis from 2020 to 2032 is included in the report.

- The key market players within market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the global metal cutting tool industry.

Metal Cutting Tool Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 107.3 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2020 - 2032 |

| Report Pages | 169 |

| By Tool Type |

|

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Tiangong International Co., FANUC CORPORATION, BIG DAISHOWA Inc., DN Solutions, Amada Machine Tools Co. Ltd., Proterial, Ltd., Sandvik AB, Berkshire Hathaway Inc. (Ingersoll Cutting Tool Company), Komatsu Ltd., Kennametal Inc. |

Analyst Review

The Asia-Pacific region dominated the metal cutting tool market in 2020. Rise in popularity of CNC machines drives the market growth. This is attributed to the benefits offered by CNC metal cutting tool, including high efficiency, transparency, cost saving, and time efficiency. In addition, major cutter companies have strengthened their efforts to develop and manufacture more advanced designs to satisfy increased customer demands. Moreover, advances in workpiece manufacturing technologies such as metal injection molding, 3D printing, investment casting, are expected to drive the market expansion during the forecast period.

Many companies in the metal cutting tool market are developing and introducing new products in the market. These new products are technologically more advanced than the previous range of their products. These new products are more efficient and effective in their performance and are widely used in the industry. For instance, in July 2021, Bosch launched the new Expert HEX-9 Hard Ceramic tile drill bits for construction trade, the Expert Thick Tough Metal reciprocating saw blades for metal and demolition trades, and the Expert Hardwood fast jigsaw blades for the woodworking trade, with an aim to improve the product portfolio. This is expected to propel the growth of the metal cutting tool market.

The metal cutting tool market was valued at $65,485.40 million in 2020.

The forecast period considered for the metal cutting tool market is 2023 to 2032, wherein, 2022 is the base year, 2022 is the base year. 2020-2021 is historic year.

The latest version of metal cutting tool market report can be obtained on demand from the website.

The base year considered in the metal cutting tool market report is 2022.

The major players profiled in the market include Ehwa Diamond, Hilti Corporation, Ingersoll Cutting Tool, Iscar Ltd., Kennametal Inc., Makita Corporation, Robert Bosch GmbH, Sandvik AB, Stanley Black & Decker Inc., and Snap-On Incorporated.

The metal cutting tool market is estimated to reach $107,287.20 million by 2032, exhibiting a CAGR of 4.1% from 2023 to 2032.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By application, the automotive segment was the largest revenue generator in 2020.

Loading Table Of Content...

Loading Research Methodology...