Metal Forging Market Overview

The global metal forging market was valued at $96.4 billion in 2024, and is projected to reach $195.6 billion by 2034, growing at a CAGR of 7.3% from 2025 to 2034. This is driven by rising demand from automotive and aerospace sectors, technological advancements in forging processes, and increased use of high-strength materials in industrial applications. These factors are expected to boost market expansion in the coming years, as industries seek stronger, more durable components to meet evolving performance and safety standards.

Market Dynamics & Insights

- The metal forging industry in Asia-Pacific held a significant share of over 72.7% in 2024.

- The metal forging industry in China is expected to grow significantly at a CAGR of 5.6% from 2025 to 2034

- By raw material, carbon steel segment is one of the dominating segments in the market and accounted for the revenue share of over 41.9% in 2024.

- By application, others application segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2024 Market Size: $96.4 Billion

- 2034 Projected Market Size: $195.6 Billion

- CAGR (2025-2034): 7.3%

- Asia Pacific: Largest market in 2024

- Asia Pacific: Fastest growing market

What is Meant by Metal Forging

Metal forging is a manufacturing process that shapes metal using compressive forces, typically applied through hammers, presses, or dies. This process enhances the strength, durability, and structural integrity of metal components by refining their grain structure. Commonly used in industries such as automotive, aerospace, construction, and defense, metal forging produces high-performance parts like crankshafts, gears, and turbine blades. It is classified into open die, closed die, and seamless rolling forging, each suited for specific applications.

The growing automotive industry is a significant driver of the Metal Forging Industry, as forged components provide exceptional strength, durability, and resistance to wear. Automotive manufacturers rely on forged parts such as crankshafts, connecting rods, and gears, which are essential for vehicle performance, reliability, and safety. The rising production of electric vehicles (EVs) has further increased the demand for lightweight forged components that enhance energy efficiency and improve battery range. Additionally, stringent government regulations on fuel efficiency and emissions have led manufacturers to adopt advanced forging techniques using high-strength materials. The increasing focus on vehicle weight reduction and sustainability is also driving innovation in forging technology. As global automobile production continues to rise, coupled with advancements in precision forging and material science, the demand for high-performance forged components is expected to grow steadily. This growth will significantly contribute to the expansion of the metal forging market, making it an essential industry for automotive advancements globally.

However, the growing demand, the Metal Forging Industry faces challenges related to high initial investment and operational costs. Setting up forging facilities requires substantial capital investment in advanced machinery, high-temperature furnaces, and precision tooling, making it financially challenging for small and medium-sized enterprises (SMEs). Moreover, metal forging is an energy-intensive process, consuming large amounts of electricity and fuel, leading to high production costs. The fluctuating prices of raw materials, such as steel and aluminum, further impact profit margins and create uncertainty in the market. Additionally, the requirement for skilled labor adds another layer of complexity, as forging operations demand experienced technicians to maintain precision and quality standards. However, companies that fail to invest in modern equipment and automation may struggle to compete with larger players adopting cost-efficient production methods. These factors collectively pose a restraint on market expansion, limiting the growth of smaller manufacturers and increasing financial pressures on existing industry players.

Furthermore, the rapid adoption of automation and smart manufacturing technologies presents a lucrative opportunity for the metal forging market. Advanced technologies, such as computer-controlled forging presses, robotic automation, and artificial intelligence-driven quality inspection, are transforming the industry by improving efficiency, reducing production costs, and enhancing precision. Moreover, the integration of the Industrial Internet of Things (IIoT) allows real-time monitoring of forging processes, leading to optimized operations and minimized material wastage. The development of hybrid forging techniques and 3D printing for mold-making further expands design possibilities and customization options. Additionally, automated forging solutions help manufacturers address the shortage of skilled labor by streamlining production and reducing reliance on manual expertise. These technological advancements are expected to drive innovation across multiple sectors, including aerospace, medical, and defense industries. As more companies invest in digital transformation and smart forging solutions, the market will witness significant growth, opening new avenues for high-performance, cost-effective, and sustainable forging applications.

Metal Forging Market Segmental Overview

The Metal Forging Market is segmented into Application, Raw Material and Technique.

By raw material, the market is categorized into carbon steel, aluminum, stainless steel, and others.

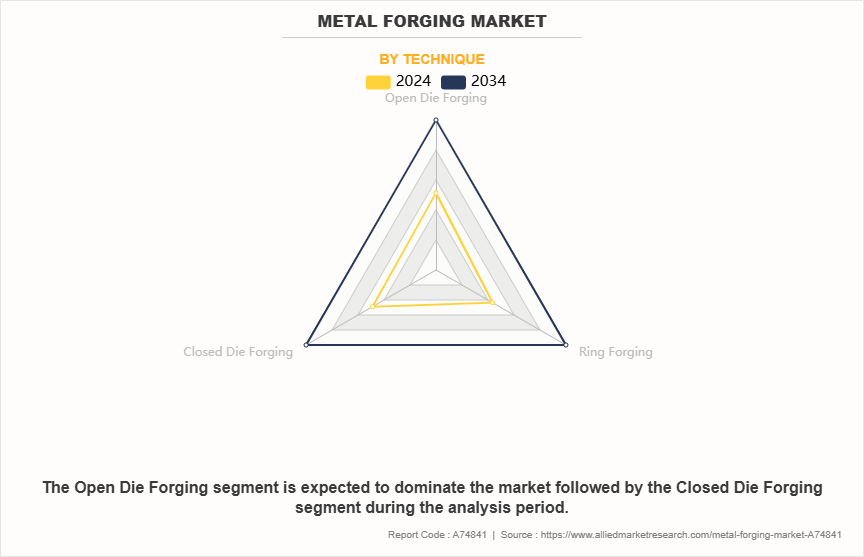

Depending on technique, the market is classified into open die forging, closed die forging, and ring forging.

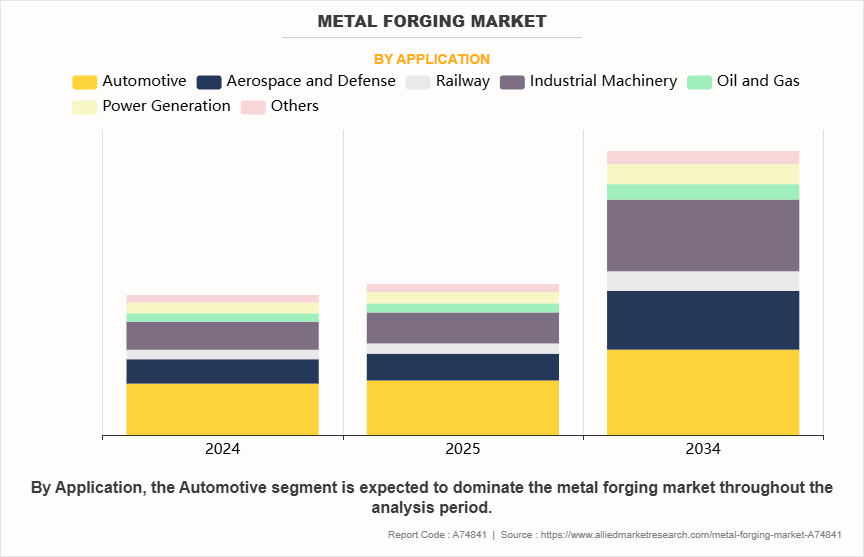

By application, the market is divided into automotive, aerospace & defense, railway, industrial machinery, oil & gas, power generation, and others.

Region wise, Metal Forging Market Outlook is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, UK, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and Latin America (Brazil, Argentina, Chile, and rest of Latin America), Middle East(Saudi Arabia, UAE, Rest Of GCC, and rest Of Middle East), and Africa(North Africa and Southern Africa).

Competition Analysis

Competitive analysis and profiles of the major players in the metal forging market is provided in the report. Major companies included in the report include ATI Inc., American Axle & Manufacturing Holdings, Inc., Bruck GmbH, Ellwood Group, Inc., Berkshire Hathaway Inc. (Precision Castparts Corp.), Asahi Forge Corporation, Trenton Forging, Nippon Steel Corporation, Bharat Forge Limited, and Canada Forgings Inc. Moreover, acquisition has been a key development strategy adopted by the key players to increase their market share.

Whare are the Recent Developments in Metal Forging Industry

- In February 2025, ATI opened its state-of-the-art Additive Manufacturing Products facility in Margate, Florida. The vertically integrated greenfield build includes design, manufacturing, heat treating, machining and inspection capabilities for large-format Additive Manufacturing.

- In October 2024, ATI collaborated with Advanced Forming Research Centre (AFRC) for advanced engineering and materials science to support sustainable air travel. Through this strategy AFRC offers its Future Forge facility for the development of the next generation of materials and process technologies for aircraft. Future Forge features a 2,000-tonne press with open die, closed die, and iso-thermal forging.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the metal forging market analysis from 2024 to 2034 to identify the prevailing Metal Forging Market Opportunity.

- The market research is offered along with information related to Forged Metal key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the metal forging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global metal forging market trends, High-Strength Forging key players, Metal Forging Market segments, application areas, and market growth strategies, Metal Forging Market Size, Metal Forging Market Share, Metal Forging Market Growth and Metal Forging Market Forecast

Metal Forging Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 195.6 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 339 |

| By Application |

|

| By Raw Material |

|

| By Technique |

|

| By Region |

|

| Key Market Players | Ellwood Group, Inc., Berkshire Hathaway Inc. (Precision Castparts Corp.), Trenton Forging, Bruck GmbH, Canada Forgings Inc., ATI, Bharat Forge, Nippon Steel Corporation, ASAHI FORGE CORPORATION, American Axle & Manufacturing Holdings, Inc. |

Adoption of Green and Sustainable Forging Practices, and Integration of Automation and Smart Manufacturing Technologies are the upcoming trends of Metal Forging Market in the globe

Automotive is the leading application of Metal Forging Market

Asia-Pacific is the largest regional market for Metal Forging

In 2024, $96 billion was the estimated industry size of Metal Forging

ATI Inc., American Axle & Manufacturing Holdings, Inc., Bruck GmbH, Ellwood Group, Inc., Berkshire Hathaway Inc. (Precision Castparts Corp.), Asahi Forge Corporation, Trenton Forging, Nippon Steel Corporation, Bharat Forge Limited, and Canada Forgings Inc are the top companies to hold the market share in Metal Forging

Loading Table Of Content...

Loading Research Methodology...