Micro Battery Market Research, 2032

The Global Micro Battery Market was valued at $0.5 billion in 2022, and is projected to reach $4 billion by 2032, growing at a CAGR of 21.6% from 2023 to 2032.

A micro battery is a kind of small battery that is intended to power small electronic systems or gadgets. Due to their small size, these batteries are usually utilized in situations where there is a shortage of space in micro battery industry. Due to size restrictions, conventional bigger batteries may not be feasible in devices such as hearing aids, sensors, medical implants, and several other microelectronic devices. In these situations, micro batteries are frequently used.

The growing use of wearable technology, the growth of the semiconductor sector, and the rise in private expenditures in technical R&D for Internet of Things (IoT) technology are the main drivers of micro battery market growth. The market demand is also driven by consumers switching from conventional batteries to micro batteries because of their many benefits. Growing awareness of the advantages of micro batteries is a major factor driving the worldwide market for micro batteries. Micro batteries often have a large operating temperature range and a high energy density.

The batteries are flexible, lightweight, and able to be shaped into any shape without sacrificing their effectiveness. These attributes make micro lipo battery pivotal in powering portable and wearable electronic devices, where space and weight considerations are critical. As industries and consumers alike recognize the benefits of these compact power sources, the demand for micro start continues to escalate, driving innovation in their design and application across an array of technological domains.

The government's emphasis on digitization in practically every industry including banking and healthcare has raised consumer electronics demand, particularly after COVID-19 when everything became digital. This raises the market's internet user base, which has fueled the e-commerce sector's explosive expansion and contributed to the rise of smart packaging.

TSolid-state lighting, power electronics, and other various applications in various industrial and renewable energy sectors are anticipated to witness significant advancements thanks to WBG semiconductors. It will be necessary to create state-of-the-art manufacturing techniques that can generate high-quality WBG materials, devices, and modules at a reasonable price in order to realise the energy-saving potential of WBG semiconductors.

With the ability to track and monitor, smart packaging solutions are now essential to satisfying the changing needs of the market. A strong ecosystem for digital transformation is being fostered by a partnership between government efforts, consumer behavior shifts, and technology improvements as the globe adopts a more technologically driven and networked landscape. This is reshaping the dynamics of numerous sectors.

At the outset of the COVID-19 pandemic, the market experienced an upturn due to an increase in demand for micro batteries. Post-pandemic, the industry quickly adjusted as the demand for micro batteries grew alongside the increase in the sale of button batteries and thin film batteries. This shift led to innovation and a subsequent rebound in the market.

Segment Overview

The micro battery market analysis is segmented into Type, Battery Type and Application.

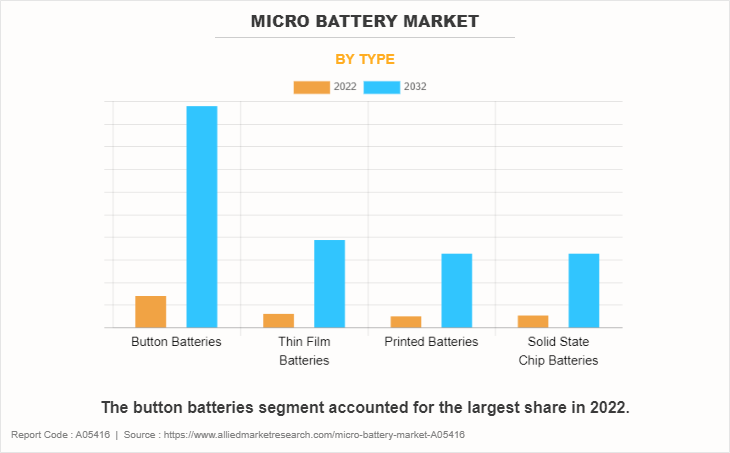

By type, the market is classified into button batteries, thin film batteries, printed batteries, and solid-state chip batteries. Button batteries segment accounted for the largest share in 2022.

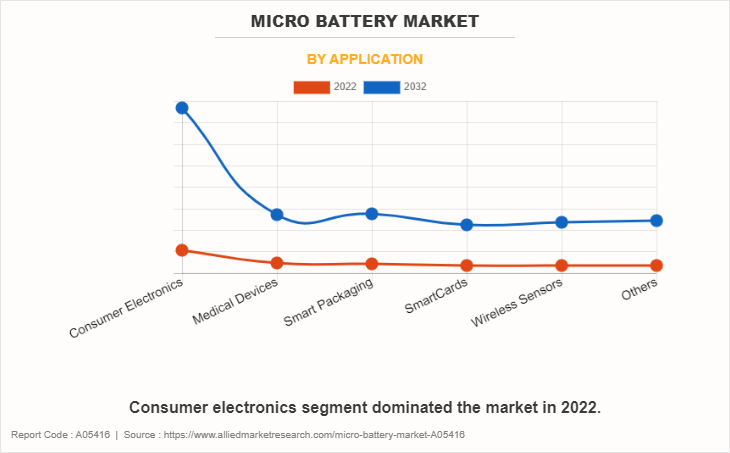

By application, it is bifurcated into consumer electronics, medical devices, smart packaging, smart cards, wireless sensors, and others. Consumer electronics generated the largest revenue in 2022.

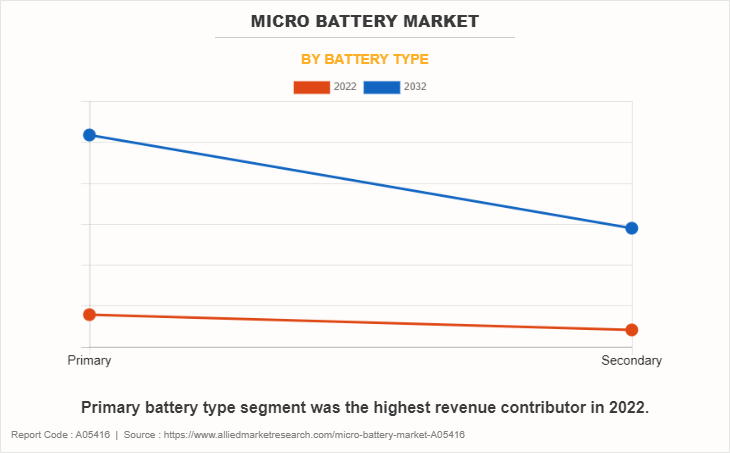

By battery type, it is divided into primary and secondary. Primary segment dominated the market in 2022.

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA along with their prominent countries.

Country-wise, the U.S. acquired a prime share in the micro battery industry in the North American region and it is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, the UK dominated the micro battery market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. However, the UK is expected to emerge as the fastest-growing country in Europe's surrounding market with a CAGR of 20.69%.

In Asia-Pacific, China, is expected to emerge as a significant market for the micro battery market industry, owing to a significant rise in investment by prime players due to an increase in the growth of consumer electronics in rural and urban regions.

In the LAMEA region, the Middle East garnered a significant market share in 2022. The LAMEA market has witnessed an improvement, owing to the growth in the inclination of prime vendors towards utilizing the micro battery across this region. Moreover, the Middle East region is expected to grow at a high CAGR of 22.83% from 2023 to 2032.

Competitive Analysis

Competitive analysis and profiles of the major global micro battery market players that have been provided in the report include Panasonic Corporation, Murata Manufacturing Co Ltd., TDK Corporation, Maxell, Ltd., VARTA AG, Enfucell, Duracell, Molex, Renata, and Seiko Instruments Inc. These key players adopt several strategies such as new product launch & development, acquisition, partnership & collaboration, and business expansion to increase the micro battery during the forecast period.

Top Impacting Factors

The micro battery market trends is expected to witness notable growth owing to the increase in the adoption of wearable devices and propelling the growth and demand for flexible and thin film batteries in the Internet of things. Moreover, the surge in the integration of micro batteries in small textiles is expected to provide lucrative micro battery market opportunity during the forecast period. On the contrary, the lack of designs in fabrication limits the growth of the market.

Historical Data & Information

The global market is highly competitive, owing to the strong presence of existing vendors. Vendors of the market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to micro battery market demand. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Panasonic Corporation, Murata Manufacturing Co Ltd., TDK Corporation, Maxell Ltd., and VARTA AG are the top companies holding a prime share in the DRAM market. Top market players have adopted various strategies, such as product launch to expand their foothold in the market.

In May 2023, Panasonic planned to ramp up the production of battery cells used in electric vehicles by building two new factories in North America. The company seeks to boost its auto battery capacity to 200 gigawatt hours per year by March 2031.

In December 2022, Panasonic Holdings concluded an agreement to supply lithium-ion batteries to electric vehicle (EV) maker Lucid Group.

In October 2020, Murata Manufacturing Co., Ltd. launched High Drain silver oxide batteries (SR) and alkaline manganese batteries (LR). The silver oxide batteries (SR) and alkaline manganese batteries (LR) are used in medical devices for dosing devices, insulin pumps/pens, and capsule endoscopes.

In October 2023, Tdk launched film solar cells. It is light and thin, which means it can stand up to dropping, and is flexible and has excellent formability characteristics.

Key Benefits For Stakeholders

- This study comprises analytical depiction of the micro battery market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall micro battery analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current micro battery market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

Micro Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4 billion |

| Growth Rate | CAGR of 21.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 387 |

| By Type |

|

| By Battery Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Murata Manufacturing Co Ltd., Panasonic Corporation, Molex, Seiko Instruments Inc., Enfucell, Duracell, VARTA AG, Renata, TDK Corporation, Maxell, Ltd. |

Analyst Review

The micro battery market is expected to leverage high potential for the button batteries and thin film batteries during the forecast period. Micro battery vendors, investing in R&D and skilled workforce, are anticipated to gain a competitive edge over their rivals. The competitive environment in this market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The constant advancement of consumer electronics, from wearables to smartphones, has made improved micro batteries with extended lifespans, high energy densities, and effective power transfer.

Leading economies are leading the way in realizing the strategic significance of sophisticated micro batteries, including the US, China, UK, and Japan. These countries actively engage in the creation and use of cutting-edge micro battery technology across a range of industries in addition to being large consumers. The United States, which is renowned for its innovation ecosystem, is leading R&D efforts to produce micro batteries that solve environmental sustainability issues and satisfy the ever-expanding needs of consumer devices.

China, a global manufacturing powerhouse, is strategically investing in the mass production of micro batteries to meet the escalating demands of its domestic and international markets. Simultaneously, the UK and Japan, renowned for their technological advancements, are fostering collaborations between industry and research institutions to accelerate the development of advanced micro batteries.

The surge in demand for micro batteries in consumer electronics across the globe for power transmission drives the need for enhanced micro batteries. Moreover, major economies, such as the U.S., China, the UK, and Japan plan to develop and deploy advanced micro batteries in various sectors.

Key micro battery market leaders profiled in the report include Panasonic Corporation, Murata Manufacturing Co Ltd., TDK Corporation, Maxell, Ltd., VARTA AG, Enfucell, Duracell, Molex, Renata, and Seiko Instruments Inc.

Consumer electronics is the leading application in micro battery market.

The trends of the micro battery market are increase in adoption of wearable devices and propelling the growth and demand for flexible.

Asia-Pacific is the largest regional market for micro battery market.

The global micro battery market was valued at $ 0.5 billion in 2022.

Primary is the leading battery type of micro battery market.

Loading Table Of Content...

Loading Research Methodology...