Micro SD Cards Market Research, 2032

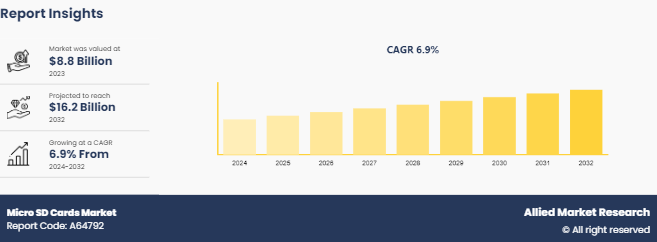

The global micro SD cards market was valued at $8.8 billion in 2023 and is projected to reach $16.2 Billion by 2032, growing at a CAGR of 6.9% from 2024 to 2032.

Market Introduction and Definition

The market for micro SD Cards involves the industry that produces, distributes, and sells these small, removable micro flash memory cards used for storing data. These cards are commonly used in various electronics like smartphones, tablets, digital cameras, drones, and gaming consoles due to their small size and large storage capacity. Moreover, micro flash memory cards are significantly witnessing growth across applications in industrial settings, automotive systems, and IoT devices for data storage, logging, and transfer purposes.

Micro SD cards are available in various storage capacities, typically ranging from 4GB to over 1TB, and they adhere to specific speed classes like Class 10, UHS-I, UHS-II, and UHS-III, indicating their read and write speeds. The market consists of different players such as manufacturers, OEMs, online and offline retailers, and distributors. Advancements in technology have led to the production of higher-capacity and faster micro SD cards to meet the rising demand for data storage fueled by high-definition media content and the increasing number of connected devices. The market is divided based on capacity, application, and distribution channel, reflecting the diverse uses and availability of micro SD cards across various sectors and consumer segments.

Key Takeaways

On the basis of capacity, the 32Gb to 128GB segment dominated the micro SD cards market size in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

On the basis of the application, the smartphone segment dominated the micro SD cards market size in terms of revenue in 2023. However, the digital camera segment is anticipated to grow at the fastest CAGR during the forecast period.

Region-wise, Asia-Pacific generated the largest revenue in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

On September 20, 2023: The Japanese government announced a partnership with major electronics manufacturers to develop a new generation of high-capacity micro SD cards for use in 5G smartphones and other data-intensive devices. The initiative aims to support the growth of the 5G ecosystem in Japan and enhance the user experience by providing faster data transfer speeds and larger storage capacities. The government is providing funding and resources for research and development and is also working with manufacturers to establish new manufacturing facilities in Japan.

On April 07, 2023: The South Korean government unveiled a plan to invest $100 million in the development of next-generation memory technologies, including micro SD cards. The investment will support research and development of new materials, processes, and designs for micro SD cards, with the goal of increasing their storage capacity, speed, and durability. This initiative aligns with the government's broader strategy to maintain South Korea's leadership in the global memory market.

On December 15, 2022: The Taiwanese government announced a new policy to promote the development of the micro SD card industry in Taiwan. The policy includes tax incentives, subsidies, and other support measures for companies engaged in the design, manufacturing, and marketing of micro SD cards. The government is also working with industry associations to establish a micro SD card innovation center in Taiwan, which will focus on research and development of new technologies and applications.

On July 22, 2022: The UK government announced a partnership with a leading micro SD card manufacturer to establish a new production facility in the UK. The facility will focus on the manufacturing of high-capacity micro SD cards for use in smartphones, tablets, and other consumer electronics. This initiative aims to create jobs in the UK and boost the country's manufacturing sector, while also ensuring a reliable supply of micro SD cards for the domestic market.

Key market dynamics

The surge in demand for large-capacity storage is fueled by the widespread availability of high-quality video content like 4K and 8K videos, and the ever-increasing size of media files. This trend necessitates the need for portable and easily expandable storage solutions such as micro SD cards. These cards meet the requirements of both everyday consumers and professionals who rely on reliable and high-performance storage for their data-heavy tasks. Moreover, the growing use of micro SD cards in a variety of consumer gadgets like smartphones, tablets, cameras, drones, and gaming consoles drives market expansion. Continuous innovation and the introduction of new electronic devices further support the popularity of these cards. The simplicity of upgrading storage without needing to switch devices makes micro SD cards an appealing choice for users.

Furthermore, the integration of micro SD cards into the rapidly expanding Internet of Things (IoT) ecosystem, where numerous devices depend on efficient and compact storage solutions for activities like data logging, firmware updates, and local storage, significantly elevates market demand. IoT devices, ranging from smart home systems to industrial sensors, count on the compact nature and reliability of micro SD cards for optimal performance and data security. The micro SD cards market share by companies reveals significant players investing in innovation to cater to this growing demand.

However, the rise of cloud storage solutions as a convenient and scalable alternate option poses a notable challenge to the micro SD card market. With more consumers and businesses opting for cloud-based storage, the dependence on physical storage media like micro SD cards may diminish. Cloud storage offers benefits like remote access, data synchronization across multiple devices, and reduced risk of physical damage or loss, making it an attractive choice for many users. This shift is highlighted in the micro SD cards industry report and micro SD cards sector analysis, which detail the competitive landscape and evolving consumer preferences.

Despite this obstacle, advancements in storage technology, like the development of higher-capacity and faster-speed micro SD memory cards (e.g., UHS-II, UHS-III, and SD Express standards) , present substantial growth prospects. These technological enhancements can meet the increasing demand for high-performance storage solutions, making micro SD cards more appealing for various high-end applications. Improved durability, enhanced read/write speeds, and expanded storage capacities empower these cards to support advanced functionalities in professional photography, video production, gaming, and more, ensuring their continued relevance in a rapidly evolving digital landscape. Detailed insights on these trends can be found in the micro SD cards market data and micro SD cards market insights reports.

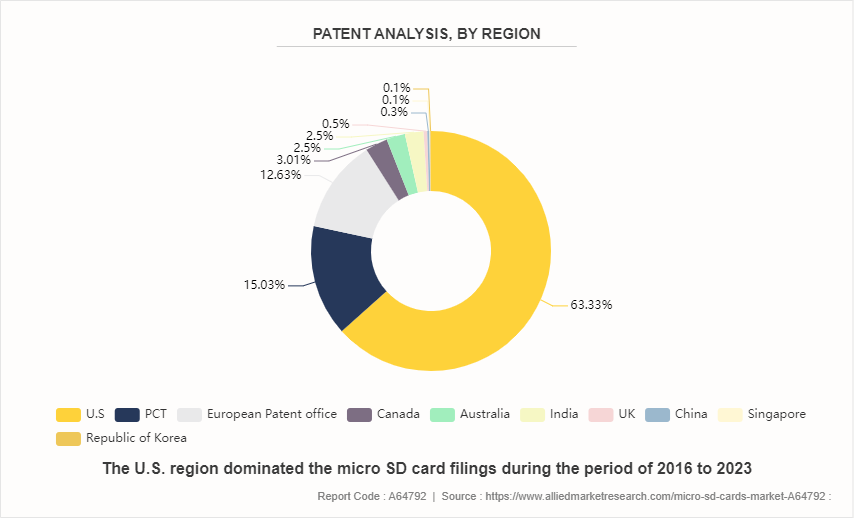

Patent Analysis of the Global Micro SD Cards Market

The global Micro SD cards industry is segmented according to the patents filed in the U.S., PCT, European Patent Office, Canada, Australia, India, UK, China, Singapore, and the Republic of Korea. The micro SD cards for US market, dominated the micro SD card filings, owing to suitable research infrastructure. and the presence of Micro SD cards company listed as the top players in the market based on their revenue and key developments.

Market Segmentation

The Micro SD cards industry is segmented into capacity, application, and region. On the basis of capacity, the market is divided into 4GB TO 16GB, 32GB TO 128GB, 256GB TO 1TB, and Above 1TB. On the basis of application, the market is classified into smartphones, tablets, PC, digital cameras, gaming consoles, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Market Segment Outlook

The 32GB to 128GB category was the most dominant in the micro SD cards market in 2023 because it strikes a perfect balance between being affordable and offering enough storage for the average consumer's needs. This range is perfect for smartphones, tablets, and various other gadgets, enabling users to store large amounts of data like high-resolution photos, videos, apps, and documents without significantly increasing the device's cost. Its popularity is also due to its compatibility with a wide range of devices, from budget-friendly to high-end models, making it accessible to a broad customer base. With the continuous growth of multimedia content in size and quality, the 32GB to 128GB capacity range offers a practical solution for users who want to expand their device storage without splurging on higher capacity options. This dominance is expected to lead to rapid growth in the market.

In 2023, the micro SD cards market forecast was ruled by the smartphone segment in terms of revenue because of the large number of smartphone users globally and the essential role these devices play in daily life. Smartphones are crucial for communication, entertainment, productivity, and capturing memories, requiring ample storage for apps, photos, videos, and other data. Many smartphones, particularly in emerging markets, have limited internal storage, making micro SD cards a popular and cost-effective way for users to increase their device's storage capacity. Moreover, the continuous improvement and launch of smartphones with better cameras and advanced features boost the demand for additional storage solutions. Despite the shift toward cloud storage, the convenience, security, and offline access of micro SD cards make them a preferred choice for many users, ensuring the sustained dominance and growth of the smartphone segment.

Regional/Country Market Outlook

Asia-Pacific recorded the highest revenue in the micro SD cards market and is projected to have the highest growth rate during the forecast period due to various factors. Further, the micro SD cards market size by country in Asia-Pacific is dominated by China during the forecast period, The region includes some of the world's largest and fastest-growing economies like China, India, and Japan, all of which have a significant presence of micro SD cards manufacturer. The high penetration of smartphones, along with the rapid adoption of other gadgets such as tablets, cameras, and drones, boosts the demand for micro SD cards. Additionally, the presence of major micro SD cards manufacturers and suppliers in the region makes these products easily accessible at competitive prices. The expanding middle class in Asia-Pacific, with growing disposable incomes and an increasing interest in digital content and advanced technology, further propels market growth. The region's strong focus on technological advancements and innovations also contributes to the anticipated high growth rate of the Micro SD cards market in the forecast period.

Competitive Landscape

The micro SD cards company list includes SanDisk (Western Digital) , Samsung Electronics, Kingston Technology, Micron Technology, Transcend Information, Lexar, PNY Technologies, Toshiba, Patriot Memory, Integral Memory, Silicon Power, ADATA, and so on.

Recent Key Strategies and Developments

On March 18, 2023: SanDisk revolutionized the micro SD card market with the launch of their Extreme PRO series, boasting capacities of Up to 1TB and unprecedented read/write speeds exceeding 200MB/s. Designed for professional content creators, these cards addressed the growing demand for high-resolution video recording (including 8K) and burst-mode photography. The Extreme PRO series utilized advanced flash memory technology and innovative error correction mechanisms, ensuring data integrity and reliability in demanding environments.

On July 02, 2023: Samsung catered to the adventurous spirit with their PRO Plus micro SD card, engineered to withstand extreme conditions. This card featured exceptional water, temperature, X-ray, and magnetic resistance, making it ideal for outdoor enthusiasts, action sports videographers, and travelers. With capacities up to 512GB and fast read/write speeds, the PRO Plus also catered to the needs of content creators who prioritize both durability and performance.

On April 25, 2024: Micron Technology, a major player in the memory industry, announced a substantial investment in research and development aimed at redefining the limits of micro SD card technology. Their focus was on developing next-generation cards with capacities exceeding 1TB, utilizing cutting-edge memory architectures and advanced manufacturing processes. This move signaled Micron's commitment to remain at the forefront of the evolving storage landscape, anticipating the growing demand for higher-capacity, faster-performing micro SD cards in the future.

Key Sources Referred

Semiconductor Industry Association (SIA)

SEMI.org

IEEE Electron Devices Society (EDS)

U.S. Department of Energy

Global Semiconductor Alliance (GSA)

World Economic Forum

European Semiconductor Industry Association (ESIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the micro SD cards market analysis from 2024 to 2032 to identify the prevailing micro SD cards market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the micro SD cards market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global micro SD cards market trends, key players, market segments, application areas, and market growth strategies.

Micro SD Cards Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 16.2 Billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 250 |

| By Capacity |

|

| By Application |

|

| By Region |

|

| Key Market Players | silicon power, Lexar, Integral Memory Plc, Micron Technology, Kingston Technology, SanDisk Corporation., Transcend Information, Patriot Memory LLC, PNY Technologies Inc., Samsung Electronics, ADATA, Toshiba Corp |

The surge in demand for large-capacity storage is fueled by the widespread availability of high-quality video content like 4K and 8K videos, and the ever-increasing size of media files.

Asia-Pacific recorded the highest revenue in the micro SD cards market and is projected to have the highest growth rate during the forecast period

The micro SD cards company list includes SanDisk (Western Digital) , Samsung Electronics, Kingston Technology, Micron Technology, Transcend Information, Lexar, PNY Technologies, Toshiba, Patriot Memory, Integral Memory, Silicon Power, ADATA, and so on.

The Global Micro SD Cards Market was valued at $8.8 billion in 2023 and is projected to reach $16.2 Billion by 2032, growing at a CAGR of 6.9% from 2024 to 2032.

Loading Table Of Content...