Microfluidic Devices Market Research, 2031

The global microfluidic devices market was valued at $21.7 billion in 2021, and is projected to reach $158.1 billion by 2031, growing at a CAGR of 22.4% from 2021 to 2031. Microfluidic devices exploit the physical and chemical properties of liquids and gases at a microscale. Microfluidic devices offer several benefits over conventionally sized systems. Microfluidics allow the analysis and use of less volume of samples, chemicals and reagents reducing the global fees of applications. Microfluidic systems are widely used in procedures such as capillary electrophoresis, isoelectric focusing, immunoassays, flow cytometry, sample injection in mass spectrometry, PCR amplification, DNA analysis, separation and manipulation of cells, and cell patterning.

The increase in prevalence of infectious diseases and chronic diseases drives the Microfluidic Devices Market growth. The microfluidic devices are used for screening of diseases. In addition, microfluidic devices are used for the early diagnosis of cancer. For instance, according to Ammerican Cancer Society (ACS), In 2021, there will be an estimated 1.9 million new cancer cases diagnosed and 608,570 cancer deaths in the U.S.

Furthermore, increasing number of geriatric population drives the growth of market. For instance, as per the report by Eurostat, the statistical office of the European Union, in 2021, more than 20.8 % of the EU population was aged 65 and over. The old age peoples are more prone to infectious diseases and chronic diseases owing to less metabolism and lower immunity system.

Moreover, increase in R&D activity for advancements in microfluidic devices, latest product launch and product approvals contributes in the growth of market. For instance, in May 2022, A University of Minnesota Twin Cities research team has developed a new microfluidic chip for diagnosing diseases that uses a minimal number of components and can be powered wirelessly by a smartphone. The innovation opens the door for faster and more affordable at-home medical testing.

The growing intrest of manufacturer & developers in the development of microfluidic devices drives the growth of market. In addition, combined manufacturers efforts for developing footprints in emerging market contributes in the growth of market. For instance, uFluidix, a Leaders in the custom fabrication of Microfluidic devices made of PDMS and thermoplastics launches a call for manufacturing projects needing funding. The uFluidix team has successfully doubled their manufacturing capacity over the last 12 months and is now optimizing for new process variables in the manufacturing of thermoplastic microfluidic chips.

Furthermore, the introduction of 3D printing technology in the manufacturing of microfluidic devices boosts the growth of microfluidic devices market. The 3D-printing can potentially fabricate a microfluidic device in one step. Also, 3D-printing allows for quick adjustment of device features with each print by changing the design in CAD software. For instance, in February 2021, A team of researchers from the University of Bristol has developed a novel low-cost and open-source 3D printing process for producing microfluidic devices.

Moreover, the increasing application of microfluidics in the novel drug delivery system further drives the growth of market. The microfluidics gained tremendous attention in manufacturing more effective drug delivery systems owing to excellent ability for precise delivering and manipulating liquids. Conventional drug delivery systems are prone to degrading drugs due to the long intake pathway. Microfluidics is capable of reducing the intake path to reduce the chance of degrading sensitive and unstable drugs

Furthermore, growing advancements in biotechnology & Microfluidic Industry, increasing access to health care facilities globally and increased health care expenditure drives the growth of market. For instance, according to American Medical Association (AMA), health spending in the U.S. increased by 9.7% in 2020 to $4.1 trillion or $12,530 per capita. Moreover, rise in the government initiatives to provide advanced healthcare facilities and financial support propels the growth of market.

Market Segmentation

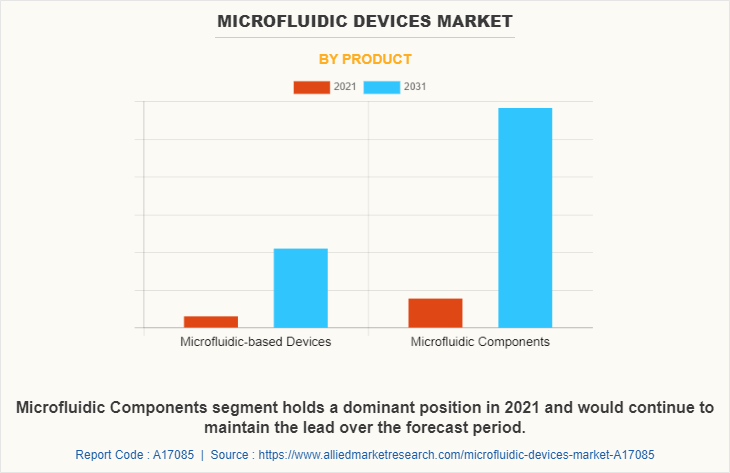

By product type market is divided into microfluidic-based devices and microfluidic components. The microfluidic components classified into microfluidic chips, flow & pressure sensors, flow & pressure controllers, microfluidic valves, micropumps, microneedles and other components.

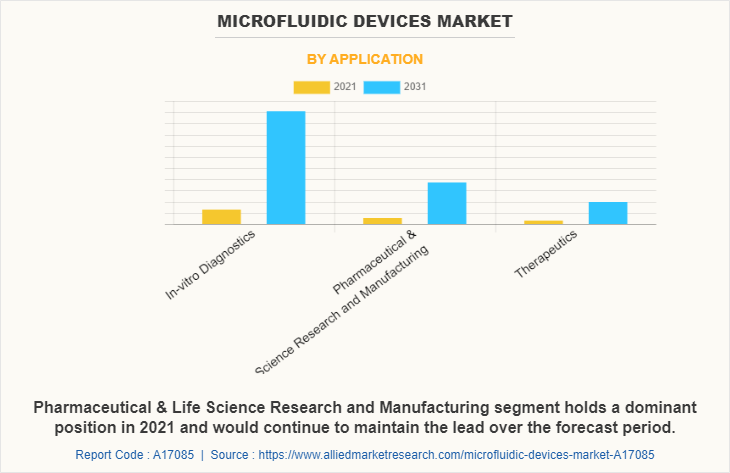

Depending on application classified into in-vitro diagnostics, pharmaceutical & life science research & manufacturing and therapeutics. The in-vitro diagnostics are further classified into clinical diagnostics, point-of-care testing and veterinary diagnostics. The pharmaceutical & life science research & manufacturing and therapeutics further classified into lab analytics, microdispensing and microreaction. The lab analytics further classified into proteomics, genomics, cell-based assays and capillary electrophoresis.

The therapeutics further classified into drug delivery and wearable devices.

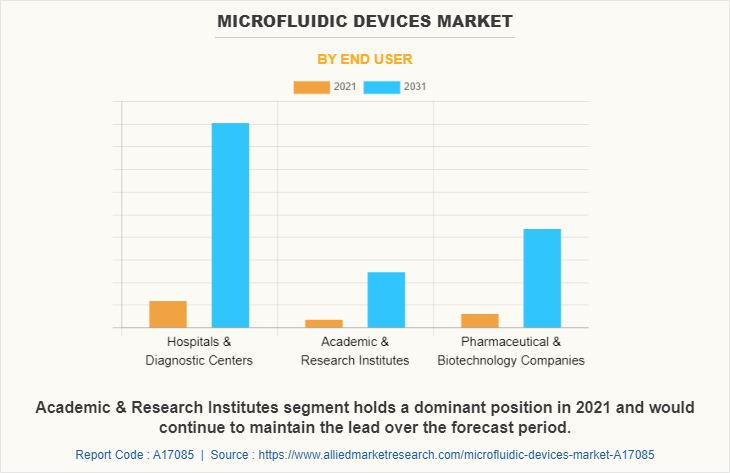

Based on end user market is categorized into hospitals & diagnostic centers, academic & research institutes, and pharmaceutical & biotechnology companies.

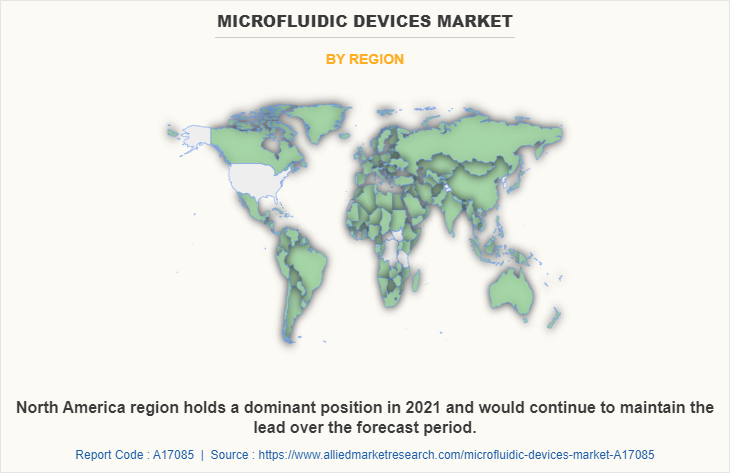

By region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, South Arabia, South Africa, and LAMEA).

Depending on product type, microfluidic components segment dominated the Microfluidic Devices Market size in 2021, and this trend is expected to continue during the forecast period, owing to advancements in microfluidic devices and increasing prevalence of chronic diseases. However, the microfluidic-based devices segment is expected to witness considerable growth during the forecast period, due to increase in adoption of microfluidics and product launch in market.

Based on application, the in-vitro diagnostics segment dominated the Microfluidic Devices Market size in 2021, and this trend is expected to continue during the forecast period, owing to incraseing prevalence of infectious diseases and rise in incidence of cancer. However, the pharmaceutical & life science research and manufacturing segment is expected to witness considerable growth during the forecast period, due to increase in use of microfluidics in pharmaceutical and drug delivery segment.

By end user, the hospitals & diagnostic centers segment dominated the Microfluidic Devices Market share in 2021, and this trend is expected to continue during the forecast period, owing to rise in number of hospitals and increase in demand of advanced treatment. However, the academic & research institutes segment is expected to witness considerable growth during the forecast period, due to increase in R&D activity and rise in number of key players.

Depending on the region, North America garnered the major share in the microfluidic devices market in 2021, and is expected to dominate the global market during the Microfluidic Devices Market forecastperiod, increase in product launch in region, well established healthcare infrastructure and presence of key players. However, Asia-Pacific is expected to register the significant growth, owing to an rise in healthcare expenditures, development in healthcare infrastructure, and high population base.

Competitive Landscape

The key players operating in the global microfluidic devices market market Lonza Group, Thermo Fisher Scientific Inc., Perkinelmer Inc., Biorad Laboratories, Inc., Illumina, Inc., Qiagen N.V., Fluidigm Corporation, Dolomite Microfluidics, bioMérieux SA, Abbott Laboratories, Danaher Corporation, SMC Corporation, Idex Corporation, Fortive Corporation, Agilent Technologies, Inc., Nanostring and Nortis Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the microfluidic devices market analysis from 2021 to 2031 to identify the prevailing Microfluidic Devices Market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the microfluidic devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global microfluidic devices market trends, key players, market segments, application areas, and market growth strategies.

Microfluidic Devices Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Qiagen N.V., Dolomite Microfluidics, Biorad Laboratories, Inc., Fluidigm Corporation, Danaher Corporation, Fortive Corporation, Thermo Fisher Scientific Inc., Abbott Laboratories, Agilent Technologies, Inc., Perkinelmer Inc., Nanostring, bioMérieux SA, Nortis Inc., Lonza Group, Idex Corporation, Illumina, Inc., SMC Corporation |

Analyst Review

This section provides the opinions of the top level CXOs in the microfluidics device market. According to the CXOs, microfluidics devices are cost effective and time saving method used for diagnosis of various diseases such as flu and cancer.

The microfluidics device mainly used for in-vitro diagnostics, in pharmaceutical & life science research, manufacturing process and in therapeutics. In therapeutics, microfluidics is used for the drug delivery and in wearable devices.

The factors such as increase in prevalence of infectious diseases, advancements in microfluidics device, and rise in demand for fast & cost-effective diagnosis drive the growth of the microfluidics device market. In addition, increase in geriatric population and rise in healthcare expenditures of patients are expected to contribute toward the growth of the microfluidics device market.

North America is expected to witness the highest growth, in terms of revenue, owing to rise in the prevalence of infectious diseases, presence of key players for manufacturing & development of advanced microfluidics devices, and well-established healthcare infrastructure in the region.

However, the high operational cost of microfluidics device may hamper the market growth

Asia-Pacific is expected to register the highest CAGR of 5.8% from 2022 to 2031, owing to increase in number of pharmaceutical companies, a rise in incidences of infectious diseases, and high population base.

The key trends in the microfluidic devices market market are by an increase in the prevalence of infectious diseases; increase in geriatric population and advancements in microfluidic devices.

North America has the largest regional market for Microfluidic Devices

The market value of microfluidic devices market market in 2022 was $25790.1 million.

The key players operating in the global microfluidic devices market market Lonza Group, Thermo Fisher Scientific Inc., Perkinelmer Inc., Biorad Laboratories, Inc., Illumina, Inc., Qiagen N.V., Fluidigm Corporation, Dolomite Microfluidics, bioMérieux SA, Abbott Laboratories, Danaher Corporation, SMC Corporation, Idex Corporation, Fortive Corporation, Agilent Technologies, Inc., Nanostring and Nortis Inc.

The base year for the report is 2021.

The total market value of microfluidic devices market market is $20971 million in 2021.

The forecast period in the report is from 2022 to 2031

Loading Table Of Content...