Microfluidics Market Research, 2033

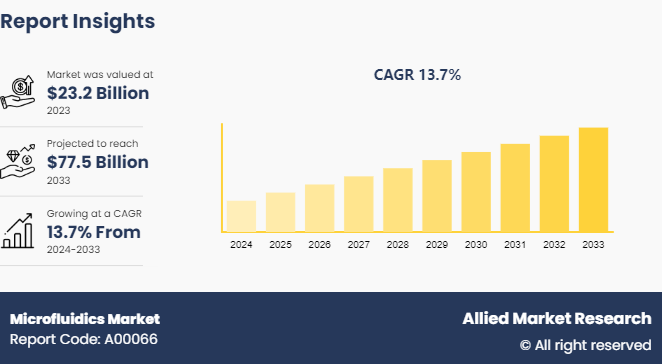

The global microfluidics market size was valued at $23.2 billion in 2023 and is projected to reach $77.5 billion by 2033, growing at a CAGR of 13.7% from 2024 to 2033.

Market Introduction

Microfluidics is a technology that manipulates small amounts of fluids through small channels ranging in size from ten to hundreds of micrometers. It is an interdisciplinary field encompassing molecular analysis, molecular biology, and microelectronics. It is useful in the design of systems that process small amounts of fluids to achieve multiplexing, automation, and high-throughput screening.

Microfluidic systems are commonly used in processes such as capillary electrophoresis, isoelectric focusing, immunoassays, flow cytometry, sample injection in mass spectrometry, PCR amplification, DNA analysis, cell separation and manipulation, and cell patterning.

Key Takeaways

- The microfluidics market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major microfluidics industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The rising need for point-of-care diagnostics is likely to provide the microfluidics market size with lucrative growth opportunities throughout the forecast period. Point-of-care diagnostics provide faster disease detection than other traditional approaches. This leads to improved diagnosis, monitoring, and management, as well as allowing healthcare personnel to make more timely medical decisions about the patient. Furthermore, the development of new products and the shrinking of microfluidic devices, such as lab-on-a-chip and portable field-testing devices, are opening up potential for microfluidics device-based applications in point-of-care testing.

Medical device manufacturers face stringent regulatory regulations to ensure the safety and effectiveness of their products. However, in recent years, the approval process for medical devices, particularly integrated microfluidic devices, has become increasingly lengthy and complex. This unpredictability in the time required to obtain regulatory approval poses a significant challenge for companies, as there is a risk that investment may be wasted if approval is not granted. The lengthy approval process also hampers companies' ability to release new and innovative products into the market in a timely manner. These challenges hinder the growth of the microfluidics market growth, limiting its potential for innovation and advancement in the medical field.

The development of more sophisticated and novel technologies for designing and manufacturing microfluidic systems is required and can help to accelerate the commercialization of microfluidic devices. Microfluidics has grown significantly in the wearable device industry, notably for healthcare applications. By controlling and manipulating small amounts of biological fluids on the microscale, microfluidics allows for more accurate and exact examination of these fluids, which is critical for continuously monitoring a patient's health. Small changes in physiological fluids can provide essential information about a patient's health, making microfluidics an important tool in healthcare monitoring. Microfluidics can also be utilized to administer medications or other therapeutic substances more precisely, hence increasing treatment effectiveness.

Global Microfluidics Market Patent Analysis

The patent analysis of the microfluidics market highlights innovative products that enhance the industry. Companies are regularly investing in intellectual property to advance technology, ensure competitive advantage, facilitate unique product development, and drive the growth of microfluidics industry products.

In March 2022, Hewlett Packard Development Co. unveiled a microfluidics system. This microfluidics measurement system comprises multiple pumps and sensors. To facilitate the selection of a specific pump and sensor, each pump and sensor is paired with a transistor, and each transistor is paired with a flip-flop. These flip-flops are arranged in a series or chain, potentially reducing the number of pads required to control the numerous pumps and sensors within the microfluidics system.

In January 2022, BOE Technology Group Co., Ltd. and Beijing BOE Sensing Technology Co., Ltd. introduced a microfluidics chip focused on biological detection. This chip consists of a central area surrounded by a peripheral area. The central area includes a liquid storage region and a reaction region, comprising two substrates—first and second—arranged opposite each other. The first substrate features a base and an electrode layer, while the second substrate also includes a base and an electrode layer. A liquid storage slot and a liquid intake hole penetrate the bottom of the liquid storage slot on the first substrate's side facing the second substrate. Both are situated within the liquid storage region. The cross-section of the liquid storage slot, perpendicular to its thickness and parallel to the direction pointing towards the reaction region, has a first side edge adjacent to the detection region. This edge has a first endpoint and a second endpoint, with the first endpoint closer to the second substrate than the second endpoint. The connection line between these endpoints is inclined relative to the liquid intake hole's axis, with the first endpoint closer to the hole's axis than the second endpoint.

In May 2020, the University of Bristol introduced a microfluidics analysis system featuring a microfluidics cell and a microscope. The microscope includes an objective lens that gathers light from a field of view encompassing a portion of the microfluidics cell. A second lens and an actuator are also included. The actuator moves the objective lens relative to the microfluidics cell, altering the field of view's position across multiple points. This translation of the objective lens occurs without shifting the second lens relative to the microfluidics cell. The second lens is designed to capture the light collected by the objective lens from various positions of the field of view, remaining stationary relative to the microfluidics cell.

Market Segmentation

The microfluidics market share is segmented into application, material, technology, and region. On the basis of application, the market is divided into medical/healthcare and non-medical. On the basis of material, the market is classified into silicone, glass, polymer, PDMS, and others. On the basis of technology, the market is divided into lab-on-a-chip, organs-on-chips, continuous flow microfluidics, optofluidics & microfluidics, acoustofluidics & microfluidics, and electrophoresis & microfluidics. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The North American microfluidics market share is rapidly expanding, driven by technological breakthroughs and rising demand for tiny medical and diagnostic devices. This market covers a wide range of applications, including molecular analysis, medication delivery systems, and point-of-care diagnostics. A strong healthcare infrastructure, major investment in R&D, and an increasing prevalence of chronic diseases necessitating better diagnostic and therapeutic solutions are all factors driving its demand. However, constraints such as demanding regulatory approvals and expensive manufacturing costs may limit the market growth. Despite these challenges, the North American microfluidics market opportunity is expected to grow significantly due to ongoing research and incorporation of microfluidic technologies into a wide range of biomedical applications.

Competitive Landscape

The major players operating in the microfluidics market forecast include Illumina, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, PerkinElmer, Inc., Thermo Fisher Scientific, Agilent Technologies, Inc., Standard BioTools, Danaher Corporation, Abbott, and others.

Recent Key Strategies and Developments

- In October 2022, Standard BioTools launched the X9 Real-time PCR System, which utilized microfluidics technology to offer a flexible and productive high-capacity genomics platform.

- In March 2022, Miroculus launched the Miro Canvas, a compact and user-friendly digital microfluidics platform designed to automate complex next-generation sequencing (NGS) sample preparation protocols on demand.

- In November 2021, Fluidigm Corporation, a biotechnology tools provider committed toward enhancing life through comprehensive health insights, announced the launch of Biomark X, the latest generation of its Biomark microfluidics platform.

Industry Trends

- In April 2023, a research group at the University of Manitoba used microfluidics technologies from Dolomite Microfluidics to design and evaluate novel nanoparticle drug delivery systems aimed at the safe and effective treatment of diseases during pregnancy.

- In January 2022, uFluidix announced that they successfully doubled their manufacturing capacity over the previous 12 months and were optimizing for new process variables in the production of thermoplastic microfluidic chips.

Key Sources Referred

- Microfluidics Association

- National Research Council Canada

- Elveflow

- INDIAN MICROFLUIDICS ASSOCIATION

- Microfluidics Innovation Center

- Royal Society of Chemistry

- uFluidix

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the microfluidics market analysis from 2023 to 2033 to identify the prevailing microfluidics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the microfluidics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global microfluidics market trends, key players, market segments, application areas, and market growth strategies.

Microfluidics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 77.5 Billion |

| Growth Rate | CAGR of 13.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Application |

|

| By Material |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Abbott, F. Hoffmann-La Roche Ltd, bioMerieux, Agilent Technologies, Inc., Standard BioTools, Danaher Corporation, Bio-Rad Laboratories, Inc., Illumina, Inc., Thermo Fisher Scientific Inc., PerkinElmer, Inc. |

Upcoming trends in the global microfluidics market include advancements in lab-on-a-chip technologies, increased integration with AI and IoT, and expanding applications in diagnostics, drug delivery, and personalized medicine.

The leading application of the microfluidics market is in healthcare industry.

Asia-Pacific is the largest regional market for microfluidics

The microfluidics market was valued at $23.2 billion in 2023 and is estimated to reach $77.5 billion by 2033, exhibiting a CAGR of 13.7% from 2024 to 2033.

The major players operating in the microfluidics market include Illumina, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, PerkinElmer, Inc., Thermo Fisher Scientific, Agilent Technologies, Inc., Standard BioTools, Danaher Corporation, Abbott, and others.

Loading Table Of Content...