The global military radar market size was valued at $13.9 billion in 2021, and is projected to reach $25.1 billion by 2031, growing at a CAGR of 6.5% from 2022 to 2031.

The radars stand for radio detection and ranging system. A military radar system is a detection system which uses radio waves to determine the angle, range, and velocity of the objects. Radars are used by defense forces for several purposes such as for surveillance, to find targets & track their movements (aircrafts, missiles, UAVs, naval vessels, and military land vehicles), to direct other weapons, and in taking countermeasures against incoming threats. Military radars are also capable in detecting & classifying targets such as crawling men troops, group of walking men and low flying helicopters. Additionally, military radars are used for navigation purposes and also as weather radars.

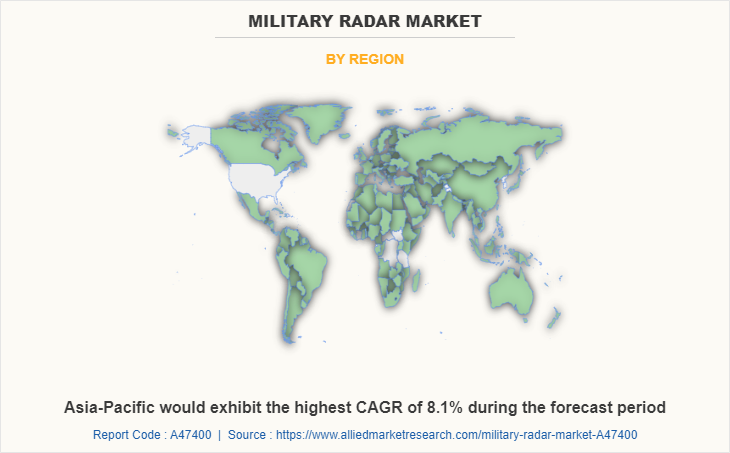

The U.S. is one of the strongest military forces in the world and is a key supplier of military radar to the global market. Moreover, the U.S. is home to a huge number of manufacturing companies operating at global level including Northrop Grumman Corporation and Lockheed Martin. Likewise, armed forces of the U.S. are also investing drastically in improving radar-related capabilities. For instance, in 2022, the Raytheon Company had partnership with the U.S. Navy to make SPY-6 radars for next-gen US Navy ships. This partnership will produce rotating, fixed-face, and solid-state SPY-6 variants that will deliver exceptional integrated missile and air defense facilities for seven types of U.S. Navy ships over the next 40 years. Such investments and partnerships are expected to increase the sales of military radar in the North America region.

The increasing investments in making advanced technologies like additive production technology for applications such as airspace monitoring & traffic management, space situation awareness, maritime patrolling, and weapon guidance to aid the military, are expected to offer future development opportunities. The U.S. Air Force is extraordinarily strong and the most powerful air force in the world. The country is armed with the most innovative technology that offers support for naval & land forces, which leads to the military radar market growth.

China has the second-largest spending in defense across the world. It is an emerging country with rapid expansion in the defense sector. Through enticements, the government of China supports industrial firms to execute innovative technologies in their facilities. For instance, China is still focusing on state-directed, and long-term planning initiatives such as "Made in China 2025," which intends to change foreign technology with domestically produced technology. In 2022, the defense budget for China was $225.5 billion. The country endeavors to improve its domestic defense industry to continue generating strong revenue growth for its region-owned companies over the forecast period.

The military radar market is segmented into Component, Range, Frequency, Application and Platform.

The military radar has evolved with time and continues to make major improvements, such as the use of acoustic radar technologies and autonomous drones. The portable type of military radars for border security have enabled numerous countries to safeguard their borders more efficiently. Moreover, these radars are deployed in strategic locations to increase the rate of detection. Furthermore, state-of-the-art military radars with low false alarms have led countries with drug illegal immigration, trafficking problems, and border disputes to rely on these advanced radars to assist in border protection.

Factors such as rise in investment to strengthen the capabilities of air defense, technological advancements in military radar, and rise in purchase of combat aircraft are the major drivers for military radar market. Moreover, the factors such as huge investment in early stage and lack of detecting small drones and stringent cross-border trading policies to restrain the growth of market. Furthermore, factors such as rise in geopolitical tensions, and increase in R&D activities in military radar for airborne platform, are expected to create lucrative opportunities for leading players of military radar products operating in the market.

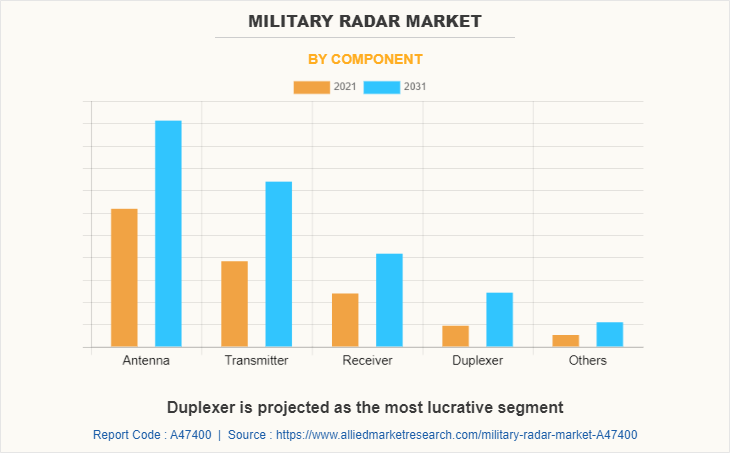

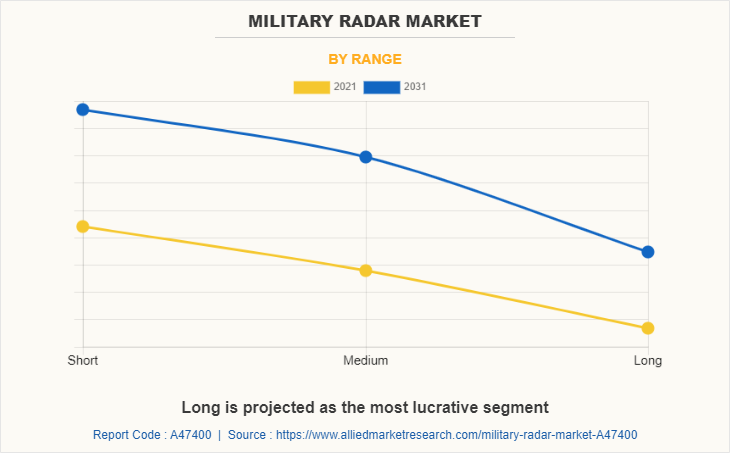

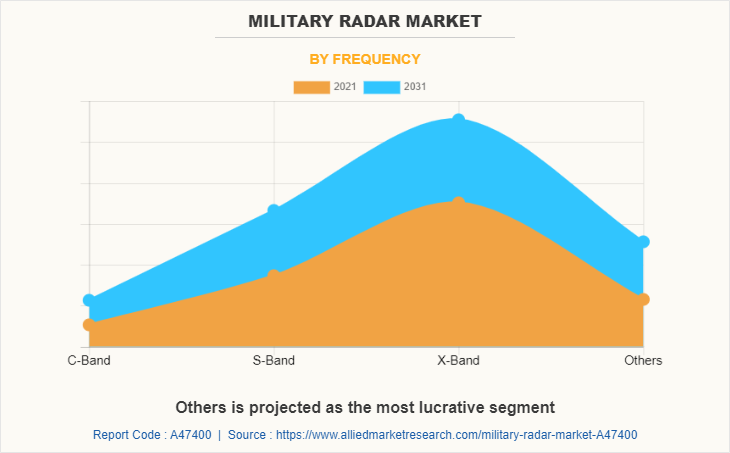

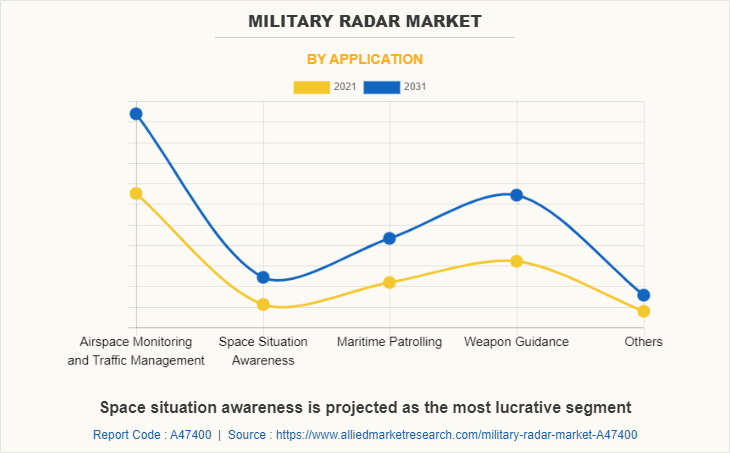

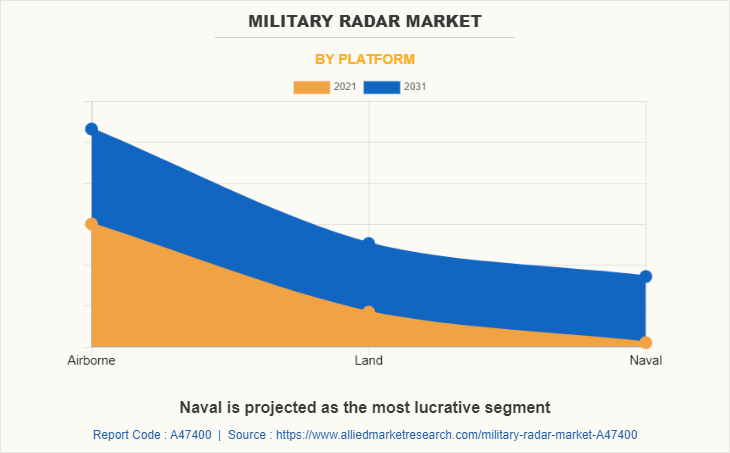

The military radar market is segmented on the basis of component, range, frequency, application, platform, and region. On the basis of component, it is divided into antenna, transmitter, receiver, duplexer, and others. On the basis of range, it is classified into short, medium, and long. On the basis of frequency, it is classified into C-band, S-band, X-band, and others. On the basis of application, it is classified into airspace monitoring & traffic management, space situation awareness, maritime patrolling, weapon guidance, and others. On the basis of platform, it is classified into airborne, land, and naval. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Growth drivers, restraints, and opportunities are explained in the study to better understand the market dynamics. This study further highlights key areas of investment. In addition, it includes Porter’s five forces analysis to understand the competitive scenario of the industry and the role of each stakeholder. The study features strategies adopted by key market players to maintain their foothold in the market.

The leading players operating in the military radar market are Aselsan A.S., BAE Systems plc, Israel Aerospace Industries, L3Harris Technologies, Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Saab AB, Thales Group, and The Raytheon Company.

Rising investment to strengthen the capabilities of air defense

The rise in two-sided conflicts of militaries among countries results in modernizing the various military-based projects across land, naval, and airborne platforms. This has led to the increasing need for armed forces of the countries to improve their border surveillance and homeland security measures. Prominent countries across the world are heavily investing in strengthening their security equipments by incorporating modern radar, which is pushing the demand for military radars globally.

The high-end weapon systems such as missiles are being used in wars by several group of terrorists. The leading countries are strengthening their defense spending to safeguard their borders with new radar systems for defense against these weapons. In addition, increase in transnational disputes among various nations have increased the defense spending of nations to safeguard their borders. Hence, the countries with increased spending on various radar and air defense systems will further drive the growth of the military radar market over the forecast period.

The Middle East region has been a war-prone region for a long time due to border tensions and conflicts between Syria, Iraq, and Saudi Arabia. The vagueness in local disputes and regional power has led towards growth in importing arms in the region. Such concerns have led to an increase in procurement of military radars and defense expenditure to identify the threats, which is likely to drive the demand for military radar. Furthermore, the shift towards cyber and electronic warfare from traditional war fighting methods is likely to create opportunities for these systems.

Also, the companies are investing in the design and development of various newer generation military radars like dual band radars, passive radars, active electronically scanned array (AESA) radars, 3D radars, etc., which offer various advantages as compared to their standard counterparts. With the rising focus on indigenization, many countries are participating in the development of military radar systems locally, which is likely to make the market more competitive in the years to come.

Technological advancements in military radar to propel the growth

Military radars are used in a various platform in defense such as airborne, land, and naval. The increasing concerns about improving defense capabilities may give remarkable growth opportunities for the market. The rising need for boosting border safety is predicted to power the sales for military radar. A supporting factor to decrease the costs and improved capabilities is the advancement in new military radar and antenna fabrication technologies. In addition to this, electronically steered array, low noise amplifiers, GaN power transistors, and antennas have been crucial to military radar and system deployments across the world. The military radars utilizing such technologies outperform conventional radar systems and have provoked a flood of innovative and new radar fabrication and design approaches.

The technologies like AESA in military radar has supported the growth to higher frequencies offering greater resolution with smaller phased-array antennas, while modular design methods empower the rapid implementation of new digital computation and processing techniques. The rising demand for surveillance and weapon guidance application has forced military radar manufacturers to upgrade the system.

The companies across the globe are more focused on the advancement of long-range radar system and catering it to various armed forces demand to stay competitive in the market. For instance, in 2022, Northrop Grumman Corporation had partnership with U.S. government to supply the AN/TPY-5(V)1, a long-range radar which offers robust multifunction and enhanced surveillance capability to the U.S. military and its international partners. The country regularly pursues to procure a strategic cross-domain military arsenal to ensure that handy solutions are easily available to defend warfighters internationally and domestically during any mission. Such developments are likely to increase the sales over the forecast period.

The ongoing R&D activities by the leading companies is expected to improve the growth to a great extent. The prominent companies are spending heavily to upgrade the technologies associated with subscription suitability to the end-users. Hence, these factors prove fruitful growth for the market. Also, the players are also seeking to fuel the quality of the military radars by making them more advanced and weather resistant. All these factors bring immense sales opportunities for the military radar. The increasing problems of terrorism and civil unrest, several regions are confronting a large number of external and internal conflicts, due to which the regions are facing infiltration issues. All these factors are leading for the allocations of high budget for defense. Therefore, this part may invite massive growth prospects for the military radar market.

Huge investment in early stage

The production of military radars involves several R&D funding. Huge costs are engaged in integrating such systems into the network of defense. The military radars must be unified with several anti-aircraft guns, command & control systems, fire control systems, and missiles. The maintenance and launch of these methods are also costly in nature. Thus, the huge amount of time and high cost is required for the deployment and manufacturing of such systems prove to be a restraint in the development of the market. For instance, in 2022, Leonardo S.p.A. had launched new TMMR tactical multi-mission radar. This newly launched military radar is designed and developed to classify, detect, and track fast and small moving floating threats, supports armed forces in unified way, assuring complete awareness of situation for circumstances where there is an excess of both air and land platforms, such as micro and mini unmanned tactical systems.

The leading companies have a preference to prototype various products and their parts prior to their development, based on the necessity, as the malfunction of advanced products may result in massive losses. The electronic devices used in the defense sector have become more complex. The need for military radar parts offering similar operations with reduction in size & weight and minimum power consumption that has caused complexity in military radar products. The regular update of military electronics needs improvements in military radar product systems to meet the design constraints of the supportive electronic equipment and systems. It is a huge challenge for suppliers to keep speed with the changing upgrade in military radar products and technical developments. Thus, the high maintenance and development costs of military radar products is expected to hinder the global sales.

Rising geopolitical tensions to ramp up the demand

Today, most of the military vessels are utilized for frontline war in order to offer geopolitical threats & maritime disputes and thus enhancing the implementation of powerful military radar systems. This has led to routine upgrades and deployment of existing offshore naval vessels and naval fleets thus strengthening the demand for military radars. Military radar systems improve the duration, surveillance resolution, and detection capabilities. The governments in leading countries such as the U.S., China, Germany, Russia, France, and India, have been advancing drastically in research and development activities to improve the capabilities of military radars.

The market has seen substantial implementation of multi-functionality military radars by naval forces, on smaller vessels owing to light- weight and high-performance features. This has caused in the growth of innovative radar systems. The increasing coastal surveillance and military operations is expected to grow more than two-fold over the projected period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the military radar market analysis from 2021 to 2031 to identify the prevailing military radar market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the military radar market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global military radar market trends, key players, market segments, application areas, and market growth strategies.

Military Radar Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 25.1 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 558 |

| By Component |

|

| By Range |

|

| By Frequency |

|

| By Application |

|

| By Platform |

|

| By Region |

|

| Key Market Players | Northrop Grumman Corporation, L3Harris Technologies, Inc., Raytheon Technologies Corporation, Lockheed Martin Corporation, Israel Aerospace Industries, Aselsan A.S., Leonardo S.P.A., Saab AB, BAE Systems plc, Thales Group |

Analyst Review

The market is expected to witness a steady growth due to the rising need of radars for defense applications that can correctly spot the projectiles coming at hypersonic speeds. The majority of missile defense systems are ship-based or ground-based, which employ missiles to block potential dangers. To efficiently calculate the elevation, distance, and range of threats, military radars should be able to follow the location of the approaching missile in three dimensions.

The military radar is used to work in the toughest environments to support battle operations. The military radar system conditions are often more rigorous than those inflicted on commercial practices. Radar systems have many applications and can be used to identify surfaces to slight changes over time like the detection of footprints in narrow depth. The military radar comprises of a transmitter that generates an electromagnetic signal which is emitted into space through an antenna. When this signal hits the object, it gets reradiated or reflected in many directions. This echo signal or reflection is taken by the military radar antenna which sends it to the receiver, where it is administered to ascertain the geographical indicators of the object. The introduction of AESA type of technology together with gallium nitride type of semiconductors and innovation in the digital computation are driving the replacement programs for all platforms. Also, the rising requirement for military radars at all levels, from hypersonic missiles to drones support the military radar market.

The rising demand for new type of combat aircraft from countries like the U.S., Russia, India, and China has risen owing to its capability to offer high tactical military radars during warfare. The issues linked with coastal and border security has further enabled the demand for unmanned aerial vehicle equipped with radars. Additionally, the increasing demand for fleet modernization in military aircraft has led to a growth in the new aircraft orders, which is also expected to push the sales. Likewise, the surging spending in military for purchasing the fighter jets incorporated with advanced radar technology to reinforce the defense capabilities is expected to fuel the sales of military radar market over the forecast period.

Moreover, the rising number of general aviation aircraft models across the globe is another major factor forcing the implementation of military radar for general aviation industry globally. For instance, in 2021 the General Aviation Manufacturers Association (GAMA) has released a report that witnessed a growth of 10% in business of jet deliveries whose shipments reported for 710 units compared to 644 in 2020. The market in Europe region is likely to perceive significant growth over the projected period due to the increased expenditure, which is recognized to the upgradation in terms of military weapons and aircraft.

European countries, such as Italy, France, and Germany promote a part of their defense expenditure on NATO, which is expected to enhance the demand for military radar over the forecast period. The market in Europe is likely to increase at a reasonable pace due to the development of defense forces in various regions such as the U.K, Germany, Russia among others. The Privatization of the space exploration division in the Europe region is likely to propel sales in the market in the forecast years. In recent years, government has supported private companies and support to launch commercial space flights, which has led to higher adoption of military radar system.

The global military radar market is estimated to reach $25,139.8 million by 2031

Airspace monitoring and traffic management, space situation awareness, maritime patrolling, weapon guidance, and others are the leading application of military radar market

North America is the largest regional market for military radar

Rising geopolitical tensions and Increase in R&D activities in military radar for airborne platform are the opportunities in military radar market in the world

Airborne platform holds the largest market share in military radar market

Loading Table Of Content...