Military Vehicle Sustainment Market Research, 2033

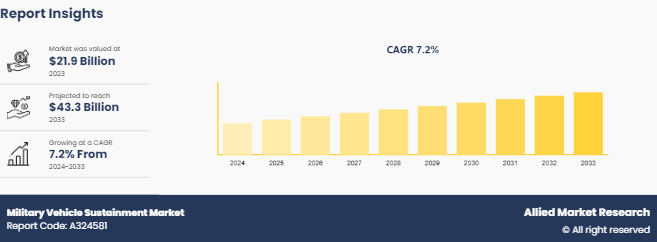

The global Military Vehicle Sustainment Market Size was valued at $21.9 billion in 2023, and is projected to reach $43.3 billion by 2033, growing at a CAGR of 7.2% from 2024 to 2033.

Market Introduction and Definition

The Military Vehicle Sustainment services prolong the life of military vehicles and improve their efficiency. Military vehicles are maintained using various techniques, including condition-based and predictive maintenance.

Condition-based maintenance, or CBM, is a technique that determines what maintenance needs to be done by keeping an eye on an asset's real state. According to CBM, maintenance should only be carried out when certain indicators point to impending failure or declining performance.

The goal of predictive maintenance is to forecast whether a machine needs maintenance by using machine learning algorithms to interpret data from sensors, equipment records, and other sources.

Key Takeaways

The Military Vehicle Sustainment Market Size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major military vehicle sustainment industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious Military Vehicle Sustainment Market Growth objectives.

Key Strategies and Developments

The U.S. Army chose General Dynamics Land Systems, a corporate unit of General Dynamics, in June 2023 to move on to the XM30 Mechanized Infantry Combat Vehicle competition's detailed design, prototype production, and test phases. The Army's next generation infantry fighting vehicle development program, the XM30, will replace the Bradley Fighting Vehicle. It was formerly known as the Optionally Manned Fighting Vehicle (OMFV) . General Dynamics Land Systems was granted a $768.7 million firm-fixed-price contract by the U.S. Army Contracting Command for Phase III and IV detailed design, prototype production, and testing.

The Association of the U.S. Army's Annual Meeting & Exposition was held on October 9–11, 2023, at the Walter E. Washington Convention Center in Washington, D.C. Four business units of General Dynamics were among the exhibitors. The list of General Dynamics products and solutions that were displayed at the event included autonomous vehicle sustainment (AVS) . AVS is a prognostic & predictive maintenance (PPMx) solution that uses an on-platform health, usage, monitoring system (HUMS) integrated with next generation electronic architecture to provide forward-looking, real-time decision actionable logistics information. This increases operational readiness and optimizes equipment performance.

In December 2022, ManTech International was issued a five-year, $862 million task order for full lifecycle maintenance support of mission-critical vehicles and systems for the U.S. army's program executive office, including combat support and service support, as well as its customers under the allied logistics engineering capabilities and sustainment (ALECS) program. The contract was provided by the U.S. army.

In March 2024, BAE Systems secured a $318 million services contract to support the U.S. Army's fleet of M109A6 and A7 self-propelled howitzers along with their companion vehicles. This contract includes delivering lifecycle sustainment and technical services.

In November 2023, Pratt & Whitney secured an $870 million contract from the Defense Logistics Agency for the sustainment of TF33 engines, which power Boeing B-52 stratofortress and E-3 Sentry aircraft. This long-term agreement supports the USAF’s readiness and involves comprehensive maintenance and support services.

In May 2023, Elbit America established a latest combat vehicle assembly and integration center of excellence in North Charleston, South Carolina, marking a significant investment in the region. This facility aims to support the U.S. military by providing crucial vehicle sustainment and integration services, thereby improving the capabilities and readiness of American and allied forces.

On June 26, 2023, General Dynamics Land Systems attained a $712.3 million order from the U.S. Army for 300 Stryker DVHA1 vehicles. This contract enhances the capabilities of Stryker brigades by providing advanced technological features such as a powerful engine, robust suspension, and digital network integration.

Key Market Dynamics

The global military vehicle sustainment Military Vehicle Sustainment Industry is driven by technological advancements and modernization needs. However, the market faces restraints such as budget restraints. Digitalization and data analytics offer significant potential for market expansion and diversification.

Market Segmentation

The military vehicle sustainment market is segmented into service, vehicle type, application, and region. By service, the market is classified into maintenance, repair and overhaul, parts & components supply, training & support. By vehicle type, the market is divided into armored fighting vehicles, engineering & recovery vehicles, ground support vehicles, landing craft & amphibious vehicles, light tactical vehicles, military trucks, mine-resistant ambush protected (MRAP) vehicles, and self-propelled artillery. By application, the market is categorized into air force, army, and navy. By region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/ Country Market Outlook

Babcock was awarded a contract in February 2024 to supply the British Army's armored vehicle community with specialized trade and technical training. It is anticipated that the approximately £75 million ($96 MILLION) seven-year deal will begin in April 2024. It will provide close combat training, including driving and maintenance, gunnery, and communications and information systems training, to a wide range of field army and defense users on tracked and wheeled armored fighting vehicles (AFVs) . As the Center of Excellence for the delivery of AFV-trained people to the British Army, the Babcock solution will provide training at Bovington and Lulworth on behalf of the Armour Centre (ARMCEN) . The solution is expected to be made available in the UK and Europe.

The U.S. Army granted BAE Systems a contract in March 2024 that is worth up to $318 million to provide technical and maintenance support services for its fleet of M109A6 and A7 Self-Propelled Howitzers (SPH) and their associated M992A3 carrier, ammunition, tracked (CAT) vehicles. To provide additional capabilities, maintenance, and testing on the family of vehicles, BAE Systems is projected to provide ongoing engineering and logistics services under the terms of the five-year contract for System Technical Support and Sustainment System Technical Support. Services in this contract will be provided at military bases in the U.S. and around the world, as well as at BAE Systems facilities in York, Pennsylvania; Minneapolis, Minnesota; Sterling Heights, Michigan; Endicott, New York; Elgin, Oklahoma; and Aiken, South Carolina.

A $300 million contract to provide weapons, reconnaissance, driving, and situational awareness systems for about 230 armored vehicles to a European customer was awarded to Elbit Systems Limited in February 2024. During the six-year contract, custom design, production, lifecycle maintenance, and full in-country support are expected to be provided to European customers.

Competitive Analysis

The major players operating in the military vehicle sustainment Military Vehicle Sustainment Market Shareinclude General Dynamics, BAE Systems Plc, Elbit Systems Limited, Babcock, ManTech International Corporation, Amentum, IDV, CAMMS Shelters, Edge Group PJSC, Larsen & Toubro Limited, and Leonardo DRS Inc. The following players adopted, product launch, and collaboration, contract, and acquisition strategies to strengthen their position in the global military vehicle sustainment market.

The other players include GS Engineering Inc., Honeywell International Inc., Indra Sistemas SA, L3Harris Technologies Inc., Lockheed Martin Corporation, Serco Group Plc, Thales Group, Terma A/S, Textron Systems Corporation, and RTX Corporation.

Industry Trends

Leading multinational defense contractor IDV, which has over 85 years of experience in the development and production of a wide range of logistic, protected, and armored vehicles for military usage, partnered with AM General, a global pioneer in military mobility solutions, in October 2022. The collaboration is done for the U.S. Army's Common Tactical Truck (CTT) Program to create a versatile and secure architecture to replace its heavy and medium tactical wheeled vehicle fleet (TWV) . AM General and IDV jointly filed a request for prototype proposal (RPP) to compete for this program. The collaboration is done in the South Bend of Indiana (U.S.) .

The U.S. Army awarded Amentum a contract in February 2023 for a remote maintenance and distribution center that could be worth up to $487 million. The contract is for the provision of field engineering and modernized, all-inclusive logistics and sustainment solutions to a wide range of military systems and equipment that have been donated by the U.S. government, as well as equipment. To deliver several layers of sustainment solutions on a complex set of vehicles, assets, radars, gear, and ground support equipment using cutting-edge predictive analytics, tools, and technology. Amentum specialists will be stationed outside of the continental U.S., including Europe.

Key Sources Referred

AM General.Com

Cadence PCB Solutions

Amendum

Babcock

Bae systems

Elbit Systems

General Dynamics

S&P Capital IQ

Baesystems.com

RTX.com.news

Elbitamerica.com

General Dynamics Land Systems

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the military vehicle sustainment market analysis from 2024 to 2033 to identify the prevailing military vehicle sustainment market opportunities.

The market research is offered along with information related to key drivers, restraints, and Military Vehicle Sustainment Market Opportunity.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the military vehicle sustainment market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global military vehicle sustainment market trends, key players, market segments, application areas, and market growth strategies and Military Vehicle Sustainment Market Forecast.

Military Vehicle Sustainment Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 43.3 Billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 253 |

| By Service Type |

|

| By Vehicle Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Thales Group, ManTech International Corporation, Terma A/S, Babcock, Larsen & Toubro Limited, Textron Systems Corporation, BAE Systems Plc, Edge Group PJSC, Lockheed Martin Corporation, General Dynamics, CAMMS Shelters, L3Harris Technologies Inc., Elbit Systems Limited, GS Engineering Inc., Serco Group Plc, Honeywell International Inc., Indra Sistemas SA, IDV, Amentum, Leonardo DRS Inc., RTX Corporation |

Military forces are increasingly integrating Internet of Things (IoT) sensors and big data analytics into their vehicles to monitor performance in real-time. This data helps predict when components might fail, allowing for proactive maintenance rather than reactive repairs.

The Maintenance, Repair & Overhaul (MRO) segment is the leading application of Military Vehicle Sustainment Market. This is due to the continuous and essential need to keep military vehicles operational and combat-ready, encompassing routine maintenance, extensive repairs, and comprehensive overhauls to extend vehicle life and functionality.

North America is the largest regional market for Military Vehicle Sustainment. This is due to its substantial defense budget, advanced technological capabilities, and extensive military vehicle fleet, primarily driven by the United States.

43.3 $Billion is the estimated industry size of military vehicle sustainment market.

General Dynamics, BAE Systems Plc, Elbit Systems Limited, Babcock, ManTech International Corporation are the top companies to hold the market share in Military Vehicle Sustainment.

Loading Table Of Content...