Millimeter Wave Technology Market Research, 2032

The Global Millimeter Wave Technology Market was valued at $3.4 billion in 2023, and is projected to reach $17.9 billion by 2032, growing at a CAGR of 20.4% from 2024 to 2032.

Market Introduction and Definition

Millimeter wave is a kind of electromagnetic technology used in various products such as phones, cars, medical devices, and others to ensure wireless broadband communications at a higher speed. It is known as extremely high frequency (EHF) because it presents signal spectrum ranges from 30GHz to 300GHz with a wavelength between 1 and 10 mm. Moreover, millimeter wave technology provides security for communication transmission.

Key Takeaways

On the basis of component, the antenna & transceiver components segment dominated the millimeter wave technology industry size in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

On the basis of product, the telecommunication equipment segment dominated the millimeter wave technology industry size in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

On the basis of license type, the unlicensed frequency segment dominated the millimeter wave technology industry size in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

On the basis of frequency brand, the 24 GHz to 57 GHz segment dominated the millimeter wave technology market size in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

On the basis of application, the telecom & datacom segment dominated the millimeter wave technology market size in terms of revenue in 2023.

Region-wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

High-performing millimeter-wave devices require efficient low-profile antennas to ensure reliable and interference-free communications, and due to small wavelength, mmWave technology infrastructure requires large antenna arrays to be packed in miniature physical dimensions, which fuel the requirement of antennas and transceivers designed for the millimeter (mm) wave technology, boosting the market growth.

According to a recent GSMA report, 5G adoption is anticipated to reach around a billion connections by 2030. The technology will likely underpin future mobile innovation and boost ongoing deployments, adding almost USD 1 trillion to the global economy in 2030. The report states that throughout 2023, a total of 30 new markets across Africa and Asia will launch 5G services. As 5G adoption continues to scale, network operators are increasing their efforts to expand their 5G fixed wireless access (FWA) offerings. Markets with low fixed broadband penetration and rising incomes will also see faster-than-average 5G growth.

In August 2023, Marki Microwave, a provider of radio frequency and microwave products, acquired the waveguide business of Precision Millimeter Wave LLC, a supplier of sub-THz waveguide technology. Marki Microwave plans to offer over 100 standard commercial waveguide products and multiple custom waveguide products like mmWave to sub-THz, including antennas, connectors, switches, and isolators.

Key Market Dynamics

The rise in demand for smart devices is a significant driver for the millimeter wave technology market. The advancement in wireless technologies such as high-speed communication, high bandwidth, high-resolution videos and carrying large amounts of data influences the demand for millimeter wave technology due to its capability to enable 5G networks. Technological advances in digital networks connect a number of devices and sensors, which ensures advances in various smart technologies such as cars, smartphones, medical devices, and others. Therefore, the rise in penetration of mobile devices from consumer electronics influences the demand for 5G networks, which further increases the need for millimeter wave technology globally.

However, the adverse impact of millimeter wave technology on the environment presents a significant restraint for the widespread adoption of millimeter wave technology. Rapid deployment of 5G network is one of the key requirements in the millimeter wave technology. The 5G network uses high band frequencies for faster communication, that is, millimeter wave technology. However, being of a limited range, it can be blocked by buildings or walls. Moreover, it gets affected by atmosphere pollutants and interferes with the presence of electrical towers, which is harmful for humans, wildlife, and trees. 5G network has its presence in developed countries such as the U.S. Germany, Canada, and France, which inevitably increases demand for millimeter wave technology, and proves to be harmful for humans, animals, and the environment.

Furthermore, the increase in usage of millimeter wave technology in military and defense sector presents a substantial opportunity for the millimeter wave technology market. Various enhanced applications are being used in military & defense sectors such as radar, electronic warfare, and satellite communications. To provide commands, military intelligence, and orders from one place to another in combat scenarios, these applications will need millimeter wave technology. The reason behind deployment of millimeter wave technology in military & defense applications, owing to high frequency range. Due to that millimeter wave technology can easily cover the range of radar and satellite communication segments, i.e. 18-40 GHz. Moreover, millimeter wave technology provides faster, secured exchange of information, and connectivity during tactical communications. Among all other sectors, military and defense is one of the highest growing sectors in the millimeter wave technology market. Therefore, growth in investments toward military & defense infrastructure is expected to provide significant opportunity for implementation of millimeter wave technology.

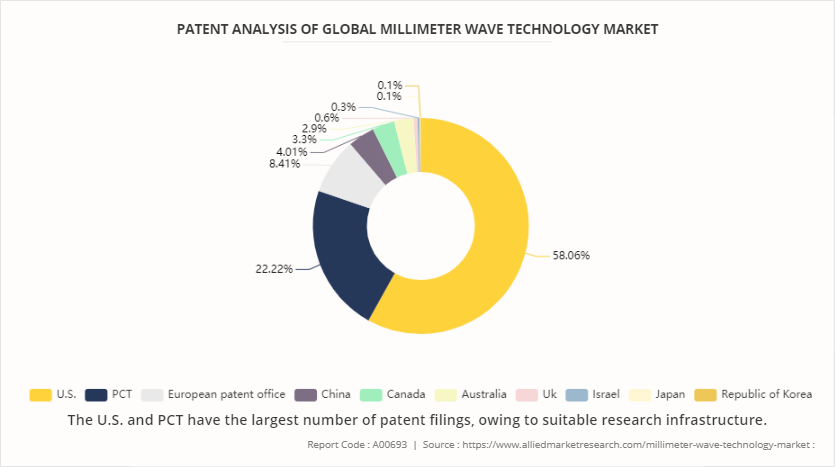

Patent Analysis of global millimeter wave technology market

The global millimeter wave technology market is segmented according to the patents filed in the U.S., PCT, European patent office, China, Canada, Australia, the UK, Israel, Japan, and Republic of Korea. The U.S. and PCT has the largest number of patent filings, owing to suitable research infrastructure. Approvals from these authorities are followed by high adoption of smart wearable devices and growth in trends in the autonomous industry vehicle in the countries. Therefore, these two regions have the maximum number of patent filings.

Market Segmentation

The millimeter wave technology market is analyzed into component, product, license type, frequency band, application, and region. On the basis of component, the market is divided into antenna & transceiver components, frequency sources & related components, communication & networking components, imaging components, rf & radio components, sensors & controls, and others. Based on product type, the market is fragmented into scanner systems, radar & satellite systems, and telecommunication equipment. Based on license type, the market is segregated into light licensed frequency, unlicensed frequency, and fully licensed frequency. Based on frequency band, the market is classified from 24 GHz to 57 GHz, 58 GHz to 86 GHz, and 87 GHz to 300 GHz. Based on application, the market is classified into telecom and datacom, military & defense, automotive, industrial, consumer, medical, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Market Segment Outlook

On the basis of product, the telecommunication equipment segment dominated the millimeter wave technology market forecast in terms of revenue in 2023 and is expected to follow the same trend during the forecast period due to the rapid expansion of 5G networks and the increasing demand for high-speed wireless communication. Millimeter wave technology enables faster data transfer rates and higher bandwidth, essential for the performance of 5G services. Further, the proliferation of connected devices and the surge in need for improved network capacity and low latency drive the adoption of millimeter wave technology in telecommunication equipment, sustaining its market dominance.

On the basis of component, the antenna & transceiver components segment held the highest share of the millimeter wave technology market insightst due to the increasing deployment of 5G networks, which require advanced antenna and transceiver designs for better performance, and ongoing advancements in antenna technology enhancing efficiency and miniaturization, which are critical for modern telecommunication and radar systems.

Based on license type, the unlicensed frequency segment held the highest market share for millimeter wave technology sector analysis in 2023 due to flexibility and accessibility. Unlicensed frequencies allow for easier deployment and lower regulatory barriers compared to licensed frequencies, enabling a wider range of applications and greater innovation. Moreover, this segment's popularity surged due to its cost-effectiveness and suitability for various consumer electronics, telecommunications, and industrial applications, driving its market dominance in 2023.

Based on frequency, the 24 GHz to 57 GHz segment held the highest market share for millimeter wave technology industry report in 2023 owing to its optimal balance between performance and regulatory considerations. This frequency range offers enough bandwidth for high-speed data transmission while remaining within regulatory limits, making it ideal for a wide array of applications, including 5G networks, automotive radar, and point-to-point communication systems.

Based on application, the telecom & datacom segment held the highest market share in 2023 owing to increase in demand for high-speed internet and reliable telecommunications infrastructure. There is a growing need for underground cables to support telecommunications networks efficiently with the global surge in digital connectivity and data transmission.

Regional/Country Market Outlook

On the basis of region, the millimeter wave technology market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America held the highest market share in the millimeter wave technology market in 2023. This is driven by the early and extensive deployment of 5G networks across the U.S. and Canada. In North America, millimeter wave technology for US market benefits from significant investments in advanced telecommunications infrastructure, strong support from government and regulatory bodies, and a high concentration of key market players and technology innovators.

Competitive Landscape

The major millimeter wave technology manufacturer operating in the market are NEC Corporation, L3 Technologies, Inc., Keysight Technologies, Millimeter Wave Products Inc., BridgeWave Communications (REMEC Broadband Wireless Networks) , CableFree: Wireless Excellence, Farran Technology, E-Band Communications, LLC, SAGE Millimeter, Inc., Siklu Communication, Denso Corporation, Fujitsu, and Mitsubishi Electric Corporation. Other millimeter wave technology manufacturer in the millimeter wave technology market include MMW Biomedical, Hubei YJT Technology and others.

Recent Key Strategies and Developments

In December 2023, Eravant (SAGE Millimeter Inc.) received a patent related to a novel series of electrical connectors used in the rapidly growing field of millimeter-wave electronics. The patented devices are compatible with the existing coaxial interfaces. Uni-Guide waveguide connectors help component manufacturers offer a wide range of waveguide sizes and orientations using a reduced number of package designs.

In August 2023, Siklu a global provider of millimeter wave (mmWave) solutions for Digital City and Gigabit Wireless Access (GWA) , launched its new MultiHaul TG T261 terminal unit. The T261 mainly represents Siklu’s fourth addition to the MultiHaul TG family of point-to-multipoint 60 GHz products and is Terragraph (TG) certified.

Key Sources Referred

Semiconductor Industry Association (SIA)

SEMI.org

IEEE Electron Devices Society (EDS)

U.S. Department of Energy

Global Semiconductor Alliance (GSA)

World Economic Forum

European Semiconductor Industry Association (ESIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the millimeter wave technology market analysis from 2024 to 2032 to identify the prevailing millimeter technology market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the millimeter wave technology market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global Millimeter Wave Technology Radar market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players, and Millimeter Wave Technology Company List.

- The report includes the analysis of the regional as well as global millimeter wave technology market trends, millimeter wave technology market share by companies, millimeter wave technology market size by country, key players, market segments, millimeter wave technology market data, application areas, and market growth strategies.

Millimeter Wave Technology Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.9 Billion |

| Growth Rate | CAGR of 20.4% |

| Forecast period | 2024 - 2032 |

| Report Pages | 250 |

| By Component |

|

| By Product Type |

|

| By License Type |

|

| By Frequency Band |

|

| By Application |

|

| By Region |

|

| Key Market Players | Mitsubishi Electric Corporation, L3 Technologies, Inc.,, BridgeWave Communications, Inc., Siklu Communication Ltd., E-Band Communications, LLC, Keysight Technologies, Inc., Millimeter Wave Products Inc., NEC Corporation, Fujitsu, Farran Technology |

Increased use in telecommunications and advancements in radar and imaging systems are the upcoming trends of the millimeter wave technology market in the globe

Telecom & datacom is the leading application of millimeter wave technology market

North America is the largest regional market for millimeter wave technology

In 2023, $3.21 billion was the estimated industry size of millimeter wave technology

NEC Corporation, L3 Technologies, Inc., Keysight Technologies, Millimeter Wave Products Inc., BridgeWave Communications (REMEC Broadband Wireless Networks), CableFree: Wireless Excellence, Farran Technology, E-Band Communications, LLC, SAGE Millimeter, Inc., Siklu Communication, Denso Corporation, Fujitsu, and Mitsubishi Electric Corporation, are the top companies to hold the market share in Millimeter Wave Technology

Loading Table Of Content...