Mineral Turpentine Market Research, 2031

The global mineral turpentine market was valued at $6.8 billion in 2021 and is projected to reach $11.5 billion by 2031, growing at a CAGR of 5.5% from 2022 to 2031.

Report Key Highlighters:

- The Mineral turpentine market has been analyzed in both value and volume. The value of the mineral turpentine market is analyzed in millions while the volume is analyzed in kilo tons.

- Global Mineral turpentine market is fragmented in nature with many players such as Al Sanea, Alshall International Co., Bharat Petroleum Corporation Limited, DHC Solvent Chemie GmbH, Global Petro, GSB Chemical Co. Pty. Ltd, Hindustan Petroleum Corporation Limited, Indian Oil Corporation Ltd., Powerzone Oil, and Sydney Solvents. Also tracked key strategies such as product launches, acquisitions, mergers, expansion etc. of various manufacturers of Mineral turpentines.

- Included more than 20 countries in the report which covers market volume as well as market value for all the countries of the mineral turpentine market.

- Conducted primary interviews with raw material suppliers, wholesalers, suppliers, and manufacturers of the mineral turpentine market to understand the market trends, growth factors, pricing, and key players competitive strategies.

Mineral turpentine, also known as a mineral spirit, which is a combination of petroleum hydrocarbons. It is a transparent, colorless liquid that is non-corrosive and chemically stable. In the end-use industries of paint & varnish, textiles, metal cleaning, and rubber, it is used as solvents and diluents.

The demand on the global market has been stimulated by the increase in the use of mineral turpentine in the end-use sectors such as paints & coatings, adhesives, and inks & dyes. Mineral turpentine is frequently used in solvent applications including cleaning solvents, degreasing solvents, and aerosol solvents due to its interaction with aliphatic and alicyclic hydrocarbons. Moreover, other applications of mineral turpentine include wood preservative solvents, varnishes, and lacquer solvents. The paint industry is the largest consumer of mineral turpentine, owing to its extensive use as a paint thinner and cleaning agent for paint brush cleaning. All these factors drive the growth of the global mineral turpentine market.

However, the global market for mineral turpentine is hampered by health risks connected to prolonged exposure. The presence of mineral turpentine in the environment may or may not lead to exposure and cause health hazards. Breathing, consumption, and skin contact with the mineral turpentine are harmful. Health hazards associated with ingestion or exposure to mineral turpentine also depend upon factors such as the dose or amount of mineral turpentine exposure and duration of exposure.

Long-term consumption of mineral turpentine leads to abdominal pain and drowsiness. Moreover, long-term exposure also leads to heart problems and pneumonitis (severe lung damage). Ingestion of mineral turpentine directly into the lungs may further increase the risk of nausea. Other risks associated with the ingestion of mineral turpentine vapor include nose & throat irritation, shortness of breath, and headache. All these factors are anticipated to restrict the growth of the global mineral turpentine market.

However, it is anticipated that the application of mineral turpentine in the paint industry would create additional opportunities in the market for mineral turpentine. The addition of the mineral turpentine reduces the viscosity of the paint and reduces the drying time. Additionally, mineral turpentine aids in the smoothness of paint products, which is another significant factor that boosts the demand for mineral turpentine globally. Other applications of mineral turpentine include wood preservation products, grease removers, preventing corrosion of metal working fluids, and automotive cleaning & polishing products. All these factors collectively increase the demand for mineral turpentine in the global market and are thereby anticipated to offer new opportunities during the forecast period.

Growth in demand for mineral turpentine in the automotive industry

The automotive ancillary industry requires significant maintenance for machines and tools used in the production of products. These machines and operating tools need regular cleaning to function well. Mineral turpentine is used as a solvent to remove oil, grease, dirt, and loose particles from machines. The application of premium paints and coatings in the automobile industry is experiencing growth. The surge in demand for mineral turpentine in the automobile industry is expected to boost the growth of the global mineral turpentine market.

Furthermore, global sales of mineral turpentine in the automotive industry is increasing owing to the rise in the production of vehicles, coupled with robust growth of the automotive sector in countries such as Brazil, China, Mexico, India, and South Korea. In addition, the surge in trends of automotive restorations and refurbishing is likely to reflect favorably on the sales prospects of automotive mineral turpentine in the aftermarket vertical. At the same time, the rapid adoption of low-aromatic mineral turpentine in the automotive sector is likely to boost the growth of the global automotive mineral turpentine market during the forecast period.

Increased demand for paints in the construction industry

The growth of the global mineral turpentine market is propelled by modest jet kerosene prices and an increase in demand from the paints & coating end-use industry. This population growth has increased the annual demand in various industries such as construction, manufacturing, and others. The surge in the number of applications of paints & coatings in industries such as construction, automobile, manufacturing, and others drives the demand for mineral turpentine in the paints & coating industry. However, the solvents used in paints and coatings, including mineral turpentine, complement these goods. The mineral turpentine market expansion is fueled by the extensive use of mineral turpentine as a solvent for paint, varnish, and lacquers, among others.

Furthermore, growth in construction activities around the globe is projected to drive the market growth of construction paints and coatings. The increasing population is also creating demand for residential infrastructure which in turn is boosting demand for paints and coatings. Moreover, rapid growth in the manufacturing industries around the globe is expected to augment the market growth of construction paints and coatings. For Instance, according to a report published by United Nations in 2018, the current estimation indicates that nearly 83 million people are being added to the global population every year. Even with the decline in fertility level, the global population is expected to reach 8.6 billion by 2030.

However, mineral turpentine is an aromatic organic solvent and a high level of exposure to mineral turpentine leads to toxic effects such as chemical burns, nausea, and others. In addition, prolonged exposure can cause chronic central nervous system disorder.

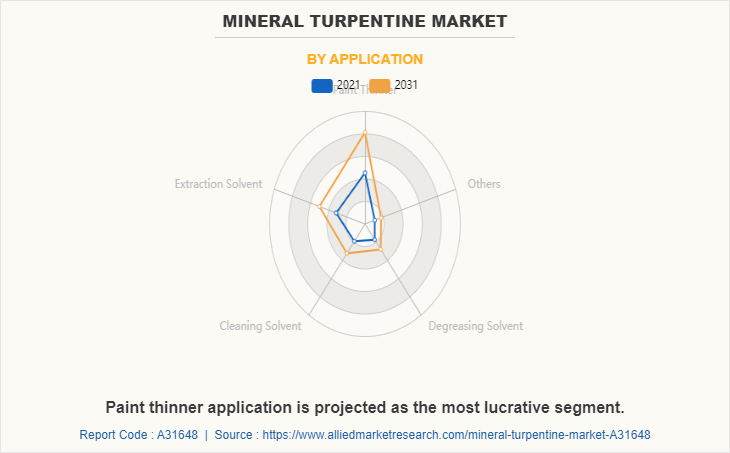

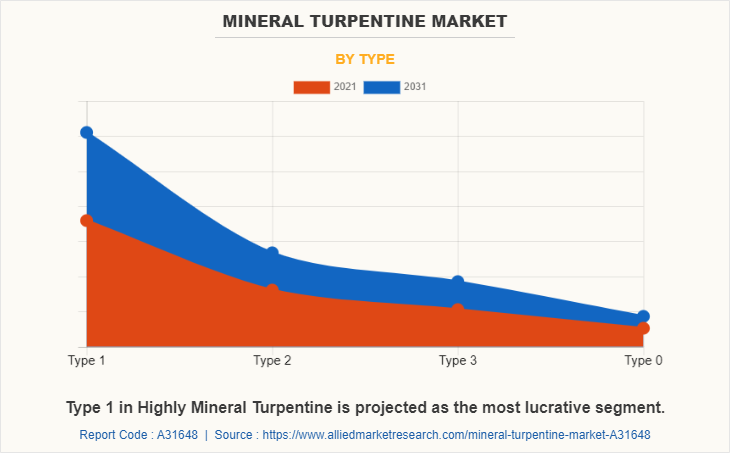

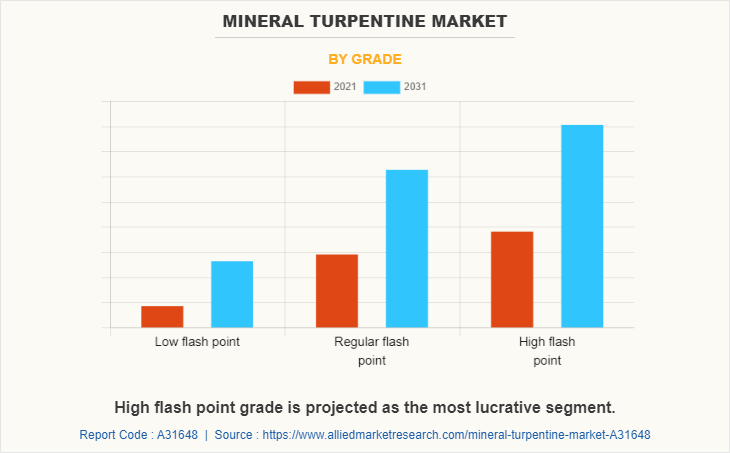

The mineral turpentine market is segmented into product type, grade, application, and region. On the basis of type, the market is divided into type 0, type 1, type 2, and type 3. On the basis of grade, the global mineral turpentine market is divided into low flash point grade mineral turpentine, regular flash point grade mineral turpentine, and high flash point grade mineral turpentine. The applications covered in the study include paint thinner, solvent extraction, cleaning solvent, degreasing solvent, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global mineral turpentine market are Al Sanea, Alshall International Co., Bharat Petroleum Corporation Limited, DHC Solvent Chemie GmbH, Global Petro, GSB Chemical Co. Pty. Ltd., Hindustan Petroleum Corporation Limited, Indian Oil Corporation Ltd., Powerzone Oil, and Sydney Solvents. Other companies operating in the mineral turpentine market are Solvay S.A., DowAksa Advanced Composites Holdings B.V., Formosa, Plastics Corporation, Hexcel Corporation, and others.

The applications covered in the study include paint thinner, solvent extraction, cleaning solvent, degreasing solvent, and others. In 2021, the paint thinner application was the largest revenue generator, and is anticipated to register a CAGR of 5.2% during the forecast period. Mineral turpentine is produced from petroleum distillate, making it viable to be used as a solvent in paint thinner, which drives the demand for mineral turpentine in pain thinner applications.

On the basis of type, the market is divided into type 0, type 1, type 2, and type 3. Type 1 product type was the largest revenue generator, in 2021 and is anticipated to register a CAGR of 5.6% during the forecast period. Type 1 mineral turpentine is subjected to hydro-desulfurization process and comprises hydrocarbons with carbon number ranging between C7-C12. Type 1 mineral turpentine is widely used as an extraction solvent and cleaning solvent owing to its high boiling point (90-230°C). The use of type 1 mineral turpentine as an active solvent in aerosol and other wood preservative products also drives the global market.

On the basis of grade, the global mineral turpentine market is divided into low flash point grade mineral turpentine, regular flash point grade mineral turpentine, and high flash point grade mineral turpentine. High flash point grade mineral turpentine was the largest revenue generator, in 2021 and is anticipated to expand at a CAGR of 5.7% during the forecast period. Regular flash point grade mineral turpentine has a flash point of 31 to 54 Centigrade, making it ideal for use in paints, varnishes, and asphalt products. This drives the demand for mineral turpentine globally.

Region-wise, the mineral turpentine market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific mineral turpentine market size is projected to expand at the highest CAGR of 5.6% during the forecast period. Mineral turpentine minimizes paint viscosity and improves paint smoothness. Moreover, the eco-friendly nature and cost-effectiveness of mineral turpentine make it suitable for applications such as paint thinners. In addition, the rise in use of mineral turpentine in the construction and automotive end-use industries also drives the Asia-Pacific mineral turpentine market.

IMPACT OF COVID-19 ON THE GLOBAL MINERAL TURPENTINE MARKET

The mineral turpentine market has been negatively impacted due to the wake of the COVID-19 pandemic owing to its dependence on automobile, color & painting, manufacturing, and building & construction industries.

According to a report published by Energy and Economic Growth Survey, the oil & gas sector is among the hardest hit sector with an average contraction of -2.8% in 2020. This has hampered the production of mineral turpentine amid the COVID-19 period. Also, more than 100 countries have locked their international borders for transportation and non-essential trade activities which in turn have reduced the consumption of mineral turpentine among the automotive sectors.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mineral turpentine market analysis from 2021 to 2031 to identify the prevailing mineral turpentine market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mineral turpentine market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global mineral turpentine market trends, key players, market segments, application areas, and market growth strategies.

Mineral Turpentine Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 11.5 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 327 |

| By Application |

|

| By Type |

|

| By Grade |

|

| By Region |

|

| Key Market Players | ALSHALL INTERNATIONAL CO., Powerzone Oil, Al Sanea, Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, Indian Oil Corporation Ltd, Sydney Solvents, GSB Chemical Co. Pty. Ltd, DHC Solvent Chemie GmbH, Global Petro |

Analyst Review

According to the CXOs of the leading companies in the market, mineral turpentine has high growth potential owing to its use in paints & coatings, waxes, adhesives, and printing ink applications. In addition, it is widely used in other applications such as cleaning & degreasing solvents and paint thinners, which further drives the growth of the global mineral turpentine market. Mineral turpentine can also be used as a solvent for the extraction of oil-bituminous rock organic components from minerals. Moreover, coal samples contain contaminants that need to be cleaned prior to use. Thus, mineral turpentine is generally used as a cleaning solvent to separate the mixture of organic liquids from coal samples. A combination of mineral turpentine and aromatic compounds can be used as an extraction or processing solvent during the synthesis of alkyd resin from camelina oil.

The mineral turpentine market has witnessed steady growth owing to rise in disposable income, increase in urbanization, change in lifestyles, and growth in construction activities. Furthermore, Asia-Pacific is expected to witness a robust growth rate during the forecast period owing to a surge in construction activities and rapid growth of manufacturing industries such as automobiles in the region. Moreover, developments in the low aromatic mineral turpentine segment are also expected to boost the growth of the mineral turpentine market.

Growth in demand for mineral turpentine in the automotive industry and increased application of mineral turpentine. These are the key factors driving the global mineral turpentine market.

The global mineral turpentine market was valued at $6.8 billion in 2021, and is projected to reach $11.5 billion by 2031, expanding at a CAGR of 5.5% from 2022 to 2031.

Europe is largest regional market for Mineral Turpentine

The global mineral turpentine market is segmented on the basis of type, grade, application and region.

The key players operating in the global mineral turpentine market are Al Sanea, Alshall International Co., Bharat Petroleum Corporation Limited, DHC Solvent Chemie GmbH, Global Petro, GSB Chemical Co. Pty. Ltd., Hindustan Petroleum Corporation Limited, Indian Oil Corporation Ltd., Powerzone Oil, and Sydney Solvents.

Paint thinner in the global mineral turpentine market is projected to increase the demand for mineral turpentine during the forecast period.

Loading Table Of Content...