Missile Guidance System Market Overview, 2031

The global missile guidance system market size was valued at $0.82 billion in 2021, and is projected to reach $1.3 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.Missile guidance systems consist of various methods to direct the missile to its intended target. It remains highly dependent on the network, and disruption from a guidance system intrusion can throw the missile off-course and even disrupt its trajectory. Each missile guidance system consists of a flight path control system and an attitude control system. Attitude control systems are responsible for maintaining a desired attitude on a given trajectory by controlling the pitch, roll, and yaw of the missile.

The missile guidance system market is segmented into Launch Platform, Type and End User.

Enhancements in the defense systems to tackle war-like situations and the need for the protection of territory have influenced major countries to deploy advanced defense and attacking systems. The guiding system uses appropriate techniques to locate the moving target in space and pursues it until it accurately hits the target. Adoption of advance missile guidance systems results in benefits such as semi-active lasers, radar homing, Inertial Navigation System (INS), and Global Positioning System (GPS).

Improved defense systems and the need to protect their territories to deal with war-like situations have led major powers to adopt advanced defense and offensive systems. Missile guidance systems use appropriate techniques to locate moving targets in space and track them to precise target hits. Advanced missile guidance systems offer advantages such as semi-active lasers, radar homing, inertial navigation systems (INS), and global positioning systems (GPS).

Increase in government spending on improve their current national security systems, increase in developments related to Hypersonic missiles, and gaining the penetration of precision-guided munition are the major factors that propel the market growth. However, high-cost associated with missile technology and fluctuation in raw material supply cost are the major factors that hamper growth of the market. Furthermore, growing preference for Automatic Target Recognition (ATR) Missile Systems, and technological advancements in guidance systems are the factors expected to offer growth opportunities during the forecast period.

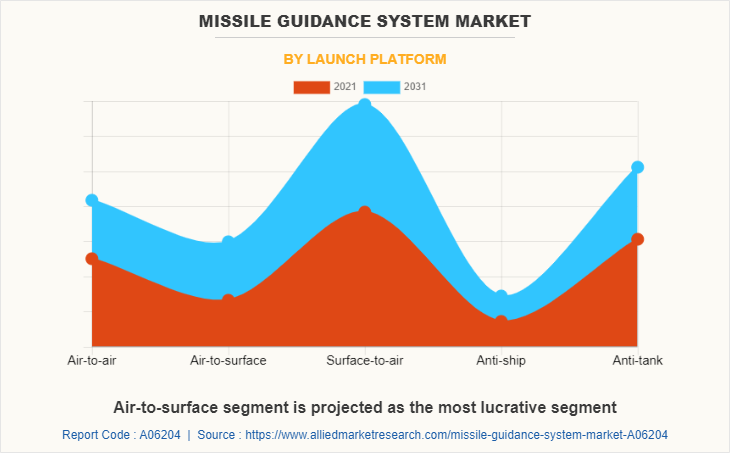

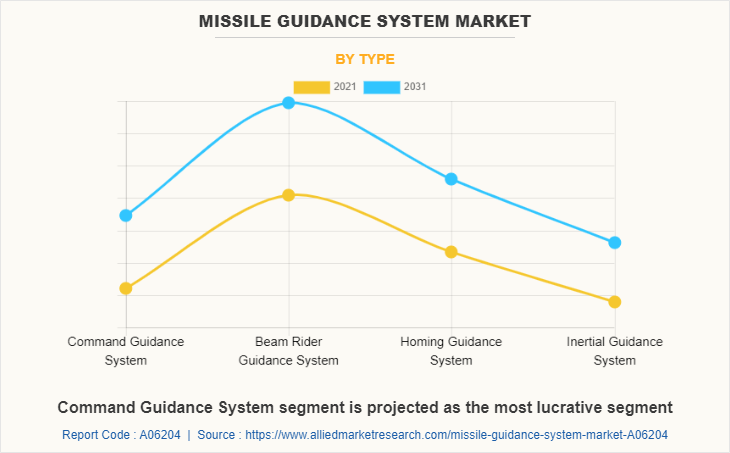

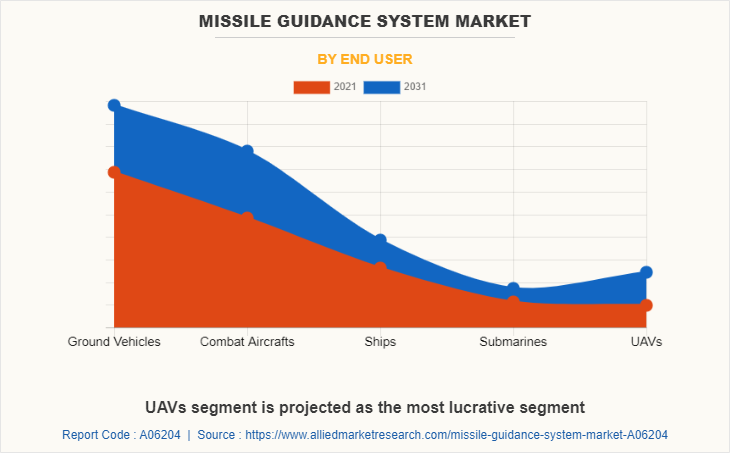

The missile guidance system market is segmented on the basis of launch platform, type, end use, and region. By launch platform, it is segmented into air-to-air, air-to-surface, surface-to-air, anti-ship and anti-tank. By type, it is classified into command guidance system, beam rider guidance system, homing guidance system and inertial guidance system. By end use, it is categorized into ground vehicles, combat aircrafts, ships, submarines and UAV’s. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

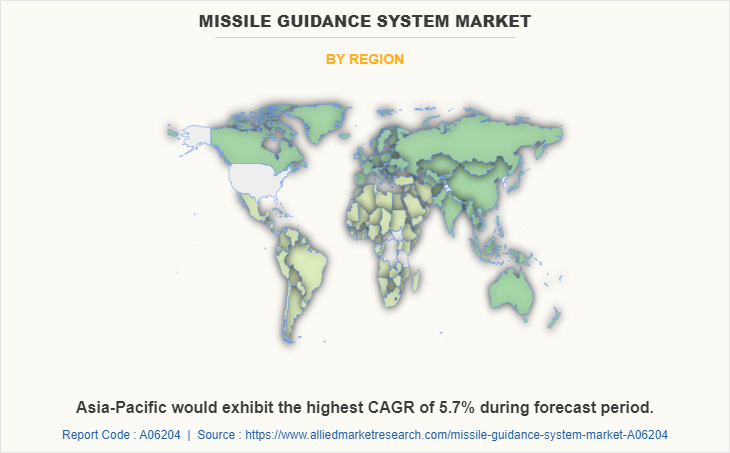

North America comprises the U.S., Canada, and Mexico has one of the advanced defense sectors across the globe. Countries such as U.S., Canada, and others in the region are highly developed in terms of missile guidance systems. The government’s improving defense expenditure to support the development of missile system and associated equipment is anticipated to boost the growth of the market across the region. Such system are well-equipped with latest technologies and are continuously upgraded to meet the latest trends. Advancements in the defense infrastructure and penetration of hypersonic missiles in air defense are the leading factors that boost demand for missile guidance system across North America. In addition, the increase in the deployment of a missile guidance system to keep the missile on the correct flight path (trajectory) and aimed at the target are expected to create lucrative growth opportunities for the missile guidance system market in the region.

Significant initiatives & investing plans by the Canada government for improving of existing weapon capability is the primary factor anticipated to boost the growth of the missile guidance system market in Canada. For instance, in July 2022, the Canadian government announced an investment of $4.9 billion over the next six years to upgrade and modernize the North American Aerospace Defense Force (NORAD). In addition, a total of $40 billion is expected to be invested over the next 20 years. The investment involves the acquisition of new advanced air-to-air missiles that are expected to enable Canadian forces to combat short, medium and long-range threats and track, assess and engage targets.

The leading aerospace companies are signing contracts to accelerate development and adoption of missiles equipped with missile guidance system in the North America, which increases the demand for missile guidance systems. For instance, in October 2022, Lockheed Martin received a contract worth $77.4 million from Army Contracting Command for 54 PrSM missiles. The PrSM provides surface-to-surface, all weather, precision-strike guided missile fired from the M270A1 Multiple Launch Rocket System (MLRS) and the M142 High Mobility Artillery Rocket System (HIMARS). Its radio homing and imaging infrared guidance helps the missile reach moving targets on land and at sea.

Some leading companies profiled in the report comprises BAE System PLC, ELBIT SYSTEM LTD., Leonardo S.P.A, General Dynamic Corporations, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Saab AB, Safran S.A., Thales Group, The Boeing Company, DRDOS (Defense Research and Development Organization). The leading companies are adopting strategies such as product launch and collaboration to strengthen their market position. In June 2022, Elbit System launched range extension & smart tail (REST) kit for air-to-surface warheads during the Eurosatory 2022, as part of its portfolio of precision munitions. Already ordered for several warhead types, REST transforms almost any type of air-to-surface warhead into a high penetration standoff precision munition. The REST kit is a modular solution that includes a smart tail for navigation and guidance, and upper wings for range extension..

In June 2021, Saab AB has successfully launched and demonstrated the new Guided Multipurpose Munition (GMM) in cooperation with the U.S. Army and Raytheon Missiles & Defense. In December 2021, Northrop Grumman Corporation entered into a collaboration Lockheed Martin Corporation to deliver the 10,000th guided multiple launch rocket system (GMLRS) propulsion system.

Increase in Territorial Conflicts

Most territorial conflicts are obtained due to dominance or supreme authority by nations over natural resources such as fertile farmland, rivers, minerals, and petroleum resources. For instance, Japan and China each claim a range of islands in the East China Sea. In Japan, they are known as the Senkaku Islands, and in China, they are known as the Diaoyu Islands. As a result, tensions between the two countries have escalated. In addition, one of the most important areas of conflict in the Middle East is the unsolved dispute between Israelis and Palestinians. Rival claims to the territory between Jordan and the Mediterranean are at the heart of the conflict. Moreover, territorial conflicts are a key cause of wars and terrorism, as nations frequently strive to exert their authority over an area through occupation, while non-state forces try to influence the acts of governments through terrorism. In addition, due to the rise in such instances and territorial conflicts, many nations improved their border security and surveillance capabilities with advanced guided weapons systems, guided missiles, and anti-missile systems and deployed missiles in civil wars for territorial acquisition. For instance, in April 2022, Russia expanded the scale of its missile strikes on Kyiv in response to Ukrainian forces' attacks or sabotage on Russian territory. In addition, in September 2020, the conflict between Armenia and Azerbaijan over the disputed Nagorno-Karabakh region included the heavy use of missiles, drones, and rocket artillery. Such growing adoption and deployment of guided missiles in territorial conflicts are anticipated to propel the growth of the market during the forecast period.

Rise in Defense Budget of Emerging Economies

Governments of countries such as Russia, the U.S., China, India, and others are increasing investment in arm forces to establish dominance on the battlefield. In April 2022, according to Stockholm International Peace Research Institute (SIPRI), total global military expenditure increased by 0.7% in real terms in 2021, to reach $2113 billion. The five largest spenders in 2021 were the U. S., China, India, the U.K., and Russia, together accounting for 62 % of expenditure. Also, total global military expenditure rose to $1981 billion in 2020, an increase of 2.6 percent from 2019. In addition, the rise in terrorist activities and civil activities in several regions and the rise in international conflicts force countries to enhance their military strengths through advancements in weapons capabilities, which increases the demand for self-guided missiles.

Moreover, governments of developed and developing countries such as the U.K., India, China, Russia, the U.S., and others are significantly spending on military modernization programs to improve their firepower and upgrade their weapons & surveillance capabilities. For instance, In July 2021, The U.K. Ministry of Defence (MoD) granted $4.8m (£3.5m) to scientists of the Defence Science Technology Laboratory (Dstl) for the development of smarter missile systems. In addition, in March 2021, U.S. Army signed a $1.12 billion contract with Lockheed Martin Corporation for Lot 16 production of Guided Multiple Launch Rocket System (GMLRS) rockets and associated equipment. These activities are expected to create opportunities for the missile guidance system market during the forecast period.

Furthermore, an increase in programs of armed forces by major economies impacts the rise in the use of missile and rocket systems, which are expected to supplement the growth of the missile guidance system market. In November 2021, the U.S. Army entered a collaboration with Lockheed Martin Corporation for the PAC-3 program. Under this program, two PAC-3 MSE missiles successfully engaged with the U.S. Army Integrated Air and Missile Defense Battle Command System (IBCS). Thus, increasing investments in missile and rocket development by major economies are expected to propel the growth of the market over the forecast period.

High-Cost Associated with Missile Technology

Rockets and missiles guidance system are integrated with expensive components such as radio command receiver, rocket motors, television transmitter, and tone filter equipment. Thus, the mounting and deployment of rockets and missile systems incur high costs. Moreover, being deliberate in determining the quantity required and knowing related expenses are critical to prevent surprise charges. Other costs to consider include software, installation, updates, and service contracts. These factors increase the overall implementation cost of missile guidance systems. For instance, according to the Cost Assessment and Program Evaluation (CAPE) office, the estimated cost of the Next Generation Interceptor (NGI) is $17.7 billion. That represents $13.1 billion for up-front costs, including the purchase of 10 developmental interceptors, $2.3 billion for 21 operational interceptors, and $2.3 billion for operations & support costs over the life of the interceptors. In addition, the average cost to develop and purchase the 31 interceptors amounts to $498 million per interceptor. Such high cost associated with rocket and missile technology restrains the growth of the market in underdeveloped and developing countries.

Growing Preference For Automatic Target Recognition (ATR) Missile Systems

Automatic target recognition (ATR) is a crucial technology required by the military forces for modern battle. In addition, automatic target recognition (ATR) is a critical tool for combat activities that has yet to fulfill its full strategic potential. A completely accurate ATR can improve the warfighter's and platform's lethality and survivability. An ATR uses sensor data to interpret actionable information. The key value-added to an ATR's weapons system is a reduced engagement timeline for target(s) acquisition. However, the present performance level available by ballistic missiles is significantly inadequate in comparison to the needs. Due to this, the preference for the ATR missile systems use against incoming rockets or anti-tank missiles is growing significantly which is expected to drive the growth of the market during the forecast period. Moreover, the development of an ATR system-integrated missiles by market players is anticipated to boost the growth of the market during the forecast period. For instance, in July 2021, Rafael Advanced Defense Systems Ltd. launched Sea Breaker, a fifth generation long-range, autonomous, precision-guided missile system integrated with AI and ATR. This missile system enables significant attack performance against a variety of high-value maritime and land targets with stand-off ranges of up to 300 km. Such developments by market players are expected to increase the preference for ATR- equipped missile systems for precision and accurate counterattacks by arm forces, which, in turn, is likely to create remunerative opportunities for the expansion of the global missile guidance system market in the coming future.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the missile guidance system market analysis from 2021 to 2031 to identify the prevailing missile guidance system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the missile guidance system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global missile guidance system market trends, key players, market segments, application areas, and market growth strategies.

Missile Guidance System Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.3 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 254 |

| By Launch Platform |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | BAE Systems plc, Leonardo S.P.A., General Dynamics Corporation, Northrop Grumman Corporation, Saab AB, Safran S.A., The Boeing Company, Lockheed Martin Corporation, DRDO, Elbit Systems Ltd., Thales Group, Raytheon Technologies Corporation |

Analyst Review

The global missile guidance system market is expected to witness growth during the forecast period owing to increased number of missile system pilot demonstrations, innovation and introduction of new technology, and increased demand for precision strike technology in the Navy and Army Air Corps. The BrahMos missile was jointly developed by India and Russia to counter the stealth technology that many governments are investing in to build better surveillance systems. Increasing demand for advanced combat techniques also contributes to the market growth.

An increase in the adoption of the inertial guidance system is expected to offer growth opportunities to the market in the coming years. The Inertial Guidance System is an electronic system that continuously monitors a missile's position, velocity, and acceleration to provide navigation data or control without requiring communication with a base station. Missile navigation data i.e., position, velocity, and attitude are required for missile guidance and control. Furthermore, the increasing demand for miniaturized accelerometers and gyroscope sensors emphasizes the development of next-generation IGS (Inertial Guidance Systems) with reduced size and weight and improved performance which propels the demand of inertial guidance system for the missile guidance system. For instance, in February 2022, India conducted a night trial of its indigenously-developed, nuclear capable Prithvi-II missile. It uses an advanced inertial guidance system with a maneuvering trajectory to hit its target. The surface-to-surface missile is primarily a battlefield weapon, with a strike range of 350 km

Some major companies operating in the market include BAE System PLC, ELBIT SYSTEM LTD., Leonardo S.P.A, General Dynamic Corporations, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Saab AB, Safran S.A., Thales Group, The Boeing Company, DRDOS (Defense Research and Development Organization).

The global missile guidance system market size was valued at $820.1 million in 2021, and is projected to reach $1,280.0 million by 2031, registering a CAGR of 4.7% from 2022 to 2031

North America is the largest regional market for Missile Guidance System

Beam Rider Guidance System is the leading application of Missile Guidance System Market

Increase in developments related to Hypersonic missiles, and growing preference for Automatic Target Recognition (ATR) Missile Systems are the upcoming trends of Missile Guidance System Market

Loading Table Of Content...