Mobile Gaming Market Statistics, 2032

The global mobile gaming market size was valued at $90.6 billion in 2022, and is projected to reach $269.8 billion by 2032, growing at a CAGR of 11.7% from 2023 to 2032.

The key factors such as increasing use and availability of mobile devices, and growing purchasing power of people, are significant factors driving the growth of this market. In addition, lack of user privacy is hampering the market growth. Furthermore, rise of mobile e-sports and advancements in augmented reality (AR) & virtual reality (VR) technologies are providing opportunities for market growth which fuels the growth of the market.

The market refers to the business and economic ecosystem surrounding the development, distribution, and consumption of video games on mobile devices, such as smartphones and tablets. This market has experienced significant growth and evolution in recent years, driven by advancements in mobile technology, increased smartphone penetration, and changes in consumer preferences

The report focuses on growth factors, restraints, and trends of the mobile gaming market analysis. The study provides Porter five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the market.

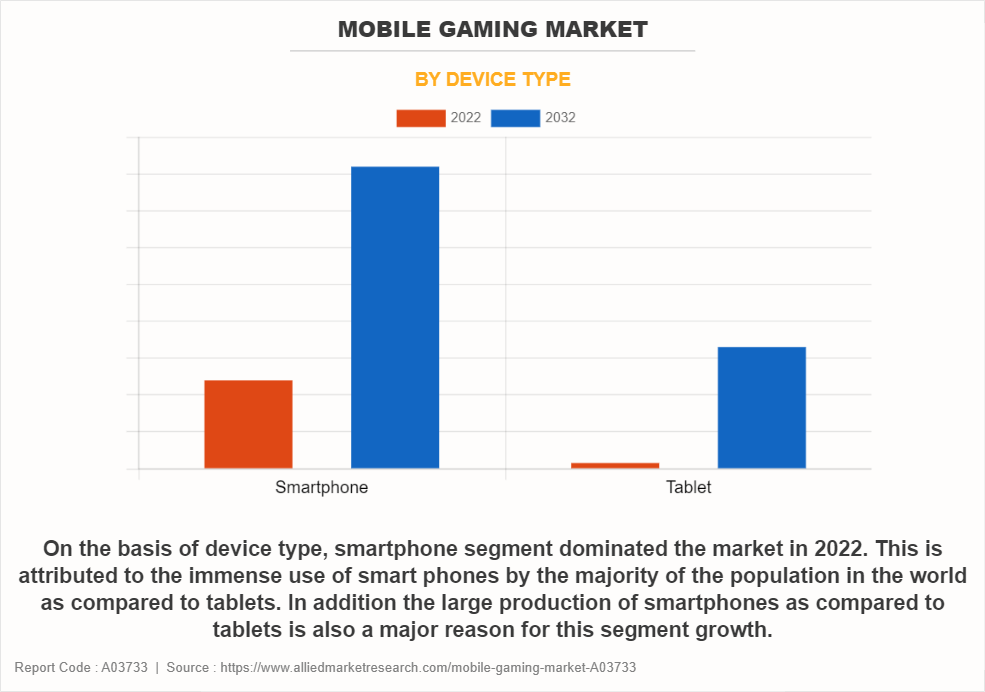

The mobile gaming market is segmented into device type, genre, platform and region. On the basis of device type, the market is divided into smartphone and tablet. By game genres, the market is categorized into action, adventure, puzzle, simulation, role playing and others. Depending on platform, the market is classified into google play and app store. On the basis of region, the market is studied across North America, Europe, Asia-Pacific and LAMEA.

By device type, the smartphone segment dominated the market in 2022. This is attributed to the immense use of mobile phones by major population in the world as compared to tablets.

Based on the region, North America dominated the global market in 2022. This can be attributed to the large number of game and graphics producing companies such as Electronic Arts, Activision, and Nvidia present in the region.

The report analyzes the profiles of key players operating in the mobile gaming market such as Google Inc., Apple Inc., Electronic Arts Inc., Ubisoft Entertainment SA, Gameloft SE, Kabam Games Inc., Rovio Entertainment Oyj, Nintendo Co Ltd., Take-Two Interactive Software Inc., and Tencent Holdings Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the market.

Market Landscape and Trends

The market involves the creation of mobile games by game developers and studios. This includes designing gameplay, graphics, and other elements that make up the gaming experience. Furthermore, mobile games are typically distributed through digital platforms and app stores. Major app stores include the Apple App Store for iOS devices and the Google Play Store for Android devices. These platforms serve as marketplaces where users can discover, download, and install mobile games. Currently mobile games are using various monetization models including, freemium -free to download games, in-app purchases, advertising and premium. In addition, various mobile games are incorporating social features, fostering communities of players. Multiplayer and online games are enabling social interaction, competition, and collaboration among users.

Top Impacting Factors

Increasing Use and Availability of Mobile Devices

The global proliferation of smartphones has been a major driver of the mobile gaming market. As smartphones become more affordable and accessible, a larger segment of the population is gaining access to mobile gaming. Furthermore, improved internet connectivity, including the rollout of 4G and 5G networks, is ensuring a seamless online gaming experience. This is allowing users to games download, receive updates, and engage in multiplayer gaming without significant lag.

Moreover, the decreasing cost of mobile devices with capable hardware is making gaming more accessible to a broader audience. Even budget smartphones are now coming equipped with processors and graphic processing units (GPUs) capable of handling sophisticated games. Therefore, all these factors are expected to drive the growth of the mobile gaming market forecast.

Growing Purchasing Power of People

The rise in purchasing power is correlating with increased affordability of smartphones. As more people are able to afford modern smartphones, they are gaining access to a platform where mobile games are readily available. Furthermore, growing purchasing power is allowing a larger segment of the population to own smartphones. With smartphones being versatile devices, they are becoming a primary platform for entertainment, including mobile gaming.

Moreover, in different regions where feature phones are prevalent, the growing purchasing power is facilitating a transition to smartphones. This shift is expanding potential user base for mobile games. Therefore, all these factors are expected to drive the mobile gaming market growth during the forecast period.

Lack of User-privacy

Privacy concerns are eroding user trust. Players feel that their personal data is not adequately protected, and they are hesitant to engage with mobile games, especially those that require account creation and access to sensitive information. Furthermore, players are less willing to share their personal information, location data, and other sensitive details as they are concerned about how the data will be used. This is limiting the ability of developers to personalize gaming experiences and deliver targeted advertisements.

Moreover, various regions have implemented and are in the process of developing strict data protection regulations such as general data protection regulation (GDPR) in Europe and central consumer protection authority (CCPA) in California. Non-compliance with these regulations is leading to legal consequences and fines, impacting the financial health of gaming companies. Therefore, all these factors are expected to drive the growth of the mobile gaming market size during the forecast period.

Rise of Mobile E-sports

E-sports events are creating new monetization opportunities for mobile gaming. Revenue streams include advertising, sponsorships, ticket sales for live events, and partnerships. These revenue sources contribute to the overall economic growth of the market. Furthermore, the growth of mobile e-sports is giving rise to professional gaming careers. Players can now aspire to become professional mobile e-sports athletes, earning income through sponsorships, team contracts, and participation in tournaments. This professionalization is attracting talent to the mobile gaming industry.

Moreover, major brands and sponsors are increasingly investing in mobile e-sports. These partnerships not only provide financial support for e-sports events but also contribute to the visibility and credibility of mobile gaming as a competitive and professional industry. Therefore, all these factors are expected to provide significant opportunities for growth of mobile gaming market share during the forecast period.

Advancements in Augmented Reality (AR) and Virtual Reality (VR) Technologies

Augmented reality (AR) is facilitating social gaming experiences, allowing players to interact with each other in real-world locations. Shared AR experiences and multiplayer AR games are promoting social connections among players. Furthermore, AR technology enhances educational and training games by overlaying informative content onto the real world. This has applications in both entertainment and educational contexts, making learning more interactive and engaging.

Moreover, virtual reality (VR) technology can create fully immersive gaming environments, transporting players to virtual worlds. The level of immersion offered by VR can enhance the overall gaming experience and can create a sense of presence. Therefore, all these factors are expected to provide significant opportunities for the mobile gaming industry growth during the forecast period.

Regional Insights

The Asia-Pacific region remains the dominant player in the market, with countries like China, India, and Japan leading the way. For instance, in June 2023, China’s Tencent reported a 25% increase in mobile gaming revenue, driven by popular titles like Honor of Kings and PUBG Mobile. India also saw a massive surge in mobile gaming, bolstered by affordable smartphones and low-cost data plans. The Indian government’s push towards Digital India has further fueled mobile game adoption, with games like Ludo King and Garena Free Fire reaching record downloads.

In North America, the market is witnessing significant growth, especially in mobile esports. For instance, in August 2023, Activision Blizzard hosted the largest Call of Duty: Mobile tournament in Los Angeles, attracting thousands of players and viewers. This event reflects the increasing popularity of mobile esports in the region, with gamers spending more time and money on competitive mobile gaming. The U.S. market, in particular, is driven by strong consumer spending and a growing ecosystem of game developers focusing on mobile-first platforms.

The market in Europe is rapidly evolving, with a growing emphasis on cloud gaming. For instance, in April 2023, NVIDIA launched its GeForce NOW cloud gaming service across several European countries, allowing players to stream high-quality games on their mobile devices without the need for high-end hardware. This development is helping bridge the gap between mobile gaming and traditional console/PC gaming, particularly in regions with strong internet infrastructure like Germany, the UK, and France.

Key Industry Developments

Recent Partnerships in the Market

In September 2023, Tencent Holdings Ltd. partnered with Bandai Namco Limited to launch the mobile version of anime game Blue Protocol. The Chinese gaming giant has secured the rights to turn blue protocol into a mobile game.

Recent Product Launches in the Market

In July 2023, Google Inc., launched Google Play games beta on PC in India. Players participating in the beta can play mobile games across their phones, tablets, chrome-books, and PCs. Users in India can access this in English and Hindi.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mobile gaming market analysis from 2022 to 2032 to identify the prevailing mobile gaming market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mobile gaming market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global mobile gaming market trends, key players, market segments, application areas, and mobile gamingmarket growth strategies.

Mobile Gaming Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 269.8 billion |

| Growth Rate | CAGR of 11.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 381 |

| By Device Type |

|

| By Genre |

|

| By Platform |

|

| By Region |

|

| Key Market Players | Kabam Games Inc., Nintendo Co. Ltd., Electronic Arts Inc., Google Inc., Ubisoft Entertainment SA, Rovio Entertainment Oyj, Take-Two Interactive Software Inc., Tencent Holdings Limited., Gameloft SE, Apple Inc. (US) |

Analyst Review

As per the insights of the top level CXOs, In many ways, mobile gaming is the core of the Metaverse and is a billion dollar industry. To compete with Facebook's Meta, gaming businesses such as Epic Games, the creator of Fortnite, are already launching their own virtual worlds. Playing video games on portable electronics, such as tablets and smartphones, is referred to as mobile gaming. The processors and displays, communication through telecom networks, cloud services, and live operations are the most significant features of this industry. The majority of CPUs included in tablets and smartphones are systems on a chip (SoCs) with specific designs. An integrated circuit security operation centers (SoC) is a microchip that houses the graphics processing unit (GPU), central processing unit (CPUs), system memory, and input/output (I/O) connectivity, among other computing components needed for the mobile gaming device.

The CXOs further added that market players are adopting strategies for enhancing their services in the market and improving customer satisfaction. For instance, in May 2020, Gameloft SE entered into a strategic partnership with ZEE5 to launch online gaming for mobile devices. Furthermore, in January 2022, Take Two Interactive Software Inc. acquired mobile games giant Zynga for $12.7 billion. Zynga’s expertise will help drive its free-to-play and cross-platform ambitions, and will help in bringing Take-Two’s console/PC properties to mobile. Moreover, in May 2023, Apple Inc. launched Apple Arcade gaming membership service that provides limitless access to more than 200 really entertaining games. WHAT THE CAR?, TMNT Splintered Fate, Disney Spell Struck, and Cityscapes: Sim Builder are among the latest games that can only be played on Apple Arcade. A number of well-known App Store titles have also been added to the service by the expansion, including Temple Run+, Playdead's LIMBO+, PPKP+, and others. Therefore, such strategies are expected to drive the growth of the mobile gaming market in the upcoming years.

The report analyzes the profiles of key players operating in the mobile gaming market such as Google Inc., Apple Inc., Electronic Arts Inc., Ubisoft Entertainment SA, Gameloft SE, Kabam Games Inc., Rovio Entertainment Oyj, Nintendo Co Ltd., Take-Two Interactive Software Inc., and Tencent Holdings Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the mobile gaming market.

Mobile gaming market are using various monetization models such as freemium (free to download games), in-app purchases, advertising, and premium.

Smartphone, Google Play and action genre are the leading applications of mobile gaming market.

North America is the largest regional market for mobile gaming.

$90563.78 million is the estimated industry size of mobile gaming.

Google Inc., Apple Inc., Electronic Arts Inc., Ubisoft Entertainment SA, Gameloft SE, Kabam Games Inc., Rovio Entertainment Oyj, Nintendo Co., Ltd., Take-Two Interactive Software, Inc., and Tencent Holdings Limited. are the top companies to hold the market share in Mobile Gaming

Loading Table Of Content...

Loading Research Methodology...